PowerPoint プレゼンテーション

... Critiques of Abenomics (2013) George Soros (investment guru)—”Japan’s monetary policy is bold but very risky; it may trigger a collapsing yen.” Prof. Kunio Okina (Kyoto Univ.)— “If deflation mind is dispelled but fiscal discipline is not secured, monetization of fiscal deficit will generate a serio ...

... Critiques of Abenomics (2013) George Soros (investment guru)—”Japan’s monetary policy is bold but very risky; it may trigger a collapsing yen.” Prof. Kunio Okina (Kyoto Univ.)— “If deflation mind is dispelled but fiscal discipline is not secured, monetization of fiscal deficit will generate a serio ...

RELATIVE INCOME HYPOTHESIS

... income as their income increases. This was indeed the pattern observed in cross-sectional consumption data: At a given point in time the rich in the population saved a higher fraction of their income than the poor did. However, Keynesian theory was contradicted by another empirical regularity: Aggre ...

... income as their income increases. This was indeed the pattern observed in cross-sectional consumption data: At a given point in time the rich in the population saved a higher fraction of their income than the poor did. However, Keynesian theory was contradicted by another empirical regularity: Aggre ...

Can US personal consumption fully recover without the value of real

... big-consuming, top 10 percent—supported this high consumption in two ways. First, it gave people the illusion of increasing their saving without having to put away much of their current incomes. Second, tens of millions of American households used their rising home values to directly support their c ...

... big-consuming, top 10 percent—supported this high consumption in two ways. First, it gave people the illusion of increasing their saving without having to put away much of their current incomes. Second, tens of millions of American households used their rising home values to directly support their c ...

ASAD long run

... demand in the economy, but output remains constant at its full employment level Neoclassical economists advocate policies that help markets work eg. reducing trade union power, abolishing minimum wages and unemployment benefits, reducing tax rates… (market- orientated supply side policies) The key t ...

... demand in the economy, but output remains constant at its full employment level Neoclassical economists advocate policies that help markets work eg. reducing trade union power, abolishing minimum wages and unemployment benefits, reducing tax rates… (market- orientated supply side policies) The key t ...

Economic Growth Impacts of Structural Reforms in Ireland

... Creation or facilitation of barriers to entry Regulatory actions that limit product market competition ...

... Creation or facilitation of barriers to entry Regulatory actions that limit product market competition ...

Gregory Miller Chief Economist SunTrust Banks, Inc. August

... • Expect interest rates range bound with downward tilt, but – No relief from inverted yield curve until Fed eases ...

... • Expect interest rates range bound with downward tilt, but – No relief from inverted yield curve until Fed eases ...

The Portuguese bailout experiment

... “An alternative policy package to the fiscal devaluation earlier proposed by staff would considerably improve growth prospects and deliver a significant narrowing of external current account deficit in the near-term. Such a package could include deeper labor and product market reforms. In its abse ...

... “An alternative policy package to the fiscal devaluation earlier proposed by staff would considerably improve growth prospects and deliver a significant narrowing of external current account deficit in the near-term. Such a package could include deeper labor and product market reforms. In its abse ...

C) Far beyond « Keynesian » fiscal policy :

... has always to spend to maintain and increase the “stock of collective or social capital” sustaining the long-term growth of the output of collective goods. As already proven by Eisner (1994), public investment has two components, tangible investment in infrastructure and equipment of all kinds and n ...

... has always to spend to maintain and increase the “stock of collective or social capital” sustaining the long-term growth of the output of collective goods. As already proven by Eisner (1994), public investment has two components, tangible investment in infrastructure and equipment of all kinds and n ...

CCIWA Student Economic Forum Cartoon Scenarios August 2011

... If the Chinese Reminbi was allowed to float to a market-clearing level (which would be an appreciation relative to the USD), would mean that Chinese exports would become relatively more expensive for US consumers, leading to a decline in US imports. On the flip-side, US exports would become relative ...

... If the Chinese Reminbi was allowed to float to a market-clearing level (which would be an appreciation relative to the USD), would mean that Chinese exports would become relatively more expensive for US consumers, leading to a decline in US imports. On the flip-side, US exports would become relative ...

Economic Impact Assessment

... the profitability of the project. Thus, the results of this study should be treated as general estimates and never as absolutes. Potential Economic Impacts for NFAT The estimated economic impacts for the preferred development plan are summarized in Table 1. A summary of the economic impacts for the ...

... the profitability of the project. Thus, the results of this study should be treated as general estimates and never as absolutes. Potential Economic Impacts for NFAT The estimated economic impacts for the preferred development plan are summarized in Table 1. A summary of the economic impacts for the ...

Diapositiva 1

... – In Central American countries (CAC) exist a relation between lower poverty and higher levels of public social expenditures – Social expenditures in education and health benefit more the poor in CAC ...

... – In Central American countries (CAC) exist a relation between lower poverty and higher levels of public social expenditures – Social expenditures in education and health benefit more the poor in CAC ...

Section 1 - Dearborn High School

... • The circular flow can be represented by the output-expenditure model. ...

... • The circular flow can be represented by the output-expenditure model. ...

Total Spending 2010

... NOTE: Debt held by the public refers to all federal debt held by individuals, corporations, state or local governments, and foreign entities. The alternative fiscal scenario includes several changes to current law that are widely anticipated to occur (i.e. adjustments to Medicare payment rates). ...

... NOTE: Debt held by the public refers to all federal debt held by individuals, corporations, state or local governments, and foreign entities. The alternative fiscal scenario includes several changes to current law that are widely anticipated to occur (i.e. adjustments to Medicare payment rates). ...

1+ r

... The government ’s budgetary balance had become extremely vulnerable to a rise in the level of interest rates. ...

... The government ’s budgetary balance had become extremely vulnerable to a rise in the level of interest rates. ...

Business cycles recessions and economic booms

... · Response lag: it takes time to decide what to do. · Implementation lag: it takes time for policy to work through and take effect As a result of such lags, by the time the government acts it may be too late; the economy may have started to turn down already but this is not yet recognised. In t his ...

... · Response lag: it takes time to decide what to do. · Implementation lag: it takes time for policy to work through and take effect As a result of such lags, by the time the government acts it may be too late; the economy may have started to turn down already but this is not yet recognised. In t his ...

The Circular Flow of Income and Expenditure

... revenue. At the other extreme, a tax rate of 100% would also bring in no revenue as nobody would be prepared to work, run a business, invest or sell assets if any extra income, profit, interest or capital gain was completely confiscated by the government. In theory, at some tax rate between 0% and 1 ...

... revenue. At the other extreme, a tax rate of 100% would also bring in no revenue as nobody would be prepared to work, run a business, invest or sell assets if any extra income, profit, interest or capital gain was completely confiscated by the government. In theory, at some tax rate between 0% and 1 ...

Paper - History of Economic Thought Society of Australia

... household savings (surplus), which lead the household saving ratio being 8.92 percent of personal disposable income. Another part showed up in huge increase of $33.1 billion in business gross internal funds, a rise of some 23.4 percent. Indeed, in 1975, the year of a major increase in unemployment a ...

... household savings (surplus), which lead the household saving ratio being 8.92 percent of personal disposable income. Another part showed up in huge increase of $33.1 billion in business gross internal funds, a rise of some 23.4 percent. Indeed, in 1975, the year of a major increase in unemployment a ...

Name 1 In The General Theory of Employment, Interest, and Money

... The key difference between the IS-LM model and the Mundell–Fleming model is that the A. Mundell–Fleming model does not take the price level as fixed. B. Mundell–Fleming model assumes a small open economy. C. Mundell–Fleming model stresses the interaction between markets different from those in the I ...

... The key difference between the IS-LM model and the Mundell–Fleming model is that the A. Mundell–Fleming model does not take the price level as fixed. B. Mundell–Fleming model assumes a small open economy. C. Mundell–Fleming model stresses the interaction between markets different from those in the I ...

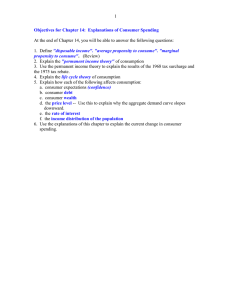

Chapter 14: Explanations of Consumer Spending

... how this method of paying workers might contribute to the higher savings rate in Japan. ...

... how this method of paying workers might contribute to the higher savings rate in Japan. ...

The Nation`s Adjustable Rate Mortgage

... Treasuries also pushed CBO’s interest rate projections down. Changes in the economy can have significant effects on the federal budget – indeed good growth policy is typically good budget policy. A growing economy raises incomes and tax revenue and diminishes spending on social safety net spending. ...

... Treasuries also pushed CBO’s interest rate projections down. Changes in the economy can have significant effects on the federal budget – indeed good growth policy is typically good budget policy. A growing economy raises incomes and tax revenue and diminishes spending on social safety net spending. ...

Syllabus - Harvard Kennedy School

... Topics covered: What is the role of monetary and fiscal policy in an open economy? What determines the balance of payments, the level of economic activity, and inflation? Should countries fix their exchange rates, or let them float? How does the globalization of financial markets affect these and ot ...

... Topics covered: What is the role of monetary and fiscal policy in an open economy? What determines the balance of payments, the level of economic activity, and inflation? Should countries fix their exchange rates, or let them float? How does the globalization of financial markets affect these and ot ...