Turning Roth IRAs into Universal Savings Accounts

... Contributions to USAs would have to be in cash, not stocks or bonds. That would ensure that current savers would have to sell securities and pay tax before they could deposit existing funds into a USA. The third reform is to repeal rules imposing taxes and a 10 percent penalty on earnings if distrib ...

... Contributions to USAs would have to be in cash, not stocks or bonds. That would ensure that current savers would have to sell securities and pay tax before they could deposit existing funds into a USA. The third reform is to repeal rules imposing taxes and a 10 percent penalty on earnings if distrib ...

OnePath Diversified Fixed Interest

... The appointment of each new, underlying investment manager becomes effective on or around 1 April 2012. We will conduct a transition of the underlying securities (assets) to each new, underlying investment manager. This transition will be conducted over a period of time such that each new manager’s ...

... The appointment of each new, underlying investment manager becomes effective on or around 1 April 2012. We will conduct a transition of the underlying securities (assets) to each new, underlying investment manager. This transition will be conducted over a period of time such that each new manager’s ...

Briefing on the 2015 Blue and Pink Books (Powerpoint presentation

... 1998 to 2013 period, largely coinciding with the changes to growth in GDP in current prices • Average growth of real GDP remains unchanged at 2.0% per annum over 1998 to 2013 ...

... 1998 to 2013 period, largely coinciding with the changes to growth in GDP in current prices • Average growth of real GDP remains unchanged at 2.0% per annum over 1998 to 2013 ...

Best Of Times Often Have Followed Worst Of Times

... No one could ever hope to forecast all of the market’s best and worst days. But given that infinitesimally small changes— being out of the market on just 20 of 20,340 trading days during the 81 years the researchers considered—can have a profound impact, it may seem worthwhile to try to identify som ...

... No one could ever hope to forecast all of the market’s best and worst days. But given that infinitesimally small changes— being out of the market on just 20 of 20,340 trading days during the 81 years the researchers considered—can have a profound impact, it may seem worthwhile to try to identify som ...

Fundamentals of Investing Chapter Fifteen

... • Stockholders are owners and share in the success of the company. • A corporation is not required to repay the money obtained from the sale of stock. • They are under no legal obligation to pay dividends to stockholders. They may instead retain all or part of earnings. ...

... • Stockholders are owners and share in the success of the company. • A corporation is not required to repay the money obtained from the sale of stock. • They are under no legal obligation to pay dividends to stockholders. They may instead retain all or part of earnings. ...

Problems

... designated as limited partners, thus limiting their personal liability for any losses incurred by the business to the amount of their investment. If the business were organized as a regular partnership, each investor could be held personally liable for business losses of an unlimited amount. Most pa ...

... designated as limited partners, thus limiting their personal liability for any losses incurred by the business to the amount of their investment. If the business were organized as a regular partnership, each investor could be held personally liable for business losses of an unlimited amount. Most pa ...

A Practioner`s Guide to Generalized Linear Models

... Central Limit Theorem Consider a sequence of random variables X1,…,Xn from an unknown distribution with mean m and finite variance s2. Let Sn = SXi be the sequence of partial sums. Then, with an = n and bn = nm, (Sn-bn)/ an approaches a normal distribution ...

... Central Limit Theorem Consider a sequence of random variables X1,…,Xn from an unknown distribution with mean m and finite variance s2. Let Sn = SXi be the sequence of partial sums. Then, with an = n and bn = nm, (Sn-bn)/ an approaches a normal distribution ...

here - Ozblogistan

... Madam Speaker, fairness is essential to the integrity of our taxation system. So I say to all Australians, rather than introducing new taxes on you, we simply want people or companies who are avoiding their tax to pay their fair share. As a result of Tax Office investigations we have identified 30 l ...

... Madam Speaker, fairness is essential to the integrity of our taxation system. So I say to all Australians, rather than introducing new taxes on you, we simply want people or companies who are avoiding their tax to pay their fair share. As a result of Tax Office investigations we have identified 30 l ...

Risk-adjusted returns - Hearthstone Investments

... stems from the asset’s dual market position – within residential, there is investment housing (private rented sector), social housing and owner occupier markets, which overlap in a way which commercial property sectors do not. Further, demand for the asset will never be wholly based around economics ...

... stems from the asset’s dual market position – within residential, there is investment housing (private rented sector), social housing and owner occupier markets, which overlap in a way which commercial property sectors do not. Further, demand for the asset will never be wholly based around economics ...

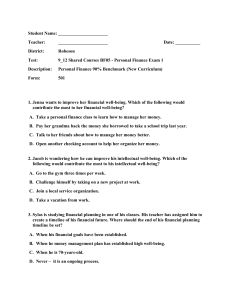

PF Pretest

... 5. Which of the following factors is not influenced by values? A. Everything is influenced by values. B. An individual's daily decisions. C. An individual's long-term decisions. D. An individual's financial decisions. 6. Megan's mother suggested that she was experiencing the consequences of her trad ...

... 5. Which of the following factors is not influenced by values? A. Everything is influenced by values. B. An individual's daily decisions. C. An individual's long-term decisions. D. An individual's financial decisions. 6. Megan's mother suggested that she was experiencing the consequences of her trad ...

Impact of Chinese Enterprise Income Tax Law on Technology Innovation

... revisions inflect the spirit of promoting the society equally with the way of finance and it is more suitable, for the needs of the development of economic society. First of all, The Enterprise Income Tax Law is useful to reduce the gap between the rich and poor. Enhancing the deduction of the publi ...

... revisions inflect the spirit of promoting the society equally with the way of finance and it is more suitable, for the needs of the development of economic society. First of all, The Enterprise Income Tax Law is useful to reduce the gap between the rich and poor. Enhancing the deduction of the publi ...

Passive Activity Losses In general, California law conforms to the

... according to IRC section 164, states that this fire-protection fee is not a tax under federal or state law but rather a regulatory fee. It is not based on property valuation. Medical and Dental Expense Deduction California does not conform to the federal change for taxpayers under the age of 65 that ...

... according to IRC section 164, states that this fire-protection fee is not a tax under federal or state law but rather a regulatory fee. It is not based on property valuation. Medical and Dental Expense Deduction California does not conform to the federal change for taxpayers under the age of 65 that ...

U.S. Tax Updates and Development Doron Sadan, Tax Partner

... In this document, “PwC Israel” refers to Kesselman & Kesselman, which is a member firm of PricewaterhouseCoopers International Limited, each member firm of which is a ...

... In this document, “PwC Israel” refers to Kesselman & Kesselman, which is a member firm of PricewaterhouseCoopers International Limited, each member firm of which is a ...

Exam 1 Review Answers - Iowa State University

... a. To capture information about the activities of a company so that it can be reported to decision makers inside the business. b. To capture information about the activities of a company so that it can be reported to decision makers outside the business. c. To capture information about employee acti ...

... a. To capture information about the activities of a company so that it can be reported to decision makers inside the business. b. To capture information about the activities of a company so that it can be reported to decision makers outside the business. c. To capture information about employee acti ...