tax incentives available in kenya

... have hit over 1.6 million in 2006 with US surpassing Germany in terms of arrivals and second after UK. ...

... have hit over 1.6 million in 2006 with US surpassing Germany in terms of arrivals and second after UK. ...

The Transition from Industrial Capitalism to a

... means of most families to pay without cutting back their expenditure elsewhere. The problem with such bubbles is that once underway, asset-price inflation becomes the only way to sustain the debt burden. Debt-financed speculation must accelerate or else end in a wave of bankruptcy. The problem is th ...

... means of most families to pay without cutting back their expenditure elsewhere. The problem with such bubbles is that once underway, asset-price inflation becomes the only way to sustain the debt burden. Debt-financed speculation must accelerate or else end in a wave of bankruptcy. The problem is th ...

ruh03-staume1 222936 en

... the primary sector now mostly benefits capitalists (that by assumption do not count in the welfare function), which cools the desire for investment subsidies. Instead, the government seeks to capture those rents that the union could not by taxing investment. The investment tax is supplemented by pro ...

... the primary sector now mostly benefits capitalists (that by assumption do not count in the welfare function), which cools the desire for investment subsidies. Instead, the government seeks to capture those rents that the union could not by taxing investment. The investment tax is supplemented by pro ...

Navigating the Fixed Income Universe

... Securitized, Investment-Grade Corporate Credit, Investment-Grade Sovereign ...

... Securitized, Investment-Grade Corporate Credit, Investment-Grade Sovereign ...

mehr...

... Therein, the computed tax rate on working hours include income taxes, social security contributions and the value-added tax. ...

... Therein, the computed tax rate on working hours include income taxes, social security contributions and the value-added tax. ...

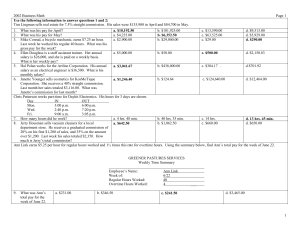

master.irm - McGraw

... Co. in the way it accounts for bad debts on its credit card receivables. The following are excerpts from that article: Sears, Roebuck & Co. is moving toward more conservative accounting methods used by competing credit-card issuers which will boost its loan losses by about $200 million during the ne ...

... Co. in the way it accounts for bad debts on its credit card receivables. The following are excerpts from that article: Sears, Roebuck & Co. is moving toward more conservative accounting methods used by competing credit-card issuers which will boost its loan losses by about $200 million during the ne ...

2016 People`s Guide to the Budget

... restoring South Africa’s public finances to a healthy state. This requires that we make tough decisions. We have therefore, decided as government to further cut wasteful expenditure, show more restraint and also delay some of the projects. But we will not compromise on spending on social services to ...

... restoring South Africa’s public finances to a healthy state. This requires that we make tough decisions. We have therefore, decided as government to further cut wasteful expenditure, show more restraint and also delay some of the projects. But we will not compromise on spending on social services to ...

Day IN OUT

... Savings and Loan Co. On December 9, interest is computed at an annual rate of 6%. How much simple interest did she receive? Use the following information to answer questions 24 and 25: On July 5, Lucy Schamburgh had a balance of $594.62 in her savings account. On that day she deposited $240 and the ...

... Savings and Loan Co. On December 9, interest is computed at an annual rate of 6%. How much simple interest did she receive? Use the following information to answer questions 24 and 25: On July 5, Lucy Schamburgh had a balance of $594.62 in her savings account. On that day she deposited $240 and the ...

ECONOMIC OPPORTUNITY COST OF CAPITAL (a)

... (international) investors require for investing in country i. If tw increases, this will cause rf to increase not ri I to fall. ...

... (international) investors require for investing in country i. If tw increases, this will cause rf to increase not ri I to fall. ...

Manulife Financial — the best 5-Year GIC rates in the industry

... Basic Account (½ year terms) - Earn higher rates by simply adding 6 months to a standard length term.1 Laddered Account - Diversify your GIC portfolio by ensuring that a portion matures each year and is reinvested at attractive long-term rates. One attractive rate is given for all your initial 1 ...

... Basic Account (½ year terms) - Earn higher rates by simply adding 6 months to a standard length term.1 Laddered Account - Diversify your GIC portfolio by ensuring that a portion matures each year and is reinvested at attractive long-term rates. One attractive rate is given for all your initial 1 ...

Jumpstart Financial Literacy

... a) They pay higher than average dividends b) Their prices are likely to be less volatile than most stocks c) The have lower than average potential for capital gains d) They have higher than average potential for price appreciation ...

... a) They pay higher than average dividends b) Their prices are likely to be less volatile than most stocks c) The have lower than average potential for capital gains d) They have higher than average potential for price appreciation ...

Accounting Fundamentals for Managing and Sustaining Profitability

... Total Debt / Total Equity (how much debt leverage you have on your business – risk versus reward issue) ...

... Total Debt / Total Equity (how much debt leverage you have on your business – risk versus reward issue) ...

ECONOMIC OPPORTUNITY COST OF CAPITAL (a)

... the investment over the life of the project should be discounted by the economic cost of capital. • If the NPV of these economic benefits and costs is equal to or greater than zero, then the project is feasible from an economic point of view. • If the NPV is less than zero, the project should be rej ...

... the investment over the life of the project should be discounted by the economic cost of capital. • If the NPV of these economic benefits and costs is equal to or greater than zero, then the project is feasible from an economic point of view. • If the NPV is less than zero, the project should be rej ...

HKCE Macroeconomics

... Direct taxes (salaries tax) reduce one's disposable income, resulting in a lower standard of living. Indirect taxes (sales tax) may cause inflation but allows higher nominal wage. The living standard will be lower if the increase in nominal wage rate is less than the inflation rate. ...

... Direct taxes (salaries tax) reduce one's disposable income, resulting in a lower standard of living. Indirect taxes (sales tax) may cause inflation but allows higher nominal wage. The living standard will be lower if the increase in nominal wage rate is less than the inflation rate. ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research

... the levels of capital income taxation in the four countries. While we would emphasize that this depends upon the particular formulation of the question, we also bring away from the study the sense that capital income taxes are lowest on average in the United Kingdom at the same time that they are le ...

... the levels of capital income taxation in the four countries. While we would emphasize that this depends upon the particular formulation of the question, we also bring away from the study the sense that capital income taxes are lowest on average in the United Kingdom at the same time that they are le ...