Trade Balance as a Fiscal Policy Goal

... 18.2, respectively. This disparity can provoke a relative disincentive to economic growth. The enterprise movement towards New Member States through the foreign direct investment (FDI) looking for lower taxes rates, that also provokes an increase trade, from economies with lower cost (poorer) to tho ...

... 18.2, respectively. This disparity can provoke a relative disincentive to economic growth. The enterprise movement towards New Member States through the foreign direct investment (FDI) looking for lower taxes rates, that also provokes an increase trade, from economies with lower cost (poorer) to tho ...

Chapter 7 Financial Operations of Insurers Agenda • Property and

... • Benefit payments, including death benefits paid to beneficiaries and annuity benefits paid to annuitants, are the life insurer’s major expense • A life insurer’s net gain from operations equals total revenues less total expenses, policyowner dividends, and federal income taxes ...

... • Benefit payments, including death benefits paid to beneficiaries and annuity benefits paid to annuitants, are the life insurer’s major expense • A life insurer’s net gain from operations equals total revenues less total expenses, policyowner dividends, and federal income taxes ...

Summary

... Because foreign invested entities in Korea are legally domestic enterprises, basically they are eligible for tax exemption or reduction privileges available to domestic enterprises under Korean tax laws. In addition, foreign invested entities have other tax benefits in several cases including the fo ...

... Because foreign invested entities in Korea are legally domestic enterprises, basically they are eligible for tax exemption or reduction privileges available to domestic enterprises under Korean tax laws. In addition, foreign invested entities have other tax benefits in several cases including the fo ...

Investment Update February 2011

... The Fund’s portfolio is well positioned to maximise capital gain and income opportunities over the next 12 – 18 months. – Pro active portfolio management strategies to take advantage of capital gain opportunities including; • Continued overweight exposure to discounted non bank sector, • Reduced exp ...

... The Fund’s portfolio is well positioned to maximise capital gain and income opportunities over the next 12 – 18 months. – Pro active portfolio management strategies to take advantage of capital gain opportunities including; • Continued overweight exposure to discounted non bank sector, • Reduced exp ...

TIF

... Specific issues – LGRR, etc. > Local government finance reform – likely to result in a more complex and less different position than many had hoped > EZs, TIF, city deals – a fairly limited and piecemeal approach to encouraging growth and investment (but good for areas that benefit) > Effectiveness ...

... Specific issues – LGRR, etc. > Local government finance reform – likely to result in a more complex and less different position than many had hoped > EZs, TIF, city deals – a fairly limited and piecemeal approach to encouraging growth and investment (but good for areas that benefit) > Effectiveness ...

FINDING RELATIVE VALUE OPPORTUNITIES IN FIXED INCOME

... yields decline to even more negative nominal rates and therefore they could make a capital gain by selling this investment to someone else at a higher price; otherwise known as the “greater fool” theory. ...

... yields decline to even more negative nominal rates and therefore they could make a capital gain by selling this investment to someone else at a higher price; otherwise known as the “greater fool” theory. ...

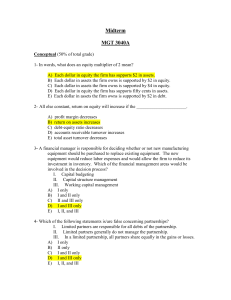

Answers to Midterm 3040A

... E) liabilities; sales 15- All else the same, which of the following occurs when a firm buys inventory with cash? A) The quick ratio goes up if it was greater than one before the change. B) The current ratio goes down if it was greater than one before the change. C) The current ratio goes down if it ...

... E) liabilities; sales 15- All else the same, which of the following occurs when a firm buys inventory with cash? A) The quick ratio goes up if it was greater than one before the change. B) The current ratio goes down if it was greater than one before the change. C) The current ratio goes down if it ...

9-20, exchange - Vear Commercial Properties

... in a short time frame in order to be the successful buyer. In this case, the investorbuyer would purchase the new property through the third-party facilitator, again setting up a parking entity to hold the property until the investor-owner can sell his or her original property. This allows for a rea ...

... in a short time frame in order to be the successful buyer. In this case, the investorbuyer would purchase the new property through the third-party facilitator, again setting up a parking entity to hold the property until the investor-owner can sell his or her original property. This allows for a rea ...

IFS PRESS RELEASE

... Alan Auerbach (University of California at Berkeley), Michael Devereux (Oxford University and IFS) and Helen Simpson (Bristol University and IFS) argue that taxable profits would be lower under an ACE than under the existing corporation tax.3 This means that a higher statutory tax rate would be requ ...

... Alan Auerbach (University of California at Berkeley), Michael Devereux (Oxford University and IFS) and Helen Simpson (Bristol University and IFS) argue that taxable profits would be lower under an ACE than under the existing corporation tax.3 This means that a higher statutory tax rate would be requ ...

Fund Facts

... and it should not be relied upon as such. Opinions expressed herein are subject to change without notice. The services described are provided by CCLA Investment Management Limited (CCLA), a firm authorised and regulated by the Financial Conduct Authority. This document is issued for information purp ...

... and it should not be relied upon as such. Opinions expressed herein are subject to change without notice. The services described are provided by CCLA Investment Management Limited (CCLA), a firm authorised and regulated by the Financial Conduct Authority. This document is issued for information purp ...

Five (easy) ways to prepare for rising interest rates

... the word "patient" from its news release following its March 17-18 meeting, opening the door to a possible rate hike later this year. Even if Canada lags the United States, eventually rates are expected to rise here as well. In fact, five- and 10-year Canadian government bond yields have already ris ...

... the word "patient" from its news release following its March 17-18 meeting, opening the door to a possible rate hike later this year. Even if Canada lags the United States, eventually rates are expected to rise here as well. In fact, five- and 10-year Canadian government bond yields have already ris ...

Y=E

... paycheck and will spend money as it comes in. Thus, consumption is a function of disposable income which increases with income. Increase in Consumption ...

... paycheck and will spend money as it comes in. Thus, consumption is a function of disposable income which increases with income. Increase in Consumption ...

CASE STUDY 4 USING A COMMSEC MARGIN LOAN TO

... Jenny & Lee both decided to invest into 5 stocks that their research identified as having a high and consistent historical dividend yield, as well as growth potential in the medium term, for a period of 6 months. At the end of the 6 month period, Jenny and Lee could reassess the future growth perfor ...

... Jenny & Lee both decided to invest into 5 stocks that their research identified as having a high and consistent historical dividend yield, as well as growth potential in the medium term, for a period of 6 months. At the end of the 6 month period, Jenny and Lee could reassess the future growth perfor ...

Tax Information Publication of Issue Price of New 2022 Notes

... IHS Markit has determined that the New Notes are "traded on an established market (publicly traded)" within the meaning of the Regulation and the issue price of the New Notes is 103.907% (expressed as a percentage of face amount). As provided by the Regulation, this determination is binding upon all ...

... IHS Markit has determined that the New Notes are "traded on an established market (publicly traded)" within the meaning of the Regulation and the issue price of the New Notes is 103.907% (expressed as a percentage of face amount). As provided by the Regulation, this determination is binding upon all ...

Northern Trust

... Constrained volume and type of tax-exempt municipal issuance Increased demand from existing and new sources Changed composition of buyers of municipal debt Overall result, richened municipal valuations relative to Treasury yields ...

... Constrained volume and type of tax-exempt municipal issuance Increased demand from existing and new sources Changed composition of buyers of municipal debt Overall result, richened municipal valuations relative to Treasury yields ...