W o r k

... The goal of this paper is to quantitatively account for this puzzle by introducing price rigidity and local currency pricing (LCP ) in an otherwise standard dynamic general equilibrium model. In studying the impact on equilibrium allocations of some firms’ ability to price discriminate across count ...

... The goal of this paper is to quantitatively account for this puzzle by introducing price rigidity and local currency pricing (LCP ) in an otherwise standard dynamic general equilibrium model. In studying the impact on equilibrium allocations of some firms’ ability to price discriminate across count ...

Unit 9 Capital Account Convertibility: Benefits, Costs and Challenges

... control regime. With gradual liberalization of both Foreign Direct Investment (FDI) and portfolio investment, the rupee has been made convertible for foreign investors. However, some controls remain in place to varying degrees for both foreign and domestic corporates and individuals, with resident c ...

... control regime. With gradual liberalization of both Foreign Direct Investment (FDI) and portfolio investment, the rupee has been made convertible for foreign investors. However, some controls remain in place to varying degrees for both foreign and domestic corporates and individuals, with resident c ...

Supporting - System Dynamics Society

... nominal aggregate demand divided by the price level. In other words, prices should be on the level that allows purchasing of all produced goods and services in the country. If the nominal aggregate demand increases due to government spending or consumption, the purchase ability with current prices ( ...

... nominal aggregate demand divided by the price level. In other words, prices should be on the level that allows purchasing of all produced goods and services in the country. If the nominal aggregate demand increases due to government spending or consumption, the purchase ability with current prices ( ...

Maurice Obstfeld Paper No. i186 1050 PAPER SERIES

... section, which ruled out crises in the policy environment described by unconditional adherence to (3) and (4), no longer applies. As a first step in the construction of an alternative equilibrium, note that in the event of an exchange—rate collapse at time T, the value of the floating exchange rate ...

... section, which ruled out crises in the policy environment described by unconditional adherence to (3) and (4), no longer applies. As a first step in the construction of an alternative equilibrium, note that in the event of an exchange—rate collapse at time T, the value of the floating exchange rate ...

Calculating the Unthinkable: Exchange Rate Effects of a Credit Event

... are denominated either in Euro or US-Dollars. These CDS are currently muchdiscussed, see, e.g. Felsenheimer (2012) or Pollack (2011). In normal times, the difference of the spreads (or prices) of CDS, denominated in different currencies, but referring to the same entity, is negligible; from the pers ...

... are denominated either in Euro or US-Dollars. These CDS are currently muchdiscussed, see, e.g. Felsenheimer (2012) or Pollack (2011). In normal times, the difference of the spreads (or prices) of CDS, denominated in different currencies, but referring to the same entity, is negligible; from the pers ...

Growth and Poverty Reduction Under Globalization: The

... misalignment of NER from PPP has been decomposed into a common aggregate timespecific component, u(t), a countryspecific timeinvariant fixed component (i.e. country fixed effects), ε(i), and another timevariant random component, w(i,t). The timespecific term, u(t), can be interpreted broadl ...

... misalignment of NER from PPP has been decomposed into a common aggregate timespecific component, u(t), a countryspecific timeinvariant fixed component (i.e. country fixed effects), ε(i), and another timevariant random component, w(i,t). The timespecific term, u(t), can be interpreted broadl ...

Elasticity of risk aversion and international trade by Udo Broll

... optimum export production remains unchanged although the exchange rate becomes more risky. If risk aversion is (in)elastic than the firm will (diminish) extend its export production. Hence, the elasticity measure provides a distinct answer to the question how a change in exchange rate risk affects i ...

... optimum export production remains unchanged although the exchange rate becomes more risky. If risk aversion is (in)elastic than the firm will (diminish) extend its export production. Hence, the elasticity measure provides a distinct answer to the question how a change in exchange rate risk affects i ...

Introducción - Banco de España

... purchases in the foreign exchange market. It was also made clear that the ensuing monetary expansion, resulting from the foreign exchange purchases, was part of the end-of-the-year liquidity provision program, in the amount of $ 3.2 billion pesos4. In this way, markets could be confident that the ce ...

... purchases in the foreign exchange market. It was also made clear that the ensuing monetary expansion, resulting from the foreign exchange purchases, was part of the end-of-the-year liquidity provision program, in the amount of $ 3.2 billion pesos4. In this way, markets could be confident that the ce ...

Impacts of Exchange Rate Movements

... 2. A simple model of FDI and the exchange rate An orthodox investment theory, the net present value (NPV) theory, assumes that investment decision is to be taken now or never. This theory ignores the option of delaying an investment. Given the inadequacy of such an orthodox investment theory, since ...

... 2. A simple model of FDI and the exchange rate An orthodox investment theory, the net present value (NPV) theory, assumes that investment decision is to be taken now or never. This theory ignores the option of delaying an investment. Given the inadequacy of such an orthodox investment theory, since ...

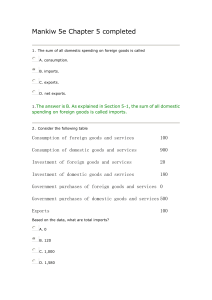

Mankiw 5e Chapter 5 completed

... 20、If the United States has an inflation rate of 10 percent, Great Britain has an inflation rate of 12 percent, and the United States dollar has a nominal appreciation against the British pound of 3 percent, then the real appreciation of the United States dollar against the British pound is A. 1 per ...

... 20、If the United States has an inflation rate of 10 percent, Great Britain has an inflation rate of 12 percent, and the United States dollar has a nominal appreciation against the British pound of 3 percent, then the real appreciation of the United States dollar against the British pound is A. 1 per ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... 7%, and then enters into a swap to convert the dollar loan into INR. The counterparty of the swap may likely be an Indian company (Party B) that requires $2 million in U.S. funds. Likewise, the Indian company will be able to attain a cheaper borrowing rate domestically than abroad – let's say that t ...

... 7%, and then enters into a swap to convert the dollar loan into INR. The counterparty of the swap may likely be an Indian company (Party B) that requires $2 million in U.S. funds. Likewise, the Indian company will be able to attain a cheaper borrowing rate domestically than abroad – let's say that t ...

Chapter 9

... not face forex risk in the short-term, but may very well in the longer-term. • Example: a restaurant in Miami that does not deal with foreign currency could suffer a drop in customers if the value of the Euro is weak. ...

... not face forex risk in the short-term, but may very well in the longer-term. • Example: a restaurant in Miami that does not deal with foreign currency could suffer a drop in customers if the value of the Euro is weak. ...

Aggregate demand

... Aggregate Demand and CA • To see how a change in E effects CA we look at EX and IM Separately. Assume an increase in E – This results in an increase in EX since domestic goods look cheaper to foreigners – This can result in an increase or decrease in IM. Why? (for now assume an increase in E result ...

... Aggregate Demand and CA • To see how a change in E effects CA we look at EX and IM Separately. Assume an increase in E – This results in an increase in EX since domestic goods look cheaper to foreigners – This can result in an increase or decrease in IM. Why? (for now assume an increase in E result ...

Colombian Purchasing Power Parity Analysed Using a Framework

... and external prices. The Johansen framework of multivariate cointegration is used for the empirical analysis, to allow for short-run dynamics. A valid cointegrating relationship is found to exist, but this is relatively far from the parity relationship stated by the PPP hypothesis. Nevertheless, the ...

... and external prices. The Johansen framework of multivariate cointegration is used for the empirical analysis, to allow for short-run dynamics. A valid cointegrating relationship is found to exist, but this is relatively far from the parity relationship stated by the PPP hypothesis. Nevertheless, the ...

External Constraints on Monetary Policy and The Financial Accelerator

... Over the past ¯fteen years there has been a dramatic rise in the frequency of ¯nancial crises that have apparently led to signi¯cant contractions in economic activity. One feature of these crises, that pertains in particular to open economies, is the strong connection with a ¯xed exchange rate regim ...

... Over the past ¯fteen years there has been a dramatic rise in the frequency of ¯nancial crises that have apparently led to signi¯cant contractions in economic activity. One feature of these crises, that pertains in particular to open economies, is the strong connection with a ¯xed exchange rate regim ...

Transaction Exposure

... the change in the present value of the firm resulting from any change in expected future operating cash flows caused by an unexpected change in exchange rates – Translation Exposure – also called accounting exposure, is the changes in owner’s equity because of the need to “translate” financial state ...

... the change in the present value of the firm resulting from any change in expected future operating cash flows caused by an unexpected change in exchange rates – Translation Exposure – also called accounting exposure, is the changes in owner’s equity because of the need to “translate” financial state ...

Order flow and the bid-ask spread: An Empirical

... 2. Some basic results on probability distributions Screen-based trading technology constitutes an important component of modern financial markets. In this section, we present a stylized mathematical model of the quasi-book provided by any such screen-based trading system. Specifically, our goal is t ...

... 2. Some basic results on probability distributions Screen-based trading technology constitutes an important component of modern financial markets. In this section, we present a stylized mathematical model of the quasi-book provided by any such screen-based trading system. Specifically, our goal is t ...

NBER WORKING PAPER SERIES EXCHANGE RATE PASS-THROUGH, EXCHANGE RATE VOLATILITY, AND

... The purpose of this paper is to explore the conditions under which local-currency pricing might induce a high level of exchange-rate volatility. By impeding the linkage of goods prices across countries, local currency pricing leads to deviations from purchasing power parity (PPP), and therefore, in ...

... The purpose of this paper is to explore the conditions under which local-currency pricing might induce a high level of exchange-rate volatility. By impeding the linkage of goods prices across countries, local currency pricing leads to deviations from purchasing power parity (PPP), and therefore, in ...

Michael Working

... finance (Solnik 1973), but Dooley and Isard (1980) argue that political risk of capital controls varies with the stock of outstanding debt. This factor may well be the ire important. '4Michael Melvin in Chapter 13 of Darby, Lothian, et al. (1983) was rather more successful in applying Solnik's (1973 ...

... finance (Solnik 1973), but Dooley and Isard (1980) argue that political risk of capital controls varies with the stock of outstanding debt. This factor may well be the ire important. '4Michael Melvin in Chapter 13 of Darby, Lothian, et al. (1983) was rather more successful in applying Solnik's (1973 ...

The Double Play: Simultaneous Speculative Attacks on Currency

... various phenomena that occur in the very short term money and asset markets during a speculative attack. Under normal circumstances, given the monetary authority’s preference, it will do all it can to maintain the exchange rate, i.e. raise interest rates as high as needed, intervene using its reserv ...

... various phenomena that occur in the very short term money and asset markets during a speculative attack. Under normal circumstances, given the monetary authority’s preference, it will do all it can to maintain the exchange rate, i.e. raise interest rates as high as needed, intervene using its reserv ...

Economics and Political Economy

... interest of measuring currency crises Eichengreen et al. (1996) add a third term: changes in the nominal interest rate. The idea behind this is that an excess demand for foreign exchange can be met through several channels. Depreciation or devaluation occurs if the speculative attack is successful, ...

... interest of measuring currency crises Eichengreen et al. (1996) add a third term: changes in the nominal interest rate. The idea behind this is that an excess demand for foreign exchange can be met through several channels. Depreciation or devaluation occurs if the speculative attack is successful, ...

12. Impact of Currency Devaluation on Economic Growth of Nigeria

... devalue the nation’s currency. According to Yioyio (2013), devaluation is a deliberate downward adjustment to the value of a country's currency, relative to another currency, group of currencies or standard. In otherwords, devaluation is a reduction in the value of a currency with respect to those g ...

... devalue the nation’s currency. According to Yioyio (2013), devaluation is a deliberate downward adjustment to the value of a country's currency, relative to another currency, group of currencies or standard. In otherwords, devaluation is a reduction in the value of a currency with respect to those g ...

MPSAS 4 The Effects of Changes In Foreign Exchange Rates

... The following terms are used in this Standard with the meanings specified: Closing rate is the spot exchange rate at the reporting date. Exchange difference is the difference resulting from translating a given number of units of one currency into another currency at different exchange rates. Exchang ...

... The following terms are used in this Standard with the meanings specified: Closing rate is the spot exchange rate at the reporting date. Exchange difference is the difference resulting from translating a given number of units of one currency into another currency at different exchange rates. Exchang ...