Chapter 18 – Trade and Development, page 1 of 8

... inflation levels that exceeded world inflation, the countries needed to devalue their currency in order for their exports to remain competitive in world markets, but frequently they failed to devalue, so the exchange rates remained overvalued; developing country governments resisted devaluation in p ...

... inflation levels that exceeded world inflation, the countries needed to devalue their currency in order for their exports to remain competitive in world markets, but frequently they failed to devalue, so the exchange rates remained overvalued; developing country governments resisted devaluation in p ...

NBER WORKING PAPER SERIES ON THE RENMINBI: THE CHOICE BETWEEN ADJUSTMENT

... An exchange rate that is de facto fixed has served China well over the last eight years. Nevertheless, four major reasons have been given to suggest that it may now be time to allow the yuan to appreciate. First, calculations based on the Balassa-Samuelson relationship suggest that the real value of ...

... An exchange rate that is de facto fixed has served China well over the last eight years. Nevertheless, four major reasons have been given to suggest that it may now be time to allow the yuan to appreciate. First, calculations based on the Balassa-Samuelson relationship suggest that the real value of ...

The Impact of Exchange Rate Movement on Export

... Ghana is well endowed with natural resources. These resources include gold, diamond, timber, cocoa, oil etc. Like many well-endowed African countries, Ghana exports almost all of its natural resources in their unprocessed state to its trading partners for further processing. Consequently, revenues a ...

... Ghana is well endowed with natural resources. These resources include gold, diamond, timber, cocoa, oil etc. Like many well-endowed African countries, Ghana exports almost all of its natural resources in their unprocessed state to its trading partners for further processing. Consequently, revenues a ...

Net Capital Outflow

... Political Instability and Capital Flight • Capital flight has its largest impact on the country from which the capital is fleeing, but it also affects other countries. • If investors become concerned about the safety of their investments, capital can quickly leave an economy. • Interest rates incre ...

... Political Instability and Capital Flight • Capital flight has its largest impact on the country from which the capital is fleeing, but it also affects other countries. • If investors become concerned about the safety of their investments, capital can quickly leave an economy. • Interest rates incre ...

32 - Mersin

... Political Instability and Capital Flight • Capital flight has its largest impact on the country from which the capital is fleeing, but it also affects other countries. • If investors become concerned about the safety of their investments, capital can quickly leave an economy. • Interest rates incre ...

... Political Instability and Capital Flight • Capital flight has its largest impact on the country from which the capital is fleeing, but it also affects other countries. • If investors become concerned about the safety of their investments, capital can quickly leave an economy. • Interest rates incre ...

Factor income shares and the current account of the New... balance of payments

... balance of payments in terms of payments rather than transactions, the overall effect on the flow excess demand for foreign exchange is zero since no actual payments take place which have to pass through the foreign exchange market. In principle, all of the profit outflows appearing in the balance o ...

... balance of payments in terms of payments rather than transactions, the overall effect on the flow excess demand for foreign exchange is zero since no actual payments take place which have to pass through the foreign exchange market. In principle, all of the profit outflows appearing in the balance o ...

NBER WORKING PAPER SERIES THE INTERNATIONAL MONETARY SYSTEM: Jacob

... slope of the labor—demand schedule, especially if wage developments are dominsted by insiders with jobs rather than by outsiders without them. Surprisingly enough, disciplinary effects on ...

... slope of the labor—demand schedule, especially if wage developments are dominsted by insiders with jobs rather than by outsiders without them. Surprisingly enough, disciplinary effects on ...

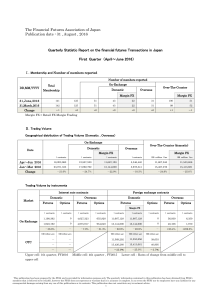

The Financial Futures Association of Japan Publication date : 31

... This publication has been prepared by the FFAJ and is provided for information purpose only. The quarterly information contained in this publication has been obtained from FFAJ's members that is believed to be reliable, however the FFAJ does not represent or warrant that it is accurate or complete. ...

... This publication has been prepared by the FFAJ and is provided for information purpose only. The quarterly information contained in this publication has been obtained from FFAJ's members that is believed to be reliable, however the FFAJ does not represent or warrant that it is accurate or complete. ...

EXCHANGE RATE RISK AND EXPORT FLOWS

... the trade volumes and exchange rate regime. Under both systems, the volume of the trade can increase or decrease depending on consumer preferences and decisions on monetary policy in each country. Based on developed theoretical models, empirical papers study the exchange rate effects on trade flows ...

... the trade volumes and exchange rate regime. Under both systems, the volume of the trade can increase or decrease depending on consumer preferences and decisions on monetary policy in each country. Based on developed theoretical models, empirical papers study the exchange rate effects on trade flows ...

The euro in the currency war - Conseil d`Analyse Economique

... in the cases of Italy and Spain, rather than to finance businesses. This outcome has made both banks and sovereigns more vulnerable to each other.7 The bank’s reluctance to extend loans to the private sector can be partly explained by the capital constraints faced by the banks as part of the current ...

... in the cases of Italy and Spain, rather than to finance businesses. This outcome has made both banks and sovereigns more vulnerable to each other.7 The bank’s reluctance to extend loans to the private sector can be partly explained by the capital constraints faced by the banks as part of the current ...

Financial Market in Latvia

... provided both by banks and by leasing companies, which are mostly part of banking groups. Investment opportunities offered by mutual funds are becoming increasingly popular, and investment funds, as well as pension funds, are rapidly growing areas of the non-bank financial sector. The insurance mark ...

... provided both by banks and by leasing companies, which are mostly part of banking groups. Investment opportunities offered by mutual funds are becoming increasingly popular, and investment funds, as well as pension funds, are rapidly growing areas of the non-bank financial sector. The insurance mark ...

1 Currency Areas, Exchange Rate Systems and

... telling defects in our international monetary system. The inefficiency of our current “syst the hundreds of trillions of dollars of waste capital movements that cross international borders every year solely as a consequence of uncertainty over exchange rates. In this respect we should look with more ...

... telling defects in our international monetary system. The inefficiency of our current “syst the hundreds of trillions of dollars of waste capital movements that cross international borders every year solely as a consequence of uncertainty over exchange rates. In this respect we should look with more ...

Market Makers

... 614D. A Market Maker wishing to conduct Options Hedging Short Selling shall notify the Exchange of its intention. A Market Maker may also apply to the Exchange to register one or more Exchange Participants as its Options Hedging Participants which will conduct on its behalf Options Hedging Transact ...

... 614D. A Market Maker wishing to conduct Options Hedging Short Selling shall notify the Exchange of its intention. A Market Maker may also apply to the Exchange to register one or more Exchange Participants as its Options Hedging Participants which will conduct on its behalf Options Hedging Transact ...

Module - 13 Foreign Exchange Quotations

... Banks also provide spot quotations for Bill buying/bill selling rates. Bill Buying rate: Suppose an Indian exporters has exported goods and the foreign counterpart has raised a bill. The Indian exporter would sell the bill to the bank (bank will buy the bill) and bank will pay a discounted value to ...

... Banks also provide spot quotations for Bill buying/bill selling rates. Bill Buying rate: Suppose an Indian exporters has exported goods and the foreign counterpart has raised a bill. The Indian exporter would sell the bill to the bank (bank will buy the bill) and bank will pay a discounted value to ...

PPT chapter 14

... • Examples of goods not traded internationally are: – those with large transportation costs, like hairdressing services and heavy construction materials – those that cannot be traded, like agricultural land and ...

... • Examples of goods not traded internationally are: – those with large transportation costs, like hairdressing services and heavy construction materials – those that cannot be traded, like agricultural land and ...

Price Levels and the Exchange Rate in the Long Run.

... restrictions make trade expensive and in some cases create non-tradable goods or services. Services are often not tradable: services are generally offered within a limited geographic region (for example, haircuts). Service and construction industries (non-tradables) represent 46% of U.S GNP. T ...

... restrictions make trade expensive and in some cases create non-tradable goods or services. Services are often not tradable: services are generally offered within a limited geographic region (for example, haircuts). Service and construction industries (non-tradables) represent 46% of U.S GNP. T ...

N F O M

... On the one hand, when these crises were unfolding the prevailing expectation had been that the crash of stable exchange regimes had to usher a relatively long period of unfettered inflation. Such an expectation was only natural in view of earlier episodes of monetary disorder in both countries. Inde ...

... On the one hand, when these crises were unfolding the prevailing expectation had been that the crash of stable exchange regimes had to usher a relatively long period of unfettered inflation. Such an expectation was only natural in view of earlier episodes of monetary disorder in both countries. Inde ...

Exam Name___________________________________

... 50) An increase in the domestic interest rate shifts the expected return schedule for ________ deposits to the ________ and causes the domestic currency to appreciate. A) domestic; right B) domestic; left C) foreign; right D) foreign; left Answer: A 51) A decrease in the domestic interest rate shif ...

... 50) An increase in the domestic interest rate shifts the expected return schedule for ________ deposits to the ________ and causes the domestic currency to appreciate. A) domestic; right B) domestic; left C) foreign; right D) foreign; left Answer: A 51) A decrease in the domestic interest rate shif ...

NBER WORKING PAPER SERIES

... 8. "Speculation" should be stabilizing rather than destabilizing. The argument originated with Friedman's claim that any class of speculators who added to the ...

... 8. "Speculation" should be stabilizing rather than destabilizing. The argument originated with Friedman's claim that any class of speculators who added to the ...

Examining the first stages of Market Performance

... Since the 1970's public attention to emerging markets has grown. This is related to the growth of the number of emerging markets, as well as to the increased importance of these markets on the international financial scene. Although many of the markets are commonly named ``emerging", differences amo ...

... Since the 1970's public attention to emerging markets has grown. This is related to the growth of the number of emerging markets, as well as to the increased importance of these markets on the international financial scene. Although many of the markets are commonly named ``emerging", differences amo ...

A Macroeconomic Theory of the Open Economy

... • The real exchange rate adjusts to balance the supply and demand for dollars. • At the equilibrium real exchange rate, the demand for dollars to buy net exports exactly balances the supply of dollars to be exchanged into foreign currency to buy assets abroad. • For example, if the US has a trade s ...

... • The real exchange rate adjusts to balance the supply and demand for dollars. • At the equilibrium real exchange rate, the demand for dollars to buy net exports exactly balances the supply of dollars to be exchanged into foreign currency to buy assets abroad. • For example, if the US has a trade s ...

Figure 6-9 Effect of a Fiscal Policy Stimulus with Fixed Exchange

... We also learned that government budget deficit can be financed partially or totally by foreign borrowing depending on the size of the economy. A small open economy can borrow the entire deficit without crowding out, while a large economy influences world interest rates and thus crowd out private inv ...

... We also learned that government budget deficit can be financed partially or totally by foreign borrowing depending on the size of the economy. A small open economy can borrow the entire deficit without crowding out, while a large economy influences world interest rates and thus crowd out private inv ...

PURCHASING POWER PARITY AND TURKISH LIRA

... The PPP is of the hypothesis that the elasticity of the exchange rate with respect to the price rate is about unity. Policies, which affect the trend of domestic prices are likely to affect the exchange rate in the same manner. 1970s have brought instability so that the PPP could not be estimated st ...

... The PPP is of the hypothesis that the elasticity of the exchange rate with respect to the price rate is about unity. Policies, which affect the trend of domestic prices are likely to affect the exchange rate in the same manner. 1970s have brought instability so that the PPP could not be estimated st ...

If Exchange Rates Are Random Walks Then Almost Everything We

... that when a central bank changes its interest rate relative to that on other major currencies this change is reflected almost entirely as changes in the excess returns on its bonds over that on foreign bonds. Interpreted in a standard model with complete markets this observation implies that changes ...

... that when a central bank changes its interest rate relative to that on other major currencies this change is reflected almost entirely as changes in the excess returns on its bonds over that on foreign bonds. Interpreted in a standard model with complete markets this observation implies that changes ...