Document

... – If the EU basket costs €100, the U.S. basket costs $120, and the nominal exchange rate is $1.20 per euro, then the real exchange rate is 1 U.S. basket per 1 EU basket. – A real depreciation of the value of U.S. products means a fall in a dollar’s purchasing power of EU products relative to a dolla ...

... – If the EU basket costs €100, the U.S. basket costs $120, and the nominal exchange rate is $1.20 per euro, then the real exchange rate is 1 U.S. basket per 1 EU basket. – A real depreciation of the value of U.S. products means a fall in a dollar’s purchasing power of EU products relative to a dolla ...

Exchange Rates

... In a recent Friday edition of the Wall Street Journal I saw that the exchange rate between the Euro and the dollar was $1.3303 per Euro. (Note most papers will print exchange rates in Friday editions.) The paper also shows that this means .75154 Euros will get $1. But let’s stick with dollars per E ...

... In a recent Friday edition of the Wall Street Journal I saw that the exchange rate between the Euro and the dollar was $1.3303 per Euro. (Note most papers will print exchange rates in Friday editions.) The paper also shows that this means .75154 Euros will get $1. But let’s stick with dollars per E ...

Choosing an exchange

... that nominal variables (such as monetary policy actions) aect the real economy, due to problems such as nominal price sluggishness, there is considerable controversy over the question of whether any real eects stem from systematic dierences in monetary policy ± such as a monetary rule to peg the ...

... that nominal variables (such as monetary policy actions) aect the real economy, due to problems such as nominal price sluggishness, there is considerable controversy over the question of whether any real eects stem from systematic dierences in monetary policy ± such as a monetary rule to peg the ...

Currency Manipulation, the US Economy

... Reserve Board to simulate the effects within the Fed’s macroeconomic model (FRB/US) of a 10 percent depreciation of the trade-weighted dollar beginning in the first quarter of 2013. US monetary policy is assumed to be unaffected until late 2014, at which time the short-term interest rate begins to r ...

... Reserve Board to simulate the effects within the Fed’s macroeconomic model (FRB/US) of a 10 percent depreciation of the trade-weighted dollar beginning in the first quarter of 2013. US monetary policy is assumed to be unaffected until late 2014, at which time the short-term interest rate begins to r ...

PDF Download

... Deteriorating fiscal conditions could constrain the use of budget policies for stabilisation purposes. Stabilisation is likely to fall disproportionately on monetary and fiscal authorities, both from a macro perspective and from a financial stability perspective. In such an environment, mandatory ad ...

... Deteriorating fiscal conditions could constrain the use of budget policies for stabilisation purposes. Stabilisation is likely to fall disproportionately on monetary and fiscal authorities, both from a macro perspective and from a financial stability perspective. In such an environment, mandatory ad ...

the political economy of international monetary relations

... 1914, to the dollar or some other currency since 1945 – when most of its neighbors have done so. The national and the international interact in complex ways; but for ease of analysis it is useful to look at separate dependent variables: the national policy choices of governments, and the character ...

... 1914, to the dollar or some other currency since 1945 – when most of its neighbors have done so. The national and the international interact in complex ways; but for ease of analysis it is useful to look at separate dependent variables: the national policy choices of governments, and the character ...

Document

... domestic rates could depart substantially from their covered parity in Mexico. Khor and Rojas-Suárez (1991): During 1987 to 1990, yields on dollar-indexed Mexican government bonds were cointegrated with yields to maturity on Mexican public external debt traded in the secondary market. So Mexico' ...

... domestic rates could depart substantially from their covered parity in Mexico. Khor and Rojas-Suárez (1991): During 1987 to 1990, yields on dollar-indexed Mexican government bonds were cointegrated with yields to maturity on Mexican public external debt traded in the secondary market. So Mexico' ...

NBER WORKING PAPER SERIES Jeffrey Frankel Working Paper 13050

... rand over the period 1984-2006. The results show a relatively good fit. As so often with exchange rate equations, there is substantial weight on the lagged exchange rate, which can be attributed to a momentum component. Nevertheless, economic fundamentals are significant and important. This is espec ...

... rand over the period 1984-2006. The results show a relatively good fit. As so often with exchange rate equations, there is substantial weight on the lagged exchange rate, which can be attributed to a momentum component. Nevertheless, economic fundamentals are significant and important. This is espec ...

Classical Economics & Relative Prices

... Suppose that trade is initially balanced. A rise in productivity increases investment demand In a closed economy, interest rates would rise In an open economy, the trade deficit would increase. In the case, the deficit increases from zero to $15,000 Do interest rates rise at all? ...

... Suppose that trade is initially balanced. A rise in productivity increases investment demand In a closed economy, interest rates would rise In an open economy, the trade deficit would increase. In the case, the deficit increases from zero to $15,000 Do interest rates rise at all? ...

Brazil`s Derivatives Markets

... execute trades in full view of all other participants. This multilateral trading environment has a leveling effect of allowing everyone the same view on the market and the same opportunity to trade at the same prices. Exchange traded derivatives are usually cleared and settled through a central clea ...

... execute trades in full view of all other participants. This multilateral trading environment has a leveling effect of allowing everyone the same view on the market and the same opportunity to trade at the same prices. Exchange traded derivatives are usually cleared and settled through a central clea ...

Exchange Rates and Trade Balances under the Dollar Standard

... Created in the 1930s and still widely accepted, the elasticities approach is central to many Keynesian (James Meade, 1951) and monetarist models (Milton Friedman 1953; Harry Johnson 1958). According to these models, the exchange rate is assigned to address external balance while government expendit ...

... Created in the 1930s and still widely accepted, the elasticities approach is central to many Keynesian (James Meade, 1951) and monetarist models (Milton Friedman 1953; Harry Johnson 1958). According to these models, the exchange rate is assigned to address external balance while government expendit ...

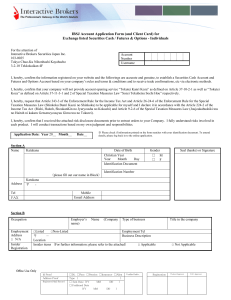

IBSJ Account Application Form (and Client Card) for Exchange listed

... Interactive Brokers (“IB”) can maintain its low commission structure because we have built automated trade processes to minimize human intervention and discretion. In this respect, we have established some simple terms which govern trading in all IB accounts. These rules recognize that from time to ...

... Interactive Brokers (“IB”) can maintain its low commission structure because we have built automated trade processes to minimize human intervention and discretion. In this respect, we have established some simple terms which govern trading in all IB accounts. These rules recognize that from time to ...

Jonathan Turnovsky PAPER SERIES

... UIP. Also, the exchange rate and domestic price level are homogeneous of degree one, and the interest rate homogeneous of degree zero, in the supplies of both domestic assets taken together, and not just money.5 Sections III and IV examine the transition between steady states, a subject which has be ...

... UIP. Also, the exchange rate and domestic price level are homogeneous of degree one, and the interest rate homogeneous of degree zero, in the supplies of both domestic assets taken together, and not just money.5 Sections III and IV examine the transition between steady states, a subject which has be ...

form of final terms - World Bank Treasury

... Rate is to be so determined. Rate Fixing Date: The Scheduled Rate Fixing Date or the Postponed Rate Fixing Date. Schedule Rate Fixing Date: Date which is five London, Mumbai, Singapore & New York Business Days prior to the Interest Payment Date or the Maturity Date or such other date on which an amo ...

... Rate is to be so determined. Rate Fixing Date: The Scheduled Rate Fixing Date or the Postponed Rate Fixing Date. Schedule Rate Fixing Date: Date which is five London, Mumbai, Singapore & New York Business Days prior to the Interest Payment Date or the Maturity Date or such other date on which an amo ...

Testing the Taylor Model Predictability for Exchange Rates

... Motivated by those new developments and trying to build up on the recent results, we incorporate Latin America economies in the exchange rate predictability analysis. Our focus is to test for cointegration relationships and apply a mean correction error formulation to the Taylor rule model and a bro ...

... Motivated by those new developments and trying to build up on the recent results, we incorporate Latin America economies in the exchange rate predictability analysis. Our focus is to test for cointegration relationships and apply a mean correction error formulation to the Taylor rule model and a bro ...

A review of the trade weighted exchange rate index Hannah Kite

... within other countries’ domestic economies, and hence ...

... within other countries’ domestic economies, and hence ...

A SINGLE CURRENCY FOR THE PACIFIC ISLAND COUNTRIES: A STEPWISE APPROACH

... in both developed and developing regions have kindled great interest in the subject for the policy makers in the South Pacific (Jayaraman, 2002). The economic gains of a currency union with a single currency in circulation replacing independent currencies are substantial. They include reduction in t ...

... in both developed and developing regions have kindled great interest in the subject for the policy makers in the South Pacific (Jayaraman, 2002). The economic gains of a currency union with a single currency in circulation replacing independent currencies are substantial. They include reduction in t ...

PDF

... but negative and significant relationship between relative prices and income of Iran‘s trading partners. Sign of the variables VOL and RELP that are marked as exchange rate volatility and relative prices were consistent with the theory, but sign of the variable income of Iran‘s trading partners is i ...

... but negative and significant relationship between relative prices and income of Iran‘s trading partners. Sign of the variables VOL and RELP that are marked as exchange rate volatility and relative prices were consistent with the theory, but sign of the variable income of Iran‘s trading partners is i ...

Foreign currency assets and chargeable gains

... Companies will be required to compute their chargeable gains and losses using their functional currency at the date of disposal. Any chargeable gain or loss will then be translated into sterling using the exchange rate at the date of disposal. There is an exception for investment companies which hav ...

... Companies will be required to compute their chargeable gains and losses using their functional currency at the date of disposal. Any chargeable gain or loss will then be translated into sterling using the exchange rate at the date of disposal. There is an exception for investment companies which hav ...

The Relationship Between Foreign Exchange

... country currency have always had its effect on the balance of trade. Kenya’s economic performance heavily relies on exports and imports both of which determine the balance of trade. The research explored the relationship between foreign exchange rate fluctuations and the balance of trade in a settin ...

... country currency have always had its effect on the balance of trade. Kenya’s economic performance heavily relies on exports and imports both of which determine the balance of trade. The research explored the relationship between foreign exchange rate fluctuations and the balance of trade in a settin ...

PDF

... The volume of U S farm exports contmues below lts 1980 peak Thls lS one of the major problems plagu mg agrlculture Lower exports contrIbuted m the elghtles to lower mcomes, financlal stress, and reduced values of land and other farm assets AgI l culture may not recover until farm exports plck up T ...

... The volume of U S farm exports contmues below lts 1980 peak Thls lS one of the major problems plagu mg agrlculture Lower exports contrIbuted m the elghtles to lower mcomes, financlal stress, and reduced values of land and other farm assets AgI l culture may not recover until farm exports plck up T ...

Jim2 Multicurrency - Happen Business Accounting Software

... All the power and proven functionality you’ve come to expect from Jim2 Business Engine – now including fully integrated Multicurrency. Seeing is believing – there’s nothing else like Jim2 Business Engine. ...

... All the power and proven functionality you’ve come to expect from Jim2 Business Engine – now including fully integrated Multicurrency. Seeing is believing – there’s nothing else like Jim2 Business Engine. ...

economic and monetary union

... • But because of differences in monetary and fiscal policies across the EMS, markets participants began buying German assets (because of high German interest rates) and selling other EMS assets. • As a result, Britain left the EMS in 1992 and allowed the pound to float against other European currenc ...

... • But because of differences in monetary and fiscal policies across the EMS, markets participants began buying German assets (because of high German interest rates) and selling other EMS assets. • As a result, Britain left the EMS in 1992 and allowed the pound to float against other European currenc ...

Impactul socurilor structurale asupra ratei reale de

... depreciation of the real exchange rate that remains permanent above the level of the initial shock. We notice that the supply shock (previous table) and the demand shock (current table) have contrasting influences over the real exchange rate, thus justifying our approach of using several “real” vari ...

... depreciation of the real exchange rate that remains permanent above the level of the initial shock. We notice that the supply shock (previous table) and the demand shock (current table) have contrasting influences over the real exchange rate, thus justifying our approach of using several “real” vari ...