The Purchasing Power Parity Debate

... 1820 –2001. Both are expressed in U.S. dollar terms, which means that the UK CPI was multiplied by the number of U.S. dollars exchanging for one UK pound at that point in time. The bottom panel shows the comparison using producer price indices, using data for a slightly longer period 1791–2001.1 We ...

... 1820 –2001. Both are expressed in U.S. dollar terms, which means that the UK CPI was multiplied by the number of U.S. dollars exchanging for one UK pound at that point in time. The bottom panel shows the comparison using producer price indices, using data for a slightly longer period 1791–2001.1 We ...

inflation and exchange rate depreciation: a

... The theory by Mundell and Flemming (1960) , considers three markets: money, assets and goods market under perfect price flexibility in the long run. One implication is that devaluation may lead to further devaluation if fiscal discipline, inflation and B.O.P disequilibria are not well managed. Anoth ...

... The theory by Mundell and Flemming (1960) , considers three markets: money, assets and goods market under perfect price flexibility in the long run. One implication is that devaluation may lead to further devaluation if fiscal discipline, inflation and B.O.P disequilibria are not well managed. Anoth ...

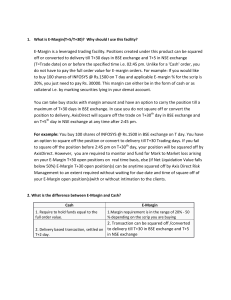

E-Margin is a leveraged trading facility. Positions

... off or converted to delivery till T+30 days in BSE exchange and T+5 in NSE exchange (T=Trade date) on or before the specified time i.e. 02:45 pm. Unlike for a 'Cash' order, you do not have to pay the full order value for E-margin orders. For example: If you would like to buy 100 shares of INFOSYS @ ...

... off or converted to delivery till T+30 days in BSE exchange and T+5 in NSE exchange (T=Trade date) on or before the specified time i.e. 02:45 pm. Unlike for a 'Cash' order, you do not have to pay the full order value for E-margin orders. For example: If you would like to buy 100 shares of INFOSYS @ ...

Questions For The Central Bank Of The Republic

... between tradable and non-tradable sectors to explain deviations in purchasing power parity. According to the B-S hypothesis, because productivity growth in tradable sectors is higher than in non-tradable sectors, real wages increase in tradable sectors. On the other hand, because the prices of trada ...

... between tradable and non-tradable sectors to explain deviations in purchasing power parity. According to the B-S hypothesis, because productivity growth in tradable sectors is higher than in non-tradable sectors, real wages increase in tradable sectors. On the other hand, because the prices of trada ...

exchange rate pass-through in india

... varying parameter model and finds a dollar appreciation during 1980s led to a smaller decline in import prices due to a larger associated increase in foreign costs. Goldberg and Knetter (1997) present the evidence of incomplete pass-through of exchange rates to goods prices especially to import pric ...

... varying parameter model and finds a dollar appreciation during 1980s led to a smaller decline in import prices due to a larger associated increase in foreign costs. Goldberg and Knetter (1997) present the evidence of incomplete pass-through of exchange rates to goods prices especially to import pric ...

3AECO – 6 Exchange rates - Economics Teachers` Association of

... between buyers and sellers but not within other countries. Australian producers of exports want to be paid in AUD while Japanese buyers of Australian exports pay in Yen. Somehow Yen must be converted into AUD (exchanged for AUD). • The problem is solved through foreign exchange markets (markets in c ...

... between buyers and sellers but not within other countries. Australian producers of exports want to be paid in AUD while Japanese buyers of Australian exports pay in Yen. Somehow Yen must be converted into AUD (exchanged for AUD). • The problem is solved through foreign exchange markets (markets in c ...

Download Dissertation

... the real exchange rate and analyze the returns of these portfolios as they relate to traditional asset pricing factors and especially how they correlate with carry trade portfolios. Deviations from long term averages of real exchange rates are found to be predictors of crash risk. I also show that t ...

... the real exchange rate and analyze the returns of these portfolios as they relate to traditional asset pricing factors and especially how they correlate with carry trade portfolios. Deviations from long term averages of real exchange rates are found to be predictors of crash risk. I also show that t ...

This PDF is a selection from a published volume from... of Economic Research Volume Title: NBER International Seminar on Macroeconomics 2012

... percent of GDP at the end of 2010) and the local market for corporate bonds remains small and dominated by a handful of large state-owned institutions. The main vehicle for households’ and firms’ financial saving is bank deposits, which amounted to about 140 percent of GDP on average in the 2000s, a ...

... percent of GDP at the end of 2010) and the local market for corporate bonds remains small and dominated by a handful of large state-owned institutions. The main vehicle for households’ and firms’ financial saving is bank deposits, which amounted to about 140 percent of GDP on average in the 2000s, a ...

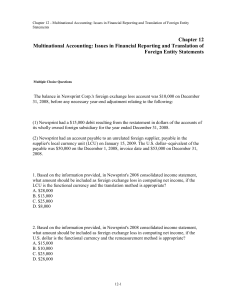

Ch12 – Financial Reporting and Translation of Foreign

... 21. The assets listed below of a foreign subsidiary have been converted to U.S. dollars at both current and historical exchange rates. Assuming that the local currency of the foreign subsidiary is the functional currency, what total amount should appear for these assets on the U.S. company's consoli ...

... 21. The assets listed below of a foreign subsidiary have been converted to U.S. dollars at both current and historical exchange rates. Assuming that the local currency of the foreign subsidiary is the functional currency, what total amount should appear for these assets on the U.S. company's consoli ...

ch20_5e

... An increase in the U.S. interest rate, say, after a monetary contraction, will cause the U.S. interest rate to increase, and the demand for U.S. bonds to rise. As investors switch from foreign currency to dollars, the dollar appreciates. The more the dollar appreciates, the more investors expect it ...

... An increase in the U.S. interest rate, say, after a monetary contraction, will cause the U.S. interest rate to increase, and the demand for U.S. bonds to rise. As investors switch from foreign currency to dollars, the dollar appreciates. The more the dollar appreciates, the more investors expect it ...

PDF

... and by no means an automatic, process. It is characterized by rigidities and inertia created by physical, psychological and legal considerations that raises the cost of spatially rearranging productive activities. Positive elasticities for all countries suggests that macroeconomic structural adjustm ...

... and by no means an automatic, process. It is characterized by rigidities and inertia created by physical, psychological and legal considerations that raises the cost of spatially rearranging productive activities. Positive elasticities for all countries suggests that macroeconomic structural adjustm ...

Exchange Rate Regimes of Developing Countries: Global Context

... and these crises have had large real economic costs. However, this phenomenon of the boom/bust cycle in private capital flows and its attendant costs is relevant primarily for the emerging market economies, which have important involvement in modern global financial markets. It has not directly affe ...

... and these crises have had large real economic costs. However, this phenomenon of the boom/bust cycle in private capital flows and its attendant costs is relevant primarily for the emerging market economies, which have important involvement in modern global financial markets. It has not directly affe ...

Portfolio Choices with Near Rational Agents: A Solution of Some

... of bad news on the expected discounted value of consumption. In this case, there is a close parallel with the stochastic discount factor of non-expected utility models discussed in Hansen et al. (2005) and Piazzesi and Schneider (2006).6 The reasons for why the model with near-rational agents genera ...

... of bad news on the expected discounted value of consumption. In this case, there is a close parallel with the stochastic discount factor of non-expected utility models discussed in Hansen et al. (2005) and Piazzesi and Schneider (2006).6 The reasons for why the model with near-rational agents genera ...

Purchasing Power Parity: Granger Causality Tests for the Yen

... On the export side, the influence of the exchange rate on the pricing behaviour of the Japanese export industry has earned keen attention. According to Marston (1990) (1991) Japanese enterprises tend to reduce yen export prices in case of appreciation. Athukorola and Menon (1994: 280) identify this ...

... On the export side, the influence of the exchange rate on the pricing behaviour of the Japanese export industry has earned keen attention. According to Marston (1990) (1991) Japanese enterprises tend to reduce yen export prices in case of appreciation. Athukorola and Menon (1994: 280) identify this ...

TCX`s role in the Kyrgyz Republic during the 2014 Russian ruble

... in the outskirts of Bishkek, the capital of the Kyrgyz Republic. It has been three years since Jyrgal inherited his father’s construction company. After a difficult first year, the business picked up in 2013. Jyrgal began to reap the fruits of his own labor while benefiting at the same time from pub ...

... in the outskirts of Bishkek, the capital of the Kyrgyz Republic. It has been three years since Jyrgal inherited his father’s construction company. After a difficult first year, the business picked up in 2013. Jyrgal began to reap the fruits of his own labor while benefiting at the same time from pub ...

NBER WORKING PAPER SERIES ASSET PRICES AND EXCHANGE RATES Anna Pavlova Roberto Rigobon

... a boost to the domestic stock and bond markets, while asset prices abroad fall. This pattern is very close to macroeconomic dynamics observed in the US in the 90’s when large capital inflows were pushing the interest rates down, increasing stock prices, and strengthening the dollar. These implicatio ...

... a boost to the domestic stock and bond markets, while asset prices abroad fall. This pattern is very close to macroeconomic dynamics observed in the US in the 90’s when large capital inflows were pushing the interest rates down, increasing stock prices, and strengthening the dollar. These implicatio ...

PDF

... opportunities of diversifying its risk portfolio and increase the expectancy for profits. Côté (1994) compares the previous approach to the derivative market, in which the commerce is identified as an option that becomes more appreciated as the exchange rate instability increases. This would occur m ...

... opportunities of diversifying its risk portfolio and increase the expectancy for profits. Côté (1994) compares the previous approach to the derivative market, in which the commerce is identified as an option that becomes more appreciated as the exchange rate instability increases. This would occur m ...

Pegging the future West African single currency in regard to

... Among the new questions, the choice of the exchange rate regime is at the forefront of the discussions though the academic work at still in a burgeoning step and rare. Some authors are concerned with the trade-off between floating and fixed exchange rate. For instance, Batte et al. (2008) study such ...

... Among the new questions, the choice of the exchange rate regime is at the forefront of the discussions though the academic work at still in a burgeoning step and rare. Some authors are concerned with the trade-off between floating and fixed exchange rate. For instance, Batte et al. (2008) study such ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... sectors, typically by increasing exports and decreasing imports of goods and services. Exchange rate changes are the main instruments to achieve expenditure switching. These two groups of policies are discussed next. Because high inflation and external sector deficits are the main economic imbalance ...

... sectors, typically by increasing exports and decreasing imports of goods and services. Exchange rate changes are the main instruments to achieve expenditure switching. These two groups of policies are discussed next. Because high inflation and external sector deficits are the main economic imbalance ...

Put-Call Parity, Transaction Costs and PHLX Currency

... arbitrage profit ($) for each LBC deviation, multiplied by the contract size. Similarly, mean profit ($) for all currencies is calculated as summation of total arbitrage profit ($) for each currency (British pound, Swiss franc and Euro) divided by total number of PCP deviations for all currencies. I ...

... arbitrage profit ($) for each LBC deviation, multiplied by the contract size. Similarly, mean profit ($) for all currencies is calculated as summation of total arbitrage profit ($) for each currency (British pound, Swiss franc and Euro) divided by total number of PCP deviations for all currencies. I ...

In this paper we wil first the large increase of foreign exchange

... part of larger process of accumulation of foreign exchange assets by developing countries, which also includes the large accumulation of foreign exchange reserves during the boom that these countries have experienced over most of the current decades, reflecting both booming exports (due in part to h ...

... part of larger process of accumulation of foreign exchange assets by developing countries, which also includes the large accumulation of foreign exchange reserves during the boom that these countries have experienced over most of the current decades, reflecting both booming exports (due in part to h ...

NBER WORKING PAPER SERIES EXTERNAL CONSTRAINTS ON MONETARY POLICY Mark Gertler

... risk premium followed. Dwindling foreign currency reserves then forced the central bank to raise the overnight call rate over a thousand basis points. The sharp rise in the country risk premium and short-term interest rates was the prelude to a substantial deterioration of real economic activity. Fi ...

... risk premium followed. Dwindling foreign currency reserves then forced the central bank to raise the overnight call rate over a thousand basis points. The sharp rise in the country risk premium and short-term interest rates was the prelude to a substantial deterioration of real economic activity. Fi ...

Between war and peace: The Ottoman economy and foreign

... by mid-February 1919 and these invasions flamed up the Turkish War of Independence (Özsoy, 2007: 96–98; Erikan, 2008: 21–14, 47–51). During the occupations, two different governments controlled the Ottoman Empire. One was located in Istanbul and controlled by the Allies. Another one was established ...

... by mid-February 1919 and these invasions flamed up the Turkish War of Independence (Özsoy, 2007: 96–98; Erikan, 2008: 21–14, 47–51). During the occupations, two different governments controlled the Ottoman Empire. One was located in Istanbul and controlled by the Allies. Another one was established ...

The Effects of Exchange Rate Volatility on Exports

... nominal exchange rate volatility on international trade depends on various factors. The overall evidence is best characterized as mixed as the results are sensitive to the choices of sample period, model specification, proxies for exchange rate volatility, and countries considered (developed, develo ...

... nominal exchange rate volatility on international trade depends on various factors. The overall evidence is best characterized as mixed as the results are sensitive to the choices of sample period, model specification, proxies for exchange rate volatility, and countries considered (developed, develo ...