Omega:A Sharper Ratio

... They aren’t any more so than any other future cash-flow - Their sensitivities are to salaries, wage and retail price inflation and longevity The apparent sensitivity arises because we discount future cash-flows using an interest rate curve In theory the default risk free – but that does not exist Bu ...

... They aren’t any more so than any other future cash-flow - Their sensitivities are to salaries, wage and retail price inflation and longevity The apparent sensitivity arises because we discount future cash-flows using an interest rate curve In theory the default risk free – but that does not exist Bu ...

Large Cap Sustainable Growth Fact Sheet

... in commodity prices, they have not yet returned to a level that would stimulate demand for Schlumberger’s deep water drilling services and equipment sales. ...

... in commodity prices, they have not yet returned to a level that would stimulate demand for Schlumberger’s deep water drilling services and equipment sales. ...

Document

... 3 Erb and Harvey (2006) use commodity futures as an example. 4 AM is always higher than GM (where volatility is non-zero), and in this case it is the assets’ GM returns that are zero. An asset whose price rises from ...

... 3 Erb and Harvey (2006) use commodity futures as an example. 4 AM is always higher than GM (where volatility is non-zero), and in this case it is the assets’ GM returns that are zero. An asset whose price rises from ...

Performance as of 04/30/2014

... NAV. Some performance results reflect expense subsidies and waivers in effect during certain periods. Absent these waivers, results would have been less favorable. Risks: There is no guarantee that the funds will reach their objective. An investment in the Funds is subject to risk including the poss ...

... NAV. Some performance results reflect expense subsidies and waivers in effect during certain periods. Absent these waivers, results would have been less favorable. Risks: There is no guarantee that the funds will reach their objective. An investment in the Funds is subject to risk including the poss ...

Markowitz and the Expanding Definition of Risk: Applications of Multi

... risk control model. Fifth, we introduce the reader to an alternative risk model that minimizes the tracking error of portfolios for asset managers. Sixth, we introduce the reader to an alternative optimal portfolio weighting scheme that uses an estimated beta as contrasted with the traditional Marko ...

... risk control model. Fifth, we introduce the reader to an alternative risk model that minimizes the tracking error of portfolios for asset managers. Sixth, we introduce the reader to an alternative optimal portfolio weighting scheme that uses an estimated beta as contrasted with the traditional Marko ...

Floating Rate Viewpoint - John Hancock Investments

... esoteric corner of the bond market: floating-rate loans. With investors increasingly concerned over the potential for rising interest rates, floating-rate loans can provide a nice hedge against such risks. But even without the threat of rising interest rates, there are a number of reasons why invest ...

... esoteric corner of the bond market: floating-rate loans. With investors increasingly concerned over the potential for rising interest rates, floating-rate loans can provide a nice hedge against such risks. But even without the threat of rising interest rates, there are a number of reasons why invest ...

Portfolio Management Workshop

... to gain only another 25-30% should the price go all the way to your 5-year projected high, versus a potential loss of 70-75% should it go down to your potential low price. This reverses the desired risk to reward ratio, giving you three times as much risk as reward! You know that Forest Labs should ...

... to gain only another 25-30% should the price go all the way to your 5-year projected high, versus a potential loss of 70-75% should it go down to your potential low price. This reverses the desired risk to reward ratio, giving you three times as much risk as reward! You know that Forest Labs should ...

docx - Minds on the Markets

... taking more risk and less additional return because times are so good they downplay the risk that something will go wrong. The green line shows a “Declining Economy” where an investor requires a greater additional return for taking on more risk. ...

... taking more risk and less additional return because times are so good they downplay the risk that something will go wrong. The green line shows a “Declining Economy” where an investor requires a greater additional return for taking on more risk. ...

The Black-Scholes Formula

... is a standard normal variable. The probability that S(T ) < K is therefore given by N (−d2 ) and the probability that S(T ) > K is given by 1−N (−d2 ) = N (d2 ). It is more complicated to show that S(0)erT N (d1 ) is the future value of underlying asset in a risk-neutral world conditional on S(T ) > ...

... is a standard normal variable. The probability that S(T ) < K is therefore given by N (−d2 ) and the probability that S(T ) > K is given by 1−N (−d2 ) = N (d2 ). It is more complicated to show that S(0)erT N (d1 ) is the future value of underlying asset in a risk-neutral world conditional on S(T ) > ...

global fixed income necessary in well-diversified portfolios

... global economy. A lot of things that we want to achieve in fixed income and the risk premiums that we want exposure to really are not available in our own market,” he said. To achieve this diversification, the levers have to be global. Tactical Bond Pool One example of a global diversified portfolio ...

... global economy. A lot of things that we want to achieve in fixed income and the risk premiums that we want exposure to really are not available in our own market,” he said. To achieve this diversification, the levers have to be global. Tactical Bond Pool One example of a global diversified portfolio ...

Sterling Class US Dollar Class Euro Class

... This document, which is issued by PDL International, does not constitute investment advice or an offer to invest and is for information purposes only. PDL International is a trading name of Absolute Assigned Policies Limited. Absolute Assigned Policies Limited is a company registered in England and ...

... This document, which is issued by PDL International, does not constitute investment advice or an offer to invest and is for information purposes only. PDL International is a trading name of Absolute Assigned Policies Limited. Absolute Assigned Policies Limited is a company registered in England and ...

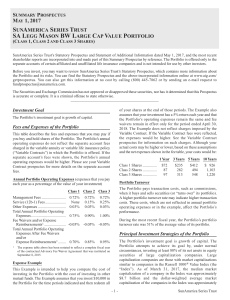

SAST - SA Legg Mason BW Large Cap Value

... assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same and fee waivers remain in effect only for the period ended April 30, 2018. The Example does not reflect charges imposed by the Variable Contract. If the Variable Contract fees were refl ...

... assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same and fee waivers remain in effect only for the period ended April 30, 2018. The Example does not reflect charges imposed by the Variable Contract. If the Variable Contract fees were refl ...

Defensive or offensive?

... potential future volatility by having higher prices so VBS funds can ‘fade’ the move even before it has begun. As such, it is no surprise that volatility-based strategies are very good at protecting against sudden unexpected moves in markets, while managed futures tend to give investors participatio ...

... potential future volatility by having higher prices so VBS funds can ‘fade’ the move even before it has begun. As such, it is no surprise that volatility-based strategies are very good at protecting against sudden unexpected moves in markets, while managed futures tend to give investors participatio ...

Long-Term Capital Market Assumptions

... slightly lower than what the 1900-2016 average would suggest. Investors are better equipped with tools to construct globally diversified portfolios than they were 100 years ago. Therefore, the compensation for market risk should, in our view, be lower. We extend this analysis to other asset classes ...

... slightly lower than what the 1900-2016 average would suggest. Investors are better equipped with tools to construct globally diversified portfolios than they were 100 years ago. Therefore, the compensation for market risk should, in our view, be lower. We extend this analysis to other asset classes ...

Portfolio Funding Profile

... Long-term view of historical returns provides the best estimates for risks and correlations ...

... Long-term view of historical returns provides the best estimates for risks and correlations ...

The 4% Withdrawal Rule—Have Planners Been Wrong?

... Milevsky's modeling generates optimal withdrawal percentages, and his initial rates are in line with the 4% rule. The optimal withdrawals do not remain level, but instead decrease over the retiree's lifetime. In one example, a 4.6% initial withdrawal rate at age 65 decreases slightly to 4.4% by age ...

... Milevsky's modeling generates optimal withdrawal percentages, and his initial rates are in line with the 4% rule. The optimal withdrawals do not remain level, but instead decrease over the retiree's lifetime. In one example, a 4.6% initial withdrawal rate at age 65 decreases slightly to 4.4% by age ...

Fixed Index Annuity Return and Risk Analysis with an Enhanced

... volatility, 10 year and 1 year US treasury rate and credit spread; a separate model for interdependencies among market variables; the option pricing models and the participation rate model. Sensitivity tests are performed for all major assumptions to reveal the impact and to check the robustness of ...

... volatility, 10 year and 1 year US treasury rate and credit spread; a separate model for interdependencies among market variables; the option pricing models and the participation rate model. Sensitivity tests are performed for all major assumptions to reveal the impact and to check the robustness of ...

western asset high yield fund

... typically range from AAA (highest) to D (lowest), or an equivalent and/or similar rating. For this purpose, if two or more of the agencies have assigned differing ratings to a security, the lowest rating is used. Securities that are unrated by all three agencies are reflected as such. The credit qua ...

... typically range from AAA (highest) to D (lowest), or an equivalent and/or similar rating. For this purpose, if two or more of the agencies have assigned differing ratings to a security, the lowest rating is used. Securities that are unrated by all three agencies are reflected as such. The credit qua ...

StochasticCalculus

... Pairing of XX makes genetic systems stable, which reduces variance of the systems. • This is why males are more divergent than females. ...

... Pairing of XX makes genetic systems stable, which reduces variance of the systems. • This is why males are more divergent than females. ...

THS 104 Rooms Division Operations I

... Follow steps shown in class by your instructor to find the present value of these estimated cash flows (Show all necessary calculations) if the prevailing interest rate is 7.25 %? (2 Points) ...

... Follow steps shown in class by your instructor to find the present value of these estimated cash flows (Show all necessary calculations) if the prevailing interest rate is 7.25 %? (2 Points) ...

Title: Arial Narrow, size 28 on 1 or 2 lines

... The information contained within this document (‘information’) is believed to be reliable but BNP Paribas Securities Services does not warrant its completeness or accuracy. Opinions and estimates contained herein constitute BNP Paribas Securities Services’ judgment and are subject to change without ...

... The information contained within this document (‘information’) is believed to be reliable but BNP Paribas Securities Services does not warrant its completeness or accuracy. Opinions and estimates contained herein constitute BNP Paribas Securities Services’ judgment and are subject to change without ...