Ijara by Zubair Usmani

... FINANCING 10. Insurance of the assets If the leased property is insured under the Islamic mode of Takaful, it should be at the expense of the lessor and not at the expense of the lessee 11. The residual value of the leased asset Through a mutual agreement of Lease, after the expiry of the lease peri ...

... FINANCING 10. Insurance of the assets If the leased property is insured under the Islamic mode of Takaful, it should be at the expense of the lessor and not at the expense of the lessee 11. The residual value of the leased asset Through a mutual agreement of Lease, after the expiry of the lease peri ...

Market Funds and Trust-Investment Law

... long-term fixed-return obligations such as mortgages and bonds. This approach to investment by trustees may have made sense in the eighteenth and nineteenth centuries in light of two facts which are not true today. First, the capital markets were relatively undeveloped and the opportunities to make ...

... long-term fixed-return obligations such as mortgages and bonds. This approach to investment by trustees may have made sense in the eighteenth and nineteenth centuries in light of two facts which are not true today. First, the capital markets were relatively undeveloped and the opportunities to make ...

Racial/Ethnic Disparities in Risky Asset Ownership

... sample of Whites a similar earnings distribution as that for Blacks, they found that differences in characteristics explain only 64% of the wealth gap, compared with 97% when the standard (linear) regression decomposition approach is used (with White coefficients). Given the importance of investment ...

... sample of Whites a similar earnings distribution as that for Blacks, they found that differences in characteristics explain only 64% of the wealth gap, compared with 97% when the standard (linear) regression decomposition approach is used (with White coefficients). Given the importance of investment ...

PDP-Working Paper

... economy. These mutually reinforcing interactions tend to amplify business cycle fluctuations and cause or exacerbate financial instability.” As the global financial crisis has reaffirmed, this instability can easily feed through into the real economy.3 The banking sector is especially prone to this ...

... economy. These mutually reinforcing interactions tend to amplify business cycle fluctuations and cause or exacerbate financial instability.” As the global financial crisis has reaffirmed, this instability can easily feed through into the real economy.3 The banking sector is especially prone to this ...

Here - Punter Southall Transaction Services

... investors are expected to lose money every year in real terms from investment in government bonds). Whilst legislation allows schemes to utilise bond yields in their valuations directly, the majority of schemes do not choose to do so. Instead they set their discount rate based on the expected retu ...

... investors are expected to lose money every year in real terms from investment in government bonds). Whilst legislation allows schemes to utilise bond yields in their valuations directly, the majority of schemes do not choose to do so. Instead they set their discount rate based on the expected retu ...

optimal investment for an insurer to minimize its probability of ruin

... considers a model in which the aggregate claims are modeled by a Brownian motion with drift, and the risky asset is modeled by a geometric Brownian motion (see also Browne 1997, 1999). The compound Poisson model is the most popular model in risk theory; Hipp and Taksar (2000) use it in modeling the ...

... considers a model in which the aggregate claims are modeled by a Brownian motion with drift, and the risky asset is modeled by a geometric Brownian motion (see also Browne 1997, 1999). The compound Poisson model is the most popular model in risk theory; Hipp and Taksar (2000) use it in modeling the ...

Use of Ratings in Insurance Industry

... A replication (synthetic asset) transaction increases the insurer’s exposure to one type of asset, the replicated (synthetic) asset, and may reduce the insurer’s exposure to the asset risk associated with the cash market components of the transaction. Required capital on a replicating transaction is ...

... A replication (synthetic asset) transaction increases the insurer’s exposure to one type of asset, the replicated (synthetic) asset, and may reduce the insurer’s exposure to the asset risk associated with the cash market components of the transaction. Required capital on a replicating transaction is ...

S - My LIUC

... obtained without knowing the shape of the utility function • but if the solution is independent of preferences functional form, then it is valid also for all utility function • Then, it is valid also for risk-neutral ...

... obtained without knowing the shape of the utility function • but if the solution is independent of preferences functional form, then it is valid also for all utility function • Then, it is valid also for risk-neutral ...

Derivatives and the Price of Risk

... is intuitive, because the derivatives’ underlying source of risk is the same: The random variable, h. The ratio is the same for all derivatives contingent on h. The ratio is called the market price of risk of h, and is usually denoted by k. The equality in eq. (10) holds only instantaneously, becaus ...

... is intuitive, because the derivatives’ underlying source of risk is the same: The random variable, h. The ratio is the same for all derivatives contingent on h. The ratio is called the market price of risk of h, and is usually denoted by k. The equality in eq. (10) holds only instantaneously, becaus ...

Disappointment Aversion in Asset Allocation

... These analytical results are supported by empirical results with asset allocations in pension funds of 35 OECD countries. The estimated DA levels (standard errors) of stock, bond, and other investments (a portfolio of real estate, infrastructure, private equities, and hedge funds) are 2.33 (0.31), 1 ...

... These analytical results are supported by empirical results with asset allocations in pension funds of 35 OECD countries. The estimated DA levels (standard errors) of stock, bond, and other investments (a portfolio of real estate, infrastructure, private equities, and hedge funds) are 2.33 (0.31), 1 ...

The Impact of Skewness and Fat Tails on the Asset Allocation Decision

... Traditional MVO leads to an efficient frontier that maximizes return per unit of variance or, equivalently, minimizes variance for a given level of return. In contrast, M-CVaR maximizes return for a given level of CVaR or, equivalently, minimizes CVaR for a given level of return. The M-CVaR process ...

... Traditional MVO leads to an efficient frontier that maximizes return per unit of variance or, equivalently, minimizes variance for a given level of return. In contrast, M-CVaR maximizes return for a given level of CVaR or, equivalently, minimizes CVaR for a given level of return. The M-CVaR process ...

Value at Risk - dedeklegacy.cz

... A bond portfolio has a value of 10 million USD and modified duration of 3.8 years. Interest rates are currently 10 % and there is a 5 % chance that interest rates will go above 11.2 % at the end of the year. What would be the VaR for the portfolio at 95 % confidence level? ...

... A bond portfolio has a value of 10 million USD and modified duration of 3.8 years. Interest rates are currently 10 % and there is a 5 % chance that interest rates will go above 11.2 % at the end of the year. What would be the VaR for the portfolio at 95 % confidence level? ...

exp06-Nagel 3988118 en

... Shum (2006) find that households that report higher risk aversion in these questions have a lower allocation to risky assets. Shaw (1996) shows that the SCF measures of risk-taking help explain differences in the willingness to make risky human capital investments and wage growth. For ease of refere ...

... Shum (2006) find that households that report higher risk aversion in these questions have a lower allocation to risky assets. Shaw (1996) shows that the SCF measures of risk-taking help explain differences in the willingness to make risky human capital investments and wage growth. For ease of refere ...

Liquidation Strategies in a Long-Short Equity Portfolio

... Financial assets are similar to any other traded good in that prices are determined by supply and demand. At any given price, there are only a limited number of potential buyers and sellers and thus a limited volume that can be traded at that price. If an investor wants to buy (or sell) a larger vol ...

... Financial assets are similar to any other traded good in that prices are determined by supply and demand. At any given price, there are only a limited number of potential buyers and sellers and thus a limited volume that can be traded at that price. If an investor wants to buy (or sell) a larger vol ...

Evaluating the Dynamic Nature of Market Risk by Todd Hubbs, Todd

... When assessing risk, further complicating issues are yields and diversification. If one studies variability in revenue from individual crops the important issue of yield risk is incorporated, but revenue variability does not accurately reflect the risk borne by producers of that crop because part of ...

... When assessing risk, further complicating issues are yields and diversification. If one studies variability in revenue from individual crops the important issue of yield risk is incorporated, but revenue variability does not accurately reflect the risk borne by producers of that crop because part of ...

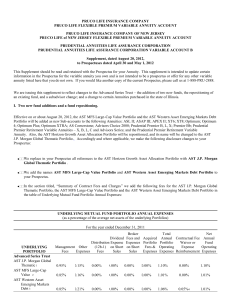

PRUCO LIFE INSURANCE COMPANY PRUCO LIFE FLEXIBLE

... Portfolio of the Trust discussed in this supplement may not be available under your variable contract. For more information about the Portfolios available under your contract, please refer to your contract prospectus. The following should be read in conjunction with the Prospectus and should be reta ...

... Portfolio of the Trust discussed in this supplement may not be available under your variable contract. For more information about the Portfolios available under your contract, please refer to your contract prospectus. The following should be read in conjunction with the Prospectus and should be reta ...

Shorts and Derivatives in Portfolio Statistics

... securities, although they may reserve the right to do so under special circumstances. Funds may also short derivatives, and this is sometimes more efficient than shorting individual securities. Short positions produce negative exposure to the security that is being shorted. This means that when the ...

... securities, although they may reserve the right to do so under special circumstances. Funds may also short derivatives, and this is sometimes more efficient than shorting individual securities. Short positions produce negative exposure to the security that is being shorted. This means that when the ...

An Analysis of the Howard Hughes Corporation

... Vegas strip, in walking distance of the key attractions • In 2007, North Vegas Strip land sold for $34M/acre • Wynn, Trump International, The Palazzo, The Venetian – all have easy access to Fashion Show • We can say with confidence that this asset is worth much more than its carrying value of $0! ...

... Vegas strip, in walking distance of the key attractions • In 2007, North Vegas Strip land sold for $34M/acre • Wynn, Trump International, The Palazzo, The Venetian – all have easy access to Fashion Show • We can say with confidence that this asset is worth much more than its carrying value of $0! ...