FEDEX CORP (Form: 424B3, Received: 01/03/2017 08:57:53)

... and transfers will be effected only through, records maintained by DTC or its nominee, and these beneficial interests may not be exchanged for certificated notes, except in limited circumstances. See "Description of Debt Securities and Guarantees—Book-Entry Procedures" in the accompanying prospectus ...

... and transfers will be effected only through, records maintained by DTC or its nominee, and these beneficial interests may not be exchanged for certificated notes, except in limited circumstances. See "Description of Debt Securities and Guarantees—Book-Entry Procedures" in the accompanying prospectus ...

Capital Structure Decision

... capital structure it should not loose site of the future impact of its present financial plan. For example if the firm has exhausted its firms capital it may be force to issue equity shares for future financing on unfavorable term due to heavy debt. Hence the firm should all ways return some unused ...

... capital structure it should not loose site of the future impact of its present financial plan. For example if the firm has exhausted its firms capital it may be force to issue equity shares for future financing on unfavorable term due to heavy debt. Hence the firm should all ways return some unused ...

Debt Refinancing and Equity Returns

... with leverage within each refinancing tertile. Furthermore, the difference in returns of highand low-leverage firms increases as the refinancing intensity increases (i.e. debt maturities become shorter). These findings are consistent with the notion that shareholders demand a premium for holding hi ...

... with leverage within each refinancing tertile. Furthermore, the difference in returns of highand low-leverage firms increases as the refinancing intensity increases (i.e. debt maturities become shorter). These findings are consistent with the notion that shareholders demand a premium for holding hi ...

COM SEC(2010)0791(PAR2)

... financial sector have led to sharply rising government debt ratios. According to the Commission Spring forecasts, the government debt-to-GDP ratio is set to increase across the EU by 25 percentage points between 2007 and 2011. This is in line with increases during previous systemic financial crises ...

... financial sector have led to sharply rising government debt ratios. According to the Commission Spring forecasts, the government debt-to-GDP ratio is set to increase across the EU by 25 percentage points between 2007 and 2011. This is in line with increases during previous systemic financial crises ...

Contagion of Sovereign Default Risk: the Role of Two Financial

... With the exception of a few recent papers, the sovereign debt literature has not paid much attention to contagion of sovereign default risk. Since Aguiar and Gopinath (2006) and Arellano (2008), most quantitative sovereign default studies6 have focused on the role of sovereign default risk in genera ...

... With the exception of a few recent papers, the sovereign debt literature has not paid much attention to contagion of sovereign default risk. Since Aguiar and Gopinath (2006) and Arellano (2008), most quantitative sovereign default studies6 have focused on the role of sovereign default risk in genera ...

Development of Insolvency Law as Part of the Transition from a

... dependent upon credit, virtually every market's operation will be disturbed when credit is not repaid in accordance with the terms of credit contracts. Insolvency laws lend a necessary element of predictability to market economies by establishing a framework for determining and enforcing the consequ ...

... dependent upon credit, virtually every market's operation will be disturbed when credit is not repaid in accordance with the terms of credit contracts. Insolvency laws lend a necessary element of predictability to market economies by establishing a framework for determining and enforcing the consequ ...

Liquidity Policies and Systemic Risk

... due to lower distortions. Ratnovski [2009] points out that liquidity requirements can mitigate moral hazard due to public liquidity provision via lender of last resort facilities. Rochet [2008] provides an overview of liquidity regulation within the context of the banking literature. The main diffe ...

... due to lower distortions. Ratnovski [2009] points out that liquidity requirements can mitigate moral hazard due to public liquidity provision via lender of last resort facilities. Rochet [2008] provides an overview of liquidity regulation within the context of the banking literature. The main diffe ...

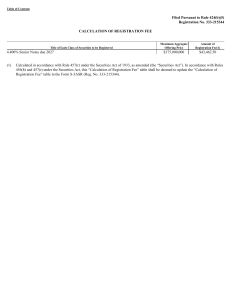

MERCURY GENERAL CORP (Form: 424B5

... ABOUT THIS PROSPECTUS SUPPLEMENT This document consists of two parts. The first part is this prospectus supplement, which describes the specific terms of our offering of the notes. The second part is the accompanying prospectus, which provides more general information, some of which may not be appli ...

... ABOUT THIS PROSPECTUS SUPPLEMENT This document consists of two parts. The first part is this prospectus supplement, which describes the specific terms of our offering of the notes. The second part is the accompanying prospectus, which provides more general information, some of which may not be appli ...

0538479736_265849

... In connection with financing arrangements, it is common practice for a company to agree to maintain a minimum or average balance on deposit with a bank. These compensating balances are defined by the SEC as “that portion of any demand deposit maintained by a ...

... In connection with financing arrangements, it is common practice for a company to agree to maintain a minimum or average balance on deposit with a bank. These compensating balances are defined by the SEC as “that portion of any demand deposit maintained by a ...

the relationship betweeen financial leverage and

... This study sought to establish the relationship between financial leverage and profitability of firms listed at the Nairobi Securities Exchange. To achieve this objective a descriptive research design was used. The study considered firms that have been listed on the NSE for the past five years and u ...

... This study sought to establish the relationship between financial leverage and profitability of firms listed at the Nairobi Securities Exchange. To achieve this objective a descriptive research design was used. The study considered firms that have been listed on the NSE for the past five years and u ...

Download Dissertation

... creditor coordination problems. This is due to the fact that when the credit quality of the firm is lower, strategic uncertainty on actions of other creditors tends to increase. Prior studies also suggest that creditor coordination problems are likely to be exacerbated when there is higher uncertain ...

... creditor coordination problems. This is due to the fact that when the credit quality of the firm is lower, strategic uncertainty on actions of other creditors tends to increase. Prior studies also suggest that creditor coordination problems are likely to be exacerbated when there is higher uncertain ...

The Urban Infrastructure Challenge in Canada: Making Greater Use

... equitable financing tools for urban infrastructure in Canada. Since the publication of Altus’ previous report, The Urban Infrastructure Challenge in Canada in May of 2008, the Canadian economy has experienced a sharp recession and a slow recovery. The pace of residential development slowed considera ...

... equitable financing tools for urban infrastructure in Canada. Since the publication of Altus’ previous report, The Urban Infrastructure Challenge in Canada in May of 2008, the Canadian economy has experienced a sharp recession and a slow recovery. The pace of residential development slowed considera ...

Corporate Environmental Liabilities and Capital Structure Xin Chang

... ratio, which is determined by firms’ choice between debt and equity and captures the relative importance of the effects of environmental liabilities on the cost of debt and the cost of equity. In addition, to the best of our knowledge, we are among the first to empirically show that corporate enviro ...

... ratio, which is determined by firms’ choice between debt and equity and captures the relative importance of the effects of environmental liabilities on the cost of debt and the cost of equity. In addition, to the best of our knowledge, we are among the first to empirically show that corporate enviro ...

The Aggregate Demand for Treasury Debt

... securities such as corporate bonds, causing the yield on Treasuries to fall further below corporate bond rates, and the bond spread to widen. The opposite applies when the stock of debt is high. Variation in the supply of Treasury securities traces out a downward sloping demand curve for Treasuries ...

... securities such as corporate bonds, causing the yield on Treasuries to fall further below corporate bond rates, and the bond spread to widen. The opposite applies when the stock of debt is high. Variation in the supply of Treasury securities traces out a downward sloping demand curve for Treasuries ...

Capital Structure of SMEs: Does Firm Size Matter?

... Table 3. Number of firms by country in the sample.................................................................... 36 Table 4. Criteria to distinguish between micro, small and medium-sized firms set by the EC .. 37 Table 5. Distribution of the sample by firm size and country ..................... ...

... Table 3. Number of firms by country in the sample.................................................................... 36 Table 4. Criteria to distinguish between micro, small and medium-sized firms set by the EC .. 37 Table 5. Distribution of the sample by firm size and country ..................... ...

13 Fiscal Monitor Fiscal Adjustment in an Uncertain World

... decades. They will need to undertake unprecedented fiscal efforts to bring their debt ratios to traditional norms, even if this is to occur only over a relatively long horizon. While achieving sufficiently large primary surpluses and then maintaining them for an extended period will be difficult, th ...

... decades. They will need to undertake unprecedented fiscal efforts to bring their debt ratios to traditional norms, even if this is to occur only over a relatively long horizon. While achieving sufficiently large primary surpluses and then maintaining them for an extended period will be difficult, th ...

The Impact of Higher Interest Rates on the Cost of Servicing

... for balanced budgets or surpluses and increase the proportion of revenues spent on debt interest payments (the “interest bite”). More revenue going to interest payments on the debt means less is available for programs that taxpayers value, such as health care and education, or tax relief. This study ...

... for balanced budgets or surpluses and increase the proportion of revenues spent on debt interest payments (the “interest bite”). More revenue going to interest payments on the debt means less is available for programs that taxpayers value, such as health care and education, or tax relief. This study ...

Bankruptcy Reform and the Housing Crisis.

... taking out a mortgage to purchase a home. Importantly, this effect is concentrated on households who bought homes in 2005 and 2006 – exactly those homeowners who are most likely to find themselves underwater as a result of a collapse in house prices – and works to reduce the mortgage default rate du ...

... taking out a mortgage to purchase a home. Importantly, this effect is concentrated on households who bought homes in 2005 and 2006 – exactly those homeowners who are most likely to find themselves underwater as a result of a collapse in house prices – and works to reduce the mortgage default rate du ...

The Employment Cost of Sovereign Default

... The recent European debt crisis was characterized by high government indebtedness and rising bond spreads in Portugal and Spain and a sovereign default in Greece. In all three countries, the crisis was accompanied by high levels of unemployment. Firm-level evidence documents that sovereign risk depr ...

... The recent European debt crisis was characterized by high government indebtedness and rising bond spreads in Portugal and Spain and a sovereign default in Greece. In all three countries, the crisis was accompanied by high levels of unemployment. Firm-level evidence documents that sovereign risk depr ...

THE NATIONAL DEBT AND ECONOMIC POLICY IN THE MEDIUM

... However, tile combination of risk aversion on the part of investors with uncertainty concerning tile future movement of exchange rates alters this situation. In a situation of uncertainty concerning the future, the "expectation" concerning tile movement of exchange rates is only the mid point of a ...

... However, tile combination of risk aversion on the part of investors with uncertainty concerning tile future movement of exchange rates alters this situation. In a situation of uncertainty concerning the future, the "expectation" concerning tile movement of exchange rates is only the mid point of a ...

US CORNER - Paul, Weiss

... about an adequate protection fight from unsecured creditors. Additionally, the ability of second lien creditors to object to actions like assets sales may be greater than the ability of unsecured creditors to object. As with pre bankruptcy actions, the presence of second lien loans will clearly impa ...

... about an adequate protection fight from unsecured creditors. Additionally, the ability of second lien creditors to object to actions like assets sales may be greater than the ability of unsecured creditors to object. As with pre bankruptcy actions, the presence of second lien loans will clearly impa ...

words

... to the reliability of, any other information that others may give you. This prospectus supplement and the accompanying prospectus is an offer to sell only the notes offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospe ...

... to the reliability of, any other information that others may give you. This prospectus supplement and the accompanying prospectus is an offer to sell only the notes offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospe ...

MICROSOFT CORP (Form: 424B2, Received: 01/31/2017 16:20:44)

... We will have the right at our option to redeem the notes of any series, in whole or in part, at any time or from time to time prior to February 6, 2020 (in the case of the 2020 Notes), January 6, 2022 (in the case of the 2022 Notes), December 6, 2023 (in the case of the 2024 Notes), November 6, 2026 ...

... We will have the right at our option to redeem the notes of any series, in whole or in part, at any time or from time to time prior to February 6, 2020 (in the case of the 2020 Notes), January 6, 2022 (in the case of the 2022 Notes), December 6, 2023 (in the case of the 2024 Notes), November 6, 2026 ...

Hot debt market - Adverse selection costs as a debt issue driver

... The purpose of this thesis is to examine the role of adverse selection costs in times of high debt issue volume, or the hot debt market. Following the pecking order theory of capital structure, I hypothesize that high information asymmetry between investors and managers hinders companies from issuin ...

... The purpose of this thesis is to examine the role of adverse selection costs in times of high debt issue volume, or the hot debt market. Following the pecking order theory of capital structure, I hypothesize that high information asymmetry between investors and managers hinders companies from issuin ...