Measuring Investment Distortions When Risk-Averse

... correct model for a firm’s capital structure, having estimates of investment distortions that are not dependent on a firm’s capital structure being optimal is also a benefit of our approach. Further, in related work, Ju, Parrino, Poteshman, and Weisbach (2005) show that the optimal capital structure ...

... correct model for a firm’s capital structure, having estimates of investment distortions that are not dependent on a firm’s capital structure being optimal is also a benefit of our approach. Further, in related work, Ju, Parrino, Poteshman, and Weisbach (2005) show that the optimal capital structure ...

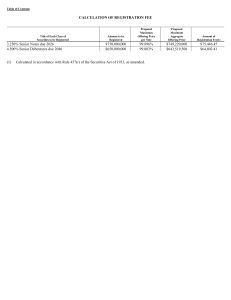

SPIRE INC (Form: 424B2, Received: 02/23/2017 15:27:05)

... opportunities in the natural gas industry, particularly local distribution companies. Further, we have internal teams that assist in the evaluation of a prospective acquisition to identify: • the potential benefits it can deliver to our customers, communities, employees and investors; • how it suppo ...

... opportunities in the natural gas industry, particularly local distribution companies. Further, we have internal teams that assist in the evaluation of a prospective acquisition to identify: • the potential benefits it can deliver to our customers, communities, employees and investors; • how it suppo ...

Responding to Shocks and Maintaining Stability in the West

... Shocks have been frequent in the WAEMU and often asymmetric. Some of them have been of a political nature, as illustrated by the crises experienced in the past few years in Côte d’Ivoire, Guinea Bissau, and Mali. The region is also affected by a large number of exogenous shocks of various natures: c ...

... Shocks have been frequent in the WAEMU and often asymmetric. Some of them have been of a political nature, as illustrated by the crises experienced in the past few years in Côte d’Ivoire, Guinea Bissau, and Mali. The region is also affected by a large number of exogenous shocks of various natures: c ...

Francesco Caprioli Optimal Fiscal Policy, Limited Commitment and Learning

... Whereas under full commitment the optimal distorting labour income tax is perfectly flat, under limited commitment it responds strongly to the incentives to default of both countries. When the Home Country would have an incentive to default, the tax rate decreases in order to allow for higher consu ...

... Whereas under full commitment the optimal distorting labour income tax is perfectly flat, under limited commitment it responds strongly to the incentives to default of both countries. When the Home Country would have an incentive to default, the tax rate decreases in order to allow for higher consu ...

Hoarding Disorder: It`s More Than Just an

... were passed down from generation to generation. Many children of hoarders from the Great Depression became hoarders and underspenders by adopting their parents’ money scripts and modeling their parents’ behaviors (Klontz & Klontz, 2009). Significant financial losses or periods of economic turmoil, s ...

... were passed down from generation to generation. Many children of hoarders from the Great Depression became hoarders and underspenders by adopting their parents’ money scripts and modeling their parents’ behaviors (Klontz & Klontz, 2009). Significant financial losses or periods of economic turmoil, s ...

the macerich company - corporate

... estate industry and a supplement to Generally Accepted Accounting Principles ("GAAP") measures. The National Association of Real Estate Investment Trusts ("NAREIT") defines FFO as net income (loss) (computed in accordance with GAAP), excluding gains (or losses) from extraordinary items and sales of ...

... estate industry and a supplement to Generally Accepted Accounting Principles ("GAAP") measures. The National Association of Real Estate Investment Trusts ("NAREIT") defines FFO as net income (loss) (computed in accordance with GAAP), excluding gains (or losses) from extraordinary items and sales of ...

ASTRAZENECA PLC (Form: F-3ASR, Received: 11/22/2016 11:52:39)

... in certain cases, more favorable to secured creditors than comparable provisions of US law. These provisions afford debtors and unsecured creditors only limited protection from the claims of secured creditors and it may not be possible for us or other unsecured creditors to prevent or delay the secu ...

... in certain cases, more favorable to secured creditors than comparable provisions of US law. These provisions afford debtors and unsecured creditors only limited protection from the claims of secured creditors and it may not be possible for us or other unsecured creditors to prevent or delay the secu ...

APPLE INC (Form: 424B2, Received: 11/04/2014 06:07:42)

... We are not, and the underwriters are not, making an offer of the notes in any jurisdiction where the offer or sale is not permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering or sale of the notes in some jurisdictions may be restricted by law. Th ...

... We are not, and the underwriters are not, making an offer of the notes in any jurisdiction where the offer or sale is not permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering or sale of the notes in some jurisdictions may be restricted by law. Th ...

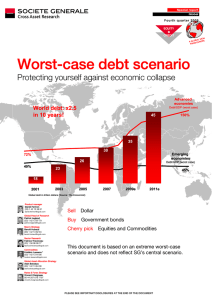

Worst-case debt scenario

... collapse in the dollar as large US debt holders reduce their exposure and inflation rises as a result. We do not see this as a likely scenario over the next 12 months as debt is currently an issue in practically all developed countries, so no other currency could realistically replace the dollar at ...

... collapse in the dollar as large US debt holders reduce their exposure and inflation rises as a result. We do not see this as a likely scenario over the next 12 months as debt is currently an issue in practically all developed countries, so no other currency could realistically replace the dollar at ...

Self-Fulfilling Crises in the Eurozone: An Empirical Test

... period. This is as the theory predicts. We will analyze whether this result stands the scrutiny of econometric testing. Do the same developments occur in ‘stand-alone’ countries, i.e. countries that are not part of a monetary union and issue debt in their own currencies? We selected 14 ‘stand-alone’ ...

... period. This is as the theory predicts. We will analyze whether this result stands the scrutiny of econometric testing. Do the same developments occur in ‘stand-alone’ countries, i.e. countries that are not part of a monetary union and issue debt in their own currencies? We selected 14 ‘stand-alone’ ...

KELLOGG CO (Form: 424B5, Received: 02/26/2016 17:06:57)

... Tender Offer for 7.45% debentures due 2031 On February 25, 2016, we commenced an offer to purchase for cash (the “tender offer”) up to $440 million aggregate principal amount (the “Maximum Tender Amount”) of our 7.45% debentures due 2031 (the “2031 Debentures”). As of such date, $1,100,000,000 aggre ...

... Tender Offer for 7.45% debentures due 2031 On February 25, 2016, we commenced an offer to purchase for cash (the “tender offer”) up to $440 million aggregate principal amount (the “Maximum Tender Amount”) of our 7.45% debentures due 2031 (the “2031 Debentures”). As of such date, $1,100,000,000 aggre ...

The Eurozone Crisis

... that had experienced a large appreciation of their effective real exchange rate had become competitively weak, and the pre-crisis buoyancy in some of them was not sustainable. The econometric results show, indeed, that countries with weaker competitiveness were prone to greater sovereign stress resu ...

... that had experienced a large appreciation of their effective real exchange rate had become competitively weak, and the pre-crisis buoyancy in some of them was not sustainable. The econometric results show, indeed, that countries with weaker competitiveness were prone to greater sovereign stress resu ...

Accruals, Financial Distress, and Debt Covenants Troy D. Janes

... financial distress and examines the use of this information by commercial lenders in setting debt covenants. Controlling for the level of earnings, firms with extreme accruals are more likely to experience financial distress than firms with moderate accruals. Tests of the relation between accruals a ...

... financial distress and examines the use of this information by commercial lenders in setting debt covenants. Controlling for the level of earnings, firms with extreme accruals are more likely to experience financial distress than firms with moderate accruals. Tests of the relation between accruals a ...

DBRS Recovery Ratings for Non-Investment Grade

... While a non-investment-grade issuer may not default for several years (if ever), a recovery rating necessarily assumes an eventual default. DBRS considers the types of likely issues that may cause the deterioration in the business and financial risk factors that might ultimately cause its default. T ...

... While a non-investment-grade issuer may not default for several years (if ever), a recovery rating necessarily assumes an eventual default. DBRS considers the types of likely issues that may cause the deterioration in the business and financial risk factors that might ultimately cause its default. T ...

Social Security and Unsecured Debt

... later, the government effectively lends money to households. We call the interest rate on such lends the internal borrowing rate (IBR). The conditions we impose imply that the IBR equals the internal rate of return on social security investment. But the welfare gains from these “loans” are so big th ...

... later, the government effectively lends money to households. We call the interest rate on such lends the internal borrowing rate (IBR). The conditions we impose imply that the IBR equals the internal rate of return on social security investment. But the welfare gains from these “loans” are so big th ...

Venture Debt Financing for Start

... ones but also to early stage fledglings which do not satisfy traditional banking standards required by debt providers. In contrast, venture debt providers applying different lending model are willing to back negative cash flow ventures despite the inherent funding risk, however, in exchange for requ ...

... ones but also to early stage fledglings which do not satisfy traditional banking standards required by debt providers. In contrast, venture debt providers applying different lending model are willing to back negative cash flow ventures despite the inherent funding risk, however, in exchange for requ ...

Full Report

... each sector of ten mature economies and four emerging economies.2 In addition, we analyzed 45 historic episodes of deleveraging, in which an economy significantly reduced its total debt-to-GDP ratio, that have occurred since 1930. This analysis adds new details to the picture of how leverage grew ar ...

... each sector of ten mature economies and four emerging economies.2 In addition, we analyzed 45 historic episodes of deleveraging, in which an economy significantly reduced its total debt-to-GDP ratio, that have occurred since 1930. This analysis adds new details to the picture of how leverage grew ar ...

Ch16 - NYU Stern

... To value a firm, you need to estimate its costs of equity and capital. In this chapter, you first consider what each of these is supposed to measure, explore a simple model for the costs and then examine the special problems associated with estimating each for technology firms. The cost of equity is ...

... To value a firm, you need to estimate its costs of equity and capital. In this chapter, you first consider what each of these is supposed to measure, explore a simple model for the costs and then examine the special problems associated with estimating each for technology firms. The cost of equity is ...

Part I – Introduction - LSA

... rate of interest; usually because owner will lend to own company at such a nominal rate (like parents lend to kids). This looks more like equity; it looks like something an owner and not a third party would do). Note that there are debts with no interest An e.g. is zero coupon bonds – buy them f ...

... rate of interest; usually because owner will lend to own company at such a nominal rate (like parents lend to kids). This looks more like equity; it looks like something an owner and not a third party would do). Note that there are debts with no interest An e.g. is zero coupon bonds – buy them f ...

Some Indicators of a Firm`s Risk and Debt Capacity

... These factors are not listed in order of priority or importance. (It is just that FRIC'.TO sounds better than ICT'.FOR). For each firm, and in different economic environments, the relative importance of the various factors will differ. However, the manager should ensure that all the important facto ...

... These factors are not listed in order of priority or importance. (It is just that FRIC'.TO sounds better than ICT'.FOR). For each firm, and in different economic environments, the relative importance of the various factors will differ. However, the manager should ensure that all the important facto ...

Utility Cost of Capital

... • If too much debt is used then there is only a sliver of equity and the equity profit would swing wildly, therefore equity investors will not want to see the equity ratio get too low • The equity cushion protects the bond investors (Shortfalls in revenue lower profits but interest must still be pai ...

... • If too much debt is used then there is only a sliver of equity and the equity profit would swing wildly, therefore equity investors will not want to see the equity ratio get too low • The equity cushion protects the bond investors (Shortfalls in revenue lower profits but interest must still be pai ...

Reinvestment Behavior of Large Repatriating Firms

... spending data for a significant window of years around the AJCA tax holiday, and I further limit the sample to include only non-financial firms. This results in a set of 350 repatriating firms and 456 firms with PRE that did not choose to repatriate. The statistical technique I use is a difference-i ...

... spending data for a significant window of years around the AJCA tax holiday, and I further limit the sample to include only non-financial firms. This results in a set of 350 repatriating firms and 456 firms with PRE that did not choose to repatriate. The statistical technique I use is a difference-i ...

Liberal Mercantilism: Exchange Rate Regimes, Foreign Currency

... strongly suggests that countries use the GATT/WTO dispute settlement system in part to manage their access to foreign exchange. This paper makes several contributions. Our state-centric viewpoint is a natural complement to the literature on the determinants of trade disputes, which typically views ...

... strongly suggests that countries use the GATT/WTO dispute settlement system in part to manage their access to foreign exchange. This paper makes several contributions. Our state-centric viewpoint is a natural complement to the literature on the determinants of trade disputes, which typically views ...

Do Tests of Capital Structure Theory Mean What They Say? ∗

... profitability is indeed positively related to leverage at the refinancing points, as one would expect since the model is based on a trade-off argument. In contrast, I show that in a dynamic economy cross-sectional tests produce a negative relationship. The basic intuition is simple: in a world of in ...

... profitability is indeed positively related to leverage at the refinancing points, as one would expect since the model is based on a trade-off argument. In contrast, I show that in a dynamic economy cross-sectional tests produce a negative relationship. The basic intuition is simple: in a world of in ...

The determinants of long-term debt issuance by European banks

... Wholesale debt is one of the main funding sources of banks, in addition to retail deposits, equity and central bank liquidity. In recent years, the analysis of developments in banks’ wholesale debt funding structures has gained considerable interest in the context of the 2008-2009 global financial c ...

... Wholesale debt is one of the main funding sources of banks, in addition to retail deposits, equity and central bank liquidity. In recent years, the analysis of developments in banks’ wholesale debt funding structures has gained considerable interest in the context of the 2008-2009 global financial c ...