HAMISH FRASER MT CECIL, HUNTER 1RD KELLOGG'S RURAL LEADERSHIP PROGRAMME 2013

... assets that return more than the interest on the debt, or in finance terms debt is a means of using anticipated income and future purchasing power in the present before it has actually been earned. This use of debt magnifies potential profits but conversely can magnify potential losses. The ratio of ...

... assets that return more than the interest on the debt, or in finance terms debt is a means of using anticipated income and future purchasing power in the present before it has actually been earned. This use of debt magnifies potential profits but conversely can magnify potential losses. The ratio of ...

Equity Auctions and the New Value Corollary to the

... that deficiency claim (which would not be paid in full) in a class separate from the class of unsecured trade claims. Bank of America voted its unsecured deficiency claim to reject the plan. The bankruptcy court confirmed the debtor’s plan under Code section 1129(b)(2)(B)(ii), holding, among other t ...

... that deficiency claim (which would not be paid in full) in a class separate from the class of unsecured trade claims. Bank of America voted its unsecured deficiency claim to reject the plan. The bankruptcy court confirmed the debtor’s plan under Code section 1129(b)(2)(B)(ii), holding, among other t ...

Banking crises and the lending channel: Evidence from industrial

... more available and guarantees access to long-term debt for unlisted firms in sectors with highly volatile returns. Fan et al. (2006) and González and González (2008) highlight the relevance of institutions on a larger international database and show that bank concentration, stronger protection of cr ...

... more available and guarantees access to long-term debt for unlisted firms in sectors with highly volatile returns. Fan et al. (2006) and González and González (2008) highlight the relevance of institutions on a larger international database and show that bank concentration, stronger protection of cr ...

Linkages across Sovereign Debt Markets

... simultaneously. Foreign defaults also make it more difficult for the home country to service the debt because these defaults lower lenders’ payoffs, which in turn tighten bond prices at home. This dependency arises during fundamental foreign defaults, where the foreign country defaults because of h ...

... simultaneously. Foreign defaults also make it more difficult for the home country to service the debt because these defaults lower lenders’ payoffs, which in turn tighten bond prices at home. This dependency arises during fundamental foreign defaults, where the foreign country defaults because of h ...

No - econpubblica - Università Bocconi

... Expenditure per resident (adjusted for the composition of population) ...

... Expenditure per resident (adjusted for the composition of population) ...

Tilburg University The Life Cycle of the Firm with

... establishes how the capital income tax system affects the cost of capital throughout the entire life cycle of a firm. In particular, the cost of newly issued equity may exceed the cost of new equity as derived by King and Fullerton (1984). Intuitively, the more new equity the firm issues initially, ...

... establishes how the capital income tax system affects the cost of capital throughout the entire life cycle of a firm. In particular, the cost of newly issued equity may exceed the cost of new equity as derived by King and Fullerton (1984). Intuitively, the more new equity the firm issues initially, ...

DebT anD (noT mucH) DeLeveraGInG

... 1 2Q14 data for advanced economies and China; 4Q13 data for other developing economies. NOTE: Numbers may not sum due to rounding. SOURCE: Haver Analytics; national sources; World economic outlook, IMF; BIS; McKinsey Global Institute analysis ...

... 1 2Q14 data for advanced economies and China; 4Q13 data for other developing economies. NOTE: Numbers may not sum due to rounding. SOURCE: Haver Analytics; national sources; World economic outlook, IMF; BIS; McKinsey Global Institute analysis ...

DebT anD (noT mucH) DeLeveraGInG

... 1 2Q14 data for advanced economies and China; 4Q13 data for other developing economies. NOTE: Numbers may not sum due to rounding. SOURCE: Haver Analytics; national sources; World economic outlook, IMF; BIS; McKinsey Global Institute analysis ...

... 1 2Q14 data for advanced economies and China; 4Q13 data for other developing economies. NOTE: Numbers may not sum due to rounding. SOURCE: Haver Analytics; national sources; World economic outlook, IMF; BIS; McKinsey Global Institute analysis ...

SWD(2014) 61 final - European Commission

... negotiating with his creditors the terms and conditions of their contracts. Such amendments may result, for example, in the rescheduling of payments, a reduction in interest rates, a total or partial write-off of the debt or new loan facilities. These are purely contractual transactions based on the ...

... negotiating with his creditors the terms and conditions of their contracts. Such amendments may result, for example, in the rescheduling of payments, a reduction in interest rates, a total or partial write-off of the debt or new loan facilities. These are purely contractual transactions based on the ...

Doctoral Dissertation Template

... more opportunistic smoothing when the firm has a low percentage of independent outside directors on board or when the firm’s directors are less debt-aligned. In addition, I show that managers with low debt compensation engage in more opportunistic smoothing when the firm has low blockholder governan ...

... more opportunistic smoothing when the firm has a low percentage of independent outside directors on board or when the firm’s directors are less debt-aligned. In addition, I show that managers with low debt compensation engage in more opportunistic smoothing when the firm has low blockholder governan ...

Inflation vs Deflation

... earliest, as the recession is still working through. First, the scarcity of natural resources and labor can contribute to inflation. Second, monetary policy is loose and debt-to-GDP ratios are rising strongly. Both induce inflation. It could be tempting for policymakers to monetize at least some of ...

... earliest, as the recession is still working through. First, the scarcity of natural resources and labor can contribute to inflation. Second, monetary policy is loose and debt-to-GDP ratios are rising strongly. Both induce inflation. It could be tempting for policymakers to monetize at least some of ...

What is the Risk of European Sovereign Debt Defaults? Fiscal

... rest of the world or may they considered to be “mispriced” in some sense, especially during the 2010 European debt crisis. In order to investigate CDS pricing dynamics during the global and European financial turmoil, we include dummy variables (t2008-10) for three crisis years: 2008 is identified a ...

... rest of the world or may they considered to be “mispriced” in some sense, especially during the 2010 European debt crisis. In order to investigate CDS pricing dynamics during the global and European financial turmoil, we include dummy variables (t2008-10) for three crisis years: 2008 is identified a ...

Corporate Law Exam Notes 2011

... 287 said that it is hard to see how the provision by a company of financial assistance, for the express purposes of assisting a person to acquire its shares, could ever be said to be in the ordinary course of business. A no liability company, that acts outside its mining purpose objects, contravene ...

... 287 said that it is hard to see how the provision by a company of financial assistance, for the express purposes of assisting a person to acquire its shares, could ever be said to be in the ordinary course of business. A no liability company, that acts outside its mining purpose objects, contravene ...

Financial Capability in the United States

... events. Forty percent of Americans are building emergency savings, up 5% from three years ago. Nevertheless, the research shows that more effort is needed to help families manage their debt and plan for the future. The study’s findings also point to the gap between the challenges Americans face, esp ...

... events. Forty percent of Americans are building emergency savings, up 5% from three years ago. Nevertheless, the research shows that more effort is needed to help families manage their debt and plan for the future. The study’s findings also point to the gap between the challenges Americans face, esp ...

FUNDAMENTALS OF HEALTHCARE FINANCE Online Appendix B

... Of course, it would be impossible to list every ratio that one might encounter in healthcare finance. Furthermore, some ratios have variants or multiple definitions, so there is no guarantee that the definitions provided here are an exact match to the ones used elsewhere. Still, this appendix provid ...

... Of course, it would be impossible to list every ratio that one might encounter in healthcare finance. Furthermore, some ratios have variants or multiple definitions, so there is no guarantee that the definitions provided here are an exact match to the ones used elsewhere. Still, this appendix provid ...

A Small Open Economy Model with Sovereign

... The model’s equilibrium results are consistent with the fact that countries are more likely to default in bad times or when facing higher levels of outstanding debt. They also suggest that the maximum level of indebtedness relative to output, i.e. the maximum risky debt to output ratio, that an econ ...

... The model’s equilibrium results are consistent with the fact that countries are more likely to default in bad times or when facing higher levels of outstanding debt. They also suggest that the maximum level of indebtedness relative to output, i.e. the maximum risky debt to output ratio, that an econ ...

Credit Availability, Start-up Financing, and Survival: Evidence from

... for start-ups by comparing the financing of start-ups founded before and during the 2008-09 financial crisis. We find that bank debt is the most important source of financing for start-ups. While the creditworthiness of start-ups founded before and during the crisis is not significantly different, t ...

... for start-ups by comparing the financing of start-ups founded before and during the 2008-09 financial crisis. We find that bank debt is the most important source of financing for start-ups. While the creditworthiness of start-ups founded before and during the crisis is not significantly different, t ...

Fiscal sustainability of an independent Scotland

... Executive summary over time. For both these reasons, there would be a strong case to focus on a measure of borrowing that excluded these revenues. Any longer-run target for debt would need to take into account that Scotland would not have an established track record with creditors and is currently ...

... Executive summary over time. For both these reasons, there would be a strong case to focus on a measure of borrowing that excluded these revenues. Any longer-run target for debt would need to take into account that Scotland would not have an established track record with creditors and is currently ...

Does austerity pay off

... which are available only for parts of our sample. Moreover, our measure of yield spreads measures the real borrowing costs of governments. We establish a number of basic facts regarding yield spreads. First, they vary considerably across time and countries. In some instances they are slightly below ...

... which are available only for parts of our sample. Moreover, our measure of yield spreads measures the real borrowing costs of governments. We establish a number of basic facts regarding yield spreads. First, they vary considerably across time and countries. In some instances they are slightly below ...

The determinants of government yield spreads in the euro area

... third of the spreads dynamic in 2009-2010 and almost 10 per cent since 2011. However, results at the country level are quite different between core and peripherals. For core countries (excluding Germany, which is our benchmark to measure spreads) the analysis shows that model-predicted spreads are b ...

... third of the spreads dynamic in 2009-2010 and almost 10 per cent since 2011. However, results at the country level are quite different between core and peripherals. For core countries (excluding Germany, which is our benchmark to measure spreads) the analysis shows that model-predicted spreads are b ...

Soft budget constraint but no moral hazard? The Dutch local

... provide nationally uniform levels of essential public services as part of an attempt to guarantee equal standards of living to all citizens of the country, regardless of where they live. In order to provide a minimum level of public services, local governments must be provided with the proper financ ...

... provide nationally uniform levels of essential public services as part of an attempt to guarantee equal standards of living to all citizens of the country, regardless of where they live. In order to provide a minimum level of public services, local governments must be provided with the proper financ ...

Chapter 2 & 9

... contribution of the related activity remain with the contributing partner and are not transferred to the partnership. – If the activity produces income in the partnership’s hands, it will be either passive income or “income from a former passive activity” which can be offset by any of the activity’s ...

... contribution of the related activity remain with the contributing partner and are not transferred to the partnership. – If the activity produces income in the partnership’s hands, it will be either passive income or “income from a former passive activity” which can be offset by any of the activity’s ...

Obsessive–compulsive disorder

... behaviors or mental acts are not actually connected to the issue, or they are excessive. In addition to these criteria, at some point during the course of the disorder, the individual must realize that his/her obsessions or compulsions are unreasonable or excessive. Moreover, the obsessions or compu ...

... behaviors or mental acts are not actually connected to the issue, or they are excessive. In addition to these criteria, at some point during the course of the disorder, the individual must realize that his/her obsessions or compulsions are unreasonable or excessive. Moreover, the obsessions or compu ...

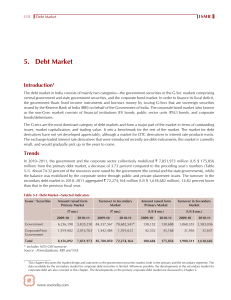

5. Debt Market

... Floating Rate Bonds: Floating rate bonds are securities that do not have a fixed coupon rate. The coupon is re-set at pre-announced intervals (say, every 6 months, or 1 year) by adding a spread over a base rate. In the case of most floating rate bonds issued by the Government of India so far, the base ...

... Floating Rate Bonds: Floating rate bonds are securities that do not have a fixed coupon rate. The coupon is re-set at pre-announced intervals (say, every 6 months, or 1 year) by adding a spread over a base rate. In the case of most floating rate bonds issued by the Government of India so far, the base ...