http://socrates

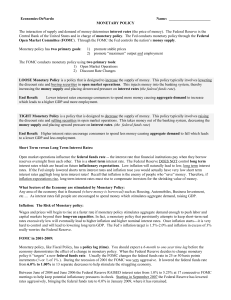

... TIGHT Monetary Policy is a policy that is designed to decrease the supply of money. This policy typically involves raising the discount rate and selling securities in open market operations. This takes money out of the banking system, decreasing the money supply and placing upward pressure on intere ...

... TIGHT Monetary Policy is a policy that is designed to decrease the supply of money. This policy typically involves raising the discount rate and selling securities in open market operations. This takes money out of the banking system, decreasing the money supply and placing upward pressure on intere ...

Achieving Economic Stability

... Subsidies to producers. Increased or decreased supply. Entitlements to consumers: Increased demand. ...

... Subsidies to producers. Increased or decreased supply. Entitlements to consumers: Increased demand. ...

Goal 9 Study Guide

... 13. If the Fed wants to stimulate the economy, what might it do to the discount rate, the reserve requirement, or open market operations? 14. If the Fed increases the money supply, what will happen to the interest rates at banks? Chapter 25.1 The Federal Budget Define the following terms: 1. budget ...

... 13. If the Fed wants to stimulate the economy, what might it do to the discount rate, the reserve requirement, or open market operations? 14. If the Fed increases the money supply, what will happen to the interest rates at banks? Chapter 25.1 The Federal Budget Define the following terms: 1. budget ...

View Additional Attachment

... Tracking the U.S. economy Defining and calculating Gross Domestic Product (GDP) Defining and calculating unemployment Defining and calculating inflation The role of productivity in economic growth and standards of living ...

... Tracking the U.S. economy Defining and calculating Gross Domestic Product (GDP) Defining and calculating unemployment Defining and calculating inflation The role of productivity in economic growth and standards of living ...

Macroeconomics & Circular Flow

... the United States—determine the amount of money in the economy. The amount of money in the economy (i.e. MONEY SUPPLY) in conjunction with how much money society wants to use determine the interest rate. $ SUPPLY + $ SOCIETY WANTS TO USE = INTEREST RATE ...

... the United States—determine the amount of money in the economy. The amount of money in the economy (i.e. MONEY SUPPLY) in conjunction with how much money society wants to use determine the interest rate. $ SUPPLY + $ SOCIETY WANTS TO USE = INTEREST RATE ...

Money matters

... money supply. This increase in deposits at banks (their liabilities) is entirely different from increases in bank lending (their - Cinema on his mind assets). The former requires no increase in their capital, as these liabilities can be readily offset by increasing riskless GAAR may not apply to tax ...

... money supply. This increase in deposits at banks (their liabilities) is entirely different from increases in bank lending (their - Cinema on his mind assets). The former requires no increase in their capital, as these liabilities can be readily offset by increasing riskless GAAR may not apply to tax ...

Macro Ch 16 - 19e - use this one

... Copyright © 2012 by The McGraw-Hill Companies, Inc. All rights reserved. ...

... Copyright © 2012 by The McGraw-Hill Companies, Inc. All rights reserved. ...

MACRO Study Guide Before AP 2016

... 18) Assume the required reserve ratio is 10% and a bank holds no excess reserves (multiplier = 1/rr) a. Joe deposits $20,000 into Bank 1 b. Fill in the balance sheet for each bank which shows the effect of Joe’s deposit c. Calculate the total new money creation caused by Joe’s deposit: ...

... 18) Assume the required reserve ratio is 10% and a bank holds no excess reserves (multiplier = 1/rr) a. Joe deposits $20,000 into Bank 1 b. Fill in the balance sheet for each bank which shows the effect of Joe’s deposit c. Calculate the total new money creation caused by Joe’s deposit: ...

Law of Supply and Demand

... decreases. High interest rates increase the opportunity cost of holding (not investing) money. When interest rates fall demand for money increases Money Supply Includes money for exchange in goods and services Includes near money= liquid assets Creation of Money When banks have reserves ab ...

... decreases. High interest rates increase the opportunity cost of holding (not investing) money. When interest rates fall demand for money increases Money Supply Includes money for exchange in goods and services Includes near money= liquid assets Creation of Money When banks have reserves ab ...

Foreign Exchange Rate Forecasting

... relegated to a role in which it influences only exchange rates through any alterations to the demand for money. The monetary approach omits a number of factors 1) the failure of PPP to hold in the short to medium term; 2) money demand appearing to be relatively unstable over time; and 3) the level o ...

... relegated to a role in which it influences only exchange rates through any alterations to the demand for money. The monetary approach omits a number of factors 1) the failure of PPP to hold in the short to medium term; 2) money demand appearing to be relatively unstable over time; and 3) the level o ...

File

... What makes up the labor force? Full and part-time workers, unemployed and actively looking. What type of unemployment makes up the 4 % during full employment? Frictional: In-between jobs. Structural: Job has been come obsolete because of technology. If unemployment is above 4 %, what type of unemplo ...

... What makes up the labor force? Full and part-time workers, unemployed and actively looking. What type of unemployment makes up the 4 % during full employment? Frictional: In-between jobs. Structural: Job has been come obsolete because of technology. If unemployment is above 4 %, what type of unemplo ...

(i) > 0

... Let Y* denote the value of real GDP corresponding to the equilibrium condition described in equation (4). Taking into account that M is presumed to be under the control of the monetary authority, (9) can be rewritten: M0 = pY* ...

... Let Y* denote the value of real GDP corresponding to the equilibrium condition described in equation (4). Taking into account that M is presumed to be under the control of the monetary authority, (9) can be rewritten: M0 = pY* ...

The Classic Dictionary of Civics and Economics

... Fiscal policyThe strategy of the government in order to influence aggregate demand to use the changes in taxation and in public spending ...

... Fiscal policyThe strategy of the government in order to influence aggregate demand to use the changes in taxation and in public spending ...

fiscal & monetary policy

... • The deficit is the difference between expenditures and revenues in one year. • So … it will equal the amount of money the government borrows for one fiscal year • The debt is the sum of all government borrowing before that time (minus the borrowing that has already been repaid) • So… every year t ...

... • The deficit is the difference between expenditures and revenues in one year. • So … it will equal the amount of money the government borrows for one fiscal year • The debt is the sum of all government borrowing before that time (minus the borrowing that has already been repaid) • So… every year t ...

Personal Finance Notes 1

... SSEPF2 The student will explain that banks and other financial institutions are businesses which channel funds from savers to investors. • A. compare services offered by different financial institutions • B. explain reasons for the spread between interest charged and interest earned • C. give exam ...

... SSEPF2 The student will explain that banks and other financial institutions are businesses which channel funds from savers to investors. • A. compare services offered by different financial institutions • B. explain reasons for the spread between interest charged and interest earned • C. give exam ...

Spending Money

... – create income from four main sources: • Services provided to banks • Interest earned on government securities--debt obligation (local or national) backed by the credit and taxing power of a country with very little risk of default (bonds, bills…) • Income from foreign currency held • Interest on l ...

... – create income from four main sources: • Services provided to banks • Interest earned on government securities--debt obligation (local or national) backed by the credit and taxing power of a country with very little risk of default (bonds, bills…) • Income from foreign currency held • Interest on l ...

Long Term Outlook for the Economy

... financial excesses that have built up in the last 30 years. It should take at least a decade to fix. ...

... financial excesses that have built up in the last 30 years. It should take at least a decade to fix. ...

Chapter 15 - Leuzinger High School

... • Bank notes were pieces of paper promising the bearer a specific amount of gold or silver when the notes were redeemed at the issuing bank. • Checks could be redeemed for gold only if endorsed by the payee. Bank notes, however, could be redeemed for gold by anyone who presented them to issuing bank ...

... • Bank notes were pieces of paper promising the bearer a specific amount of gold or silver when the notes were redeemed at the issuing bank. • Checks could be redeemed for gold only if endorsed by the payee. Bank notes, however, could be redeemed for gold by anyone who presented them to issuing bank ...