A rise in the price of oil imports has resulted in a decrease of short

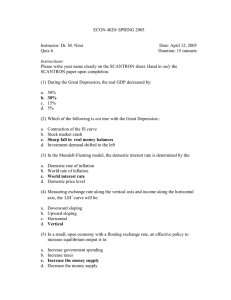

... a. in the inflationary gap. b. in the recessionary gap. c. at natural real GDP (QN) 27. Congress and the president are directly in charge of: a. monetary policy. b. fiscal policy. c. both of the above. d. none of the above. 28. If the government did not collect taxes but simply paid for its purchase ...

... a. in the inflationary gap. b. in the recessionary gap. c. at natural real GDP (QN) 27. Congress and the president are directly in charge of: a. monetary policy. b. fiscal policy. c. both of the above. d. none of the above. 28. If the government did not collect taxes but simply paid for its purchase ...

20140416 Budgeting and Macro Policy

... boost employment and production without incurring unacceptable increases in inflation • Why? Because once people have dropped out of the labor force, it may be hard to get them back. • Each month that the strong recovery we have been waiting for is delayed: – We lose $100 billion in useful commoditi ...

... boost employment and production without incurring unacceptable increases in inflation • Why? Because once people have dropped out of the labor force, it may be hard to get them back. • Each month that the strong recovery we have been waiting for is delayed: – We lose $100 billion in useful commoditi ...

Answers to Questions in Chapter 18

... reason banks will not normally grant 100% mortgages.) 444 Is the following statement true: `The greater the number of types of assets that are counted as being liquid, the smaller will be the bank multiplier'? Yes. The more assets it counts as liquid for purposes of deciding how much credit to gra ...

... reason banks will not normally grant 100% mortgages.) 444 Is the following statement true: `The greater the number of types of assets that are counted as being liquid, the smaller will be the bank multiplier'? Yes. The more assets it counts as liquid for purposes of deciding how much credit to gra ...

The Business Cycle

... cheese, flour, pepperonis, and sauce it is made of We would include the dollar value of the Dresser Not the dollar value of the wood, hardware, and glue it is made of ...

... cheese, flour, pepperonis, and sauce it is made of We would include the dollar value of the Dresser Not the dollar value of the wood, hardware, and glue it is made of ...

Reflections on 25 Years of Inflation Targeting

... This year marks the 25th anniversary of the Reserve Bank of New Zealand Act (1989), which granted the Reserve Bank of New Zealand (RBNZ) its independence, introduced price stability as its primary objective, and thus instituted inflation targeting as a monetary policy regime. To mark this occasion, ...

... This year marks the 25th anniversary of the Reserve Bank of New Zealand Act (1989), which granted the Reserve Bank of New Zealand (RBNZ) its independence, introduced price stability as its primary objective, and thus instituted inflation targeting as a monetary policy regime. To mark this occasion, ...

MONETARY POLICY BUSINESS CYCLE Beryl W. Sprinkel

... work and is as likely as not to be destabilizing by inducing a stop-go pattern to economic performance and the business cycle. There is a fairly consistent lead-lag relationship between monetary change and the business cycle. Although this relationship is debatable, the evidence of the direction of ...

... work and is as likely as not to be destabilizing by inducing a stop-go pattern to economic performance and the business cycle. There is a fairly consistent lead-lag relationship between monetary change and the business cycle. Although this relationship is debatable, the evidence of the direction of ...

A rise in the price of oil imports has resulted in a decrease of short

... a. in the inflationary gap. b. in the recessionary gap. c. at natural real GDP (QN) 27. Congress and the president are directly in charge of: a. monetary policy. b. fiscal policy. c. both of the above. d. none of the above. 28. If the government did not collect taxes but simply paid for its purchase ...

... a. in the inflationary gap. b. in the recessionary gap. c. at natural real GDP (QN) 27. Congress and the president are directly in charge of: a. monetary policy. b. fiscal policy. c. both of the above. d. none of the above. 28. If the government did not collect taxes but simply paid for its purchase ...

Demand for Loans Real Interest Rate

... B) Unemployment decreases with an increase in inflation C) Increased automation will lead to lower levels of structural unemployment in the long-run. D) Changes in the composition of the overall demand for labor tend to be deflationary in the long-run. E) The natural rate of unemployment is independ ...

... B) Unemployment decreases with an increase in inflation C) Increased automation will lead to lower levels of structural unemployment in the long-run. D) Changes in the composition of the overall demand for labor tend to be deflationary in the long-run. E) The natural rate of unemployment is independ ...

Beginning Activity

... • Creeping inflation – 1 to 3% per year • Galloping inflation – 100 to 300% per year • Hyperinflation – 500% and up – Ex. Hungary’s currency inflation went up to 828 octillion to 1 because it printed money to pay its bills. – What currency rule does that violate? ...

... • Creeping inflation – 1 to 3% per year • Galloping inflation – 100 to 300% per year • Hyperinflation – 500% and up – Ex. Hungary’s currency inflation went up to 828 octillion to 1 because it printed money to pay its bills. – What currency rule does that violate? ...

Understanding Money and Banking

... relationship between nominal interest rates and the quantity of money demanded 1. What happens to the quantity demanded of money when interest rates increase? Quantity demanded falls because individuals would prefer to have interest earning assets instead 2. What happens to the quantity demanded whe ...

... relationship between nominal interest rates and the quantity of money demanded 1. What happens to the quantity demanded of money when interest rates increase? Quantity demanded falls because individuals would prefer to have interest earning assets instead 2. What happens to the quantity demanded whe ...

EconomicPolicy AP2013

... PolicY: Increase taxes Decrease spending Result: Consumers have LESS money to spend! ...

... PolicY: Increase taxes Decrease spending Result: Consumers have LESS money to spend! ...

Institute of Business Management Semester: Spring Course

... Q#8 Use the IS-LM model to determine the effects of each of the following on the general equilibrium values of the real wage, employment, output, real interest rate, consumption, investment, and price level. a. A reduction in the effective tax rate on capital increases desired investment. b. The ex ...

... Q#8 Use the IS-LM model to determine the effects of each of the following on the general equilibrium values of the real wage, employment, output, real interest rate, consumption, investment, and price level. a. A reduction in the effective tax rate on capital increases desired investment. b. The ex ...

Macroeconomics

... Value of Money Acceptable as a medium of exchange Currency is legal tender or fiat money; must be accepted by law Relative scarcity of money compared to goods & services will allow money to retain its ...

... Value of Money Acceptable as a medium of exchange Currency is legal tender or fiat money; must be accepted by law Relative scarcity of money compared to goods & services will allow money to retain its ...

AS/AD Model part 2

... How much will income change by if the Fed buys $10 billion worth of bonds? How much will income change by if the Fed sells $15 billion worth of bonds? ...

... How much will income change by if the Fed buys $10 billion worth of bonds? How much will income change by if the Fed sells $15 billion worth of bonds? ...

Economics 330: Money and Banking (Professor Kelly)

... have very low inflation while the countries with less independent central banks like Spain, Italy, New Zealand, Australia have very high inflation rates. b. (2 points) However, from a macroeconomic point of view, there are other important variables like GDP, unemployment, exchange rates, that may ha ...

... have very low inflation while the countries with less independent central banks like Spain, Italy, New Zealand, Australia have very high inflation rates. b. (2 points) However, from a macroeconomic point of view, there are other important variables like GDP, unemployment, exchange rates, that may ha ...