GOAL 8 – US Economic System MONSTER REVIEW! Economic

... 2. How are all economic decisions made in a command economy? 3. Who makes economic decisions in a market economy? 4. How are prices determined in a free-enterprise economic system? 5. Capitalism is associated with what type of economy? 6. What economist wrote Communist Manifesto and explained the f ...

... 2. How are all economic decisions made in a command economy? 3. Who makes economic decisions in a market economy? 4. How are prices determined in a free-enterprise economic system? 5. Capitalism is associated with what type of economy? 6. What economist wrote Communist Manifesto and explained the f ...

syllabus2

... A. Money, banking, and financial markets Definition of financial assets: money, stocks, and bonds Time value of money Measures of money supply Banks and creation of money Money demand Money market Loanable funds market B. Central banking and control of the money supply Tools of central bank policy Q ...

... A. Money, banking, and financial markets Definition of financial assets: money, stocks, and bonds Time value of money Measures of money supply Banks and creation of money Money demand Money market Loanable funds market B. Central banking and control of the money supply Tools of central bank policy Q ...

SOLUTION EXAM 06/07/04

... 2. a) X is a normal good. The sign of income in the demand function is positive. b) X and Y are substitutes. The sign of Py is positive, that means that changes in the price of good Y will provoke changes in the opposite direction in the demand of good X, therefore they must be substitutes. c) For P ...

... 2. a) X is a normal good. The sign of income in the demand function is positive. b) X and Y are substitutes. The sign of Py is positive, that means that changes in the price of good Y will provoke changes in the opposite direction in the demand of good X, therefore they must be substitutes. c) For P ...

Advanced Placement Microeconomics Review Sheet

... 18) How does monetary policy affect the value of the dollar and net exports? 19) Define the following terms: Medium of exchange, standard of value, store of value, M1, M2, M3, fiat money, commodity money, representative money, checkable deposits, demand deposits, time deposits, legal tender, transac ...

... 18) How does monetary policy affect the value of the dollar and net exports? 19) Define the following terms: Medium of exchange, standard of value, store of value, M1, M2, M3, fiat money, commodity money, representative money, checkable deposits, demand deposits, time deposits, legal tender, transac ...

Ch16-- Macroeconomic Viewpoints

... New Classical “Policy” Most observed unemployment is voluntary. Only unanticipated policies can have any effect. “policy ineffectiveness proposition”. Therefore, attempt no activist policy. Follow predictable and stable monetary and fiscal policies for long run employment and price stability. ...

... New Classical “Policy” Most observed unemployment is voluntary. Only unanticipated policies can have any effect. “policy ineffectiveness proposition”. Therefore, attempt no activist policy. Follow predictable and stable monetary and fiscal policies for long run employment and price stability. ...

Word Document

... FDR created programs designed to keep prices and wages high. In 1942 FDR set income tax rates above $25,000 at 100% by executive order. In the 1920’s Ms expanded by 40%, but the price level was stable because Md also increased. Milton Friedman pointed out that when you see unemployment high ...

... FDR created programs designed to keep prices and wages high. In 1942 FDR set income tax rates above $25,000 at 100% by executive order. In the 1920’s Ms expanded by 40%, but the price level was stable because Md also increased. Milton Friedman pointed out that when you see unemployment high ...

Lecture 2 PPT - Kleykamp in Taiwan

... Some Criticisms of This Policy (1)It is not “people” but commercial banks that want to sit on trillions of dollars of money (reserves held at the Fed). They do this because of simple Keynesian liquidity preference – they expect higher rates will prevail in the future and do not want to lend now at ...

... Some Criticisms of This Policy (1)It is not “people” but commercial banks that want to sit on trillions of dollars of money (reserves held at the Fed). They do this because of simple Keynesian liquidity preference – they expect higher rates will prevail in the future and do not want to lend now at ...

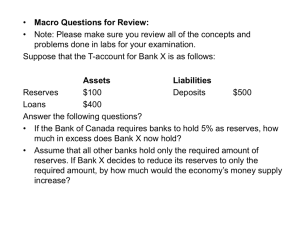

Time Value, Velocity, and Quantity of Money, Liquidity, the Reserve

... through the money supply alone. If the money supply is increased, but velocity decreases, GDP may stay the same or even decline . Price levels will also rise because of the abundance of money. Along the same idea, the quantity theory of money states that there is a direct relationship between the qu ...

... through the money supply alone. If the money supply is increased, but velocity decreases, GDP may stay the same or even decline . Price levels will also rise because of the abundance of money. Along the same idea, the quantity theory of money states that there is a direct relationship between the qu ...

Monthly Investment Commentary

... reallocated to life’s necessities. Our concern going forward is that if the Fed is forced to continue abnormally low interest rates in an effort to stimulate the economy, how long will it be before economic gains are offset by rising inflation? It seems like years ago that we were worried about whet ...

... reallocated to life’s necessities. Our concern going forward is that if the Fed is forced to continue abnormally low interest rates in an effort to stimulate the economy, how long will it be before economic gains are offset by rising inflation? It seems like years ago that we were worried about whet ...

A rise in the price of oil imports has resulted in a decrease of short

... unemployment and wages in the U.S. economy if there is a large decrease in the price of oil. On your diagram, mark the starting output as QN, the output at the end of the short run as Q2, and the output at the end of the long run as Q3. Mark the starting price as P1, the price at the end of the shor ...

... unemployment and wages in the U.S. economy if there is a large decrease in the price of oil. On your diagram, mark the starting output as QN, the output at the end of the short run as Q2, and the output at the end of the long run as Q3. Mark the starting price as P1, the price at the end of the shor ...

Monetary Policy

... All banks are required to hold a minimum percentage of deposits as reserve. Changes in required reserve ratios can have an important influence on the money supply. Changes in reserve requirements are made sparingly because they present too large change in monetary policy. ...

... All banks are required to hold a minimum percentage of deposits as reserve. Changes in required reserve ratios can have an important influence on the money supply. Changes in reserve requirements are made sparingly because they present too large change in monetary policy. ...

Chapter 34: The Influence of Monetary and Fiscal Policy on

... iii. Remember, money is a highly liquid asset that facilitates transactions. (1) People react to its cost, the interest rate available on other assets, and income, because it is a normal good. iv. In this analysis, there is no inflation so the nominal and real interest rates are the same. v. There i ...

... iii. Remember, money is a highly liquid asset that facilitates transactions. (1) People react to its cost, the interest rate available on other assets, and income, because it is a normal good. iv. In this analysis, there is no inflation so the nominal and real interest rates are the same. v. There i ...

Ch. 10

... at full-employment; so Y will not change if there is no growth. If there is growth, then Y is predictable: Y is known. Velocity is also thought predictable in the ...

... at full-employment; so Y will not change if there is no growth. If there is growth, then Y is predictable: Y is known. Velocity is also thought predictable in the ...

Imports

... Demand-pull inflation Aggregate demand > productive capacity Causes include increases in money supply or credit. ...

... Demand-pull inflation Aggregate demand > productive capacity Causes include increases in money supply or credit. ...