Lecture 5

... A contractionary monetary policy: the Fed sells bonds to reduce money supply and raise interest rate ...

... A contractionary monetary policy: the Fed sells bonds to reduce money supply and raise interest rate ...

Return on Investment of the Recruiting Process

... • Facilitate achievement of debt target of 50% of GDP by 2018 ...

... • Facilitate achievement of debt target of 50% of GDP by 2018 ...

Practice Short Answer Final Exam Questions

... Canada buys government securities from the chartered banks rather than from the public is due to the fact that a. excess reserves are larger when the Bank of Canada buys government securities from the chartered banks. b. excess reserves are smaller when the Bank of Canada buys government securities ...

... Canada buys government securities from the chartered banks rather than from the public is due to the fact that a. excess reserves are larger when the Bank of Canada buys government securities from the chartered banks. b. excess reserves are smaller when the Bank of Canada buys government securities ...

Practice Powerpoint - Black Hawk College

... Treasury bonds at different times in the past, depending upon how it wants the economy to move. • In the past 25 years, the Feds has more often sold bonds to fight inflation. ...

... Treasury bonds at different times in the past, depending upon how it wants the economy to move. • In the past 25 years, the Feds has more often sold bonds to fight inflation. ...

interest rates

... – All goods and services are priced in common monetary units – Allows us to compare relative prices easily. – Only need one set of prices. ...

... – All goods and services are priced in common monetary units – Allows us to compare relative prices easily. – Only need one set of prices. ...

Monetary policy

... Monetary policy, the utilization of changes in the amount of money in circulation to alter credit markets, employment, and the rate of inflation. Organization of the Federal Reserve System Loose and Tight Monetary Policies. The Fed implements policy by increasing or reducing the rate of growth of th ...

... Monetary policy, the utilization of changes in the amount of money in circulation to alter credit markets, employment, and the rate of inflation. Organization of the Federal Reserve System Loose and Tight Monetary Policies. The Fed implements policy by increasing or reducing the rate of growth of th ...

Presentation to Lambda Alpha International and Arizona Bankers Association Phoenix, Arizona

... “quantitative easing” or “QE” by people outside the Fed. Inside the Fed, it’s less elegantly referred to as LSAPs. That stands for large-scale asset purchases. This program was part of our response to the financial crisis and slow recovery. During the worst days of the recession, the economy was st ...

... “quantitative easing” or “QE” by people outside the Fed. Inside the Fed, it’s less elegantly referred to as LSAPs. That stands for large-scale asset purchases. This program was part of our response to the financial crisis and slow recovery. During the worst days of the recession, the economy was st ...

Exam 2 study guide

... equilibrium/disequilibrium. Total spending = total output if S + ____ = Ip + ____. Study/review recommendations: Text and class outline. Aplia – The Classical Long Run Model (I & II). Chap. 9 (6 quests.) What happens to output, employment, and unemployment during an expansion; during a recession? Wh ...

... equilibrium/disequilibrium. Total spending = total output if S + ____ = Ip + ____. Study/review recommendations: Text and class outline. Aplia – The Classical Long Run Model (I & II). Chap. 9 (6 quests.) What happens to output, employment, and unemployment during an expansion; during a recession? Wh ...

Objectives and Instruments of Macroeconomics

... goods and services as well as the amount of private saving. • Private consumption and saving have important effects on investment and output in the short and long run. ...

... goods and services as well as the amount of private saving. • Private consumption and saving have important effects on investment and output in the short and long run. ...

CHAPTER5HOMEWORKWITHANSWERS

... The rate of return on a savings account may also be referred to as a. yield. b. compounding. c. liquidity. d. equity. ...

... The rate of return on a savings account may also be referred to as a. yield. b. compounding. c. liquidity. d. equity. ...

An Open Letter to Clients – January 2008

... country will be affected adversely. Personally, I think the real issue is far more significant and “systemic”. The world is awash in debt, particularly in the United States. In my last letter I wrote about the burgeoning US debt. For readers new and not so new, I’ll repeat the figure. They have $55, ...

... country will be affected adversely. Personally, I think the real issue is far more significant and “systemic”. The world is awash in debt, particularly in the United States. In my last letter I wrote about the burgeoning US debt. For readers new and not so new, I’ll repeat the figure. They have $55, ...

Current Issues

... minimum wage law, pro-union legislation, and guaranteed prices for some products as in agriculture. b. Monetarists say that government also contributes to the economy’s business cycles through clumsy, mistaken, monetary policies. 4. The fundamental equation of monetarism is the equation of exchange. ...

... minimum wage law, pro-union legislation, and guaranteed prices for some products as in agriculture. b. Monetarists say that government also contributes to the economy’s business cycles through clumsy, mistaken, monetary policies. 4. The fundamental equation of monetarism is the equation of exchange. ...

Fiscal and Monetary Policy

... 1. Pay off public debt Buy back bonds Puts $ back into the system, increases consumption • May offset contractionary policy that created the surplus ...

... 1. Pay off public debt Buy back bonds Puts $ back into the system, increases consumption • May offset contractionary policy that created the surplus ...

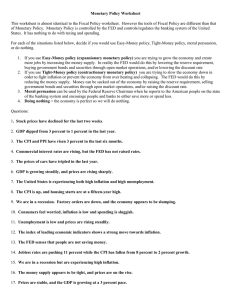

Monetary Policy Worksheet

... In reality the FED would do this by lowering the reserve requirement, buying government bonds and securities through open market operations, and/or lowering the discount rate 2. If you use Tight-Money policy you are trying to slow the economy down in order to fight inflation or prevent the economy f ...

... In reality the FED would do this by lowering the reserve requirement, buying government bonds and securities through open market operations, and/or lowering the discount rate 2. If you use Tight-Money policy you are trying to slow the economy down in order to fight inflation or prevent the economy f ...