How the Fed Conducts Monetary Policy PPT

... Under a gold standard, a country has no direct control over its inflation rate. Most economists regard the gold standard as an outmoded system, but advocates regret its passing. ...

... Under a gold standard, a country has no direct control over its inflation rate. Most economists regard the gold standard as an outmoded system, but advocates regret its passing. ...

Macroeconomics 6

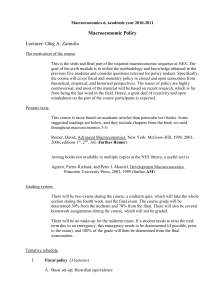

... the course will cover fiscal and monetary policy in closed and open economies from theoretical, empirical, and historical perspectives. The issues of policy are highly controversial, and most of the material will be based on recent research, which is far from being the last word in the field. Hence, ...

... the course will cover fiscal and monetary policy in closed and open economies from theoretical, empirical, and historical perspectives. The issues of policy are highly controversial, and most of the material will be based on recent research, which is far from being the last word in the field. Hence, ...

The General Theory and Victoria Chick at 80: A Celebration

... Money always comes in exchange for something else, as a counterpart of an Keynesian and income-generating expenditure (whether investment, government expenditure or Monetarist assume that credit-financier consumption) the mode of introduction of new money is a A monetary change is “only one half of ...

... Money always comes in exchange for something else, as a counterpart of an Keynesian and income-generating expenditure (whether investment, government expenditure or Monetarist assume that credit-financier consumption) the mode of introduction of new money is a A monetary change is “only one half of ...

Chapter12-Multiple Choice Questions on Inflation

... 5. A cost-push inflation spiral results if the Fed's response to stagflation is to keep A) decreasing aggregate demand. B) decreasing aggregate supply. C) increasing aggregate demand. D) increasing aggregate supply. 6. For a cost-push inflation to occur, oil price increases must be accompanied by A) ...

... 5. A cost-push inflation spiral results if the Fed's response to stagflation is to keep A) decreasing aggregate demand. B) decreasing aggregate supply. C) increasing aggregate demand. D) increasing aggregate supply. 6. For a cost-push inflation to occur, oil price increases must be accompanied by A) ...

14.02: Principles of Macroeconomics

... A possible explanation is that investment is no longer responded to the interest rates. That means the link between goods market and financial market is broken. The IS curve, in this case, will be very steep or vertical. As a result, monetary policy, though can lower interest rate, will not have any ...

... A possible explanation is that investment is no longer responded to the interest rates. That means the link between goods market and financial market is broken. The IS curve, in this case, will be very steep or vertical. As a result, monetary policy, though can lower interest rate, will not have any ...

Essential Understandings Economic Philosophies Basic concepts of

... Discuss the impact of interest rates on the demand for money (Theory of liquidity preference) Impact of interest rates on Money Supply? ...

... Discuss the impact of interest rates on the demand for money (Theory of liquidity preference) Impact of interest rates on Money Supply? ...

Chapter 14 - The Citadel

... federal funds market, in which banks can borrow reserves from other banks that want to lend them and pay the federal funds rate. Copyright © 2005 Pearson Addison-Wesley. All rights reserved. ...

... federal funds market, in which banks can borrow reserves from other banks that want to lend them and pay the federal funds rate. Copyright © 2005 Pearson Addison-Wesley. All rights reserved. ...

neweconchsunit3upload - Goshen Community Schools

... 1. control the nation’s money supply (practice monetary policy) 2. serve as a banker’s bank (and monitors “bad banks”, lender of last resort) 3. clearinghouse for all checks 4. serve as the Government’s bank Money is measured, M1 & M2 are the primary measurements used. M1 = demand deposits + currenc ...

... 1. control the nation’s money supply (practice monetary policy) 2. serve as a banker’s bank (and monitors “bad banks”, lender of last resort) 3. clearinghouse for all checks 4. serve as the Government’s bank Money is measured, M1 & M2 are the primary measurements used. M1 = demand deposits + currenc ...

Chapter 26 Money and Economic Stability in the ISLM World

... In this chapter, the IS-LM model is used to discuss the fundamental difference between noninterventionists (Monetarist-New Classicals) and interventionists (Keynesians). Noninterventionists believe the economy is inherently stable, or at least that policy makers do not have the information or the sk ...

... In this chapter, the IS-LM model is used to discuss the fundamental difference between noninterventionists (Monetarist-New Classicals) and interventionists (Keynesians). Noninterventionists believe the economy is inherently stable, or at least that policy makers do not have the information or the sk ...

What Have We Learned since October 1979?

... basis point moves, with careful management of the exact monthly timing of this rate increase or that rate decrease, with several actual and attempted soft landings, with influencing markets with minor variations in wording, and so on. If that is not fine tuning, I don’t know what is. And you know w ...

... basis point moves, with careful management of the exact monthly timing of this rate increase or that rate decrease, with several actual and attempted soft landings, with influencing markets with minor variations in wording, and so on. If that is not fine tuning, I don’t know what is. And you know w ...

CHAPTER 3 THE FED AND INTEREST RATES CHAPTER

... “NOW” accounts and similar interest-on-checking accounts ...

... “NOW” accounts and similar interest-on-checking accounts ...

American Government 100 Part IV Patterson, pgs. 546

... the board of the Fed, serve terms of: a) 4 years, b) 8 years, c) 14 years, d) no limit. 19. What is the key advantage that monetary policy has over fiscal policy according to Patterson? a) monetary policy is less complex than fiscal policy, b) monetary policy can be implemented more quickly, c) memb ...

... the board of the Fed, serve terms of: a) 4 years, b) 8 years, c) 14 years, d) no limit. 19. What is the key advantage that monetary policy has over fiscal policy according to Patterson? a) monetary policy is less complex than fiscal policy, b) monetary policy can be implemented more quickly, c) memb ...

The Flexible Price Benchmark

... Mt = money holdings at the end of date t Pt = aggregate domestic price level Ct = consumption index ht(j) = supply of labor of type j by the representative individual wt(j) = wage rate of labor of type j it* = world interest rate t(j) = profit of firm j (domestic) t = exchange rate in period t Tt ...

... Mt = money holdings at the end of date t Pt = aggregate domestic price level Ct = consumption index ht(j) = supply of labor of type j by the representative individual wt(j) = wage rate of labor of type j it* = world interest rate t(j) = profit of firm j (domestic) t = exchange rate in period t Tt ...

Mr - 4J Blog Server

... in order to _________ interest rates, thus _________ investment in the short-term and adding to the capital stock 2. _________ the money supply in order to _________ interest rates, thus fighting inflation and __________ investment in the long-term Advantage: #2 successful in producing long-term pri ...

... in order to _________ interest rates, thus _________ investment in the short-term and adding to the capital stock 2. _________ the money supply in order to _________ interest rates, thus fighting inflation and __________ investment in the long-term Advantage: #2 successful in producing long-term pri ...

Unit 4 Homework Packet Due Friday 4/10 Read pages 306

... 34. What happens to the demand of the government if Congress increases spending? 35. According to Keynes what would be the proper fiscal policy during periods of ...

... 34. What happens to the demand of the government if Congress increases spending? 35. According to Keynes what would be the proper fiscal policy during periods of ...

ECO 317 Intermediate Macroeconomics

... to class today I was reading an article that stated that a main reason why our economy has not felt the same effects of having a 70% debt to GDP ratio is that we have lower interest rates compared to European countries who have similar debt-GDP ratios(but these countries have higher interest rates). ...

... to class today I was reading an article that stated that a main reason why our economy has not felt the same effects of having a 70% debt to GDP ratio is that we have lower interest rates compared to European countries who have similar debt-GDP ratios(but these countries have higher interest rates). ...

Vortrag/Präsentation - EESC European Economic and Social

... can be deployed even when other measures possible MF carries substantial risks that need to (and can) be avoided by careful policy design ...

... can be deployed even when other measures possible MF carries substantial risks that need to (and can) be avoided by careful policy design ...