fundamental principles of russian insurance contract law

... RUSSIAN LAW (dislosure of information) Requirement of disclosure of information on risks applied, but, as well as all over the world, courts are becoming more reluctant to view it as a must duty of the insurer the insured will only experience adverse effects if he intentionally concealed impor ...

... RUSSIAN LAW (dislosure of information) Requirement of disclosure of information on risks applied, but, as well as all over the world, courts are becoming more reluctant to view it as a must duty of the insurer the insured will only experience adverse effects if he intentionally concealed impor ...

Real estate terms and definitions

... A cosigner cannot improve a credit report, but can improve the chances of getting a mortgage. Cosigners should be aware that cosigning for a loan will adversely affect future creditworthiness since that loan becomes what is known as a contingent liability against future borrowing power. Credit Repor ...

... A cosigner cannot improve a credit report, but can improve the chances of getting a mortgage. Cosigners should be aware that cosigning for a loan will adversely affect future creditworthiness since that loan becomes what is known as a contingent liability against future borrowing power. Credit Repor ...

This PDF is a selection from a published volume from... Bureau of Economic Research

... to Asian countries (as shown by the author, citing statistics collected by the Bank for International Settlements [BIS]). Given how important international bank lending has been in Asian economies, both positively (before the crisis) and negatively (during the crisis), a contribution on understandin ...

... to Asian countries (as shown by the author, citing statistics collected by the Bank for International Settlements [BIS]). Given how important international bank lending has been in Asian economies, both positively (before the crisis) and negatively (during the crisis), a contribution on understandin ...

quick estimator - Cottonwood Insurance

... Include group insurance and personal insurance purchased on your own 12. Total of all assets (Add lines 9, 10 and 11.) 13. Estimated amount of additional life insurance needed (Subtract line 12 from line 8.) ...

... Include group insurance and personal insurance purchased on your own 12. Total of all assets (Add lines 9, 10 and 11.) 13. Estimated amount of additional life insurance needed (Subtract line 12 from line 8.) ...

AZIONARIO TREND LUNGO PERIODO (LU0089650302) a Sub

... responsible for awarding the remuneration and benefits, including the composition of the remuneration committee, are available on http://www. mdo-manco.com/remuneration-policy, a paper copy will be made available free of charge upon request. Luxembourg's taxation regime may have an impact on the per ...

... responsible for awarding the remuneration and benefits, including the composition of the remuneration committee, are available on http://www. mdo-manco.com/remuneration-policy, a paper copy will be made available free of charge upon request. Luxembourg's taxation regime may have an impact on the per ...

Securitisation

... DMCS: properties • Innovations in mortgage loans will be reflected on the funding side. • Investors who buy the issued bonds do not incur any default risk in practice (almost all bonds are Aaa rated). It is a secure product that has never led to credit losses. • It has a stabilizing effect on the D ...

... DMCS: properties • Innovations in mortgage loans will be reflected on the funding side. • Investors who buy the issued bonds do not incur any default risk in practice (almost all bonds are Aaa rated). It is a secure product that has never led to credit losses. • It has a stabilizing effect on the D ...

Speech to the Stanford Institute for Economic Policy Research Stanford, California

... reluctant to lend. This reflects recognition of the need to preserve their own liquidity to meet unexpected credit demands, greater uncertainty about the creditworthiness of counterparties, or concerns about their capital positions. My basic point is that a process of deleveraging, in which many fin ...

... reluctant to lend. This reflects recognition of the need to preserve their own liquidity to meet unexpected credit demands, greater uncertainty about the creditworthiness of counterparties, or concerns about their capital positions. My basic point is that a process of deleveraging, in which many fin ...

Real Estate Finance - PowerPoint presentation - Ch 03

... Housing and Economic Recovery Act of 2008 FAQs Q: How will the law help struggling homeowners keep their homes? A: Through the Federal Housing Administration (FHA), an estimated 400,000 borrowers in danger of losing their homes will be able to refinance into more affordable government-insured mortg ...

... Housing and Economic Recovery Act of 2008 FAQs Q: How will the law help struggling homeowners keep their homes? A: Through the Federal Housing Administration (FHA), an estimated 400,000 borrowers in danger of losing their homes will be able to refinance into more affordable government-insured mortg ...

Mobilising Private Capital Flows for Infrastructure Development in APAC 30

... amounting to USD 4.4 billion provided by a • Co-financing of large infrastructure projects syndicate of international financial institutions will be particularly critical for developing and export credit agencies, together with 15 countries with a higher country risk profile. commercial banks. • Mul ...

... amounting to USD 4.4 billion provided by a • Co-financing of large infrastructure projects syndicate of international financial institutions will be particularly critical for developing and export credit agencies, together with 15 countries with a higher country risk profile. commercial banks. • Mul ...

Press release

... changes in laws and regulations, including monetary convergence and the European Monetary Union, (xi) changes in the policies of central banks and/or foreign governments, (xii) the impact of acquisitions, including related integration issues, (xiii) reorganization measures, and (xiv) general competi ...

... changes in laws and regulations, including monetary convergence and the European Monetary Union, (xi) changes in the policies of central banks and/or foreign governments, (xii) the impact of acquisitions, including related integration issues, (xiii) reorganization measures, and (xiv) general competi ...

Financial Institutions

... go to a stockbroker, the stockbroker would place the order and charge a fee (commission) › Full-service brokerage firms advise customers on which securities to buy and help manage their investments › Discount brokers place orders for customers too but other services may be limited…fees are less ...

... go to a stockbroker, the stockbroker would place the order and charge a fee (commission) › Full-service brokerage firms advise customers on which securities to buy and help manage their investments › Discount brokers place orders for customers too but other services may be limited…fees are less ...

Thank you for the business

... This newsletter is solely the work of the author for the private information of clients. Although the author is a registered Investment Advisor at Canaccord Genuity Corp., this is not an official publication of Canaccord Genuity Corp. and the author is not a Canaccord Genuity Corp. analyst. The view ...

... This newsletter is solely the work of the author for the private information of clients. Although the author is a registered Investment Advisor at Canaccord Genuity Corp., this is not an official publication of Canaccord Genuity Corp. and the author is not a Canaccord Genuity Corp. analyst. The view ...

Eurobonds: a crucial step towards political union and an engine for

... • It has the effect of transforming bad news about one particular country into bad news for other countries, and for the system as a whole. ...

... • It has the effect of transforming bad news about one particular country into bad news for other countries, and for the system as a whole. ...

draft statement to the oireachtas joint committee

... When assessing risk insurers analyse the claims history of the property and any flood prevention measures implemented by the OPW or local authority. Some people pay a higher premium or have a higher flood excess because the flood risk is higher. Exclusion of cover is a last resort. Insurance offers ...

... When assessing risk insurers analyse the claims history of the property and any flood prevention measures implemented by the OPW or local authority. Some people pay a higher premium or have a higher flood excess because the flood risk is higher. Exclusion of cover is a last resort. Insurance offers ...

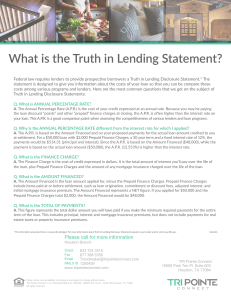

What is the Truth in Lending Statement?

... statement is designed to give you information about the costs of your loan so that you can be compare these costs among various programs and lenders. Here are the most common questions that we get on the subject of Truth in Lending Disclosure Statements: Q. What is ANNUAL PERCENTAGE RATE? ...

... statement is designed to give you information about the costs of your loan so that you can be compare these costs among various programs and lenders. Here are the most common questions that we get on the subject of Truth in Lending Disclosure Statements: Q. What is ANNUAL PERCENTAGE RATE? ...

risk management

... repayment is 0.90 what would be the expected return rate of the corporation if the recovery rate of principal and interest is 0.95 Expt. rate = p * r + q [ (1 + r) R -1] Where p is probability of repayment q= 1-p r is contractual rate and R is recovery rate ...

... repayment is 0.90 what would be the expected return rate of the corporation if the recovery rate of principal and interest is 0.95 Expt. rate = p * r + q [ (1 + r) R -1] Where p is probability of repayment q= 1-p r is contractual rate and R is recovery rate ...

Market Discipline and why Risk Management is so Important

... Not many people can relate to experiences in their career of more than 1-in-25 years Some people will understand the concept and own the output of a stress test at 1-in-50 or 1-in-100 year confidence level, but anyone who believes the output above these levels is reliable is probably deluded – • ...

... Not many people can relate to experiences in their career of more than 1-in-25 years Some people will understand the concept and own the output of a stress test at 1-in-50 or 1-in-100 year confidence level, but anyone who believes the output above these levels is reliable is probably deluded – • ...

The Returns and Risks From Investing

... TR, RR are useful for a given, single time period W hat about summarizing returns over several time periods? Arithmetic mean, or simply mean, ...

... TR, RR are useful for a given, single time period W hat about summarizing returns over several time periods? Arithmetic mean, or simply mean, ...

How do you assess multi-asset funds?

... Content is provided for information purposes only and is not intended as investment advice nor is it a recommendation to buy or sell any particular security. Any discussion of particular topics is not meant to be comprehensive and may be subject to change. Any investment or strategy mentioned herein ...

... Content is provided for information purposes only and is not intended as investment advice nor is it a recommendation to buy or sell any particular security. Any discussion of particular topics is not meant to be comprehensive and may be subject to change. Any investment or strategy mentioned herein ...

14-June-Property-buyers-face-new-threat-from

... Property buyers are being let down because lenders are increasingly pulling out of deals at the last moment, forcing loan renegotiations on worse terms or the need to start looking for another loan. Prudent buyers getting pre-approvals up to six months before finding the property they want to buy ar ...

... Property buyers are being let down because lenders are increasingly pulling out of deals at the last moment, forcing loan renegotiations on worse terms or the need to start looking for another loan. Prudent buyers getting pre-approvals up to six months before finding the property they want to buy ar ...

1) - - Prince Sultan University

... Using gap analysis, what is the effect of a 4 percent increase in interest rates? What is the effect of a 3 percent decrease in rates? Why is knowledge of interest-rate risk important? How might banks respond if rates are expected to change unfavorably? (18.33 Answer: The gap is –$40 million. A 4 pe ...

... Using gap analysis, what is the effect of a 4 percent increase in interest rates? What is the effect of a 3 percent decrease in rates? Why is knowledge of interest-rate risk important? How might banks respond if rates are expected to change unfavorably? (18.33 Answer: The gap is –$40 million. A 4 pe ...

ETHICS CHECKIST: TEN TESTS OF ETHICALITY William

... Copyright © 2000 by William F. Doverspike, Ph.D. ...

... Copyright © 2000 by William F. Doverspike, Ph.D. ...

New Mortgage Rules to Reinforce Soft Landing in

... for chartered banks, which could increase mortgage costs next year. Moreover, risk-sharing discussions with lenders and their potential implementation may also play a part of weighing on the mortgage market. As a further effort to reduce the financial sectors dependency on mortgage insurance, the fe ...

... for chartered banks, which could increase mortgage costs next year. Moreover, risk-sharing discussions with lenders and their potential implementation may also play a part of weighing on the mortgage market. As a further effort to reduce the financial sectors dependency on mortgage insurance, the fe ...