Market discipline, disclosure and moral hazard in banking

... In recent years considerable attention has been paid to the topic of market discipline in banking. Market discipline refers to a market-based incentive scheme in which investors in bank liabilities, such as subordinated debt or uninsured deposits, “punish” banks for greater risk-taking by demanding ...

... In recent years considerable attention has been paid to the topic of market discipline in banking. Market discipline refers to a market-based incentive scheme in which investors in bank liabilities, such as subordinated debt or uninsured deposits, “punish” banks for greater risk-taking by demanding ...

Negative Externality: A Framework for Contemplating Systemic Risk

... Traditional approaches—e.g., Pigou taxes—may not be either appropriate or desirable. ...

... Traditional approaches—e.g., Pigou taxes—may not be either appropriate or desirable. ...

Economics 330 Money and Banking Lecture 18

... Long position = agree to buy securities at future date Hedges by locking in future interest rate if funds coming in future Short position = agree to sell securities at future date Hedges by reducing price risk from change in interest rates if holding bonds Pros 1. Flexible Cons 1. Lack of liquidity: ...

... Long position = agree to buy securities at future date Hedges by locking in future interest rate if funds coming in future Short position = agree to sell securities at future date Hedges by reducing price risk from change in interest rates if holding bonds Pros 1. Flexible Cons 1. Lack of liquidity: ...

Audit Committee

... Share of nominal exports on GDP at 80% in 2010 84% of exports concentrated on the EU-27 in 2010 (two predominant partners: Germany 32% and Slovakia 9%) Absence of major macroeconomic imbalances - current account worsened to 3.8% of GDP in 2010 ...

... Share of nominal exports on GDP at 80% in 2010 84% of exports concentrated on the EU-27 in 2010 (two predominant partners: Germany 32% and Slovakia 9%) Absence of major macroeconomic imbalances - current account worsened to 3.8% of GDP in 2010 ...

bank - Oman College of Management & Technology

... • The least desirable (highest risk) borrowers are the most likely to accept loans at high interest rates ...

... • The least desirable (highest risk) borrowers are the most likely to accept loans at high interest rates ...

Dirk Lohmann

... Although all reasonable care has been taken to ensure the facts stated herein are accurate and that the opinions contained herein are fair and reasonable, this document is selective in nature and is intended to provide an introduction to, and overview of, the business of Converium. Where any informa ...

... Although all reasonable care has been taken to ensure the facts stated herein are accurate and that the opinions contained herein are fair and reasonable, this document is selective in nature and is intended to provide an introduction to, and overview of, the business of Converium. Where any informa ...

Recent Developments in Transferring Risk - mynl.com

... Fairfax Holdings has arranged similar protection for its acquisitions Most recent deal: $1B adverse loss development cover ...

... Fairfax Holdings has arranged similar protection for its acquisitions Most recent deal: $1B adverse loss development cover ...

Risk Management Claims

... Claim: Risk management is a substitute for equity or, equivalently, risk management increases a firm’s debt capacity. If this claim holds then it becomes apparent that the risk management and capital structure decisions should be made jointly. In making a capital structure decision the firm must dec ...

... Claim: Risk management is a substitute for equity or, equivalently, risk management increases a firm’s debt capacity. If this claim holds then it becomes apparent that the risk management and capital structure decisions should be made jointly. In making a capital structure decision the firm must dec ...

Adjustable Rate Mortgage

... BUT when interest rates rise, payment rises For Lender Allows lenders to better match long term loan interest rates to short term deposits __________________ rates Negative amortization may occur Other Financing Equity Sharing & Shared Appreciation Mortgage ◦ Lender receives part of the equity/appre ...

... BUT when interest rates rise, payment rises For Lender Allows lenders to better match long term loan interest rates to short term deposits __________________ rates Negative amortization may occur Other Financing Equity Sharing & Shared Appreciation Mortgage ◦ Lender receives part of the equity/appre ...

Speech to the National Association for Business Economics’ Annual Meeting

... markets themselves are not functioning efficiently, or may not be functioning much at all. This illiquidity has become an enormous problem for companies that specialize in originating mortgages and then bundling them to sell as securities. The markets for selling these securities have all but dried ...

... markets themselves are not functioning efficiently, or may not be functioning much at all. This illiquidity has become an enormous problem for companies that specialize in originating mortgages and then bundling them to sell as securities. The markets for selling these securities have all but dried ...

Portfolio Selection and the Asset Allocation Decision

... reserved. Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United states Copyright Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the ...

... reserved. Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United states Copyright Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the ...

Quadrants of Risk

... risks managed separately are not the same as they are when managed together. Three main theoretical concepts explain how ERM works: • Interdependency • Correlation • Portfolio theory The silo type of management that is typical of traditional risk management ignores any interdependencies and assum ...

... risks managed separately are not the same as they are when managed together. Three main theoretical concepts explain how ERM works: • Interdependency • Correlation • Portfolio theory The silo type of management that is typical of traditional risk management ignores any interdependencies and assum ...

required rate of return2

... – Most models of default risk use financial ratios to measure the cash flow coverage (magnitude of the cash flows relative to the obligation) and control for industry effects in order to evaluate the variability of the cash flows. – The most widely used measure of a firm’s default risk is its ...

... – Most models of default risk use financial ratios to measure the cash flow coverage (magnitude of the cash flows relative to the obligation) and control for industry effects in order to evaluate the variability of the cash flows. – The most widely used measure of a firm’s default risk is its ...

Investors and Markets

... “futures”. This led to dealing in “puts” and “calls” as well as buying and selling on margins. … There was an era of sudden wealth, wild extravagance and inflated prices. … Good faith had been swamped by the delusion conjured up by dazzling visions of immediate wealth. “(the Panic of 1720 was) …due ...

... “futures”. This led to dealing in “puts” and “calls” as well as buying and selling on margins. … There was an era of sudden wealth, wild extravagance and inflated prices. … Good faith had been swamped by the delusion conjured up by dazzling visions of immediate wealth. “(the Panic of 1720 was) …due ...

Live now, pay later – but how much?

... Retirement annuity rates have been lower for women because, in general, they can expect to receive their annuity income for more years. From 21 December 2012, it will no longer be possible for an insurer to offer a man of, say, 70, a higher annuity rate than a woman of similar age and health. Whilst ...

... Retirement annuity rates have been lower for women because, in general, they can expect to receive their annuity income for more years. From 21 December 2012, it will no longer be possible for an insurer to offer a man of, say, 70, a higher annuity rate than a woman of similar age and health. Whilst ...

Answers to Chapter 24 Questions

... 2. Short-term loan sales usually consist of maturities between one and three months and are secured by the assets of a firm. They are usually sold in units of $1 million or more and are made to firms that have investment grade credit ratings. Banks have originated and disposed of shortterm loans as ...

... 2. Short-term loan sales usually consist of maturities between one and three months and are secured by the assets of a firm. They are usually sold in units of $1 million or more and are made to firms that have investment grade credit ratings. Banks have originated and disposed of shortterm loans as ...

Chapter 6

... To measure the level of wealth created by an investment rather than the change in wealth, need to cumulate returns over time Cumulative Wealth Index, CWIn, over n periods, = WI (1 TR )(1 TR )...(1 TR ) ...

... To measure the level of wealth created by an investment rather than the change in wealth, need to cumulate returns over time Cumulative Wealth Index, CWIn, over n periods, = WI (1 TR )(1 TR )...(1 TR ) ...

We need to solve the mortgage problem before interest rates rise

... most vulnerable group are at the lower end of the income distribution, giving them little leeway to deal with rising mortgage costs. Dealing with the wider problem of affordability is likely to require a range of solutions, from treading easy on rate rises, to starting conversations with borrowers a ...

... most vulnerable group are at the lower end of the income distribution, giving them little leeway to deal with rising mortgage costs. Dealing with the wider problem of affordability is likely to require a range of solutions, from treading easy on rate rises, to starting conversations with borrowers a ...

Opportunities for Small Life Insurance Companies to Improve Asset

... those issuing securities of higher credit quality. High-yield debt instruments are generally considered predominantly speculative by the applicable rating agencies as these issuers are more likely to encounter financial difficulties and are more vulnerable to changes in the relevant economy, such as ...

... those issuing securities of higher credit quality. High-yield debt instruments are generally considered predominantly speculative by the applicable rating agencies as these issuers are more likely to encounter financial difficulties and are more vulnerable to changes in the relevant economy, such as ...

Speech to UCLA Symposium at UC Berkeley Berkeley, California

... of a job. In a market in which house prices have been declining, a borrower with a recent mortgage secured with little or no down payment does not have the flexibility to tap into the equity in the house to weather these problems or may be unable to refinance or sell the house for enough to cover th ...

... of a job. In a market in which house prices have been declining, a borrower with a recent mortgage secured with little or no down payment does not have the flexibility to tap into the equity in the house to weather these problems or may be unable to refinance or sell the house for enough to cover th ...

This is a sample

... o review significant recent local weather events, the consequences and institutional responses in order to understand current vulnerability o assess effectiveness of current response arrangements ...

... o review significant recent local weather events, the consequences and institutional responses in order to understand current vulnerability o assess effectiveness of current response arrangements ...

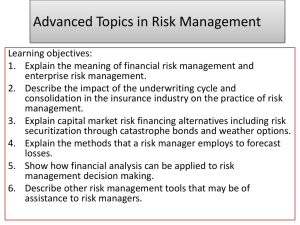

Advanced Topics in Risk Management

... IRR = 19.44 percent , greater than the required rate of return, 8%, the project is acceptable. Future cash flows are estimates of the benefits that will be obtained by investing the project. Benefits may come in the form of increased revenues, decreased expenses, or a combination of the two. Althou ...

... IRR = 19.44 percent , greater than the required rate of return, 8%, the project is acceptable. Future cash flows are estimates of the benefits that will be obtained by investing the project. Benefits may come in the form of increased revenues, decreased expenses, or a combination of the two. Althou ...

Country Risk Updates – Q4 2015 Oct

... expected returns. However, country-wide factors may result in higher volatility of returns at a future date. Enough uncertainty over expected returns to warrant close monitoring of country risk. Customers should actively manage their risk exposures. Significant uncertainty over expected returns. Ris ...

... expected returns. However, country-wide factors may result in higher volatility of returns at a future date. Enough uncertainty over expected returns to warrant close monitoring of country risk. Customers should actively manage their risk exposures. Significant uncertainty over expected returns. Ris ...

Risk Management - Spears School of Business

... this, so the shouldn’t be reward associated with risk management in perfect markets ...

... this, so the shouldn’t be reward associated with risk management in perfect markets ...

2009 - Homex

... New Homes Registry (RUV) New Homes Registry (RUV) is a system and data base where all homes being built by developers are registered before construction begins and until the new homes are finish and finally sold ...

... New Homes Registry (RUV) New Homes Registry (RUV) is a system and data base where all homes being built by developers are registered before construction begins and until the new homes are finish and finally sold ...