Forward Reliability Markets: Less Risk, Less Market

... The misconception most responsible for the current state of affairs is the notion that a cleverly designed “energy-only” market can induce optimal adequacy, or something close to it, even while the market has insufficient demand elasticity. Interestingly, when the notion of reliability markets was f ...

... The misconception most responsible for the current state of affairs is the notion that a cleverly designed “energy-only” market can induce optimal adequacy, or something close to it, even while the market has insufficient demand elasticity. Interestingly, when the notion of reliability markets was f ...

the importance of local capital markets for financing development

... markets is enormously beneficial to governments attempting to finance development internally. For investors and savers, capital markets can offer more attractive investing opportunities—with better returns—than bank deposits, depending on risk profile, liquidity needs, and other factors. Further, wi ...

... markets is enormously beneficial to governments attempting to finance development internally. For investors and savers, capital markets can offer more attractive investing opportunities—with better returns—than bank deposits, depending on risk profile, liquidity needs, and other factors. Further, wi ...

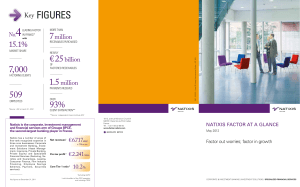

Key FIGURES - Natixis Factor

... in the optimization and management of receivables. Its range of multisegment services, for all clients from small to large companies, and its long-standing client relationships make it a leading player. Natixis Factor serves clients of Groupe BPCE banks (Banque Populaire and Caisse d’Epargne), the s ...

... in the optimization and management of receivables. Its range of multisegment services, for all clients from small to large companies, and its long-standing client relationships make it a leading player. Natixis Factor serves clients of Groupe BPCE banks (Banque Populaire and Caisse d’Epargne), the s ...

What Does a Mutual Fund`s Average Credit Quality

... Although not a required disclosure, many bond mutual funds report the Average Credit Quality or Average Credit Rating of their funds. This statistic is reported in a summary table that frequently includes Weighted-Average Coupon, Maturity and Yield to Maturity. While Weighted-Average Coupon, Maturit ...

... Although not a required disclosure, many bond mutual funds report the Average Credit Quality or Average Credit Rating of their funds. This statistic is reported in a summary table that frequently includes Weighted-Average Coupon, Maturity and Yield to Maturity. While Weighted-Average Coupon, Maturit ...

NBER WORKING PAPER SERIES MACROECONOMICS WITH FINANCIAL FRICTIONS: A SURVEY Markus K. Brunnermeier

... with low technological and market liquidity and by issuing short-term debt claims, financial institutions expose themselves to a liquidity mismatch. This maturity transformation – better labeled liquidity transformation – is one of the functions of financial intermediation but results in fragility. ...

... with low technological and market liquidity and by issuing short-term debt claims, financial institutions expose themselves to a liquidity mismatch. This maturity transformation – better labeled liquidity transformation – is one of the functions of financial intermediation but results in fragility. ...

Skybridge Multi-Adviser Hedge Fund Portfolios LLC

... may receive all or a substantial part of the relevant payments) of compensation in excess of that which otherwise would have been paid in connection with their placement of shares of a different investment fund. A prospective investor with questions regarding these arrangements may obtain additional ...

... may receive all or a substantial part of the relevant payments) of compensation in excess of that which otherwise would have been paid in connection with their placement of shares of a different investment fund. A prospective investor with questions regarding these arrangements may obtain additional ...

Form ADV - Mirador Capital Partners

... We provide a variety of financial planning and consulting services to individuals, families and other clients regarding the management of their financial resources based upon an analysis of the client’s current situation, goals, and objectives. Generally, such financial planning services will involv ...

... We provide a variety of financial planning and consulting services to individuals, families and other clients regarding the management of their financial resources based upon an analysis of the client’s current situation, goals, and objectives. Generally, such financial planning services will involv ...

Global Investment Strategy: Stocks likely to Post Modest Gains with

... Eurozone: The outlook for Eurozone bonds remains positive. Core Eurozone bond yields have fallen to record lows recently, giving them little room to fall further. While risk aversion has eased in the past few weeks following the Greek reelections and the EU summit, Spanish and Italian bond yields re ...

... Eurozone: The outlook for Eurozone bonds remains positive. Core Eurozone bond yields have fallen to record lows recently, giving them little room to fall further. While risk aversion has eased in the past few weeks following the Greek reelections and the EU summit, Spanish and Italian bond yields re ...

U.S. Equity Market Structure

... Five of the 13 US exchanges do not even maintain a 1% market share, yet these venues receive the benefits of being an exchange, such as market data revenue sharing. Should there be a minimum volume threshold required in order to maintain exchange status and the attendant benefits? There are real cos ...

... Five of the 13 US exchanges do not even maintain a 1% market share, yet these venues receive the benefits of being an exchange, such as market data revenue sharing. Should there be a minimum volume threshold required in order to maintain exchange status and the attendant benefits? There are real cos ...

downstream securities regulation

... that the financial services component of securities regulation is a separate genre of securities regulation, different in important respects from its more renowned counterpart; that it does not revolve around securities issuers; and, critically, that it need not rely solely on disclosure and antifra ...

... that the financial services component of securities regulation is a separate genre of securities regulation, different in important respects from its more renowned counterpart; that it does not revolve around securities issuers; and, critically, that it need not rely solely on disclosure and antifra ...

“Macroeconomics with Financial Frictions”

... with low technological and market liquidity and by issuing short-term debt claims, financial institutions expose themselves to a liquidity mismatch. This maturity transformation – better labeled liquidity transformation – is one of the functions of financial intermediation but results in fragility. ...

... with low technological and market liquidity and by issuing short-term debt claims, financial institutions expose themselves to a liquidity mismatch. This maturity transformation – better labeled liquidity transformation – is one of the functions of financial intermediation but results in fragility. ...

Unlocking funding for European investment and growth

... The findings of the report can stand alone, but are also designed to offer constructive recommendations to the debate prompted by the European Commission’s Green Paper on the long term financing of the real economy. The report focuses on current barriers to funding and what could be done to improve ...

... The findings of the report can stand alone, but are also designed to offer constructive recommendations to the debate prompted by the European Commission’s Green Paper on the long term financing of the real economy. The report focuses on current barriers to funding and what could be done to improve ...

fund fact sheet user`s guide

... Expense Ratio The net and gross expenses shown include the total operating expenses of the funds and the indirect expenses of the funds’ underlying portfolios. Your investment returns are reduced by various fees and expenses. For each plan investment option, the “Expense Ratio” presentation shows th ...

... Expense Ratio The net and gross expenses shown include the total operating expenses of the funds and the indirect expenses of the funds’ underlying portfolios. Your investment returns are reduced by various fees and expenses. For each plan investment option, the “Expense Ratio” presentation shows th ...

view - Pacra.com

... Premium Mix: CSI is a small sized company with 0.8% of market share at endSep14. GPW portfolio is dominated by motor (46%), and Health (39%), with minor share of other segments. Top ten customer concentration is very high. Performance: In 9M14, CSI achieved a GPW size of PKR 200mln, in the first ...

... Premium Mix: CSI is a small sized company with 0.8% of market share at endSep14. GPW portfolio is dominated by motor (46%), and Health (39%), with minor share of other segments. Top ten customer concentration is very high. Performance: In 9M14, CSI achieved a GPW size of PKR 200mln, in the first ...

1 September 2006 Page 1 of 52 The SPI Fund of Scottish Provident

... in the PPFM and what is said in any such policy document, the latter shall prevail. (For these purposes, ‘policy documents’ means the documentation containing the terms of the contract between SPL and the policyholder. This may include information or documents supplied to SPL by the policyholder, or ...

... in the PPFM and what is said in any such policy document, the latter shall prevail. (For these purposes, ‘policy documents’ means the documentation containing the terms of the contract between SPL and the policyholder. This may include information or documents supplied to SPL by the policyholder, or ...

Chapter 12 The Balance of Payments and the Exchange Rate

... you buy a financial asset, like a US treasury bill, no good is produced. However investors expect a return on their financial investment usually in the form of the interest rate. So when the interest on a US treasury bill rises, it becomes relatively more attractive as compared to, say a German gov ...

... you buy a financial asset, like a US treasury bill, no good is produced. However investors expect a return on their financial investment usually in the form of the interest rate. So when the interest on a US treasury bill rises, it becomes relatively more attractive as compared to, say a German gov ...

Nuveen Build America Bond Fund

... by capital appreciation of the Fund’s portfolio. The potential to achieve such capital appreciation will depend largely on NAM’s investment capabilities in executing the Fund’s investment strategy as well as the performance of BABs relative to the securities underlying the Fund’s hedging instruments ...

... by capital appreciation of the Fund’s portfolio. The potential to achieve such capital appreciation will depend largely on NAM’s investment capabilities in executing the Fund’s investment strategy as well as the performance of BABs relative to the securities underlying the Fund’s hedging instruments ...

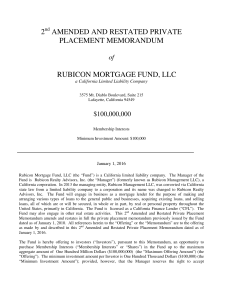

2 amended and restated private placement

... The Fund will deposit the Investors’ accepted subscription funds into the Fund’s bank account, and the Investors will, thereby, become Members of the Fund. A capital account (“Capital Account”) will be established for each Member on the books and records of the Fund. Each Member will share in distri ...

... The Fund will deposit the Investors’ accepted subscription funds into the Fund’s bank account, and the Investors will, thereby, become Members of the Fund. A capital account (“Capital Account”) will be established for each Member on the books and records of the Fund. Each Member will share in distri ...

Open full article - Acta Universitatis

... This article is aimed at proposing of an inovative method for calculating the shares of operational and financial risks. This methodological tool will support managers while monitoring the risk structure. The method is based on the capital asset pricing model (CAPM) for calculation of equity cost, na ...

... This article is aimed at proposing of an inovative method for calculating the shares of operational and financial risks. This methodological tool will support managers while monitoring the risk structure. The method is based on the capital asset pricing model (CAPM) for calculation of equity cost, na ...

The Origins and Severity of the Public Pension Crisis

... on savings, then an individual investor will suffer considerably as a result of taking on risk. By contrast, it is difficult to envision plausible events that could lead state and local governments to experience comparable declines in income. Even the sharp downturn in revenue that followed in the w ...

... on savings, then an individual investor will suffer considerably as a result of taking on risk. By contrast, it is difficult to envision plausible events that could lead state and local governments to experience comparable declines in income. Even the sharp downturn in revenue that followed in the w ...

Chapter 4

... • Most investors are risk averse – choose the asset with the lower risk when two assets have the same expected returns – resulting in trade-offs between risk and return. • Risk-loving investors prefer to hold risky assets with the possibility of maximizing returns. ...

... • Most investors are risk averse – choose the asset with the lower risk when two assets have the same expected returns – resulting in trade-offs between risk and return. • Risk-loving investors prefer to hold risky assets with the possibility of maximizing returns. ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.