The Effects of Bank Market Power in Short-Term and Long

... measured as the price-cost margin, improves credit availability, in particular for younger firms, although in the second step of his analysis, the results reveal that the adjusted price-cost margin is negatively correlated to the share of nationwide larger banks; he also provides evidence for the po ...

... measured as the price-cost margin, improves credit availability, in particular for younger firms, although in the second step of his analysis, the results reveal that the adjusted price-cost margin is negatively correlated to the share of nationwide larger banks; he also provides evidence for the po ...

Document

... For illustrative purposes; the stock example above is intended only to illustrate the application of our investment philosophy, and this particular security may or may not be held in the current Japan Growth portfolio. The reader should not assume that this was, or will be, a profitable investment. ...

... For illustrative purposes; the stock example above is intended only to illustrate the application of our investment philosophy, and this particular security may or may not be held in the current Japan Growth portfolio. The reader should not assume that this was, or will be, a profitable investment. ...

Outerwall (OUTR)

... read carefully the Offering Memorandum, including the description of the risks, fees, expenses, liquidity restrictions and other terms of investing in the funds. Performance data has not been prepared to meet any specific requirements applicable to the presentation thereof and should in no event be ...

... read carefully the Offering Memorandum, including the description of the risks, fees, expenses, liquidity restrictions and other terms of investing in the funds. Performance data has not been prepared to meet any specific requirements applicable to the presentation thereof and should in no event be ...

G E L M

... Firstly, a pooled OLS regression was applied to equation 1 to obtain a benchmark for the study. This results in no distinctions between the different countries in the sample and is of course subject to abundant errors. However, it still provides a suitable starting point in this study and has been u ...

... Firstly, a pooled OLS regression was applied to equation 1 to obtain a benchmark for the study. This results in no distinctions between the different countries in the sample and is of course subject to abundant errors. However, it still provides a suitable starting point in this study and has been u ...

financialIntermediation_KiyotakiPaper

... stabilize …nancial markets in a crisis, just as it just did recently. With the existing macroeconomic frameworks it is not possible to address this issue. In this paper we develop a macroeconomic model with an intermediation sector that allow banks to issue outside equity as well as short term debt. ...

... stabilize …nancial markets in a crisis, just as it just did recently. With the existing macroeconomic frameworks it is not possible to address this issue. In this paper we develop a macroeconomic model with an intermediation sector that allow banks to issue outside equity as well as short term debt. ...

The Trump Factor

... And then there’s the Trump Factor—which could be a game changer for the economy, potentially extending the real estate cycle. ...

... And then there’s the Trump Factor—which could be a game changer for the economy, potentially extending the real estate cycle. ...

- Covenant University Repository

... many" and serves as one of the silent prerequisites of any free and efficient market. It is also known as "full disclosure" and helps to prevent corruption that inevitably occurs when a select few have access to important information, allowing them to use it for personal gain. It simply means the d ...

... many" and serves as one of the silent prerequisites of any free and efficient market. It is also known as "full disclosure" and helps to prevent corruption that inevitably occurs when a select few have access to important information, allowing them to use it for personal gain. It simply means the d ...

Q1 2017 Summary Slides

... These headlines are not offered to explain market returns. Instead, they serve as a reminder that investors should view daily events from a long-term perspective and avoid making investment decisions based solely on the news. Graph Source: MSCI ACWI Index [net div.]. MSCI data © MSCI 2017, all right ...

... These headlines are not offered to explain market returns. Instead, they serve as a reminder that investors should view daily events from a long-term perspective and avoid making investment decisions based solely on the news. Graph Source: MSCI ACWI Index [net div.]. MSCI data © MSCI 2017, all right ...

Green quantitative easing

... There are two ways to explain quantitative easing. One is the hard way. The Financial Times has done that, and we have used their explanation in an appendix to this report. The other is the easy way. And that’s very easy indeed. Quantitative easing is, when all is said and done, the Bank of England ...

... There are two ways to explain quantitative easing. One is the hard way. The Financial Times has done that, and we have used their explanation in an appendix to this report. The other is the easy way. And that’s very easy indeed. Quantitative easing is, when all is said and done, the Bank of England ...

Download Second Paper

... A majority of the United States population and an even larger share of the nation’s income lives within 80 kilometers of coast (Rappaport and Sachs 2003). Many of the nation’s most beautiful and productive cities are located along the ocean and river coasts. New York City, Miami, Seattle, Washington ...

... A majority of the United States population and an even larger share of the nation’s income lives within 80 kilometers of coast (Rappaport and Sachs 2003). Many of the nation’s most beautiful and productive cities are located along the ocean and river coasts. New York City, Miami, Seattle, Washington ...

Implementing the Golden Rule for Public Investment in Europe

... government debt from rising because of a lack of compliance can be contested. Secondly, those rules are not comparable with the proposed Golden Rule in the European framework. The German rule was much less sophisticated as it simply provided an upper limit to gross public investment as measured in t ...

... government debt from rising because of a lack of compliance can be contested. Secondly, those rules are not comparable with the proposed Golden Rule in the European framework. The German rule was much less sophisticated as it simply provided an upper limit to gross public investment as measured in t ...

2 The D2N2 Economic Context for the EU Strategy

... European Structural and Investment Fund Strategy 2014-2020. The D2N2 Local Enterprise Partnership provides a framework to enable growth, create jobs and make a strong case for investment. D2N2 has a proud history of industry and making things. Innovation is in our economic DNA. From being the cradle ...

... European Structural and Investment Fund Strategy 2014-2020. The D2N2 Local Enterprise Partnership provides a framework to enable growth, create jobs and make a strong case for investment. D2N2 has a proud history of industry and making things. Innovation is in our economic DNA. From being the cradle ...

Session 1 - Fisher College of Business

... • varied, if not conflicting needs for information, • diverse levels of financial expertise, • widely varying access to management plans and expectations, and • differing cost-benefit ratios for both public and private information. A&MIS 521 ...

... • varied, if not conflicting needs for information, • diverse levels of financial expertise, • widely varying access to management plans and expectations, and • differing cost-benefit ratios for both public and private information. A&MIS 521 ...

Suitability, Know Your Customer and You

... Effecting a transaction pursuant to discretionary authority or without first informing the customer are implicit recommendations ...

... Effecting a transaction pursuant to discretionary authority or without first informing the customer are implicit recommendations ...

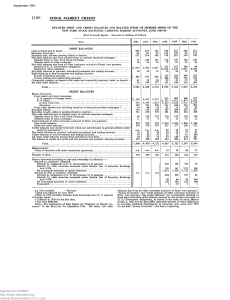

Detailed Debit and Credit Balances and Related Items of Member

... Entirely by obligations of U. S. Government or its agencies Entirely by other securities exempted under Section 3 (a) of Securities Exchange Act—1934 By nonexempt securities or mixed collateral Secured by firm or partners' collateral: Entirely by obligations of U S. Government or its agencies Entire ...

... Entirely by obligations of U. S. Government or its agencies Entirely by other securities exempted under Section 3 (a) of Securities Exchange Act—1934 By nonexempt securities or mixed collateral Secured by firm or partners' collateral: Entirely by obligations of U S. Government or its agencies Entire ...

MARLIN BUSINESS SERVICES CORP

... quarter last year. Return on equity for the quarter was 11.66%, up from 9.47% a year ago. “I am very pleased with Marlin’s second quarter results that included accelerating origination volume, excellent credit quality and solid net income growth,” commented Jeffrey Hilzinger, Marlin’s President and ...

... quarter last year. Return on equity for the quarter was 11.66%, up from 9.47% a year ago. “I am very pleased with Marlin’s second quarter results that included accelerating origination volume, excellent credit quality and solid net income growth,” commented Jeffrey Hilzinger, Marlin’s President and ...

Trading Fees and Slow-Moving Capital - Search Faculty

... additional endogenous, stochastic and perhaps quantitatively more important consequence of the fee. Liquidity begets liquidity. Conceptually and qualitatively speaking, the endogenous stochastic process of the liquidity of securities is as important to investment and valuation as is the exogenous st ...

... additional endogenous, stochastic and perhaps quantitatively more important consequence of the fee. Liquidity begets liquidity. Conceptually and qualitatively speaking, the endogenous stochastic process of the liquidity of securities is as important to investment and valuation as is the exogenous st ...

Topic No: 2

... from the investment in human capital and physical capital. The investment in physical capital has only monetary and market returns whereas investment in human capital has non-monetary as well as non-market returns. – The returns to human and physical capital tend to behave differently. When individu ...

... from the investment in human capital and physical capital. The investment in physical capital has only monetary and market returns whereas investment in human capital has non-monetary as well as non-market returns. – The returns to human and physical capital tend to behave differently. When individu ...

THE REAL EFFECTS OF POLITICAL UNCERTAINTY: ELECTIONS, CAPITAL ALLOCATION, AND PERFORMANCE

... and disclosure by politicians. Interestingly, of these conditioning factors, only the last three (corruption, state ownership, and disclosure by politicians) are significantly related to the drop in investment-to-price sensitivity. This implies that if a company is located in a country with a highe ...

... and disclosure by politicians. Interestingly, of these conditioning factors, only the last three (corruption, state ownership, and disclosure by politicians) are significantly related to the drop in investment-to-price sensitivity. This implies that if a company is located in a country with a highe ...

paper

... higher values than the former. Likewise, when estimating risk values for nonfatal injuries, those derived by the CA method were higher than those derived by the CV method. There are several possible explanations for these results. First, the theoretical foundation differs between the elicitation met ...

... higher values than the former. Likewise, when estimating risk values for nonfatal injuries, those derived by the CA method were higher than those derived by the CV method. There are several possible explanations for these results. First, the theoretical foundation differs between the elicitation met ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.