EPI BRIEFING PAPER

... layoffs, depress aggregate demand, exacerbate the recession, as well as delay or sacrifice the benefits that those projects would provide. The gas tax has also lost substantial purchasing power since it was last changed in 1993. Not only is it not indexed for general inflation, the prices for the ...

... layoffs, depress aggregate demand, exacerbate the recession, as well as delay or sacrifice the benefits that those projects would provide. The gas tax has also lost substantial purchasing power since it was last changed in 1993. Not only is it not indexed for general inflation, the prices for the ...

... development has been the use of public-private partnerships for the development of economic and social infrastructure. PPPs make a significant contribution to the development of infrastructure for the benefit of the Australian public and Governments at all levels. PPPs are increasingly a key procure ...

7. Which of the following statements regarding money

... In that investors are willing to pay only 12 times above earnings for one stock but are willing to pay the higher “price” of 20 times above earnings for the other. Difficulty: moderate ...

... In that investors are willing to pay only 12 times above earnings for one stock but are willing to pay the higher “price” of 20 times above earnings for the other. Difficulty: moderate ...

Chapter 6

... – Involves an increase in the company’s issued capital – Typically issued at a discount to market price – Theoretically, the market price will fall by an amount dependent on The number of shares issued The size of the discount ...

... – Involves an increase in the company’s issued capital – Typically issued at a discount to market price – Theoretically, the market price will fall by an amount dependent on The number of shares issued The size of the discount ...

Chapter 4 Capital resources

... If a firm has an exposure arising through a second-charge mortgage secured on the same property as a first-charge loan from a different firm, the exposure, taking into account the first-charge mortgage, must be split into the following components and risk weighted as follows, after taking into accou ...

... If a firm has an exposure arising through a second-charge mortgage secured on the same property as a first-charge loan from a different firm, the exposure, taking into account the first-charge mortgage, must be split into the following components and risk weighted as follows, after taking into accou ...

Emotional State and Market Behavior Adriana Breaban Charles N

... In each period, each trader had the ability to trade units of the asset for cash with any other trader in an open market, provided that he always maintained non-negative cash and share balances. Transaction prices were determined in a continuous double-auction market (Smith, 1962). This type of mar ...

... In each period, each trader had the ability to trade units of the asset for cash with any other trader in an open market, provided that he always maintained non-negative cash and share balances. Transaction prices were determined in a continuous double-auction market (Smith, 1962). This type of mar ...

Does Fundamental and Technical Analysis Reduce Investment Risk

... in which the portfolios form based on past trading volume, make performance assessment meaningful. Kuo and Fan (2004) mention that based on the fundamental difference, the growth stock is not entirely trial value stock’s fundament analysis. Therefore, Kuo and Fan improve the value stock scoring syst ...

... in which the portfolios form based on past trading volume, make performance assessment meaningful. Kuo and Fan (2004) mention that based on the fundamental difference, the growth stock is not entirely trial value stock’s fundament analysis. Therefore, Kuo and Fan improve the value stock scoring syst ...

Soft Landings (February 2000), with Martin Schneider

... While there is considerable evidence that bailout guarantees are present, the standard account of lending booms suffers from two drawbacks. First, the typical lending boom does not end in a crisis. Around 85% of booms lead to a soft landing, with credit and asset prices gradually reverting to trend. ...

... While there is considerable evidence that bailout guarantees are present, the standard account of lending booms suffers from two drawbacks. First, the typical lending boom does not end in a crisis. Around 85% of booms lead to a soft landing, with credit and asset prices gradually reverting to trend. ...

esma_priips_euronext_reply_form_jan_29

... Another key difference between listed derivatives and ‘packaged products’ in the traditional sense of the word is that listed derivatives are not issued by regulated markets. Moreover, the regulated markets do not become a counterparty to the retail investor (or anyone for that matter) committing t ...

... Another key difference between listed derivatives and ‘packaged products’ in the traditional sense of the word is that listed derivatives are not issued by regulated markets. Moreover, the regulated markets do not become a counterparty to the retail investor (or anyone for that matter) committing t ...

PowerPoint **

... any remaining difference in option moneyness using option’s vega”? • What kind of volatility used to calculate daily delta when constructing daily rebalanced deltaneutral option portfolio? • This paper also estimates VRP by controlling for exposure to price jump risk. Given the possibility that pric ...

... any remaining difference in option moneyness using option’s vega”? • What kind of volatility used to calculate daily delta when constructing daily rebalanced deltaneutral option portfolio? • This paper also estimates VRP by controlling for exposure to price jump risk. Given the possibility that pric ...

Two Essays on Managerial Behaviors in the Mutual Fund Industry

... Because the SEC allows managers to file their reports with 60-day delay, a large number of mutual funds postpone their portfolio disclosure. Poorly performing managers could benefit from window-dressing with delayed reports. If a poorly performing manager window-dresses and fund performance improve ...

... Because the SEC allows managers to file their reports with 60-day delay, a large number of mutual funds postpone their portfolio disclosure. Poorly performing managers could benefit from window-dressing with delayed reports. If a poorly performing manager window-dresses and fund performance improve ...

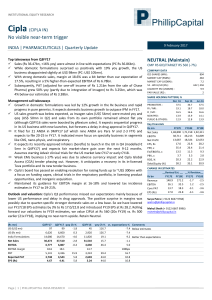

No visible near-term trigger

... This report has been prepared by Institutional Equities Group. The views and opinions expressed in this document may, may not match, or may be contrary at times with the views, estimates, rating, and target price of the other equity research groups of PhillipCapital (India) Pvt. Ltd. This report ...

... This report has been prepared by Institutional Equities Group. The views and opinions expressed in this document may, may not match, or may be contrary at times with the views, estimates, rating, and target price of the other equity research groups of PhillipCapital (India) Pvt. Ltd. This report ...

Public Investment as an Engine of Growth

... As some of the scholarly articles reveal, even basic data is difficult to track down, such as how much was spent. And this is long before the discussion turns to rate of return estimates or impact studies with control groups. Research in this area is bedeviled by the fact that governments that imple ...

... As some of the scholarly articles reveal, even basic data is difficult to track down, such as how much was spent. And this is long before the discussion turns to rate of return estimates or impact studies with control groups. Research in this area is bedeviled by the fact that governments that imple ...

Public Investment as an Engine of Growth 148 WP/14/ Andrew M. Warner

... As some of the scholarly articles reveal, even basic data is difficult to track down, such as how much was spent. And this is long before the discussion turns to rate of return estimates or impact studies with control groups. Research in this area is bedeviled by the fact that governments that imple ...

... As some of the scholarly articles reveal, even basic data is difficult to track down, such as how much was spent. And this is long before the discussion turns to rate of return estimates or impact studies with control groups. Research in this area is bedeviled by the fact that governments that imple ...

Compiled by CA. Aditya Kumar Maheshwari AS – 30 :: Financial

... Acquired or incurred principally for the purpose of selling or repurchasing it in the near term; or Part of a portfolio of identified financial instruments that are managed together and for which there is evidence (other than hedging instrument) 2. It is designated as FVTPL upon initial Recognit ...

... Acquired or incurred principally for the purpose of selling or repurchasing it in the near term; or Part of a portfolio of identified financial instruments that are managed together and for which there is evidence (other than hedging instrument) 2. It is designated as FVTPL upon initial Recognit ...

Sprott preciouS metalS watch

... continue to be resolved to the measurable benefit of investors choosing to denominate a portion of their wealth in assets which can neither default nor be debased. Over the short run (one-to-two years), gold’s performance can be impacted by consensus views on a wide array of market variables. We wou ...

... continue to be resolved to the measurable benefit of investors choosing to denominate a portion of their wealth in assets which can neither default nor be debased. Over the short run (one-to-two years), gold’s performance can be impacted by consensus views on a wide array of market variables. We wou ...

South African Communications Union

... ICASA does not inhibit the costly investments in the technologies which are making broadband available to ever more homes. However, so far, most of those who have actually taken up broadband were analogue to ADSL conversions. Consumer is using broadband to do essentially the same things as they did ...

... ICASA does not inhibit the costly investments in the technologies which are making broadband available to ever more homes. However, so far, most of those who have actually taken up broadband were analogue to ADSL conversions. Consumer is using broadband to do essentially the same things as they did ...

Guide to BT Margin Lending

... for losses. It’s therefore important to understand both the risks involved and how you can manage those risks. For this reason, we recommend that you discuss these with your financial adviser and ensure that you’re familiar with the terms and conditions of BT Margin Loan. Like any investment, invest ...

... for losses. It’s therefore important to understand both the risks involved and how you can manage those risks. For this reason, we recommend that you discuss these with your financial adviser and ensure that you’re familiar with the terms and conditions of BT Margin Loan. Like any investment, invest ...

New Zealand debt and house prices climbing rapidly

... persons who have professional experience in matters relating to investments who fall within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (b) high net worth entities, and other persons to whom it may otherwise lawfully be communicated, ...

... persons who have professional experience in matters relating to investments who fall within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (b) high net worth entities, and other persons to whom it may otherwise lawfully be communicated, ...

Fin 129

... into their components. Be able to interpret changes in any of the components. Given the relevant information be able to use the component to analyze changes in the banks financial position. Be able to look at a UBPR and interpret the information and apply ration analysis to the information in the re ...

... into their components. Be able to interpret changes in any of the components. Given the relevant information be able to use the component to analyze changes in the banks financial position. Be able to look at a UBPR and interpret the information and apply ration analysis to the information in the re ...

VENTURE COMPANY TYPES AND PHASES of THEIR

... marketing in the course of their primary market launching (ideal American model which has no parallels in Europe) Funding to facilitate company growth through "take over" or increase in capacity, markets and products development or to receive additional floating assets Company buyout under current m ...

... marketing in the course of their primary market launching (ideal American model which has no parallels in Europe) Funding to facilitate company growth through "take over" or increase in capacity, markets and products development or to receive additional floating assets Company buyout under current m ...

Lemons, Market Shutdowns and Learning

... productivity shocks increase current dividends, which increases the supply of savings and raises asset prices. This persuades more entrepreneurs to sell their nonlemons, improving the overall mix of projects that get sold and lowering the implicit tax on financial transactions. Shocks to the produc ...

... productivity shocks increase current dividends, which increases the supply of savings and raises asset prices. This persuades more entrepreneurs to sell their nonlemons, improving the overall mix of projects that get sold and lowering the implicit tax on financial transactions. Shocks to the produc ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.