chapter 1 - Test Bank wizard

... Your friend is considering adding one additional stock to a 3-stock portfolio, to form a 4-stock portfolio. She is highly risk averse and has asked for your advice. The three stocks currently held all have b = 1.0, and they are perfectly positively correlated with the market. Potential new Stocks A ...

... Your friend is considering adding one additional stock to a 3-stock portfolio, to form a 4-stock portfolio. She is highly risk averse and has asked for your advice. The three stocks currently held all have b = 1.0, and they are perfectly positively correlated with the market. Potential new Stocks A ...

Monte Carlo Simulation in Financial Valuation

... so as to estimate the probability distribution. This is useful when the model cannot be studied analytically. There are several problems in finance where Monte Carlo simulation is useful, see e.g. Glasserman [1]. This paper uses a simple equity growth model to simulate the future equity, earnings an ...

... so as to estimate the probability distribution. This is useful when the model cannot be studied analytically. There are several problems in finance where Monte Carlo simulation is useful, see e.g. Glasserman [1]. This paper uses a simple equity growth model to simulate the future equity, earnings an ...

Words - Nasdaq`s INTEL Solutions

... 2012, we had commitments of approximately $212.1 million and outstanding loans of approximately $210.6 million in aggregate principal amount. The difference between the amount of commitments and the outstanding loans is attributable to the unfunded portion of revolving loans in our portfolio at that ...

... 2012, we had commitments of approximately $212.1 million and outstanding loans of approximately $210.6 million in aggregate principal amount. The difference between the amount of commitments and the outstanding loans is attributable to the unfunded portion of revolving loans in our portfolio at that ...

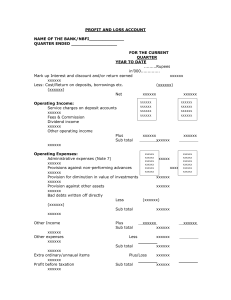

profit and loss account - State Bank of Pakistan

... intention of reselling them in the short term. Investment securities are acquired and held for yield or capital growth purposes and are usually held maturity 2. ADVANCE: Advances (Net of Provisions) Rupees in ‘000 Gross Advances (Please specify type-wise break-up of advances) ____________ Sub-Total ...

... intention of reselling them in the short term. Investment securities are acquired and held for yield or capital growth purposes and are usually held maturity 2. ADVANCE: Advances (Net of Provisions) Rupees in ‘000 Gross Advances (Please specify type-wise break-up of advances) ____________ Sub-Total ...

Grupo Televisa, SAB

... (8) The figures set forth in this line item represent total circulation of magazines that we publish independently and through joint ventures and other arrangements and do not represent magazines distributed on behalf of third parties. (9) Sky has operations in Mexico, the Dominican Republic and Cen ...

... (8) The figures set forth in this line item represent total circulation of magazines that we publish independently and through joint ventures and other arrangements and do not represent magazines distributed on behalf of third parties. (9) Sky has operations in Mexico, the Dominican Republic and Cen ...

CFA Level I - LOS Changes 2016 - 2017

... describe the scope of the GIPS standards with respect to an investment firm’s definition and historical performance record explain how the GIPS standards are implemented in countries with existing standards for performance reporting and describe the appropriate response when the GIPS standards and l ...

... describe the scope of the GIPS standards with respect to an investment firm’s definition and historical performance record explain how the GIPS standards are implemented in countries with existing standards for performance reporting and describe the appropriate response when the GIPS standards and l ...

FORM 10-K - Morningstar Document Research

... Forward-looking statements concerning the operations, performance, financial condition, plans and prospects of Orient-Express Hotels Ltd. and its subsidiaries are based on the current expectations, assessments and assumptions of management, are not historical facts, and are subject to various risks ...

... Forward-looking statements concerning the operations, performance, financial condition, plans and prospects of Orient-Express Hotels Ltd. and its subsidiaries are based on the current expectations, assessments and assumptions of management, are not historical facts, and are subject to various risks ...

Belief Heterogeneity, Collateral Constraint, and Asset Prices with a

... including Heathcote and Perri (2011). The movement in wealth distribution also generates the patterns of booms and busts observed in Burnside, Eichenbaum, and Rebelo (2011). The second set of results that follows from this framework concerns collateral shortages. I show that collateral constraints w ...

... including Heathcote and Perri (2011). The movement in wealth distribution also generates the patterns of booms and busts observed in Burnside, Eichenbaum, and Rebelo (2011). The second set of results that follows from this framework concerns collateral shortages. I show that collateral constraints w ...

Multiple Choice Questions 1. A payment made out of a

... B. a firm to maintain a constant dividend policy even if they frequently have to issue new shares of stock to do so. C. maintaining a constant dividend policy even when profits decline significantly. D. maintaining a high dividend policy. E. maintaining a low dividend policy and rarely issuing extra ...

... B. a firm to maintain a constant dividend policy even if they frequently have to issue new shares of stock to do so. C. maintaining a constant dividend policy even when profits decline significantly. D. maintaining a high dividend policy. E. maintaining a low dividend policy and rarely issuing extra ...

Optimal Asset Location and Allocation with Taxable and Tax

... between the taxable and tax-deferred accounts is largely ignored. The ability to invest on a tax-deferred basis is valuable to investors because it allows them to earn the pre-tax return on assets. However, because assets differ in terms of the tax liabilities they create for investors, the value of ...

... between the taxable and tax-deferred accounts is largely ignored. The ability to invest on a tax-deferred basis is valuable to investors because it allows them to earn the pre-tax return on assets. However, because assets differ in terms of the tax liabilities they create for investors, the value of ...

2016 Form 10-K - PSEG Investor Relations

... FORWARD-LOOKING STATEMENTS Certain of the matters discussed in this report about our and our subsidiaries’ future performance, including, without limitation, future revenues, earnings, strategies, prospects, consequences and all other statements that are not purely historical constitute “forward-lo ...

... FORWARD-LOOKING STATEMENTS Certain of the matters discussed in this report about our and our subsidiaries’ future performance, including, without limitation, future revenues, earnings, strategies, prospects, consequences and all other statements that are not purely historical constitute “forward-lo ...

Annual Report 2014 - British American Tobacco

... We have increased our share of the global cigarette market in this period by 70 basis points and grown our Global Drive Brands (GDBs) and share of key segments at an even faster rate, improving the underlying quality of our portfolio. We are meeting consumer needs with differentiated products, inclu ...

... We have increased our share of the global cigarette market in this period by 70 basis points and grown our Global Drive Brands (GDBs) and share of key segments at an even faster rate, improving the underlying quality of our portfolio. We are meeting consumer needs with differentiated products, inclu ...

WESTPAC BANKING CORP (Form: 6-K, Received

... Westpac’s appetite for risk is influenced by a range of factors, including whether a risk is considered consistent with its strategy (core risk) and whether an appropriate return can be achieved from taking that risk. Westpac has a lower appetite for risks that are not part of its strategy. Westpac ...

... Westpac’s appetite for risk is influenced by a range of factors, including whether a risk is considered consistent with its strategy (core risk) and whether an appropriate return can be achieved from taking that risk. Westpac has a lower appetite for risks that are not part of its strategy. Westpac ...

Risk Management and Value Creation in Financial Institutions

... corporate level can be useful. Very little research has been conducted as to why there is an economic rationale for risk management at the bank level. This book provides a closer and a more differentiated view on the subject than previous research and is intended to describe both the theory and the ...

... corporate level can be useful. Very little research has been conducted as to why there is an economic rationale for risk management at the bank level. This book provides a closer and a more differentiated view on the subject than previous research and is intended to describe both the theory and the ...

Pillar 3 Report for 30 September 2016 (PDF 1MB)

... Appetite Statement and monitoring the effectiveness of risk management by the Westpac Group, including satisfying itself through appropriate reporting and oversight that appropriate internal control mechanisms are in place and are being implemented in accordance with regulatory requirements. The Boa ...

... Appetite Statement and monitoring the effectiveness of risk management by the Westpac Group, including satisfying itself through appropriate reporting and oversight that appropriate internal control mechanisms are in place and are being implemented in accordance with regulatory requirements. The Boa ...

2015 Annual Report - Deutsche Post DHL Group

... innovative services to compete over the long term and achieve profitable growth. Likewise, you have to identify and open up potential in future growth markets and industries. The Life Sciences and Healthcare sector is without doubt one such growth market. The world market for pharmaceuticals, for ex ...

... innovative services to compete over the long term and achieve profitable growth. Likewise, you have to identify and open up potential in future growth markets and industries. The Life Sciences and Healthcare sector is without doubt one such growth market. The world market for pharmaceuticals, for ex ...

DIVIDEND POLICY MODELS Cezary Mech * RESEARCH PAPER

... appeal to tax-induced investor clienteles. They argue that this «supply effect» effectively means that no corporation is able to affect its dividend policy, especially since there are different classes of investors that prefer different dividend yields. Additionally, there is a «diversification effe ...

... appeal to tax-induced investor clienteles. They argue that this «supply effect» effectively means that no corporation is able to affect its dividend policy, especially since there are different classes of investors that prefer different dividend yields. Additionally, there is a «diversification effe ...

Implied Expected Returns and the Choice of a Mean–Variance

... portfolio than in the mean–variance efficient one, and vice versa for underpriced stocks. If pricing errors are corrected, this leads to a drag on returns for market-capitalization-based portfolios. Perold [2007] and Graham [2012] emphasize, however, that this result is sensitive to the assumption t ...

... portfolio than in the mean–variance efficient one, and vice versa for underpriced stocks. If pricing errors are corrected, this leads to a drag on returns for market-capitalization-based portfolios. Perold [2007] and Graham [2012] emphasize, however, that this result is sensitive to the assumption t ...

AVALONBAY COMMUNITIES INC (Form: 10-K

... income. We have also participated, and may in the future participate, in master planned or other large multi-use developments where we commit to build infrastructure (such as roads) to be used by other participants or commit to act as construction manager or general contractor in building structures ...

... income. We have also participated, and may in the future participate, in master planned or other large multi-use developments where we commit to build infrastructure (such as roads) to be used by other participants or commit to act as construction manager or general contractor in building structures ...

Information Memorandum: Newpin Social Benefit Bond

... The expansion of the Newpin program will see more children live safely with their parents. Over the expected seven year term of the Newpin SBB, it is estimated that more than 700 families will participate. Based on historical performance this means more than 400 children will be safely returned to t ...

... The expansion of the Newpin program will see more children live safely with their parents. Over the expected seven year term of the Newpin SBB, it is estimated that more than 700 families will participate. Based on historical performance this means more than 400 children will be safely returned to t ...

Glove Manufacturers

... Source: AllianceDBS, Bloomberg Finance L.P. Closing price as of 6 Jan 2017 Hartalega Holdings Berhad : Hartalega is a niche player in nitrile gloves (94% of sales volume). It has the largest nitrile glove capacity among the glove makers under our coverage. Top Glove Corporation : Top Glove is the wo ...

... Source: AllianceDBS, Bloomberg Finance L.P. Closing price as of 6 Jan 2017 Hartalega Holdings Berhad : Hartalega is a niche player in nitrile gloves (94% of sales volume). It has the largest nitrile glove capacity among the glove makers under our coverage. Top Glove Corporation : Top Glove is the wo ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.