Answers to Questions in Chapter 10

... loans. Then there is the point that if a firm does not fund such research, its rivals may discover new profitable energy-saving techniques first: techniques which are denied to the first firm because of patents. There is a major weaknesses with this argument, however. It is concerned with risk and u ...

... loans. Then there is the point that if a firm does not fund such research, its rivals may discover new profitable energy-saving techniques first: techniques which are denied to the first firm because of patents. There is a major weaknesses with this argument, however. It is concerned with risk and u ...

Document

... securities or to forecast broad market trends Finding undervalued securities Timing the market ...

... securities or to forecast broad market trends Finding undervalued securities Timing the market ...

doc - South Carolina Small Business Development Centers

... capital firms have specific investment preferences that involve business style, size of investment opportunity, rapid growth, and high return. To a venture capitalist, the most important factors are the management team and the ability to recover investment with substantial return in 5-7 years. Ventu ...

... capital firms have specific investment preferences that involve business style, size of investment opportunity, rapid growth, and high return. To a venture capitalist, the most important factors are the management team and the ability to recover investment with substantial return in 5-7 years. Ventu ...

G-7 recommends vigilance on hedge funds

... statement saying the practices of hedge funds, which have drawn growing concern among financial policy makers over the past few years, had "become more complex and challenging" in light of the industry's prominence and volatility. "Given the strong growth of the hedge fund industry and the instrumen ...

... statement saying the practices of hedge funds, which have drawn growing concern among financial policy makers over the past few years, had "become more complex and challenging" in light of the industry's prominence and volatility. "Given the strong growth of the hedge fund industry and the instrumen ...

Consumption & Investment

... Borrowing constraints and precautionary savings suggest that consumption should respond more to business cycle changes in income than PIH argues. Interest Rates have ambiguous theoretical impact on consumption and savings. Empirically, the effect of interest rates on savings is positive, but sma ...

... Borrowing constraints and precautionary savings suggest that consumption should respond more to business cycle changes in income than PIH argues. Interest Rates have ambiguous theoretical impact on consumption and savings. Empirically, the effect of interest rates on savings is positive, but sma ...

security analysis - Goenka College of Commerce and Business

... It involves examination and evaluation of various factors that can affect the prices of securities. The role of a security analyst is to gather market information and advice the investors to adopt a suitable market strategy. ...

... It involves examination and evaluation of various factors that can affect the prices of securities. The role of a security analyst is to gather market information and advice the investors to adopt a suitable market strategy. ...

Damascus looks to investment banks | Special Report | MEED

... positions and want to sell, you have to wait,” says the investor. There is also a concern the SCFM is taking too close an interest in IPO prices, micromanaging a process that should be determined on the free market. “If an investment bank approaches a company to take it public, it has to go to the r ...

... positions and want to sell, you have to wait,” says the investor. There is also a concern the SCFM is taking too close an interest in IPO prices, micromanaging a process that should be determined on the free market. “If an investment bank approaches a company to take it public, it has to go to the r ...

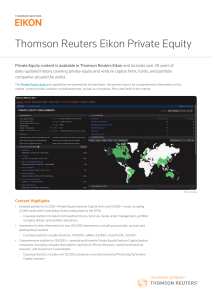

Eikon Private Equity PDF

... • Benchmarks are based on one of the industry’s largest institutional quality datasets, with all data directly sourced from contributing fund managers’ financial statements and subjected to additional layers of rigorous quality control • Detail-driven report types give access to enhanced analysis in ...

... • Benchmarks are based on one of the industry’s largest institutional quality datasets, with all data directly sourced from contributing fund managers’ financial statements and subjected to additional layers of rigorous quality control • Detail-driven report types give access to enhanced analysis in ...

MARKETS - Man Group

... underperformance of active strategies, particularly hedge funds or managers without an explicit benchmark, and concluded that they aren’t worth the hassle. Is it any wonder, therefore, that investors are moving out of active investments and into passive replication strategies at a record rate? It is ...

... underperformance of active strategies, particularly hedge funds or managers without an explicit benchmark, and concluded that they aren’t worth the hassle. Is it any wonder, therefore, that investors are moving out of active investments and into passive replication strategies at a record rate? It is ...

Read more.

... categories on a global basis. Bernie leads the group’s efforts to integrate top‐down research, local market fundamental analysis, relative value considerations, and specialized portfolio modeling to implement allocations that are tailored to investor objectives and preferences. Leveraging the Gl ...

... categories on a global basis. Bernie leads the group’s efforts to integrate top‐down research, local market fundamental analysis, relative value considerations, and specialized portfolio modeling to implement allocations that are tailored to investor objectives and preferences. Leveraging the Gl ...

Review Questions

... from property provides a steady, dependable stream of income for investors. Some REITs either make or purchase mortgage loans on comm ercial property, and some do both. Individual REITs have different characteristics and may be highly specialized, depending on the investment strategy and management ...

... from property provides a steady, dependable stream of income for investors. Some REITs either make or purchase mortgage loans on comm ercial property, and some do both. Individual REITs have different characteristics and may be highly specialized, depending on the investment strategy and management ...

Trust Company Advisor CTF R1 – 20bps R2

... available on multiple retirement trading platforms. Performance: CTF advisors have an investment product with a simple NAV to NAV performance calculation. Once the funds go live a performance history is reported via Morningstar and fact sheets. Audit: Plan clients will take comfort in the independen ...

... available on multiple retirement trading platforms. Performance: CTF advisors have an investment product with a simple NAV to NAV performance calculation. Once the funds go live a performance history is reported via Morningstar and fact sheets. Audit: Plan clients will take comfort in the independen ...

- Advisor To Client

... To make it easier for you to prepare meeting materials, we’ve developed these slides about the 5 types of hedge funds. The presentation is in a Word file to make it simpler to customize content to meet your clients’ information needs. ...

... To make it easier for you to prepare meeting materials, we’ve developed these slides about the 5 types of hedge funds. The presentation is in a Word file to make it simpler to customize content to meet your clients’ information needs. ...

Hot Topics presentation March 2014

... trustees should: “understand the changing risk profile of assets of the fund over time, taking into account comprehensive risk analysis” Trustees remain responsible for compliance even when asset management, for example, is outsourced ...

... trustees should: “understand the changing risk profile of assets of the fund over time, taking into account comprehensive risk analysis” Trustees remain responsible for compliance even when asset management, for example, is outsourced ...

International Fixed Interest Fund

... The International Fixed Interest Fund invests mainly in international fixed interest assets. Investments may include: • fixed interest assets issued by government or international companies, and • cash and cash equivalents. The fund aims to achieve a positive yearly return (after the fund charge and ...

... The International Fixed Interest Fund invests mainly in international fixed interest assets. Investments may include: • fixed interest assets issued by government or international companies, and • cash and cash equivalents. The fund aims to achieve a positive yearly return (after the fund charge and ...

Investment Process

... Investing involves risk. Principal loss is possible. The Validea Market Legends ETF has the same risks as the underlying securities traded on the exchange throughout the day. Redemptions are limited and often commissions are charged on each trade, and ETFs may trade at a premium or discount to their ...

... Investing involves risk. Principal loss is possible. The Validea Market Legends ETF has the same risks as the underlying securities traded on the exchange throughout the day. Redemptions are limited and often commissions are charged on each trade, and ETFs may trade at a premium or discount to their ...

Financing for climate change – meeting the challenge

... New Financial Investment by Region, 2002-2008,$ billions Global Trends in Sustainable Energy Investment 2009 ...

... New Financial Investment by Region, 2002-2008,$ billions Global Trends in Sustainable Energy Investment 2009 ...

Money and Investing - St. John the Baptist Diocesan High School

... From whom can you buy shares? Why do company’s go public? (IPO) How are risk, liquidity, and return related? ...

... From whom can you buy shares? Why do company’s go public? (IPO) How are risk, liquidity, and return related? ...

In the years after the Second World War global FDI was dominated

... In the US, in the late 1960s and early 1970s, outward investment became increasingly politicized. Organized labor, convinced that investment abroad exported jobs, undertook a major campaign to reform the tax provisions which affected foreign direct investment. The Foreign Trade and Investment Act of ...

... In the US, in the late 1960s and early 1970s, outward investment became increasingly politicized. Organized labor, convinced that investment abroad exported jobs, undertook a major campaign to reform the tax provisions which affected foreign direct investment. The Foreign Trade and Investment Act of ...

Financial Planning Canberra - Milestone Financial

... Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of ...

... Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of ...

NN Global Investment Grade Credit - Home

... accept any liability or responsibility in respect to the information or any recommendations expressed herein. Any information given in this document may be subject to change or update without notice. Investment sustains risks. Please note that the value of your investment may rise or fall and also t ...

... accept any liability or responsibility in respect to the information or any recommendations expressed herein. Any information given in this document may be subject to change or update without notice. Investment sustains risks. Please note that the value of your investment may rise or fall and also t ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.