Prepare for the Bear, Whenever It Arrives A Study In Succession

... need, then return them to the IRA within 60 days, and there are no tax consequences. For many years it was widely believed that one 60-day rollover was allowed from each IRA a taxpayer maintained. But earlier this year the U.S. Tax Court (see Bobrow v. Commissioner) scotched that idea, interpreting ...

... need, then return them to the IRA within 60 days, and there are no tax consequences. For many years it was widely believed that one 60-day rollover was allowed from each IRA a taxpayer maintained. But earlier this year the U.S. Tax Court (see Bobrow v. Commissioner) scotched that idea, interpreting ...

the full article

... “Many of these plans have consultants, they will come in once a quarter, but they do not have the fiduciary responsibility of managing [an investment portfolio] and executing the investment process day-by-day,” said Frishman, who recently joined the firm after an investment career that includes serv ...

... “Many of these plans have consultants, they will come in once a quarter, but they do not have the fiduciary responsibility of managing [an investment portfolio] and executing the investment process day-by-day,” said Frishman, who recently joined the firm after an investment career that includes serv ...

UNIT 6: THE FINANCIAL PLAN When the company has more

... Whenever a supplier gives us a deferment of payment of those products that you have purchased we have got a short-term financing. The amount is the value of our purchase and the postponement by the provider, usually 30, 60 or 90 days. Although you can sometimes get higher postponement, it is unusual ...

... Whenever a supplier gives us a deferment of payment of those products that you have purchased we have got a short-term financing. The amount is the value of our purchase and the postponement by the provider, usually 30, 60 or 90 days. Although you can sometimes get higher postponement, it is unusual ...

Introduction to Social Finance: reusing money for financial and

... Social Finance is authorised and regulated by the Financial Service Authority FSA No: 497568 ...

... Social Finance is authorised and regulated by the Financial Service Authority FSA No: 497568 ...

Quarterly Newsletter - December 2001 : Pinney and Scofield : http

... events and market reactions, and yet your portfolio has held steady – with a small loss or a small gain. This is a remarkable result, and we are proud of it. It happened because we are very diversified. Our portfolios contain fixed income, real estate (REITs), domestic and international small capita ...

... events and market reactions, and yet your portfolio has held steady – with a small loss or a small gain. This is a remarkable result, and we are proud of it. It happened because we are very diversified. Our portfolios contain fixed income, real estate (REITs), domestic and international small capita ...

Opportunities for Small Life Insurance Companies to Improve Asset

... Recent capital market trends may drive further changes in asset allocation decisions and risk tolerance levels. With the exception of the 2008 crisis period, overall bond yields have declined meaningfully over the last decade, and opportunities to invest for yield have diminished. Looking at Figure ...

... Recent capital market trends may drive further changes in asset allocation decisions and risk tolerance levels. With the exception of the 2008 crisis period, overall bond yields have declined meaningfully over the last decade, and opportunities to invest for yield have diminished. Looking at Figure ...

Refinancing of 700 million euros for ARC Fund

... because of the spectacular growth accomplished by the Fund. It underlines yet again the everincreasing demand for medium-priced residential rental properties and the role played by institutional investors in creating supply. Over the next few years, the substantial pipeline of new houses created by ...

... because of the spectacular growth accomplished by the Fund. It underlines yet again the everincreasing demand for medium-priced residential rental properties and the role played by institutional investors in creating supply. Over the next few years, the substantial pipeline of new houses created by ...

Week5.1 Money Markets - B-K

... Cash Investments • Text calls all these “money market” investments ...

... Cash Investments • Text calls all these “money market” investments ...

The New Landscape for Business Startups and Their Investors

... employees who hold shares) or 2,000 total shareholders generally will no longer be required to register with the Securities and Exchange Commission (SEC). By exempting smaller companies from registration requirements, the Act enables them to bypass many SEC regulations that are designed to increase ...

... employees who hold shares) or 2,000 total shareholders generally will no longer be required to register with the Securities and Exchange Commission (SEC). By exempting smaller companies from registration requirements, the Act enables them to bypass many SEC regulations that are designed to increase ...

Handling Market Volatility

... tools for trying to manage market volatility. Because asset classes often perform differently under different market conditions, spreading your assets across a variety of investments such as stocks, bonds, and cash alternatives has the potential to help reduce your overall risk. Ideally, a decline i ...

... tools for trying to manage market volatility. Because asset classes often perform differently under different market conditions, spreading your assets across a variety of investments such as stocks, bonds, and cash alternatives has the potential to help reduce your overall risk. Ideally, a decline i ...

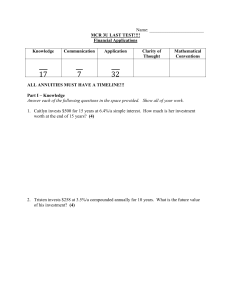

Test Chapter 8 Spring `14

... years, the interest rate changes to 9%/a compounded semi-annually. Calculate the value of the investment two years after this change. (7) ...

... years, the interest rate changes to 9%/a compounded semi-annually. Calculate the value of the investment two years after this change. (7) ...

Professional profile and biography of Mr Emilio

... b) He has held the following professional positions: from 1998 until present at JP Morgan Chase (UK) Holdings LTD. From 2015 until present he has been Vice-Chairman of JP Morgan Chase & Co (the Bank's listed holding company) and a member of the Corporate and Investment Bank Management Committee. Fro ...

... b) He has held the following professional positions: from 1998 until present at JP Morgan Chase (UK) Holdings LTD. From 2015 until present he has been Vice-Chairman of JP Morgan Chase & Co (the Bank's listed holding company) and a member of the Corporate and Investment Bank Management Committee. Fro ...

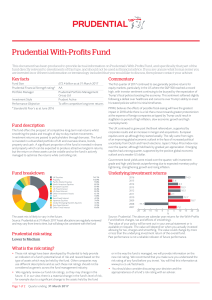

Prudential With

... The performance figures shown are overall annualised returns for contributions made on the dates specified. The returns include both regular and final bonuses added to a benefit paid at normal retirement date, but make no allowance for any applicable initial charges, allocation rates or early cash i ...

... The performance figures shown are overall annualised returns for contributions made on the dates specified. The returns include both regular and final bonuses added to a benefit paid at normal retirement date, but make no allowance for any applicable initial charges, allocation rates or early cash i ...

20160624_brexit

... • UK could switch to European Free Trade Association (EFTA) – Could happen quite quickly since a lot of overlap with existing agreements – Would need to have agreement on basic agricultural products, as currently negotiated on case-by-case basis. – Would also need to consider negotiating additional ...

... • UK could switch to European Free Trade Association (EFTA) – Could happen quite quickly since a lot of overlap with existing agreements – Would need to have agreement on basic agricultural products, as currently negotiated on case-by-case basis. – Would also need to consider negotiating additional ...

SA investment to UK

... • UK could switch to European Free Trade Association (EFTA) – Could happen quite quickly since a lot of overlap with existing agreements – Would need to have agreement on basic agricultural products, as currently negotiated on case-by-case basis. – Would also need to consider negotiating additional ...

... • UK could switch to European Free Trade Association (EFTA) – Could happen quite quickly since a lot of overlap with existing agreements – Would need to have agreement on basic agricultural products, as currently negotiated on case-by-case basis. – Would also need to consider negotiating additional ...

IPKW - PowerShares International BuyBack Achievers Portfolio fact

... that lessens the impact of large outliers and increases the impact of small ones. Weighted Average Return on Equity is net income divided by net worth.Weighted Market Capitalization is the sum of each underlying securities’ market value. The 30-Day SEC Yield is based on a 30-day period and is comput ...

... that lessens the impact of large outliers and increases the impact of small ones. Weighted Average Return on Equity is net income divided by net worth.Weighted Market Capitalization is the sum of each underlying securities’ market value. The 30-Day SEC Yield is based on a 30-day period and is comput ...

Answers for HW5 #9.2 a The firm maximizes profit by setting

... The price elasticity in country A in absolute terms is larger than in country B. Thus, the optimal price in country A is lower than that in country B, which is consistent with Ramsey optimal pricing. ...

... The price elasticity in country A in absolute terms is larger than in country B. Thus, the optimal price in country A is lower than that in country B, which is consistent with Ramsey optimal pricing. ...

Deloitte report identifies `red flags` for hedge fund managers and

... Research who focuses on the financial services industry. 'Competition is becoming more intense, institutional investors are growing in importance, and regulators are paying greater attention. 'Those that thrive in this new competitive environment will be those that pay particular attention to risk m ...

... Research who focuses on the financial services industry. 'Competition is becoming more intense, institutional investors are growing in importance, and regulators are paying greater attention. 'Those that thrive in this new competitive environment will be those that pay particular attention to risk m ...

security analysis and portfolio management

... c) Ownership securities as returns are based on net profit—rates are variable. 2. Returns— A major factor influencing pattern of investment is its return—i.e. yield plus capital appreciation .(Yield is interest or dividend). Yield has to be calculated on the purchase price. ...

... c) Ownership securities as returns are based on net profit—rates are variable. 2. Returns— A major factor influencing pattern of investment is its return—i.e. yield plus capital appreciation .(Yield is interest or dividend). Yield has to be calculated on the purchase price. ...

Protecting Against Alternative Investment Risk

... portfolios. However, many institutional investors have concerns over the inclusion of alternative investments in their strategy. Comprehensive and thorough risk management is key to allaying these concerns – but it is something that must be deeply embedded within the entire investment process rather ...

... portfolios. However, many institutional investors have concerns over the inclusion of alternative investments in their strategy. Comprehensive and thorough risk management is key to allaying these concerns – but it is something that must be deeply embedded within the entire investment process rather ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.