how to profit when investors are scared buy low sell high

... ment at a low point and at good valuation by analyzing the economic data about that investment. The standard most often used to measure whether an investment represents good value is the PE ratio — P stands for the price of the shares and E represents the earnings of the company. The PE ratio is use ...

... ment at a low point and at good valuation by analyzing the economic data about that investment. The standard most often used to measure whether an investment represents good value is the PE ratio — P stands for the price of the shares and E represents the earnings of the company. The PE ratio is use ...

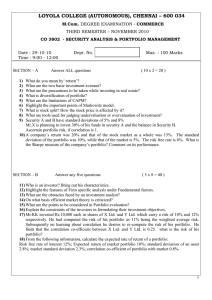

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... 11) Who is an investor? Bring out his characteristics. 12) Highlight the features of Firm specific analysis under Fundamental factors. 13) What are the obstacles faced by an investment analyst? 14) On what basis efficient market theory is criticized? 15) What are the points to be considered in Portf ...

... 11) Who is an investor? Bring out his characteristics. 12) Highlight the features of Firm specific analysis under Fundamental factors. 13) What are the obstacles faced by an investment analyst? 14) On what basis efficient market theory is criticized? 15) What are the points to be considered in Portf ...

PDF Download

... In 1998, the latest year for which worldwide figures are available, global FDI flows reached a record level despite the financial crises and recessions in Asia and Latin America. FDI inflows and outflows from the industrialised countries soared to new heights – to about $460 billion and $595 billion ...

... In 1998, the latest year for which worldwide figures are available, global FDI flows reached a record level despite the financial crises and recessions in Asia and Latin America. FDI inflows and outflows from the industrialised countries soared to new heights – to about $460 billion and $595 billion ...

Managed portfolio service

... clients the highest investment standards and a level of service that is tailored to their needs. Our managed portfolio service follows this tradition by giving clients with £15,000 or more access to high-quality investing, together with a service specifically designed to meet their requirements. The ...

... clients the highest investment standards and a level of service that is tailored to their needs. Our managed portfolio service follows this tradition by giving clients with £15,000 or more access to high-quality investing, together with a service specifically designed to meet their requirements. The ...

Thornton Matheson

... The thesis comprises two studies of regional investment in transitional Russia: one on private domestic and foreign investment and the other on local public investment. The first study constructs a general equilibrium model of a regional economy with non-traded goods, industrial specialization and p ...

... The thesis comprises two studies of regional investment in transitional Russia: one on private domestic and foreign investment and the other on local public investment. The first study constructs a general equilibrium model of a regional economy with non-traded goods, industrial specialization and p ...

Income Drawdown Plan - Home | Capita Financial

... eroded by the impact of inflation • Your investment will not perform well enough to generate the income you need now or in the future • If you exercise your cancellation rights, transfer out, or exit (if you are 55 or over), you may not (even without a fall in the price of the units) get back the ...

... eroded by the impact of inflation • Your investment will not perform well enough to generate the income you need now or in the future • If you exercise your cancellation rights, transfer out, or exit (if you are 55 or over), you may not (even without a fall in the price of the units) get back the ...

10- Practice Free Respons Answers

... 1f) Tax cuts = less revenue for Gov’t Government Spending ↑ => more $ going out • Gov’t now running a BUDGET DEFICIT 1g) National Savings Falls Supply Curve = National Savings = Sum of Public & Private Savings • So Supply shifts left causing real interest rates to ↑ ...

... 1f) Tax cuts = less revenue for Gov’t Government Spending ↑ => more $ going out • Gov’t now running a BUDGET DEFICIT 1g) National Savings Falls Supply Curve = National Savings = Sum of Public & Private Savings • So Supply shifts left causing real interest rates to ↑ ...

RHB-OSK China-India Dynamic Growth Fund

... the private sector HSBC PMI rose from 49.7 in January to 50.7 in February – its first sign of expansion after more than a year in contraction. Other latest activity indicators such as industrial production and retail sales generally improved across global markets except in Japan, Russia and India. I ...

... the private sector HSBC PMI rose from 49.7 in January to 50.7 in February – its first sign of expansion after more than a year in contraction. Other latest activity indicators such as industrial production and retail sales generally improved across global markets except in Japan, Russia and India. I ...

Did you notice - T3 Equity Labs LLC

... •That’s 120% of the yield on Treasures of similar maturity •The ratio reached an all-time high of 124% Sept. 17, 2008. •Avg. rates on weekly reset debt rose more than fourfold in two weeks to 7.96%, the highest since they began compiling the data in 1989. ...

... •That’s 120% of the yield on Treasures of similar maturity •The ratio reached an all-time high of 124% Sept. 17, 2008. •Avg. rates on weekly reset debt rose more than fourfold in two weeks to 7.96%, the highest since they began compiling the data in 1989. ...

The difference between a recession and a depression? "It`s a

... We know we have said it before, but we will say it again…. staying put is still the best option for most investors. Those who panic and cash in growth assets will be doing so at what is arguably close to or at the bottom of the market. Example: If your equity portfolio has lost 50%, and you decide t ...

... We know we have said it before, but we will say it again…. staying put is still the best option for most investors. Those who panic and cash in growth assets will be doing so at what is arguably close to or at the bottom of the market. Example: If your equity portfolio has lost 50%, and you decide t ...

Armine Yalnizyan: Income Inequality and Investment

... • Eroded legitimacy of system (Stiglitz, Freeland) ...

... • Eroded legitimacy of system (Stiglitz, Freeland) ...

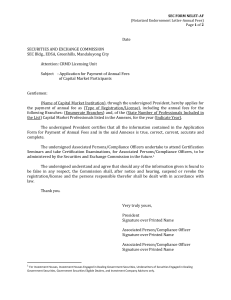

SEC Form NELET-AF - Securities and Exchange Commission

... The undersigned Associated Persons/Compliance Officers undertake to attend Certification Seminars and take Certification Examinations, for Associated Persons/Compliance Officers, to be administered by the Securities and Exchange Commission in the future.1 The undersigned understand and agree that sh ...

... The undersigned Associated Persons/Compliance Officers undertake to attend Certification Seminars and take Certification Examinations, for Associated Persons/Compliance Officers, to be administered by the Securities and Exchange Commission in the future.1 The undersigned understand and agree that sh ...

Against this background GUE/NGL rejects the so called Juncker

... GDP over three years), will fail to kick-start the EU economy There is not fresh public money for investment; instead, the EU contributions to the EFSI guarantee fund will be taken (partially) from existing programs (CEF and Horizon 2020), which have a leverage factor similar to the one envisaged ...

... GDP over three years), will fail to kick-start the EU economy There is not fresh public money for investment; instead, the EU contributions to the EFSI guarantee fund will be taken (partially) from existing programs (CEF and Horizon 2020), which have a leverage factor similar to the one envisaged ...

The strategy`s return for the quarter was

... Public Trustee is a statutory entity founded in 1881. At the end of the September 2015 quarter, it had approximately $902m in funds under management. Public Trustee’s Funds Management Service has a distinguished record of high quality, proven and consistent investment performance. We are proud of ou ...

... Public Trustee is a statutory entity founded in 1881. At the end of the September 2015 quarter, it had approximately $902m in funds under management. Public Trustee’s Funds Management Service has a distinguished record of high quality, proven and consistent investment performance. We are proud of ou ...

Alternative Investment Exposures at Endowments

... Sharpe ratios and efficient frontiers require normally distributed returns, where skewness and excess kurtosis are zero ...

... Sharpe ratios and efficient frontiers require normally distributed returns, where skewness and excess kurtosis are zero ...

Key Investor Information

... At least 80% of the fund will be invested in shares of UK companies. The fund has no bias to any particular industry. The fund follows an investment approach based around the business cycle, where the managers attempt to identify turning points in the cycle and then focus on the types of companies t ...

... At least 80% of the fund will be invested in shares of UK companies. The fund has no bias to any particular industry. The fund follows an investment approach based around the business cycle, where the managers attempt to identify turning points in the cycle and then focus on the types of companies t ...

Deconstructing the time in the market mantra

... ‘Time in the market’ used to be the rationale why investors should hang on to equities come hell or high water. However this mantra rings hollow to many investors who have seen the value of their equity portfolios halved over the last year. While investing is still about taking a long term view what ...

... ‘Time in the market’ used to be the rationale why investors should hang on to equities come hell or high water. However this mantra rings hollow to many investors who have seen the value of their equity portfolios halved over the last year. While investing is still about taking a long term view what ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.