Q1 Global Brief 2014

... asked, “The system is safer, but is it safe enough?” The world economy remains more highly leveraged than ever before. What progress has been made in reducing ...

... asked, “The system is safer, but is it safe enough?” The world economy remains more highly leveraged than ever before. What progress has been made in reducing ...

Downlaod File

... they make it easier and quicker to sell there financial instruments to raise cash (more liquid) and increasing liquidity makes them more desirable and thus easier for the issuing firm to sell in the primary market. Second they determine the price of the security that the issuing firm sells in the pr ...

... they make it easier and quicker to sell there financial instruments to raise cash (more liquid) and increasing liquidity makes them more desirable and thus easier for the issuing firm to sell in the primary market. Second they determine the price of the security that the issuing firm sells in the pr ...

18 November - MoneyLetter

... of tighter monetary policy, coupled with slowing in China and a continuing decline in commodities prices, kept pressure on domestic stocks. But even though the minutes show the Fed feels “it may well be appropriate” to liftoff in December, statements this week by Committee members reminded investors ...

... of tighter monetary policy, coupled with slowing in China and a continuing decline in commodities prices, kept pressure on domestic stocks. But even though the minutes show the Fed feels “it may well be appropriate” to liftoff in December, statements this week by Committee members reminded investors ...

A Tropical Forest and Agriculture focused fund

... capitalization target for the Fund of 400 million USD, to be drawn from bilateral and multilateral public donors as well as private sector partners. By 2020, more than 20 production and forest protection projects should be funded globally, while leveraging private capital investments more than 4 tim ...

... capitalization target for the Fund of 400 million USD, to be drawn from bilateral and multilateral public donors as well as private sector partners. By 2020, more than 20 production and forest protection projects should be funded globally, while leveraging private capital investments more than 4 tim ...

Economics Unit 2 Study Guide

... __ 15. An establishment owned by two or more persons in which only one person has unlimited personal liability for the business __ 16. Nonprofit association that promotes the interests of a particular industry __ 17. Money and other valuables belonging to an individual or business __ 18. A business ...

... __ 15. An establishment owned by two or more persons in which only one person has unlimited personal liability for the business __ 16. Nonprofit association that promotes the interests of a particular industry __ 17. Money and other valuables belonging to an individual or business __ 18. A business ...

Fair Market Value for a Worthless Asset Form

... administrative in nature. The Accountholder or his/her authorized representative must direct all investment transactions and choose the investment(s) for the account. NuView IRA has no responsibility or involvement in selecting or evaluating any investment. Nothing contained in this letter shall be ...

... administrative in nature. The Accountholder or his/her authorized representative must direct all investment transactions and choose the investment(s) for the account. NuView IRA has no responsibility or involvement in selecting or evaluating any investment. Nothing contained in this letter shall be ...

State Street Invite

... necessarily reflect those of Morgan Stanley. Individuals should consult with their tax/legal advisors before making any tax/legal-related investment decisions as Morgan Stanley and its Financial Advisors do not provide tax/legal advice. The appropriateness of a particular investment or strategy will ...

... necessarily reflect those of Morgan Stanley. Individuals should consult with their tax/legal advisors before making any tax/legal-related investment decisions as Morgan Stanley and its Financial Advisors do not provide tax/legal advice. The appropriateness of a particular investment or strategy will ...

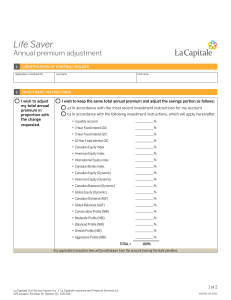

IND001E Life Saver - Annual Premium Adjustment

... generated by these accounts are tied to the performance of a market index or underlying fund, less any applicable management fees. The value of the market index or underlying fund fluctuates depending on the market value of the securities that make up the index or fund. The value of these accounts m ...

... generated by these accounts are tied to the performance of a market index or underlying fund, less any applicable management fees. The value of the market index or underlying fund fluctuates depending on the market value of the securities that make up the index or fund. The value of these accounts m ...

careers

... How do I value stocks/bonds? Go to or Look at what? If T-bond rates go up – T-Bonds do what? And the US $? Points on a mortgage sound good. Really? Should I borrow to start my business? At what rate? ...

... How do I value stocks/bonds? Go to or Look at what? If T-bond rates go up – T-Bonds do what? And the US $? Points on a mortgage sound good. Really? Should I borrow to start my business? At what rate? ...

ARK_letter10-07 - ARK Financial Services

... How should you respond to these events? Stay disciplined and adhere to your carefully designed investment strategy. Stocks are volatile, so no one can consistently predict when the risks of equity investing will appear. It would be a mistake to try to time the market by reacting to events such as th ...

... How should you respond to these events? Stay disciplined and adhere to your carefully designed investment strategy. Stocks are volatile, so no one can consistently predict when the risks of equity investing will appear. It would be a mistake to try to time the market by reacting to events such as th ...

Nov. 30, 2015 - Centre Funds

... (EPS)4 gains and equity prices. History indicates that buybacks are linked to share prices. Ironically, most companies seem to buy high and don’t buy at all when their stock prices are low so history indicates that we should expect a slowdown in stock buybacks if share prices fall. ...

... (EPS)4 gains and equity prices. History indicates that buybacks are linked to share prices. Ironically, most companies seem to buy high and don’t buy at all when their stock prices are low so history indicates that we should expect a slowdown in stock buybacks if share prices fall. ...

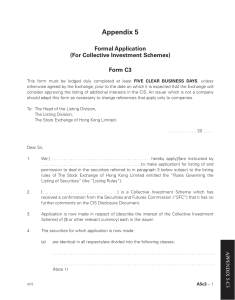

Appendix 5

... SFC from time to time that are applicable to the authorisation of the Collective Investment Schemes and with the Listing Rules from time to time of The Stock Exchange of Hong Kong Limited so far as applicable to the Collective Investment Scheme. ...

... SFC from time to time that are applicable to the authorisation of the Collective Investment Schemes and with the Listing Rules from time to time of The Stock Exchange of Hong Kong Limited so far as applicable to the Collective Investment Scheme. ...

Dreyfus/Standish Global Fixed Income Fund Mar 31

... the inception date for Class A and Class C shares, and the performance of Class A and C, respectively, from that inception date. Performance reflects the applicable class’ sales load and distribution/servicing fees since the inception date. Had these fees and expenses been reflected for periods prio ...

... the inception date for Class A and Class C shares, and the performance of Class A and C, respectively, from that inception date. Performance reflects the applicable class’ sales load and distribution/servicing fees since the inception date. Had these fees and expenses been reflected for periods prio ...

3rd Quarter - Legacy Asset Management

... Our long-term outlook has not changed since last December. We are still looking for modest GDP growth over the next several quarters as the country works through a dormant job cycle, excessive housing inventory and uncertainty related to regulation, taxes and national debt. Since last December, we h ...

... Our long-term outlook has not changed since last December. We are still looking for modest GDP growth over the next several quarters as the country works through a dormant job cycle, excessive housing inventory and uncertainty related to regulation, taxes and national debt. Since last December, we h ...

Project Conference: The Future of National Development Banks

... – Infrastructure has emerged as a distinct asset class. – In OECD countries, institutional investors held over US$70 trillion in assets as of December 2011…Many of these investors are moving towards socially and environmentally responsible investment strategies. Also growing rapidly are Sovereign We ...

... – Infrastructure has emerged as a distinct asset class. – In OECD countries, institutional investors held over US$70 trillion in assets as of December 2011…Many of these investors are moving towards socially and environmentally responsible investment strategies. Also growing rapidly are Sovereign We ...

About Cash Your investment options:

... When you invest in cash you effectively lend money to a company or government body and earn interest. These investments are much like bonds, except the time invested is much shorter, ranging from one day to less than a year. ...

... When you invest in cash you effectively lend money to a company or government body and earn interest. These investments are much like bonds, except the time invested is much shorter, ranging from one day to less than a year. ...

Source: CB Richard Ellis

... Investment Highlights The rate of growth in investment of fixed capital through the Region for 2007 was 126% compared to the 2006 level (for Russia this indicator was 121%), and the amount invested totaled US $9 billion. 13% of this amount, US $715 million, came from foreign investors. Over the las ...

... Investment Highlights The rate of growth in investment of fixed capital through the Region for 2007 was 126% compared to the 2006 level (for Russia this indicator was 121%), and the amount invested totaled US $9 billion. 13% of this amount, US $715 million, came from foreign investors. Over the las ...

Trading Volumes in Perspective

... This document, and the information contained herein, is not, and does not constitute, directly or indirectly, a public or retail offer to buy or sell, or a public or retail solicitation of an offer to buy or sell, any fund, units or shares of any fund, security or other instrument ("Securities"), or ...

... This document, and the information contained herein, is not, and does not constitute, directly or indirectly, a public or retail offer to buy or sell, or a public or retail solicitation of an offer to buy or sell, any fund, units or shares of any fund, security or other instrument ("Securities"), or ...

DailyNewsTSIK

... Briarwood eighth in investment contest A team of four Briarwood Elementary School students took eighth place in the fall 2006 statewide Take Stock in Kentucky investment competition. More than 300 teams from across the state competed in the fall Take Stock in Kentucky competition in which teams of s ...

... Briarwood eighth in investment contest A team of four Briarwood Elementary School students took eighth place in the fall 2006 statewide Take Stock in Kentucky investment competition. More than 300 teams from across the state competed in the fall Take Stock in Kentucky competition in which teams of s ...

Diversification

... Derivatives are instruments based on the future, and therefore uncertain, price of another security, such as a share of stock, a government bond, a currency, or a commodity. Mutual funds are portfolios of investments designed to achieve maximum diversification with minimal cost through economies of ...

... Derivatives are instruments based on the future, and therefore uncertain, price of another security, such as a share of stock, a government bond, a currency, or a commodity. Mutual funds are portfolios of investments designed to achieve maximum diversification with minimal cost through economies of ...

Stocks

... Derivatives are instruments based on the future, and therefore uncertain, price of another security, such as a share of stock, a government bond, a currency, or a commodity. Mutual funds are portfolios of investments designed to achieve maximum diversification with minimal cost through economies of ...

... Derivatives are instruments based on the future, and therefore uncertain, price of another security, such as a share of stock, a government bond, a currency, or a commodity. Mutual funds are portfolios of investments designed to achieve maximum diversification with minimal cost through economies of ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.