Fund Manager Sector Minimum Investment Fund Size

... The Total Expense Ra�o (TER) is the annualised percentage of the Fund’s average assets under management that has been used to pay the Fund’s actual expenses over the past three years. This percentage of the average Net Asset Value of the por�olio was incurred as charges, levies and fees related to t ...

... The Total Expense Ra�o (TER) is the annualised percentage of the Fund’s average assets under management that has been used to pay the Fund’s actual expenses over the past three years. This percentage of the average Net Asset Value of the por�olio was incurred as charges, levies and fees related to t ...

principles of finance

... a. Earnings to changes in operating expenses b. Earnings to changes in output c. Earnings before taxes to changes in operating income d. Operating income to changes in net income Rev 3/2017 ...

... a. Earnings to changes in operating expenses b. Earnings to changes in output c. Earnings before taxes to changes in operating income d. Operating income to changes in net income Rev 3/2017 ...

Ch 11: 1.1

... a. Traditional pension plans are defined benefit plans under which retirement payouts are fixed by a formula that is typically based on the worker’s years on the job and final salary. 401(k) plans are defined contribution plans under which payouts depend on the return earned by the plan’s investment ...

... a. Traditional pension plans are defined benefit plans under which retirement payouts are fixed by a formula that is typically based on the worker’s years on the job and final salary. 401(k) plans are defined contribution plans under which payouts depend on the return earned by the plan’s investment ...

Trade Log March 2016 - Cougar Global Investments

... Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity and redemption features. Bonds are subject to mar ...

... Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity and redemption features. Bonds are subject to mar ...

Monthly Report for February 2010

... visible to the naked eye. Rather, in the short term it is often reflected in an increase in debt by affected nations and later in lower, sub-potential real economic growth. This lower growth is linked to several factors, among them the fact that many nations, in an effort to stop the downward econom ...

... visible to the naked eye. Rather, in the short term it is often reflected in an increase in debt by affected nations and later in lower, sub-potential real economic growth. This lower growth is linked to several factors, among them the fact that many nations, in an effort to stop the downward econom ...

20170504 CACEIS partner in the initiative to develop apost

... CACEIS has signed an investment agreement intended to develop a post-market Blockchain infrastructure for the SME segment in Europe. Launched in June 2016, the objective of this partnership is to improve the access of such companies to capital markets, while facilitating and enhancing the security o ...

... CACEIS has signed an investment agreement intended to develop a post-market Blockchain infrastructure for the SME segment in Europe. Launched in June 2016, the objective of this partnership is to improve the access of such companies to capital markets, while facilitating and enhancing the security o ...

U.S. Stock Markets Nearing All Time Highs: Why They Can Move

... Like it or not, Central Bank monetary policy has been instrumental in encouraging investors to buy stocks and real estate. The rebound in these two investment classes has helped the wealth effect and each respective market. Clearly, the benefit is most captured by the upper income individuals and ha ...

... Like it or not, Central Bank monetary policy has been instrumental in encouraging investors to buy stocks and real estate. The rebound in these two investment classes has helped the wealth effect and each respective market. Clearly, the benefit is most captured by the upper income individuals and ha ...

brexit: european equities positioning

... James’s Place (the latter is effectively a wealth manager). We believe however that the greater risk is posed by companies which are sensitive to the UK financial system (specifically the banks) and also exporters of products where there could be restrictions on trade. We have little exposure to the ...

... James’s Place (the latter is effectively a wealth manager). We believe however that the greater risk is posed by companies which are sensitive to the UK financial system (specifically the banks) and also exporters of products where there could be restrictions on trade. We have little exposure to the ...

Prudential Short Duration High Yield Income Fund

... Used with permission. Source of default data: Moody’s as of 12/31/2016. Annualized returns and standard deviation for risk/return are based on indexes. Short duration, higher-rated high yield bonds are represented by the Bloomberg Barclays U.S. High Yield Ba/B 1–5 Year 1% Constrained Index, which re ...

... Used with permission. Source of default data: Moody’s as of 12/31/2016. Annualized returns and standard deviation for risk/return are based on indexes. Short duration, higher-rated high yield bonds are represented by the Bloomberg Barclays U.S. High Yield Ba/B 1–5 Year 1% Constrained Index, which re ...

Invesco India Bond Fund

... You can check the latest price for the Share Class on our website and on Reuters, Bloomberg and Morningstar. Information on the up-to-date remuneration policy of the Management Company, Invesco Management S.A., including but not limited to, a description of how remuneration and benefits are calculat ...

... You can check the latest price for the Share Class on our website and on Reuters, Bloomberg and Morningstar. Information on the up-to-date remuneration policy of the Management Company, Invesco Management S.A., including but not limited to, a description of how remuneration and benefits are calculat ...

The Benefits of High-Quality in an Uncertain Environment

... meetings with many leading tech executives, and his plans to allow companies with significant offshore cash holdings to repatriate at low tax rates could be quite favorable for several technology companies. ...

... meetings with many leading tech executives, and his plans to allow companies with significant offshore cash holdings to repatriate at low tax rates could be quite favorable for several technology companies. ...

File

... in a special-purpose entity controlled by a trustee. The pooled loans become collateral for issuing asset-backed securities. These securities are sold to capital-market investors around the world. As the loans generate interest and principal income, that income is passed on to the holders of the sec ...

... in a special-purpose entity controlled by a trustee. The pooled loans become collateral for issuing asset-backed securities. These securities are sold to capital-market investors around the world. As the loans generate interest and principal income, that income is passed on to the holders of the sec ...

Mutual Funds May 2012

... Funds charge investors fees & expenses A high cost fund must outperform a lowcost fund to generate the same returns Even small differences in fees can translate into large differences in returns FINRA Fund Analyzer http://apps.finra.org/fundanalyzer/1/fa.aspx ...

... Funds charge investors fees & expenses A high cost fund must outperform a lowcost fund to generate the same returns Even small differences in fees can translate into large differences in returns FINRA Fund Analyzer http://apps.finra.org/fundanalyzer/1/fa.aspx ...

Chapter 11

... your 300 shares for $25 a share, to avoid losing more money. How much did you sell them for? ...

... your 300 shares for $25 a share, to avoid losing more money. How much did you sell them for? ...

October 2016 - Reynders, McVeigh Capital Management

... cash to buy selected equities at discounts should markets correct. This tactical response to current market circumstances should not be confused as a call to exit markets. We still believe equity investments are one of the most attractive places for long-term investors to drive capital growth and in ...

... cash to buy selected equities at discounts should markets correct. This tactical response to current market circumstances should not be confused as a call to exit markets. We still believe equity investments are one of the most attractive places for long-term investors to drive capital growth and in ...

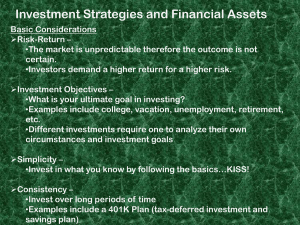

Investment Strategies and Financial Assets

... Investment Strategies and Financial Assets Basic Considerations Risk-Return – •The market is unpredictable therefore the outcome is not certain. •Investors demand a higher return for a higher risk. Investment Objectives – •What is your ultimate goal in investing? •Examples include college, vacatio ...

... Investment Strategies and Financial Assets Basic Considerations Risk-Return – •The market is unpredictable therefore the outcome is not certain. •Investors demand a higher return for a higher risk. Investment Objectives – •What is your ultimate goal in investing? •Examples include college, vacatio ...

Slide 1

... securities advice and does not take into account any person's investment objectives, financial situation or particular needs. Before making an investment decision you need to consider, whether any investment is appropriate in light of your particular investment needs, objectives and financial circum ...

... securities advice and does not take into account any person's investment objectives, financial situation or particular needs. Before making an investment decision you need to consider, whether any investment is appropriate in light of your particular investment needs, objectives and financial circum ...

Factsheet-WisdomTree Germany Equity UCITS ETF - USD

... companies incorporated in Germany that trade primarily on German Exchanges and derive less than 80% of their revenue from sources in Germany. By excluding companies that derive 80% or more of their revenue from Germany, the Index is tilted towards companies with a significant global revenue base. Th ...

... companies incorporated in Germany that trade primarily on German Exchanges and derive less than 80% of their revenue from sources in Germany. By excluding companies that derive 80% or more of their revenue from Germany, the Index is tilted towards companies with a significant global revenue base. Th ...

Issues Influencing the Market

... investments that may have greater potential, based on their ranking from a mathematical scoring process. In a declining market, bonds and money market investments are often identified by the models as having stronger price patterns, indicating money flowing into those investment categories. As the m ...

... investments that may have greater potential, based on their ranking from a mathematical scoring process. In a declining market, bonds and money market investments are often identified by the models as having stronger price patterns, indicating money flowing into those investment categories. As the m ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.