July 16, 2014 - Morgan Stanley Locator

... purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security or other financial instrument, or to participate in any trading strategy. The individuals mentioned as the Portfolio Management Team are Financial Advisors with Morgan Stanley participating in ...

... purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security or other financial instrument, or to participate in any trading strategy. The individuals mentioned as the Portfolio Management Team are Financial Advisors with Morgan Stanley participating in ...

MF score-card in Q2: HDFC, SBI Mutual see

... selection and a streak of aggression in investment strategy. Only five of the top 50 gainers among stocks figured in the portfolios of mutual funds. Funds from HDFC Mutual and SBI Mutual notched up yet another good quarter. The former has an impressive presence in the diversified funds space; the la ...

... selection and a streak of aggression in investment strategy. Only five of the top 50 gainers among stocks figured in the portfolios of mutual funds. Funds from HDFC Mutual and SBI Mutual notched up yet another good quarter. The former has an impressive presence in the diversified funds space; the la ...

Internal rate of return RAB – Regulated Asset Base

... and an assessment of likely future debt costs. Debt costs were derived from yields on debt markets. Small companies were allowed a slightly higher cost of debt since small companies have access to less competitive and more limited sources of finance and are therefore more exposed to risks associated ...

... and an assessment of likely future debt costs. Debt costs were derived from yields on debt markets. Small companies were allowed a slightly higher cost of debt since small companies have access to less competitive and more limited sources of finance and are therefore more exposed to risks associated ...

Chapter 17 - ATP Real Estate School

... Advantages of Real Estate Investments • Rate of return • Tax advantages • Hedge against inflation – Property values have appreciated faster than CPI ...

... Advantages of Real Estate Investments • Rate of return • Tax advantages • Hedge against inflation – Property values have appreciated faster than CPI ...

Gerry Co - JustAnswer

... Desired sales = (fixed cost + net income)/ contribution margin per unit 30,000 = (60,000 + net income)/ 3 90,000 = 60,000 + net income Net income = 90,000 – 60,000 = 30,000 ...

... Desired sales = (fixed cost + net income)/ contribution margin per unit 30,000 = (60,000 + net income)/ 3 90,000 = 60,000 + net income Net income = 90,000 – 60,000 = 30,000 ...

Entrepreneurship

... money for your business, will have you pay interest on the amount borrowed. – Interest: The amount paid to “use” money for a period of time. • The original amount lent is called the principal • The percentage of the principal which must be paid annually as interest is called the interest rate. ...

... money for your business, will have you pay interest on the amount borrowed. – Interest: The amount paid to “use” money for a period of time. • The original amount lent is called the principal • The percentage of the principal which must be paid annually as interest is called the interest rate. ...

Banks and European exchanges seek to profit from Mifid Luke Jeffs

... compliance to profit-making after its introduction, according to sources and IT consultancy LogicaCMG, which this month published a paper entitled Mifid – an opportunity to profit. Lode Snykers, a managing director at LogicaCMG, said: “Mifid is much more than regulatory obligation, it is just like a ...

... compliance to profit-making after its introduction, according to sources and IT consultancy LogicaCMG, which this month published a paper entitled Mifid – an opportunity to profit. Lode Snykers, a managing director at LogicaCMG, said: “Mifid is much more than regulatory obligation, it is just like a ...

POWERFUL FORCES CREATE ATTRACTIVE MARKET CONDITIONS

... performance of the markets, any security, or any funds managed by Fred Alger Management, Inc. These views should not be considered a recommendation to purchase or sell securities. Individual securities or industries/sectors mentioned, if any, should be considered in the context of an overall portfol ...

... performance of the markets, any security, or any funds managed by Fred Alger Management, Inc. These views should not be considered a recommendation to purchase or sell securities. Individual securities or industries/sectors mentioned, if any, should be considered in the context of an overall portfol ...

1.0 Introduction The modern engineering science has perhaps led

... various activities in the value chain of an industry and did not introduce the concept of diversification. The Real Estate industry would also hold various activities in its value chain and it is an area very much worth investigating for the purpose of this paper with embedding the concept of risk a ...

... various activities in the value chain of an industry and did not introduce the concept of diversification. The Real Estate industry would also hold various activities in its value chain and it is an area very much worth investigating for the purpose of this paper with embedding the concept of risk a ...

Fixed income for defined benefit plan investing

... Whether DB investors achieve their plan’s investment goals depends upon a lot—starting with determining the most effective strategy, then selecting the most efficient investments to implement it all along the path to full funding. At Vanguard, these investors can depend on our investment-strategy pr ...

... Whether DB investors achieve their plan’s investment goals depends upon a lot—starting with determining the most effective strategy, then selecting the most efficient investments to implement it all along the path to full funding. At Vanguard, these investors can depend on our investment-strategy pr ...

Understanding Human Capital

... to their financial holdings—stocks, mutual funds, real estate, and other assets. This method, however, may not result in the most appropriate portfolio for every investor. ...

... to their financial holdings—stocks, mutual funds, real estate, and other assets. This method, however, may not result in the most appropriate portfolio for every investor. ...

AWM 2011 Second Quarter Newsletter

... banking system through the purchase of approximately $1 trillion in Treasury securi es, which in turn gave banks abundant funds to lend out to businesses and consumers. The Fed officials hoped it would prevent very low infla on from giving way to a Japan‐style ...

... banking system through the purchase of approximately $1 trillion in Treasury securi es, which in turn gave banks abundant funds to lend out to businesses and consumers. The Fed officials hoped it would prevent very low infla on from giving way to a Japan‐style ...

Incorporating Strategy Risk of Active Managers into Portfolio Risk and Optimization

... to active managers who make formal alpha forecasts for each investment period. It cannot be used by more fundamental managers, nor by “outsiders” such as pension funds who employ the managers. The second is that the property of breadth is notoriously difficult to actually measure, as it represents a ...

... to active managers who make formal alpha forecasts for each investment period. It cannot be used by more fundamental managers, nor by “outsiders” such as pension funds who employ the managers. The second is that the property of breadth is notoriously difficult to actually measure, as it represents a ...

Where to Raise Capital as a Certified B Corporation

... resources within the B Community to help your company raise capital. If you are interested in learning about B Corps that have already sucessfully raised capital and how your B Corp status can help you raise capital, see the the Attracting Investors section of our website. Equity Investment There ar ...

... resources within the B Community to help your company raise capital. If you are interested in learning about B Corps that have already sucessfully raised capital and how your B Corp status can help you raise capital, see the the Attracting Investors section of our website. Equity Investment There ar ...

Incorporating Extreme Weather Risks in Asset Management Planning

... • Top (Prioritized) Undermanaged Risks – Inability to appropriately manage culverts ...

... • Top (Prioritized) Undermanaged Risks – Inability to appropriately manage culverts ...

Joint stock company

... One of the key risks is the impact of macroeconomic processes on the Company, which may result in the increase of costs of the provided services and goods. Significant impact on the Company activities may be caused also by the regularity of macroeconomics both in Latvia and worldwide. Financial mana ...

... One of the key risks is the impact of macroeconomic processes on the Company, which may result in the increase of costs of the provided services and goods. Significant impact on the Company activities may be caused also by the regularity of macroeconomics both in Latvia and worldwide. Financial mana ...

Looking East with Hope

... Finally, India, the Philippines and Indonesia have consistently recorded a deficit on their trade account, implying that trade was a growth dampener, with that effect being particularly strong in the case of Indonesia. In sum, the perception that the leading economies of the Asian region are benefit ...

... Finally, India, the Philippines and Indonesia have consistently recorded a deficit on their trade account, implying that trade was a growth dampener, with that effect being particularly strong in the case of Indonesia. In sum, the perception that the leading economies of the Asian region are benefit ...

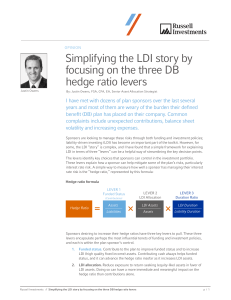

Simplifying the LDI story by focusing on the three DB hedge ratio

... investment, nor a solicitation of any type. The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional. Please remember that all investments carry some level of risk, including the potential ...

... investment, nor a solicitation of any type. The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional. Please remember that all investments carry some level of risk, including the potential ...

CNN Money

... That brings stock prices down, and sends bond prices higher. On the other hand, when interest rates come down again, once more with other things equal, then investors tend to shift money into stocks, reversing the previous trend. Note, however, that the operative phrase above is "other things equal. ...

... That brings stock prices down, and sends bond prices higher. On the other hand, when interest rates come down again, once more with other things equal, then investors tend to shift money into stocks, reversing the previous trend. Note, however, that the operative phrase above is "other things equal. ...

May 2014

... asset returns. For several of our clients, this has resulted in funding level triggers being reached with some outright de-risking and LDI coverage extension off the back of this. We also see clients looking to re-strike their yield triggers in line with the current forward curve. Very low levels of ...

... asset returns. For several of our clients, this has resulted in funding level triggers being reached with some outright de-risking and LDI coverage extension off the back of this. We also see clients looking to re-strike their yield triggers in line with the current forward curve. Very low levels of ...

It`s 3:00 am. Do you know where your economy is?

... assets which financed speculation and consumption instead of productive assets – the activity which Minsky called Ponzi Finance. The returns on these Ponzi Assets were then supercharged with leverage. The resulting high nominal returns on financial assets drew funds away from investment in plant and ...

... assets which financed speculation and consumption instead of productive assets – the activity which Minsky called Ponzi Finance. The returns on these Ponzi Assets were then supercharged with leverage. The resulting high nominal returns on financial assets drew funds away from investment in plant and ...

Government-Wide Financial Reporting

... State, General Purpose or Special Purpose Local Government that is legally separate and fiscally independent of other state or local governments ...

... State, General Purpose or Special Purpose Local Government that is legally separate and fiscally independent of other state or local governments ...

Foreign-investment-in-the

... What is FDI? Basically, FDI is a measure of the amount of business investment a country is receiving from abroad: “Investments made by a company based in one country, into a company or subsidiary in another country.” FDI does not include stock market flows; nor does it include remittances from natio ...

... What is FDI? Basically, FDI is a measure of the amount of business investment a country is receiving from abroad: “Investments made by a company based in one country, into a company or subsidiary in another country.” FDI does not include stock market flows; nor does it include remittances from natio ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.