Nobody plans to fail....

... Amount in savings x annual interest rate x time period equals the interest. I = PRT (Interest = Principal x Rate x Time)I $100 x 5% x 1 (1 year) 100 x .05 x 1 = $5.00 In one year you have $100 in principle plus $5.00 in interest for a total of $105 at the end of the year. ...

... Amount in savings x annual interest rate x time period equals the interest. I = PRT (Interest = Principal x Rate x Time)I $100 x 5% x 1 (1 year) 100 x .05 x 1 = $5.00 In one year you have $100 in principle plus $5.00 in interest for a total of $105 at the end of the year. ...

Why Should Older People Invest Less in Stocks Than Younger

... reasons. One reason is obvious: if investors can rebalance their portfolios over time, a long horizon is basically the same as a short horizon; what matters for investment decisions is the length of time between rebalancing, not the investment horizon itself. The other reason for the irrelevance of ...

... reasons. One reason is obvious: if investors can rebalance their portfolios over time, a long horizon is basically the same as a short horizon; what matters for investment decisions is the length of time between rebalancing, not the investment horizon itself. The other reason for the irrelevance of ...

Center for Economic Policy Analysis A Minskian Analysis of

... relative to firms’ cash flows, financial institutions become increasingly exposed to failures in asset performance (nonperforming loans). When cash flows into financial intermediaries fall, they become more risk averse and cut exposure by decreasing loans for consumption and investment (Minsky 1995b ...

... relative to firms’ cash flows, financial institutions become increasingly exposed to failures in asset performance (nonperforming loans). When cash flows into financial intermediaries fall, they become more risk averse and cut exposure by decreasing loans for consumption and investment (Minsky 1995b ...

Principles of Economics, Case and Fair,9e

... process thus involves not only estimating future benefits but also comparing them with the possible alternative uses of the funds required to undertake the project. At a minimum, those funds could earn interest in financial markets. ...

... process thus involves not only estimating future benefits but also comparing them with the possible alternative uses of the funds required to undertake the project. At a minimum, those funds could earn interest in financial markets. ...

FBLA ACCOUNTING II

... 23. Partners are required by law to split profits equally in a a. True partnership. 24. The balance sheet reports net income or net loss of the a. True business for the fiscal period. 25. The number of times the average amount of merchandise a. True inventory is sold during a specific time period is ...

... 23. Partners are required by law to split profits equally in a a. True partnership. 24. The balance sheet reports net income or net loss of the a. True business for the fiscal period. 25. The number of times the average amount of merchandise a. True inventory is sold during a specific time period is ...

McGraw Hill / Irwin 6

... A measure of the performance of one investment relative to another A ratio bigger than 1.0 indicates that on relative basis , the company is outperformed Example page 255 between ford and GM ...

... A measure of the performance of one investment relative to another A ratio bigger than 1.0 indicates that on relative basis , the company is outperformed Example page 255 between ford and GM ...

Trade Size and the Cross Section of Stock Returns

... higher for sales than for buys. The finding seems to suggest that large traders may not have trading advantage over small traders in the short term. Asthana et al. (2004) show that small traders do trade correctly on and benefit (more than large traders) from annual report filings on EDGAR. However, ...

... higher for sales than for buys. The finding seems to suggest that large traders may not have trading advantage over small traders in the short term. Asthana et al. (2004) show that small traders do trade correctly on and benefit (more than large traders) from annual report filings on EDGAR. However, ...

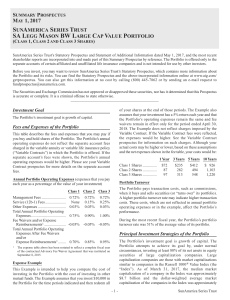

SAST - SA Legg Mason BW Large Cap Value

... to foreign markets involve additional risk. Foreign countries in which the Portfolio invests may have markets that are less liquid, less regulated and more volatile than U.S. markets. The value of the Portfolio’s investments may decline because of factors affecting the particular issuer as well as f ...

... to foreign markets involve additional risk. Foreign countries in which the Portfolio invests may have markets that are less liquid, less regulated and more volatile than U.S. markets. The value of the Portfolio’s investments may decline because of factors affecting the particular issuer as well as f ...

Amlak International for Real Estate Finance Company

... Income on financial assets comprising Murabaha placements, Murabaha and Ijara receivables are recognised on an effective profit basis (“EPR”). Income on Ijara mawsofa fi athemmah receivables are calculated on an EPR basis and are recognised in the income statement over the life of the underlying tra ...

... Income on financial assets comprising Murabaha placements, Murabaha and Ijara receivables are recognised on an effective profit basis (“EPR”). Income on Ijara mawsofa fi athemmah receivables are calculated on an EPR basis and are recognised in the income statement over the life of the underlying tra ...

How the Stock Market Works 2

... – Bond is a type of debt that a company issues to investors for a specified amount of time. – Stock Market is a general term used to describe all transactions involving the buying and selling of stocks and bonds issued by a company © Family Economics & Financial Education – Revised November 2004 – I ...

... – Bond is a type of debt that a company issues to investors for a specified amount of time. – Stock Market is a general term used to describe all transactions involving the buying and selling of stocks and bonds issued by a company © Family Economics & Financial Education – Revised November 2004 – I ...

New Tax Rules for Offshore Portfolio Investment in Shares

... paying low or no dividends. The investor could still, however, derive an economic gain from the investment via an increase in the share price. It was therefore quite easy to achieve a low tax or no tax result for direct portfolio investment in shares outside New Zealand. This could give higher inco ...

... paying low or no dividends. The investor could still, however, derive an economic gain from the investment via an increase in the share price. It was therefore quite easy to achieve a low tax or no tax result for direct portfolio investment in shares outside New Zealand. This could give higher inco ...

Chapter 6: Reporting and Interpreting Sales Revenue, Receivables

... 4. What items are commonly included in a bank reconciliation? 5. Apple Company’s bank statement showed an ending balance of $5,000. Items appearing in the bank reconciliation included: outstanding checks $500, deposits in transit $1,000, bank service charges $10, and Orange Company’s check erroneou ...

... 4. What items are commonly included in a bank reconciliation? 5. Apple Company’s bank statement showed an ending balance of $5,000. Items appearing in the bank reconciliation included: outstanding checks $500, deposits in transit $1,000, bank service charges $10, and Orange Company’s check erroneou ...

Understanding Personal Finances and Investments

... A personal budget is a specific plan for spending your income. You begin by estimating your income for a specific period—for example, next month. For most people, their major source of income is their salary. The second step is to list your expenditures for the same time period. Typical expenditures ...

... A personal budget is a specific plan for spending your income. You begin by estimating your income for a specific period—for example, next month. For most people, their major source of income is their salary. The second step is to list your expenditures for the same time period. Typical expenditures ...