Financial-Accounting-6th-Edition-Libby-Test-Bank

... 26. The assumption that the assets and liabilities of the business are accounted for on the books of the company but not included in the records of the owner is the A. unit-of-measure assumption. B. continuity assumption. C. historical cost principle. D. separate entity assumption. ...

... 26. The assumption that the assets and liabilities of the business are accounted for on the books of the company but not included in the records of the owner is the A. unit-of-measure assumption. B. continuity assumption. C. historical cost principle. D. separate entity assumption. ...

BERMUDA MONETARY AUTHORITY

... material risks, and self-determine the capital resources it would need to support its operations in accordance with the principle of proportionality. Minimally, the Board and senior management are required to certify that the CISSA: “... is an integral part of the insurer’s risk management framewo ...

... material risks, and self-determine the capital resources it would need to support its operations in accordance with the principle of proportionality. Minimally, the Board and senior management are required to certify that the CISSA: “... is an integral part of the insurer’s risk management framewo ...

Guidelines on Risk Based Capital Adequacy

... periods of stress. Besides, the reforms have a macro prudential focus also, addressing system wide risks, which can build up across the banking sector, as well as the procyclical amplification of these risks over time. These new global regulatory and supervisory standards mainly addressed the follow ...

... periods of stress. Besides, the reforms have a macro prudential focus also, addressing system wide risks, which can build up across the banking sector, as well as the procyclical amplification of these risks over time. These new global regulatory and supervisory standards mainly addressed the follow ...

Technological Progress, Industry Rivalry, and Stock Returns

... A society’s rate of technological progress is the key determinant of growth in the economy. Technological progress refers to the perpetual process through which new inventions make existing technologies obsolete (Schumpeter (1934)). A large body of work in industrial organization and on the economic ...

... A society’s rate of technological progress is the key determinant of growth in the economy. Technological progress refers to the perpetual process through which new inventions make existing technologies obsolete (Schumpeter (1934)). A large body of work in industrial organization and on the economic ...

Chapter 6 - NYU Stern School of Business

... The risk factors are external to the firm and include as many market and credit risk factors as possible (i.e., interest rate fluctuations, stock price movements, macroeconomic effects, etc.). The multi-factor model measures operational risk as 2 = (1 – R2)i2 where i2 is the variance of firm i’s ...

... The risk factors are external to the firm and include as many market and credit risk factors as possible (i.e., interest rate fluctuations, stock price movements, macroeconomic effects, etc.). The multi-factor model measures operational risk as 2 = (1 – R2)i2 where i2 is the variance of firm i’s ...

NEWMONT MINING CORP /DE/ (Form: 8-K

... Cash, Marketable Securities and Debt At the end of the third quarter, cash and cash equivalents totaled $1.4 billion and outstanding debt totaled $1.7 billion. Of the outstanding debt, $784.1 million was Batu Hijau debt that is non-recourse to Newmont. During the third quarter, outstanding debt decr ...

... Cash, Marketable Securities and Debt At the end of the third quarter, cash and cash equivalents totaled $1.4 billion and outstanding debt totaled $1.7 billion. Of the outstanding debt, $784.1 million was Batu Hijau debt that is non-recourse to Newmont. During the third quarter, outstanding debt decr ...

(2007), Paul Wilmott Introduces Quantitative

... 23.3 Risky bonds 23.4 Modeling the risk of default 23.5 The Poisson process and the instantaneous risk of default 23.5.1 A note on hedging 23.6 Time-dependent intensity and the term structure of default 23.7 Stochastic risk of default ...

... 23.3 Risky bonds 23.4 Modeling the risk of default 23.5 The Poisson process and the instantaneous risk of default 23.5.1 A note on hedging 23.6 Time-dependent intensity and the term structure of default 23.7 Stochastic risk of default ...

The Risky Capital of Emerging Markets – A Long-Run

... the former on the latter amounts to 55% of that observed in the data. Finally, to gain additional insights behind the risk-return relationship, we decompose predicted returns into their short- and long-run risk components. Our findings here are striking: risk premia stemming solely from short-run r ...

... the former on the latter amounts to 55% of that observed in the data. Finally, to gain additional insights behind the risk-return relationship, we decompose predicted returns into their short- and long-run risk components. Our findings here are striking: risk premia stemming solely from short-run r ...

... were Public companies had significantly higher deal values than those that were private. Using 3day event window analysis, returns of acquiring companies were shown to be slightly negative and significantly less than the S&P composite index returns over the same period. Previous studies suggest that ...

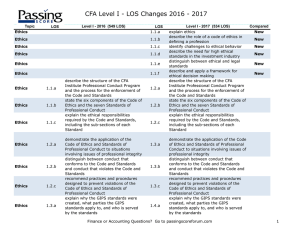

CFA Level I - LOS Changes 2016 - 2017

... describe the scope of the GIPS standards with respect to an investment firm’s definition and historical performance record explain how the GIPS standards are implemented in countries with existing standards for performance reporting and describe the appropriate response when the GIPS standards and l ...

... describe the scope of the GIPS standards with respect to an investment firm’s definition and historical performance record explain how the GIPS standards are implemented in countries with existing standards for performance reporting and describe the appropriate response when the GIPS standards and l ...

Exam: 20 MC, 1 essay question. Economic backdrop:

... partner in a partnership is an agent of the partnership for the purpose of its business. An act of a partner that’s apparently in the ordinary course of business binds the partnership, unless the partner had no authority to act for the partnership in the particular matter and the third party knew or ...

... partner in a partnership is an agent of the partnership for the purpose of its business. An act of a partner that’s apparently in the ordinary course of business binds the partnership, unless the partner had no authority to act for the partnership in the particular matter and the third party knew or ...

Slices - personal.kent.edu

... Line of credit – prearranged agreement with a bank that allows the firm to borrow up to a certain amount on a short-term basis Committed – formal legal arrangement that may require a commitment fee and generally has a floating interest rate Non-committed – informal agreement with a bank that is ...

... Line of credit – prearranged agreement with a bank that allows the firm to borrow up to a certain amount on a short-term basis Committed – formal legal arrangement that may require a commitment fee and generally has a floating interest rate Non-committed – informal agreement with a bank that is ...

flowers foods, inc. - corporate

... “intend,” “may,” “plan,” “predict,” “project,” “should,” “will,” “would,” “is likely to,” “is expected to” or “will continue,” or the negative of these terms or other comparable terminology. These forward-looking statements are based upon assumptions we believe are reasonable. Forward-looking statem ...

... “intend,” “may,” “plan,” “predict,” “project,” “should,” “will,” “would,” “is likely to,” “is expected to” or “will continue,” or the negative of these terms or other comparable terminology. These forward-looking statements are based upon assumptions we believe are reasonable. Forward-looking statem ...

Financial statements of limited companies – profit and loss account

... In Chapter 2 we looked at how to prepare simple financial statements from transactions carried out by a business during an accounting period. We then looked in a little more detail at the first of these financial statements, namely the balance sheet. This chapter will be concerned with the second of ...

... In Chapter 2 we looked at how to prepare simple financial statements from transactions carried out by a business during an accounting period. We then looked in a little more detail at the first of these financial statements, namely the balance sheet. This chapter will be concerned with the second of ...

performance analysis for the two-minute portfolio in both canadian

... to-volatility ratio to evaluate a portfolio’s excess return over the risk-free rate to the systematic risk, which could be estimated by regressing the portfolio return to the benchmark. Sharpe (1966) introduces the reward-to-variability ratio. It measures the excess return adjusted for the degree o ...

... to-volatility ratio to evaluate a portfolio’s excess return over the risk-free rate to the systematic risk, which could be estimated by regressing the portfolio return to the benchmark. Sharpe (1966) introduces the reward-to-variability ratio. It measures the excess return adjusted for the degree o ...