* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

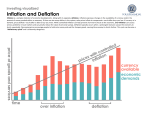

Download Deflation and real estate

United States housing bubble wikipedia , lookup

Greeks (finance) wikipedia , lookup

Business valuation wikipedia , lookup

Real estate broker wikipedia , lookup

Pensions crisis wikipedia , lookup

Financialization wikipedia , lookup

Present value wikipedia , lookup

Stock selection criterion wikipedia , lookup

Hyperinflation wikipedia , lookup

Financial economics wikipedia , lookup