NBER WORKING PAPER SERIES TAXES, REGULATIONS, AND ASSET PRICES Ellen R. McGrattan

... two main extensions. First, we allow for two sectors — corporate and noncorporate. Even though our primary focus is on corporate equity, the corporate sector accounts for less than 60 percent of U.S. value added and has only one-third of tangible assets. Second, we include the primary sources of U.S ...

... two main extensions. First, we allow for two sectors — corporate and noncorporate. Even though our primary focus is on corporate equity, the corporate sector accounts for less than 60 percent of U.S. value added and has only one-third of tangible assets. Second, we include the primary sources of U.S ...

Homeownership and Investment in Risky Assets in Europe

... developed mortgage markets, while the seven bank-based economies have less developed mortgage markets. The SHARE provides extensive information on household income and wealth. Therefore, the SHARE is an important source of data when examining a household’s portfolio. The 2004 SHARE surveyed 32,405 i ...

... developed mortgage markets, while the seven bank-based economies have less developed mortgage markets. The SHARE provides extensive information on household income and wealth. Therefore, the SHARE is an important source of data when examining a household’s portfolio. The 2004 SHARE surveyed 32,405 i ...

***** 1

... values at that date. Any difference between the cost of the business combination and the acquirer’s interest in the net fair value of the identifiable assets, liabilities and provisions for contingent liabilities so recognized shall be accounted as ‘negative goodwill’ or gain from bargain purchase. ...

... values at that date. Any difference between the cost of the business combination and the acquirer’s interest in the net fair value of the identifiable assets, liabilities and provisions for contingent liabilities so recognized shall be accounted as ‘negative goodwill’ or gain from bargain purchase. ...

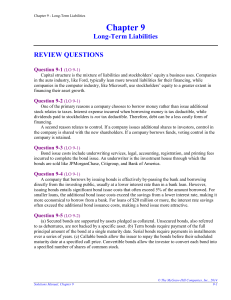

Moore lcr08 7952932 en

... We also …nd that both the returns on equity and money are lower than the rate of time preference. This means that agents such as workers, who don’t anticipate having investment opportunities, will choose to hold neither equity nor money. They will simply consume their labour income, period by period ...

... We also …nd that both the returns on equity and money are lower than the rate of time preference. This means that agents such as workers, who don’t anticipate having investment opportunities, will choose to hold neither equity nor money. They will simply consume their labour income, period by period ...

The Accounting Equation

... Says that income can be determined for any period of time (month, quarter, year, etc.) Any accounting period of twelve months is called a FISCAL YEAR ...

... Says that income can be determined for any period of time (month, quarter, year, etc.) Any accounting period of twelve months is called a FISCAL YEAR ...

printmgr file - Goldman Sachs

... wide range of financial services to a substantial and diversified client base that includes corporations, financial institutions, governments and individuals. Founded in 1869, the firm is headquartered in New York and maintains offices in all major financial centers around the world. Cautionary Note ...

... wide range of financial services to a substantial and diversified client base that includes corporations, financial institutions, governments and individuals. Founded in 1869, the firm is headquartered in New York and maintains offices in all major financial centers around the world. Cautionary Note ...

Statement of Financial Condition

... Cash and cash equivalents are defined as highly liquid investments, with an original maturity of three months or less when purchased. At June 30, 2016, the Company had cash equivalents of $9,656 in demand deposit accounts at cost, which approximates fair value. Financial Instruments Financial instru ...

... Cash and cash equivalents are defined as highly liquid investments, with an original maturity of three months or less when purchased. At June 30, 2016, the Company had cash equivalents of $9,656 in demand deposit accounts at cost, which approximates fair value. Financial Instruments Financial instru ...

Fair Value Accounting: Information or Confusion for Financial Markets?

... stock market investors (see Barth et al., 2001a, for an early review of the evidence). However, most of the evidence relies on valuation models that show an association between FVA-based assets and a firm’s stock price, which does not reveal much about the underlying process by which FVAderived info ...

... stock market investors (see Barth et al., 2001a, for an early review of the evidence). However, most of the evidence relies on valuation models that show an association between FVA-based assets and a firm’s stock price, which does not reveal much about the underlying process by which FVAderived info ...

BERKLEY WR CORP (Form: DEFA14A, Received

... decision-making that is not aligned with long-term stockholders’ interests; We maintain a strong long-term incentive program with features that are stricter than what are typical at most companies, including longer performance and vesting periods. In particular: o Long-Term Incentive Plan (“LTIP ...

... decision-making that is not aligned with long-term stockholders’ interests; We maintain a strong long-term incentive program with features that are stricter than what are typical at most companies, including longer performance and vesting periods. In particular: o Long-Term Incentive Plan (“LTIP ...

5information about the company, its share capital and stock

... Firstly, the Board of Directors is seeking authorization to issue new shares for cash and to grant newly issued shares or share equivalents to employees, in accordance with the law including Articles L.225-129, L.225-129-6 and L.225-138 of the French Commercial Code and Article L.3332-18 of the Fren ...

... Firstly, the Board of Directors is seeking authorization to issue new shares for cash and to grant newly issued shares or share equivalents to employees, in accordance with the law including Articles L.225-129, L.225-129-6 and L.225-138 of the French Commercial Code and Article L.3332-18 of the Fren ...

Service Business - Computer Basics a Review

... involved in getting the goods delivered to the company. This additional cost can be dealt with in two different ways: 1. If the Transportation Costs are directly related to inventory a separate expense is not need and the extra cost is charged off to the asset inventory which will eventually be writ ...

... involved in getting the goods delivered to the company. This additional cost can be dealt with in two different ways: 1. If the Transportation Costs are directly related to inventory a separate expense is not need and the extra cost is charged off to the asset inventory which will eventually be writ ...

Accruals, Net Stock Issues and Value-Glamour Anomalies

... Since Graham and Dodd (1934), many studies have argued that value firms exhibit higher ...

... Since Graham and Dodd (1934), many studies have argued that value firms exhibit higher ...

Advances in Environmental Biology study: Shasta Holding)

... affiliated firms always meet the demands of group firms and by keeping their legal entity can maximize the share of shareholders [4]. Return rate of an investment is a concept with different meanings from the view of various investors. Some firms search for cash short term return and give less value ...

... affiliated firms always meet the demands of group firms and by keeping their legal entity can maximize the share of shareholders [4]. Return rate of an investment is a concept with different meanings from the view of various investors. Some firms search for cash short term return and give less value ...

docx - ICEBUSS

... An enterprise must be want profitability high.To companies must keep profitabilitasnya remain stable. So the purpose company to achieved profitability optimal can be achieved. Profitability can provide guidance useful in judging keefektivan of the operation of a company, raising the profitability go ...

... An enterprise must be want profitability high.To companies must keep profitabilitasnya remain stable. So the purpose company to achieved profitability optimal can be achieved. Profitability can provide guidance useful in judging keefektivan of the operation of a company, raising the profitability go ...

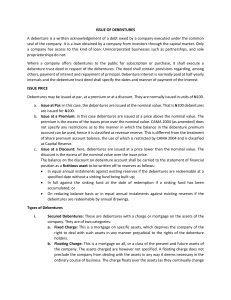

Print this article - The Clute Institute

... The Liberty Company Bond is the equivalent of a U.S. Savings Bond. Because the bond has only one nonzero interest rate, students come to understand both the nature and effect of both the market and contract rates of interest rate. The author asks which students received U.S. Savings Bonds as graduat ...

... The Liberty Company Bond is the equivalent of a U.S. Savings Bond. Because the bond has only one nonzero interest rate, students come to understand both the nature and effect of both the market and contract rates of interest rate. The author asks which students received U.S. Savings Bonds as graduat ...

Banco Bradesco S.A - University of Oregon Investment Group

... a domestic central bank to satisfy requirements, but most deposits are used to create loans that generate revenue. In today’s economy, banks have become vastly more sophisticated and have developed instruments for debt and equity that generates generous amounts of profits. The banking industry is hi ...

... a domestic central bank to satisfy requirements, but most deposits are used to create loans that generate revenue. In today’s economy, banks have become vastly more sophisticated and have developed instruments for debt and equity that generates generous amounts of profits. The banking industry is hi ...