130510496X_441953

... Different types of derivatives Presuppositions for financial markets, risk preferences, risk-return tradeoff, and market efficiency Theoretical fair value Arbitrage, storage, and delivery The role of derivative markets Criticisms of derivatives Ethics ...

... Different types of derivatives Presuppositions for financial markets, risk preferences, risk-return tradeoff, and market efficiency Theoretical fair value Arbitrage, storage, and delivery The role of derivative markets Criticisms of derivatives Ethics ...

Presentation

... which in turn affects what we measure • The current debate on the consequences and wisdom of returning to current values could benefit greatly from consideration of reflexivity • Financial derivatives: why is it so difficult to devise ...

... which in turn affects what we measure • The current debate on the consequences and wisdom of returning to current values could benefit greatly from consideration of reflexivity • Financial derivatives: why is it so difficult to devise ...

Fund Manager Sector Minimum Investment Fund Size

... The Total Expense Ra�o (TER) is the annualised percentage of the Fund’s average assets under management that has been used to pay the Fund’s actual expenses over the past three years. This percentage of the average Net Asset Value of the por�olio was incurred as charges, levies and fees related to t ...

... The Total Expense Ra�o (TER) is the annualised percentage of the Fund’s average assets under management that has been used to pay the Fund’s actual expenses over the past three years. This percentage of the average Net Asset Value of the por�olio was incurred as charges, levies and fees related to t ...

control premiums and the eeeectiveness oe corporate governance

... the difference between the price per share paid by the acquiring party and the price per share prevailing on the market should reflect the differential payoff accruing to the controlling shareholder. And after some adjustments (discussed below), this difference can be used as a measure of the privat ...

... the difference between the price per share paid by the acquiring party and the price per share prevailing on the market should reflect the differential payoff accruing to the controlling shareholder. And after some adjustments (discussed below), this difference can be used as a measure of the privat ...

Document

... instrument to be hedged against past price changes in a futures instrument. The number of futures contracts to be purchased or sold, (NF), is given by: ...

... instrument to be hedged against past price changes in a futures instrument. The number of futures contracts to be purchased or sold, (NF), is given by: ...

Chapter 4

... Most small business have a times interest earned ratio in the 4 to 5 times range. How do we interpret that ratio? Most small businesses have total asset turnover (TATO) ratios greater than 2 times. Is a business okay with a TATO ratio of 1 time? How do we interpret a Gross Profit Margin of 46%? ...

... Most small business have a times interest earned ratio in the 4 to 5 times range. How do we interpret that ratio? Most small businesses have total asset turnover (TATO) ratios greater than 2 times. Is a business okay with a TATO ratio of 1 time? How do we interpret a Gross Profit Margin of 46%? ...

Guaranteed returns with the benefit of Tax-Deferral

... clients need it most. Your clients may withdraw any or all of their account value without surrender charge if they are first diagnosed with a fatal illness after the contract is issued or are admitted to a Medical Care Facility after the issue date and remain confined there until the later of the fi ...

... clients need it most. Your clients may withdraw any or all of their account value without surrender charge if they are first diagnosed with a fatal illness after the contract is issued or are admitted to a Medical Care Facility after the issue date and remain confined there until the later of the fi ...

The Effect of the Financial Leverage on the Profitability in the

... financial market increased from 163 companies in 2000 to become 277 in 2010, all of them working in different economic sectors (Amman Stock Exchange, 2011). Within the scope of modernization of capital market in Jordan, the Jordanian government validated a number of laws in 1997 which aim at develop ...

... financial market increased from 163 companies in 2000 to become 277 in 2010, all of them working in different economic sectors (Amman Stock Exchange, 2011). Within the scope of modernization of capital market in Jordan, the Jordanian government validated a number of laws in 1997 which aim at develop ...

related linked diversification strategy, only limited links or

... Efficient Internal Capital Market Allocation Access to information is the main reason ...

... Efficient Internal Capital Market Allocation Access to information is the main reason ...

ALLAN GRAY BALANCED FUND

... down as well as up and past performance is not necessarily a guide to future performance. Movements in exchange rates may also cause the value of underlying international investments to go up or down. The Management Company does not provide any guarantee regarding the capital or the performance of t ...

... down as well as up and past performance is not necessarily a guide to future performance. Movements in exchange rates may also cause the value of underlying international investments to go up or down. The Management Company does not provide any guarantee regarding the capital or the performance of t ...

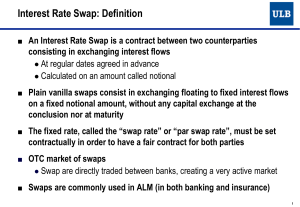

Interest Rate Swap

... ■ More complex contracts can be concluded in the OTC market, where e.g. ● The notional vary with time ● The contract is not spot but forward ● One or both legs are function of more than one reference rates (structured swaps) ...

... ■ More complex contracts can be concluded in the OTC market, where e.g. ● The notional vary with time ● The contract is not spot but forward ● One or both legs are function of more than one reference rates (structured swaps) ...

Derivatives

... Short Call: Agreed to sell the other party the right to buy the underlying asset, if the other party exercises the option you deliver the asset. Short Put: Agreed to buy the underlying asset from the other party if they decide to exercise the option. ...

... Short Call: Agreed to sell the other party the right to buy the underlying asset, if the other party exercises the option you deliver the asset. Short Put: Agreed to buy the underlying asset from the other party if they decide to exercise the option. ...

View Sample

... name suggests, derivatives are “derived” from some more fundamental financial instruments known as underlying assets. Before we start our journey of derivatives, we need to understand the underlying assets. In this first lesson we focus on stocks. ...

... name suggests, derivatives are “derived” from some more fundamental financial instruments known as underlying assets. Before we start our journey of derivatives, we need to understand the underlying assets. In this first lesson we focus on stocks. ...

This PDF is a selection from a published volume from... National Bureau of Economic Research

... ally on a fairly different topic. There’s very little overlap. Its title is “Struggling to Understand the Stock Market.” It does one thing that is routine that I won’t dwell on. It makes the case from financial economics that we really have no reason to condemn the stock market as irrational. If it w ...

... ally on a fairly different topic. There’s very little overlap. Its title is “Struggling to Understand the Stock Market.” It does one thing that is routine that I won’t dwell on. It makes the case from financial economics that we really have no reason to condemn the stock market as irrational. If it w ...

Analysis and Interpretation of Financial Statements

... financial statement item from one period to the next ...

... financial statement item from one period to the next ...

Mr Madoff`s Amazing Returns: An analysis of the Split Strike

... average monthly return for the strategy 84.00 basis points corresponding to an annual average return of 10.59%. Investors clearly put a very high value on this combination of high returns and low volatility given the popularity of Madoff’s funds. If these returns were in fact achievable they would d ...

... average monthly return for the strategy 84.00 basis points corresponding to an annual average return of 10.59%. Investors clearly put a very high value on this combination of high returns and low volatility given the popularity of Madoff’s funds. If these returns were in fact achievable they would d ...

4-5 Practice A,B,C packet

... varies directly with the amount of money in the account. A certain bank offers a 2% savings rate. Write a direct variation equation for the amount of interest y earned on a balance of x. Then graph. ________________________________________ ...

... varies directly with the amount of money in the account. A certain bank offers a 2% savings rate. Write a direct variation equation for the amount of interest y earned on a balance of x. Then graph. ________________________________________ ...