PDF - BTR Capital Management

... typical response we heard was that we simply didn’t understand. It was a new era, and historical comparisons were thought to be of little relevance – this time was different. Or So They Thought Consider the change, from then till now. Contrary to expectations, bonds have performed quite well since e ...

... typical response we heard was that we simply didn’t understand. It was a new era, and historical comparisons were thought to be of little relevance – this time was different. Or So They Thought Consider the change, from then till now. Contrary to expectations, bonds have performed quite well since e ...

Chp. 1.1 Simple Interest

... Fixed Interest Rate (r): An interest rate that is guaranteed not to change during the term of an investment or loan. ...

... Fixed Interest Rate (r): An interest rate that is guaranteed not to change during the term of an investment or loan. ...

30 June 2007 Balance Nature strives for balance. In the wild, lions

... their future earnings, raise capital or have other goals made possible by a public listing. Investors ...

... their future earnings, raise capital or have other goals made possible by a public listing. Investors ...

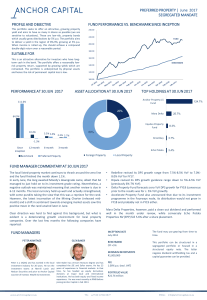

fund performance vs. benchmark since inception

... PREFERRED PROPERTY | June 2017 SEGREGATED MANDATE PROFILE AND OBJECTIVE ...

... PREFERRED PROPERTY | June 2017 SEGREGATED MANDATE PROFILE AND OBJECTIVE ...

The World Economy

... with a 100 basis point monetary tightening might knock ½-¾ of a percentage point off growth during that period. – US scenario: 10% real fall in house prices over two years with a 200 basis point monetary tightening might achieve about the same in the USA. • However, there is scope for monetary easin ...

... with a 100 basis point monetary tightening might knock ½-¾ of a percentage point off growth during that period. – US scenario: 10% real fall in house prices over two years with a 200 basis point monetary tightening might achieve about the same in the USA. • However, there is scope for monetary easin ...

Chapter 1 PPP

... increase in value, and where funds can be placed with the expectation that it will generate positive income and/or that its value will be preserved or increased Return: the reward for owning an investment ...

... increase in value, and where funds can be placed with the expectation that it will generate positive income and/or that its value will be preserved or increased Return: the reward for owning an investment ...

Form 8-K - Value Line

... $208,464,000 of Shareholders' Equity as of our last reporting date, January 31, 2004. "The purpose of the dividend is to return to all shareholders, in the form of cash, a significant portion of the earnings of the Company from our successful operations over the past number of years, at a time when ...

... $208,464,000 of Shareholders' Equity as of our last reporting date, January 31, 2004. "The purpose of the dividend is to return to all shareholders, in the form of cash, a significant portion of the earnings of the Company from our successful operations over the past number of years, at a time when ...

DCG: Metodología para Despliegue Estratégico y Control de

... making wireless delivery of voice and data the most promising option. As teledensity grows voice is going to become a commodity. Focus is over data; voice and data, along with all related and converged devices. VoIP is bringing down tariffs in those countries where it has been legalized. ...

... making wireless delivery of voice and data the most promising option. As teledensity grows voice is going to become a commodity. Focus is over data; voice and data, along with all related and converged devices. VoIP is bringing down tariffs in those countries where it has been legalized. ...

Banking on Analytics, Dr A S Ramasastri, Director, IDRBT

... Analytics Center at IDRBT • Lab exclusively for analytics has been set up at IDRBT a few years back • Banks have training programs and experiments conducted at IDRBT lab – both at individual bank level and bank group level • The areas of focus are generally CRM, risk management and fraud analytics ...

... Analytics Center at IDRBT • Lab exclusively for analytics has been set up at IDRBT a few years back • Banks have training programs and experiments conducted at IDRBT lab – both at individual bank level and bank group level • The areas of focus are generally CRM, risk management and fraud analytics ...

Investment Policy - OutServe-SLDN

... and diligence under the circumstances prevailing from time to time that a prudent expert acting in a like capacity and familiar with such matters would use in the investment of funds of like characters with similar aims. Reporting: OS/SLDN will prepare at least quarterly, or when requested by the Bo ...

... and diligence under the circumstances prevailing from time to time that a prudent expert acting in a like capacity and familiar with such matters would use in the investment of funds of like characters with similar aims. Reporting: OS/SLDN will prepare at least quarterly, or when requested by the Bo ...

01-0440 SmallCapGrSAR0301.lyt

... The performance gap began to widen in March and continued through the end of this most recent June quarter. The current investment climate is reminiscent of late 1999 and early 2000 when the market peaked and technology stocks, with little hope for positive earnings, were being driven higher. A stud ...

... The performance gap began to widen in March and continued through the end of this most recent June quarter. The current investment climate is reminiscent of late 1999 and early 2000 when the market peaked and technology stocks, with little hope for positive earnings, were being driven higher. A stud ...

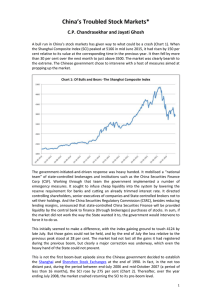

FINANCIAL CRISIS

... Credit crisis occurred around the world Resulted from Dot Com Bubbles Federal reserves kept short-term interest rate This condition coincided with a global savings surplus Due to high savings that accumulated large reserves Global interest rate decreased Investors were alarmed of this ...

... Credit crisis occurred around the world Resulted from Dot Com Bubbles Federal reserves kept short-term interest rate This condition coincided with a global savings surplus Due to high savings that accumulated large reserves Global interest rate decreased Investors were alarmed of this ...

FT: Hope remains for a little more resilience

... investments in unlisted funds looking for prime assets in the region, according to Adrian Baker, of CBRE Investors. "Such opportunities should produce strong annualised returns while taking on minimal risk," he says. "Markets with more risk exposure, such as India, will see less investor appetite in ...

... investments in unlisted funds looking for prime assets in the region, according to Adrian Baker, of CBRE Investors. "Such opportunities should produce strong annualised returns while taking on minimal risk," he says. "Markets with more risk exposure, such as India, will see less investor appetite in ...

Canadian Fixed Income 2017 Outlook

... Towards year-end, however, yields began to rise as perceptions that central banks may have reached the limits of their ability to influence economic activity led to calls for more extensive fiscal stimulus. This trend was further supported by the election of Donald Trump in the United States. Anothe ...

... Towards year-end, however, yields began to rise as perceptions that central banks may have reached the limits of their ability to influence economic activity led to calls for more extensive fiscal stimulus. This trend was further supported by the election of Donald Trump in the United States. Anothe ...

Financial and Fiscal Reforms in Support of China’s Rebalancing David Dollar

... to finance long gestation infrastructure projects, putting local finance on a risky foundation. Furthermore, the system is not transparent. There are widely differing estimates of the total local debt. Citizens do not have a good picture of all of the expenditures, including investment, by their loc ...

... to finance long gestation infrastructure projects, putting local finance on a risky foundation. Furthermore, the system is not transparent. There are widely differing estimates of the total local debt. Citizens do not have a good picture of all of the expenditures, including investment, by their loc ...

Downlaod File

... the value of research and development new products that are being developed but which are not yet marketable, the value of the intellectual capital of its workforce the ability of the companies’ employees to come up with new ideas and products in the fast changing technology industry, and the value ...

... the value of research and development new products that are being developed but which are not yet marketable, the value of the intellectual capital of its workforce the ability of the companies’ employees to come up with new ideas and products in the fast changing technology industry, and the value ...

Causes of the Depression

... Cha-Ching when stock prices continued rising. Epic fail when stock prices fell. Margin call issued by broker when price fell. The investor was required to repay the loan immediately. Investors were sensitive to stock prices falling. ...

... Cha-Ching when stock prices continued rising. Epic fail when stock prices fell. Margin call issued by broker when price fell. The investor was required to repay the loan immediately. Investors were sensitive to stock prices falling. ...

BG Perspective 2

... As widely reported, the stock market continues to swing wildly – down 30-40% since early September. Besides the losses to investors, the downward swings have pushed the stock values of many seemingly viable companies near bankruptcy levels as investors run away from any perceptions of risky situatio ...

... As widely reported, the stock market continues to swing wildly – down 30-40% since early September. Besides the losses to investors, the downward swings have pushed the stock values of many seemingly viable companies near bankruptcy levels as investors run away from any perceptions of risky situatio ...

Collective Investments

... therefore be above or below the value of all the assets in the fund. This is called trading at a ‘premium’ or ‘discount’. In addition to the money invested by shareholders, the investment trust can borrow to make additional ...

... therefore be above or below the value of all the assets in the fund. This is called trading at a ‘premium’ or ‘discount’. In addition to the money invested by shareholders, the investment trust can borrow to make additional ...

Justification for the 09.05.2017 decision by the FCMC Board on

... export and investment volumes and private consumption growth. Major risks for economic growth are related to external uncertainty factors and global political situation4. Capital adequacy ratios continue to substantially exceed both – minimum and total capital requirements, as well as an average EU ...

... export and investment volumes and private consumption growth. Major risks for economic growth are related to external uncertainty factors and global political situation4. Capital adequacy ratios continue to substantially exceed both – minimum and total capital requirements, as well as an average EU ...

Emerging markets in 2017

... This information is for Investment Professionals only and should not be relied upon by private investors. It must not be reproduced or circulated without prior permission . This communication is not directed at, and must not be acted upon by persons inside the United States and is otherwise only dir ...

... This information is for Investment Professionals only and should not be relied upon by private investors. It must not be reproduced or circulated without prior permission . This communication is not directed at, and must not be acted upon by persons inside the United States and is otherwise only dir ...

Against this background GUE/NGL rejects the so called Juncker

... cronyism while preserving the advantages of decentralised investment which is often better targeted. Even within the existing legal framework, such a program could be financed through the European Investment Bank (EIB) or national promotional banks recycling ample liquidity on financial markets in ...

... cronyism while preserving the advantages of decentralised investment which is often better targeted. Even within the existing legal framework, such a program could be financed through the European Investment Bank (EIB) or national promotional banks recycling ample liquidity on financial markets in ...

The Invisible Hand and the Banking Trade

... value of the thrift, they will do so, even if this requires that they invest in projects with negative net present value. … [But] when they can take out more than the thrift is worth, they cause the thrift to default on its obligations in period 2. If they are going to default, the owners do not car ...

... value of the thrift, they will do so, even if this requires that they invest in projects with negative net present value. … [But] when they can take out more than the thrift is worth, they cause the thrift to default on its obligations in period 2. If they are going to default, the owners do not car ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.