The Roots of the Global Financial Crisis

... systematic extraction of financial profits out of wages and salaries, is one of the root causes of the current crisis (see Lapavitsas 2009). Why were commercial banks motivated to generate financial profits from such new sources? The groundwork was laid by financial deregulation, which began in the ...

... systematic extraction of financial profits out of wages and salaries, is one of the root causes of the current crisis (see Lapavitsas 2009). Why were commercial banks motivated to generate financial profits from such new sources? The groundwork was laid by financial deregulation, which began in the ...

Hosted Core Banking Solution

... space. Tata Communications serves its customers from its offices in 80 cities in 40 countries worldwide. Tata Communications has a strategic investment in South African operator Neotel, providing the company with a strong anchor to build an African footprint. The number one global international who ...

... space. Tata Communications serves its customers from its offices in 80 cities in 40 countries worldwide. Tata Communications has a strategic investment in South African operator Neotel, providing the company with a strong anchor to build an African footprint. The number one global international who ...

The difference between a recession and a depression? "It`s a

... ‘Staying Put still the best option’ We know we have said it before, but we will say it again…. staying put is still the best option for most investors. Those who panic and cash in growth assets will be doing so at what is arguably close to or at the bottom of the market. Example: If your equity port ...

... ‘Staying Put still the best option’ We know we have said it before, but we will say it again…. staying put is still the best option for most investors. Those who panic and cash in growth assets will be doing so at what is arguably close to or at the bottom of the market. Example: If your equity port ...

The City of Neenah Municipal Museum Fund

... Foreign equities are allowable to the extent they are in a well-diversified foreign equity fund and represent a range of 5% to 15% of total equities. Should the equity exposure exceed the maximum limitation at the end of any quarter, the equity exposure will be reviewed and reduced where appropriat ...

... Foreign equities are allowable to the extent they are in a well-diversified foreign equity fund and represent a range of 5% to 15% of total equities. Should the equity exposure exceed the maximum limitation at the end of any quarter, the equity exposure will be reviewed and reduced where appropriat ...

CRISIS WILL NOT HALT INVESTMENT Dr Igor Lukšić, Deputy Prime

... In such changed circumstances, we are aware of the social and economic significance of KAP for Montenegro with a view of several large companies, primarily the Railway, the Port of Bar, Bauxite Mines, as well as a number of small and medium-size companies directly linked to and dependant on the oper ...

... In such changed circumstances, we are aware of the social and economic significance of KAP for Montenegro with a view of several large companies, primarily the Railway, the Port of Bar, Bauxite Mines, as well as a number of small and medium-size companies directly linked to and dependant on the oper ...

Role of the Reserve Bank in Promoting Financial Stability

... achievement of at least one out of four criteria: proportion of non-performing loans to total banking system assets exceeds 10%, or the public bailout cost exceeds 2% of GDP, or large scale bank nationalization, or extensive bank runs are visible and if not, emergency government intervention ...

... achievement of at least one out of four criteria: proportion of non-performing loans to total banking system assets exceeds 10%, or the public bailout cost exceeds 2% of GDP, or large scale bank nationalization, or extensive bank runs are visible and if not, emergency government intervention ...

types of investments - hrsbstaff.ednet.ns.ca

... A term deposit and a GIC used to be somewhat different but now the words are often used interchangeably Usually bought at a bank Typically the first kind of investment someone makes Similar to a savings account; 100% secure Good investment for an extra money you won’t need anytime soon or ...

... A term deposit and a GIC used to be somewhat different but now the words are often used interchangeably Usually bought at a bank Typically the first kind of investment someone makes Similar to a savings account; 100% secure Good investment for an extra money you won’t need anytime soon or ...

central bank of cyprus banking supervision and regulation division

... establishment of a branch or by way of the provision of services on a crossborder basis, provided that the memorandum and articles of association of the subsidiary of the bank permit the carrying on of these activities and the subsidiary fulfils each of the following conditions: ...

... establishment of a branch or by way of the provision of services on a crossborder basis, provided that the memorandum and articles of association of the subsidiary of the bank permit the carrying on of these activities and the subsidiary fulfils each of the following conditions: ...

weekly commodity research report

... (a) 24 Carat Financial Services or its associates have not received any compensation from the subject company in the past twelve months; (b) 24 Carat Financial Services or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months; ( ...

... (a) 24 Carat Financial Services or its associates have not received any compensation from the subject company in the past twelve months; (b) 24 Carat Financial Services or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months; ( ...

Market Volatility: a Friend of Active Management?

... Passive investing is based on the premise that markets are efficient. Therefore, any and all news or data is reflected in a security’s current price; so there is virtually no benefit to security analysis, or managers actively building portfolios. This entire notion assumes the following: 1. Informat ...

... Passive investing is based on the premise that markets are efficient. Therefore, any and all news or data is reflected in a security’s current price; so there is virtually no benefit to security analysis, or managers actively building portfolios. This entire notion assumes the following: 1. Informat ...

2. Predictability of asset returns Deterministic and Random Walk

... in a portfolio with several different assets. A third step was the Arbitrage pricing theory (APT) of Ross (1976), being a generalization of the latter. ...

... in a portfolio with several different assets. A third step was the Arbitrage pricing theory (APT) of Ross (1976), being a generalization of the latter. ...

ersc-fosc-cityredi-kpmg-event-report-final

... reduced the available land and made private sector investment difficult; Many development plots are too small for investors, making them unprofitable. For instance, Birmingham has no big (in developer terms) sites within the urban built up area, therefore for them to be worthwhile investments they n ...

... reduced the available land and made private sector investment difficult; Many development plots are too small for investors, making them unprofitable. For instance, Birmingham has no big (in developer terms) sites within the urban built up area, therefore for them to be worthwhile investments they n ...

competition tribunal

... Within a bank, the treasury department procures funding in the financial markets and allocates it to the various banking departments at a margin. It further manages internal risk within the bank. Absa’s existing treasury function is ...

... Within a bank, the treasury department procures funding in the financial markets and allocates it to the various banking departments at a margin. It further manages internal risk within the bank. Absa’s existing treasury function is ...

Media Release Europe replaces China as main concern for

... (59.65%) and shortage of manpower talent to support growth (29.82%) were seen as the three biggest threats to the growth of the investment management industry in Singapore in the next 3 years. More than half of the fund managers anticipate increasing demand for lower cost products (57.89%), together ...

... (59.65%) and shortage of manpower talent to support growth (29.82%) were seen as the three biggest threats to the growth of the investment management industry in Singapore in the next 3 years. More than half of the fund managers anticipate increasing demand for lower cost products (57.89%), together ...

Family Offices - SchulthessZimmermann Executive Search

... A big advantage of single and multifamily offices that on pay, the sky is the limit. The most wellconnected, productive and skilled advisors can earn several million a year. Cynically referred to as «you eat what you kill» among advisors, family offices tend to operate on a system of individual ...

... A big advantage of single and multifamily offices that on pay, the sky is the limit. The most wellconnected, productive and skilled advisors can earn several million a year. Cynically referred to as «you eat what you kill» among advisors, family offices tend to operate on a system of individual ...

tendering exercise for investment management

... These 4 firms were invited to make short formal presentations which would be followed by a detailed question and answer session. The Committee also requested that Legal & General be asked to submit a further written proposal to elaborate on their earlier proposal for a combination of active and pass ...

... These 4 firms were invited to make short formal presentations which would be followed by a detailed question and answer session. The Committee also requested that Legal & General be asked to submit a further written proposal to elaborate on their earlier proposal for a combination of active and pass ...

The Central Bank Report on the Financial System

... system, with assets accounting for 48.6% as of June 2014 The balance of commercial bank assets showed real annual growth of 7.4% with respect to June 2013. The most lively components were security investments and derivatives trading, whereas the loans portfolio rose at a more sedate pace than assets ...

... system, with assets accounting for 48.6% as of June 2014 The balance of commercial bank assets showed real annual growth of 7.4% with respect to June 2013. The most lively components were security investments and derivatives trading, whereas the loans portfolio rose at a more sedate pace than assets ...

UNIT 6: THE FINANCIAL PLAN When the company has more

... Whenever a supplier gives us a deferment of payment of those products that you have purchased we have got a short-term financing. The amount is the value of our purchase and the postponement by the provider, usually 30, 60 or 90 days. Although you can sometimes get higher postponement, it is unusual ...

... Whenever a supplier gives us a deferment of payment of those products that you have purchased we have got a short-term financing. The amount is the value of our purchase and the postponement by the provider, usually 30, 60 or 90 days. Although you can sometimes get higher postponement, it is unusual ...

Does Building Green Create Value?

... Sustainability in Building Valuations Part of the problem is that current valuation and appraisal techniques do not address the issue of sustainability in buildings. In 2007, representatives from nations around the world signed the Vancouver Valuation Accord -- an agreement to address the interrelat ...

... Sustainability in Building Valuations Part of the problem is that current valuation and appraisal techniques do not address the issue of sustainability in buildings. In 2007, representatives from nations around the world signed the Vancouver Valuation Accord -- an agreement to address the interrelat ...

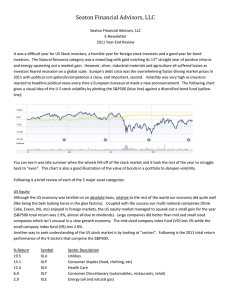

2011 - Seaton Financial Advisors, LLC

... Medium term treasuries and corporate bonds produced returns well above inflation as medium term interest rates moved sideways or down (which increases the value of bonds). US Treasury out-performed corporate bonds due to the “safe haven” status treasuries still enjoy in the marketplace (particularly ...

... Medium term treasuries and corporate bonds produced returns well above inflation as medium term interest rates moved sideways or down (which increases the value of bonds). US Treasury out-performed corporate bonds due to the “safe haven” status treasuries still enjoy in the marketplace (particularly ...

presentation

... as well as in the other European countries ... ... but it is a low value-added industry, with profitability lower than cost of capital Basle II is an important discontinuity which could significantly reshape the industry and improve its profitability ...

... as well as in the other European countries ... ... but it is a low value-added industry, with profitability lower than cost of capital Basle II is an important discontinuity which could significantly reshape the industry and improve its profitability ...

No Slide Title

... consolidation + scale – exit definite Inertia not branding Ruthless HR Models Retention Recruitment Reward Type II HR model Financial incentives ...

... consolidation + scale – exit definite Inertia not branding Ruthless HR Models Retention Recruitment Reward Type II HR model Financial incentives ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.