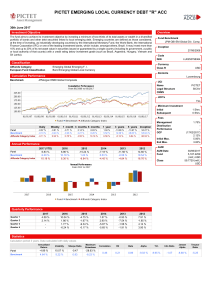

pictet emerging local currency debt "r" acc

... offer or solicitation to buy or sell any investment. ADCB will not be held liable for the information provided in this document which has been obtained from and prepared by 3 party sources. This document should be read in conjunction with the Fund Prospectus, TermSheet and Subscription Agreement. In ...

... offer or solicitation to buy or sell any investment. ADCB will not be held liable for the information provided in this document which has been obtained from and prepared by 3 party sources. This document should be read in conjunction with the Fund Prospectus, TermSheet and Subscription Agreement. In ...

Banking crises yesterday and today

... waves of failures) reveals that they do not always coincide, although they sometimes do. Bank panics can happen without a significant increase in failed banks (the panic of , for example); while at other times, many bank failures occur without any systemic banking panic (as during the wave of US ...

... waves of failures) reveals that they do not always coincide, although they sometimes do. Bank panics can happen without a significant increase in failed banks (the panic of , for example); while at other times, many bank failures occur without any systemic banking panic (as during the wave of US ...

New Financial Regulator Seen to Target Chaebol

... company, we may enhance the regulations for companies which have difficulty regulating themselves.’’ Yoon’s project is in line with recent suggestions by the International Monetary Fund (IMF), which advised Korea to implement a three-year roadmap for reform of the family-controlled chaebol or conglo ...

... company, we may enhance the regulations for companies which have difficulty regulating themselves.’’ Yoon’s project is in line with recent suggestions by the International Monetary Fund (IMF), which advised Korea to implement a three-year roadmap for reform of the family-controlled chaebol or conglo ...

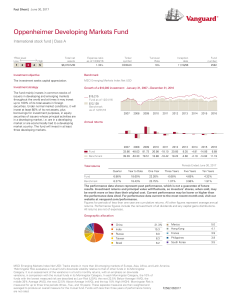

Oppenheimer Developing Markets Fund - Vanguard

... Foreign Securities: Investments in foreign securities may be subject to increased volatility as the value of these securities can change more rapidly and extremely than can the value of U.S. securities. Foreign securities are subject to increased issuer risk because foreign issuers may not experienc ...

... Foreign Securities: Investments in foreign securities may be subject to increased volatility as the value of these securities can change more rapidly and extremely than can the value of U.S. securities. Foreign securities are subject to increased issuer risk because foreign issuers may not experienc ...

Drawing Boundaries Around and Through the Banking System

... deposit insurance and access to central bank liquidity be allowed to do more than take deposits and make loans? The United States has had a particularly tortured history with respect to the latter question. US regulators are currently groping for a reasonable implementation of the Volcker Rule, whic ...

... deposit insurance and access to central bank liquidity be allowed to do more than take deposits and make loans? The United States has had a particularly tortured history with respect to the latter question. US regulators are currently groping for a reasonable implementation of the Volcker Rule, whic ...

Drawing Boundaries Around and Through the Banking System

... deposit insurance and access to central bank liquidity be allowed to do more than take deposits and make loans? The United States has had a particularly tortured history with respect to the latter question. US regulators are currently groping for a reasonable implementation of the Volcker Rule, whic ...

... deposit insurance and access to central bank liquidity be allowed to do more than take deposits and make loans? The United States has had a particularly tortured history with respect to the latter question. US regulators are currently groping for a reasonable implementation of the Volcker Rule, whic ...

Delaware Investments Global Value Fund - fund

... (information available upon request) Investment philosophy / process The team’s investment approach is based on the concept that adversity creates opportunity and that transitory problems can be overcome by well-managed companies. Its goal is to construct a diversified portfolio of global companies ...

... (information available upon request) Investment philosophy / process The team’s investment approach is based on the concept that adversity creates opportunity and that transitory problems can be overcome by well-managed companies. Its goal is to construct a diversified portfolio of global companies ...

Opportunistic Portfolios

... Because Opportunistic Portfolios are periodically adjusted to stay in line with your investment objectives, we use ranges to illustrate target allocations. ...

... Because Opportunistic Portfolios are periodically adjusted to stay in line with your investment objectives, we use ranges to illustrate target allocations. ...

It`s all explained in

... not lent out. The velocity of circulation is, therefore, very low. However, even this increase in bank liquidity is not without effect. It makes banks more confident and engenders a more relaxed deployment of funds than would occur without quantitative easing – exactly as was intended by the policy. ...

... not lent out. The velocity of circulation is, therefore, very low. However, even this increase in bank liquidity is not without effect. It makes banks more confident and engenders a more relaxed deployment of funds than would occur without quantitative easing – exactly as was intended by the policy. ...

letter to shareholders

... market share in 1965 has eroded over time to 57% in 2005. Many suppliers have filed for bankruptcy, e.g., Dana Corp., Collins & Aikman, and Delphi. We expect more to come. These companies have fallen on hard times and the economy is still in good shape. In a recession, we would expect to see auto sa ...

... market share in 1965 has eroded over time to 57% in 2005. Many suppliers have filed for bankruptcy, e.g., Dana Corp., Collins & Aikman, and Delphi. We expect more to come. These companies have fallen on hard times and the economy is still in good shape. In a recession, we would expect to see auto sa ...

national securities

... Efforts to restrict costs were not particularly successful, given that personnel and administrative expenses increased by 5.8%, while provision and depreciation charges went up by 9.9% and 19.6% respectively. These expenses vindicate management efforts to restructure and improve both IT and human re ...

... Efforts to restrict costs were not particularly successful, given that personnel and administrative expenses increased by 5.8%, while provision and depreciation charges went up by 9.9% and 19.6% respectively. These expenses vindicate management efforts to restructure and improve both IT and human re ...

Panasonic Manufacturing Malaysia Berhad Maintain NEUTRAL

... segment is due the underperformance of its products such as: (i) rice cookers segment which is struggling to reach breakeven level due to the higher cost of production as a result from the transfer of manufacturing activities from Thailand to Malaysia and; (ii) vacuum cleaner and iron segment record ...

... segment is due the underperformance of its products such as: (i) rice cookers segment which is struggling to reach breakeven level due to the higher cost of production as a result from the transfer of manufacturing activities from Thailand to Malaysia and; (ii) vacuum cleaner and iron segment record ...

Looking Back and Thinking Ahead Looking Back

... mix as well as broad interest rate risk exposures. From there we can move to tactical decision-making, relative value analysis, and the security selection process. This sort of top-down method provides a framework for active management of investments by rebalancing and restructuring the portfolio in ...

... mix as well as broad interest rate risk exposures. From there we can move to tactical decision-making, relative value analysis, and the security selection process. This sort of top-down method provides a framework for active management of investments by rebalancing and restructuring the portfolio in ...

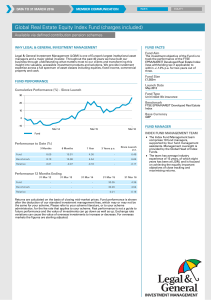

Global Real Estate Equity Index Fund

... United States Japan Hong Kong Australia United Kingdom Germany Canada Netherlands Singapore France Other ...

... United States Japan Hong Kong Australia United Kingdom Germany Canada Netherlands Singapore France Other ...

Reducing US Stocks to Bring Balanced Portfolios Closer to Long

... Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represen ...

... Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represen ...

Total financial assets

... Financial crisis in 2008 was mostly unforeseen Do not explaing today what happened yesterday as it was easy to understand There will be many financial crisis in the future Try to give you a rule to understand a crisis is underway ...

... Financial crisis in 2008 was mostly unforeseen Do not explaing today what happened yesterday as it was easy to understand There will be many financial crisis in the future Try to give you a rule to understand a crisis is underway ...

Be Careful of What You Think You Know

... Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries. Issued in the United States by MFS Institutional Advisors, Inc. (“MFSI”) and MFS Investment Management. Issued in Canada by MFS Investment Management ...

... Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries. Issued in the United States by MFS Institutional Advisors, Inc. (“MFSI”) and MFS Investment Management. Issued in Canada by MFS Investment Management ...

Value Versus Growth - CORDA Investment Management

... So, too, is attempting to predict or time the market. Since one cannot accurately predict when a single company will appreciate in value, building a diversified portfolio of companies with most paying attractive dividends will typically lead to a successful result. One must be willing to hold the in ...

... So, too, is attempting to predict or time the market. Since one cannot accurately predict when a single company will appreciate in value, building a diversified portfolio of companies with most paying attractive dividends will typically lead to a successful result. One must be willing to hold the in ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.