WAM 8-11-09 Be Wary of Things will be Different This Time

... The Labor Department just reported this morning that productivity rose at an annual rate of 6.4% in the second quarter. In addition to productivity being an excellent short-term economic predictor, it also defines the long-term return in the stock market. The annual long-term stock market return is ...

... The Labor Department just reported this morning that productivity rose at an annual rate of 6.4% in the second quarter. In addition to productivity being an excellent short-term economic predictor, it also defines the long-term return in the stock market. The annual long-term stock market return is ...

Ansa Mcal Limited

... Based on Ansa Mcal's performance, steady dividend payments and group diversity, this stock is valued at TTD57.18. On the market AMCL has been trading flat since 2014, ranging between a share price of TTD67.50 and TTD66.15. For the stock price to break through the current range, the company would hav ...

... Based on Ansa Mcal's performance, steady dividend payments and group diversity, this stock is valued at TTD57.18. On the market AMCL has been trading flat since 2014, ranging between a share price of TTD67.50 and TTD66.15. For the stock price to break through the current range, the company would hav ...

L04: Homework Assignment

... Instructions: You are encouraged to collaborate with other students on the homework, but it is important that you do your own work. Before working with someone else on the assignment, you should attempt each problem on your own. 1. In your own words, list the three rules of probability. ...

... Instructions: You are encouraged to collaborate with other students on the homework, but it is important that you do your own work. Before working with someone else on the assignment, you should attempt each problem on your own. 1. In your own words, list the three rules of probability. ...

Chapter 12: Market Microstructure and Strategies

... – Dealers: trade for their own account or also facilitate customer orders (broker/dealer). ...

... – Dealers: trade for their own account or also facilitate customer orders (broker/dealer). ...

im08

... as pension plans and life insurance. Also a fall in a company’s stock value may indicate impending insolvency which could cause losses for bondholders. Moreover, movements in the stock market as a whole tend to be a leading indicator, albeit an imprecise one, of ...

... as pension plans and life insurance. Also a fall in a company’s stock value may indicate impending insolvency which could cause losses for bondholders. Moreover, movements in the stock market as a whole tend to be a leading indicator, albeit an imprecise one, of ...

“MORE IS DIFFERENT” transition in Finance

... More is different: a single molecule does not boil at 100C0 ...

... More is different: a single molecule does not boil at 100C0 ...

Reporting Considerations

... Entities may have historical practices (although no explicit written policy) to price investments and/or cutoff for financial reporting purposes at 4pm ET or their past practice may be to take into account after-market activity and cut-off the financial statements later than 4pm ET. Generally speaki ...

... Entities may have historical practices (although no explicit written policy) to price investments and/or cutoff for financial reporting purposes at 4pm ET or their past practice may be to take into account after-market activity and cut-off the financial statements later than 4pm ET. Generally speaki ...

CP World History (Unit 7, #2)

... taking a risk of losing money as well. B. ____________________________ 1. The greater the risk you are willing to take the higher the potential rewards you can earn C. ____________________________ 1. The lower the risk you are willing to take the lower the potential rewards you will earn V. Risk and ...

... taking a risk of losing money as well. B. ____________________________ 1. The greater the risk you are willing to take the higher the potential rewards you can earn C. ____________________________ 1. The lower the risk you are willing to take the lower the potential rewards you will earn V. Risk and ...

Fair Value Hierarchy In determining fair value, we utilize various

... In determining fair value, we utilize various methods including the market and income approaches. Based on these approaches, we utilize assumptions that market participants would use in pricing the asset or liability, including assumptions about risk and or the risks inherent in the inputs to the va ...

... In determining fair value, we utilize various methods including the market and income approaches. Based on these approaches, we utilize assumptions that market participants would use in pricing the asset or liability, including assumptions about risk and or the risks inherent in the inputs to the va ...

Consumers, Savers, and Investors

... Pool of money in a portfolio Company diversifies its investments to take an advantage of the highs and lows of the stock market ...

... Pool of money in a portfolio Company diversifies its investments to take an advantage of the highs and lows of the stock market ...

Downshifting to Sustainable Growth

... 2003 to an annual rate of 3.0% during the first four months of this year. While a portion of this increase is, of course, due to higher energy costs, the strengthening in prices has not been confined to the energy markets. PCE prices excluding food and energy have risen at an annual rate of 1.7%, up ...

... 2003 to an annual rate of 3.0% during the first four months of this year. While a portion of this increase is, of course, due to higher energy costs, the strengthening in prices has not been confined to the energy markets. PCE prices excluding food and energy have risen at an annual rate of 1.7%, up ...

Researching to Find Good Investments

... • Geographic distribution • Potential for growth in volume • Pricing • New ideas: make-or-buy decisions ...

... • Geographic distribution • Potential for growth in volume • Pricing • New ideas: make-or-buy decisions ...

inflation, real interest rates and the shiller p/e

... Why this matters: Investors often look at unconditional valuation metrics such as the Shiller P/E to infer if the stock market is cheap or expensive. Arnott argues that the fair value of the Shl ...

... Why this matters: Investors often look at unconditional valuation metrics such as the Shiller P/E to infer if the stock market is cheap or expensive. Arnott argues that the fair value of the Shl ...

The Economics of the Great Depression

... Hundreds of banks close which wipes out billions in savings. In 1933 –364,000 farms went bankrupt –GNP had decreased by 40%. –Unemployment Rate = 25% ...

... Hundreds of banks close which wipes out billions in savings. In 1933 –364,000 farms went bankrupt –GNP had decreased by 40%. –Unemployment Rate = 25% ...

Meet Goldilocks` Ugly Sister, “She`s Not So Bad”

... limiting holdings of highly cyclical companies, unless their growth is unusually weighted to emerging markets. We are actively looking for companies that have predictable business models, even if their growth is modest, and, especially, for companies that appear to have the opportunity to grow at a ...

... limiting holdings of highly cyclical companies, unless their growth is unusually weighted to emerging markets. We are actively looking for companies that have predictable business models, even if their growth is modest, and, especially, for companies that appear to have the opportunity to grow at a ...

How the Stock Market Works

... under rules intended to assure that trading will be fair, honest, and free from manipulation. The price at which stocks are bought and sold in this situation can be a compromise between the highest price a buyer is willing to pay and the lowest price for which the owner is willing to sell but, other ...

... under rules intended to assure that trading will be fair, honest, and free from manipulation. The price at which stocks are bought and sold in this situation can be a compromise between the highest price a buyer is willing to pay and the lowest price for which the owner is willing to sell but, other ...

REAL CLIENT MANAGED PORTFOLIO MEMORANDUM

... recent years. Growth has started to accelerate after it slowed in 2008 due to the economic recession, and revenue is expected to rise 2.7% in 2012, with 4.5% annual growth from 2012 to 2017. There are five external business drivers for this industry, which are Federal funding for Medicare and Medica ...

... recent years. Growth has started to accelerate after it slowed in 2008 due to the economic recession, and revenue is expected to rise 2.7% in 2012, with 4.5% annual growth from 2012 to 2017. There are five external business drivers for this industry, which are Federal funding for Medicare and Medica ...

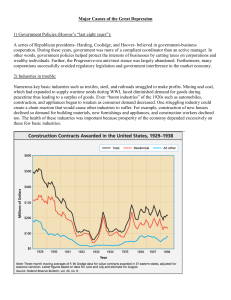

Lesson 1: Hooking Lesson

... wealthy individuals. Further, the Progressive-era anti-trust stance was largely abandoned. Furthermore, many corporations successfully avoided regulatory legislation and government interference in the market economy. 2) Industries in trouble: Numerous key basic industries such as textiles, steel, an ...

... wealthy individuals. Further, the Progressive-era anti-trust stance was largely abandoned. Furthermore, many corporations successfully avoided regulatory legislation and government interference in the market economy. 2) Industries in trouble: Numerous key basic industries such as textiles, steel, an ...

Stocks

... For example, if you buy 20 shares of Joe's Pizza for $10 a share, your investment cost is $200. If you sell those shares for $250, then your ROI is ($250-200)/$200 for a total of 0.25 or 25%. ...

... For example, if you buy 20 shares of Joe's Pizza for $10 a share, your investment cost is $200. If you sell those shares for $250, then your ROI is ($250-200)/$200 for a total of 0.25 or 25%. ...