November 15th, 2013

... on an interest rate (hence “fixed income”), then principal at maturity • Equity vs. Fixed Income = stakeholder in firm vs. lender to firm • Parts of a bond: ...

... on an interest rate (hence “fixed income”), then principal at maturity • Equity vs. Fixed Income = stakeholder in firm vs. lender to firm • Parts of a bond: ...

Armine Yalnizyan: Income Inequality and Investment

... • Slow growth? Boost profit by lowering costs (lower wages) BUT • If I can’t buy, you can’t sell Inadequate aggregate demand, slower growth • Lower wages means less saving, smaller base for investments down the road....or dramatically shifting geo-political realities ...

... • Slow growth? Boost profit by lowering costs (lower wages) BUT • If I can’t buy, you can’t sell Inadequate aggregate demand, slower growth • Lower wages means less saving, smaller base for investments down the road....or dramatically shifting geo-political realities ...

Problem Set 1

... also. The initial capital-labor ratios have no effect on the steady-state capital-labor ratios. (b) y = 6k1/2 = 24 for both countries. c = (1 – s)y, so country A has c = 0.9y = 21.6, while country B has c = 0.8y = 19.2. The two countries have the same capital-labor ratio and output per worker, but d ...

... also. The initial capital-labor ratios have no effect on the steady-state capital-labor ratios. (b) y = 6k1/2 = 24 for both countries. c = (1 – s)y, so country A has c = 0.9y = 21.6, while country B has c = 0.8y = 19.2. The two countries have the same capital-labor ratio and output per worker, but d ...

Q3 2016 - Partnervest

... Global equity prices and pound sterling recovered from the panic selling that greeted the news Britain’s EU departure in June. (See Partnervest Brexit Market Commentary June 29, 2016) However, we fear the coming Brexit (UK expects to commence negotiations in March 2017) may imperil European banks th ...

... Global equity prices and pound sterling recovered from the panic selling that greeted the news Britain’s EU departure in June. (See Partnervest Brexit Market Commentary June 29, 2016) However, we fear the coming Brexit (UK expects to commence negotiations in March 2017) may imperil European banks th ...

Titel Titel 2

... Ageing will lead to increasing supply of stocks and bonds, because of dissaving in retirement age Higher public deficit due to increasing expenditure for elderly persons will lead to growth in the supply of bonds Lower potential growth will lead to slowdown of the development of stock markets ...

... Ageing will lead to increasing supply of stocks and bonds, because of dissaving in retirement age Higher public deficit due to increasing expenditure for elderly persons will lead to growth in the supply of bonds Lower potential growth will lead to slowdown of the development of stock markets ...

ECONOMICS IS NOT ALWAYS ECONOMICAL

... by replacing “Russia” with “China”, or, you could replace “Amazon & Yahoo” with, well “Amazon & Netflix.” Investors behave the same just as things are so different. The lesson from 1998 is that even though valuations were high, just as they are today, they could go ever higher. The key difference fr ...

... by replacing “Russia” with “China”, or, you could replace “Amazon & Yahoo” with, well “Amazon & Netflix.” Investors behave the same just as things are so different. The lesson from 1998 is that even though valuations were high, just as they are today, they could go ever higher. The key difference fr ...

Globe Union half year Bulletin

... increased significantly over the last 12 to 18 months, while data shows the gap between market demand and supply has been gradually narrowed; therefore it is anticipated that the raw material prices are unlikely to rise significantly. The implementation of unreclaimable input VATdeduction from 1st ...

... increased significantly over the last 12 to 18 months, while data shows the gap between market demand and supply has been gradually narrowed; therefore it is anticipated that the raw material prices are unlikely to rise significantly. The implementation of unreclaimable input VATdeduction from 1st ...

February 6, 2015

... Staples is in advanced talks about a deal in which Staples would acquire Office Depot. Staples will pay $7.25 in cash and 0.2188 of a share in Staples stock for each share of Office Depot. Staple’s shares dropped 12% while Office Depot’s share rose 2.2%. Should a deal be announced, Staples and Offic ...

... Staples is in advanced talks about a deal in which Staples would acquire Office Depot. Staples will pay $7.25 in cash and 0.2188 of a share in Staples stock for each share of Office Depot. Staple’s shares dropped 12% while Office Depot’s share rose 2.2%. Should a deal be announced, Staples and Offic ...

derivative security - the School of Economics and Finance

... loss in short-selling is more than the loss in outright purchase? Question 2: Interest rate seems to have positive effect on the profit/loss on short-selling but negative effect on the profit/loss on outright purchase. Reason? Question 3: At what interest rate, profit/loss from short-selling or from ...

... loss in short-selling is more than the loss in outright purchase? Question 2: Interest rate seems to have positive effect on the profit/loss on short-selling but negative effect on the profit/loss on outright purchase. Reason? Question 3: At what interest rate, profit/loss from short-selling or from ...

Chapter 2 Economic Systems and Decision Making Section 1 p. 33

... business period than they were when they started. – Company A had $10 million more at the end of the second quarter (April to June) than they had at the beginning. – Company A had $10 million less at the end of the second quarter (April to June) than they had at the beginning = ...

... business period than they were when they started. – Company A had $10 million more at the end of the second quarter (April to June) than they had at the beginning. – Company A had $10 million less at the end of the second quarter (April to June) than they had at the beginning = ...

Venture_Capital_ENG_

... Convert “fixed costs” (incurred whether or not a sale is made) to “variable costs” (incurred only when a sale is made) Outsourcing – reduce capital needs Universities – expertise, pro bono work Suppliers – terms, loans, leads, etc. Factors – advance money, reduce collection risk ...

... Convert “fixed costs” (incurred whether or not a sale is made) to “variable costs” (incurred only when a sale is made) Outsourcing – reduce capital needs Universities – expertise, pro bono work Suppliers – terms, loans, leads, etc. Factors – advance money, reduce collection risk ...

Financial Markets

... Equivalent tax yield: Illustration Suppose you are in 30% tax bracket. Would you prefer to earn a 6% taxable return or a 4% tax-free return? What is the equivalent taxable yield of the 4% tax-free yield? After-tax return on 6% bond is: ...

... Equivalent tax yield: Illustration Suppose you are in 30% tax bracket. Would you prefer to earn a 6% taxable return or a 4% tax-free return? What is the equivalent taxable yield of the 4% tax-free yield? After-tax return on 6% bond is: ...

Stocks vs. Bonds: A Decade of Record Disparity

... on a quarterly basis), starting with the period ended 1926. Stocks are generally more risky and volatile investments than bonds, but their 10-year return has exceeded that of Treasury bonds in 85% of these periods, according to The Leuthold Group, a market research firm. However, for the decade ende ...

... on a quarterly basis), starting with the period ended 1926. Stocks are generally more risky and volatile investments than bonds, but their 10-year return has exceeded that of Treasury bonds in 85% of these periods, according to The Leuthold Group, a market research firm. However, for the decade ende ...

How to Predict the Next Fiasco

... Concentrate on Cash: The cash-flow statement tracks all the changes that affect a company's cash position, be it cash flowing in from debt and stock offerings, or cash flowing out in the form of dividends. It can also serve as an indicator of potential chicanery inside a company's accounting. ...

... Concentrate on Cash: The cash-flow statement tracks all the changes that affect a company's cash position, be it cash flowing in from debt and stock offerings, or cash flowing out in the form of dividends. It can also serve as an indicator of potential chicanery inside a company's accounting. ...

File - Ryan Reynolds

... 1. What is the “trend” in the graph for the “top 20%” ? What is the trend for the “bottom ...

... 1. What is the “trend” in the graph for the “top 20%” ? What is the trend for the “bottom ...

Sample Exercises Chapter 11

... of stock that are outstanding. 2) Rich Co. issues $2 million, 10-year, 8% bonds at 97, with interest payable on July 1 and January 1. a) Prepare the journal entry to record the sale of these bonds on January 1, 2008. b) Assuming instead that the above bonds sold for 104, prepare the journal entry to ...

... of stock that are outstanding. 2) Rich Co. issues $2 million, 10-year, 8% bonds at 97, with interest payable on July 1 and January 1. a) Prepare the journal entry to record the sale of these bonds on January 1, 2008. b) Assuming instead that the above bonds sold for 104, prepare the journal entry to ...

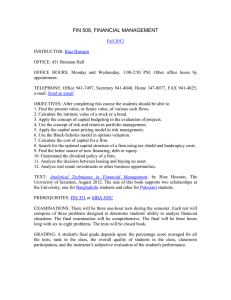

FIN 508: Financial Management

... OBJECTIVES: After completing this course the students should be able to 1. Find the present value, or future value, of various cash flows. 2. Calculate the intrinsic value of a stock or a bond. 3. Apply the concept of capital budgeting in the evaluation of projects. 4. Use the concept of risk and re ...

... OBJECTIVES: After completing this course the students should be able to 1. Find the present value, or future value, of various cash flows. 2. Calculate the intrinsic value of a stock or a bond. 3. Apply the concept of capital budgeting in the evaluation of projects. 4. Use the concept of risk and re ...

CHAPTER 1

... (NO SOLUTION ONLINE) Spam Corp. is financed entirely by common stock and has a beta of 1.0. The firm is expected to generate a level, perpetual stream of earnings and dividends. The stock has a price-earnings ratio of 8 and a cost of equity of 12.5%. The company’s stock is selling for $50. Now the f ...

... (NO SOLUTION ONLINE) Spam Corp. is financed entirely by common stock and has a beta of 1.0. The firm is expected to generate a level, perpetual stream of earnings and dividends. The stock has a price-earnings ratio of 8 and a cost of equity of 12.5%. The company’s stock is selling for $50. Now the f ...