Chapter 27: Money, Banking, and the Financial Sector

... stock prices to the extent that growth in stock prices and GDP growth both reflect economic well-being in a country. Also, many of the companies are multinational companies, and where the company is based may not reflect where its value added is generated. Chapter 27: Appendix B 2. a. ...

... stock prices to the extent that growth in stock prices and GDP growth both reflect economic well-being in a country. Also, many of the companies are multinational companies, and where the company is based may not reflect where its value added is generated. Chapter 27: Appendix B 2. a. ...

The tide is turning – developed market equities in the sweet spot

... that should give investors a return of inflation plus 7.5%, but such investment opportunities have markedly decreased over the last 18 months. The average share on our local bourse should only give a return of inflation plus 2.5%. It is therefore difficult to identify new equity opportunities. On a ...

... that should give investors a return of inflation plus 7.5%, but such investment opportunities have markedly decreased over the last 18 months. The average share on our local bourse should only give a return of inflation plus 2.5%. It is therefore difficult to identify new equity opportunities. On a ...

DAINAM Securities

... remained below 300,000 for a 14th straight week, a sign of labor market strength that will help fuel U.S. growth.Jobless claims rose by 2,000 to 279,000 in the week ended June 6, a Labor Department report showed Thursday in Washington. The median forecast of 48 economists surveyed by Bloomberg calle ...

... remained below 300,000 for a 14th straight week, a sign of labor market strength that will help fuel U.S. growth.Jobless claims rose by 2,000 to 279,000 in the week ended June 6, a Labor Department report showed Thursday in Washington. The median forecast of 48 economists surveyed by Bloomberg calle ...

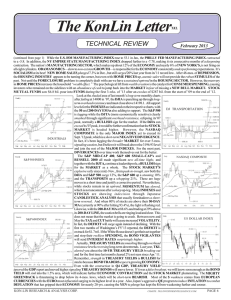

The KonLin Letter page 6.pmd

... Look at the shaded area of last month’s long-term monthly charts after failing at 14000 in ’07, the DJIA is punching up through longterm overhead resistance and must close above 14198.1. All support levels for the INDEXES are indicated on their respective charts, with DJ TRANSPORTATION the 50 and 20 ...

... Look at the shaded area of last month’s long-term monthly charts after failing at 14000 in ’07, the DJIA is punching up through longterm overhead resistance and must close above 14198.1. All support levels for the INDEXES are indicated on their respective charts, with DJ TRANSPORTATION the 50 and 20 ...

Loan Presentation Information

... Guarantor: Owner and spouse—Sam and Chris Smith Existing Relationship: company checking account: average 1 year balance = $300,000 Sam/Chris checking account: average 1 year balance = $1,000 Loan Experience: Loan Line of Credit Equipment Loan ...

... Guarantor: Owner and spouse—Sam and Chris Smith Existing Relationship: company checking account: average 1 year balance = $300,000 Sam/Chris checking account: average 1 year balance = $1,000 Loan Experience: Loan Line of Credit Equipment Loan ...

Methods for Teaching Personal Financial Literacy 7/8/13 See notes

... Benefit of paying off loan early, B(x)? Interest you do not have to pay bank Cost of paying off loan early, C(x)? Forgone “return” from next best alternative use of $ Loan term and time value Time value of money**** Starting place Net worth(wealth) statement (balance sheet for a company) At a point ...

... Benefit of paying off loan early, B(x)? Interest you do not have to pay bank Cost of paying off loan early, C(x)? Forgone “return” from next best alternative use of $ Loan term and time value Time value of money**** Starting place Net worth(wealth) statement (balance sheet for a company) At a point ...

Document

... experiences. The borrowing cost varies with nominal interest rate. But most people’s earnings are not adjusted for inflation. This is probably also true for rental incomes, minimum wages and other relatively fixed incomes. ...

... experiences. The borrowing cost varies with nominal interest rate. But most people’s earnings are not adjusted for inflation. This is probably also true for rental incomes, minimum wages and other relatively fixed incomes. ...

Chapter 7: Principles of Asset Valuation

... Competition in financial markets ensure that not only the prices of equivalent assets are the same but also interest rates on equivalent assets are the same. Interest rates on the U.S. treasure Bonds & World Bank dollar-denominated debt (both are free of default risk). Interest-rate arbitrage: ...

... Competition in financial markets ensure that not only the prices of equivalent assets are the same but also interest rates on equivalent assets are the same. Interest rates on the U.S. treasure Bonds & World Bank dollar-denominated debt (both are free of default risk). Interest-rate arbitrage: ...

Physics and the Laws of Investing Was it Sir Isaac Newton who said

... themselves to create more robust profits, or a combination of the two. US company earnings have been outstanding for the last 6 months as very lean companies are emerging from “The Great Recession” amidst the back-drop of government stimulus, inventory building, and the continued growth in emerging ...

... themselves to create more robust profits, or a combination of the two. US company earnings have been outstanding for the last 6 months as very lean companies are emerging from “The Great Recession” amidst the back-drop of government stimulus, inventory building, and the continued growth in emerging ...

Mid-Year Investment Review

... them out of their illiquidity upon discovering that the market wouldn’t buy their assets at anything close to modeled value; S&P and Moody’s are moving toward downgrades on nearly $20 billion in subprime mortgage backed securities, while intimating more such to come; and a half dozen new high-yield ...

... them out of their illiquidity upon discovering that the market wouldn’t buy their assets at anything close to modeled value; S&P and Moody’s are moving toward downgrades on nearly $20 billion in subprime mortgage backed securities, while intimating more such to come; and a half dozen new high-yield ...

Making Sense of Conflicting Signals

... current environment of near zero interest rates has had only a limited impact on economic activity: the consumer is spending more and low mortgage rates are encouraging him to invest in more home ownership, but corporations to date have been unwilling to borrow funds or employ cash savings to invest ...

... current environment of near zero interest rates has had only a limited impact on economic activity: the consumer is spending more and low mortgage rates are encouraging him to invest in more home ownership, but corporations to date have been unwilling to borrow funds or employ cash savings to invest ...

Quarterly Market Update 3Q16.pub

... Average is close behind at 7.21%. The NASDAQ Composite, which has been the laggard all year, experienced large gains in the quarter. It is now up 7.15% year-to-date. Domestically, the best results remain in mid- and small-sized companies. The S&P 400 Mid-Cap Index has advanced 12.40% this year, whil ...

... Average is close behind at 7.21%. The NASDAQ Composite, which has been the laggard all year, experienced large gains in the quarter. It is now up 7.15% year-to-date. Domestically, the best results remain in mid- and small-sized companies. The S&P 400 Mid-Cap Index has advanced 12.40% this year, whil ...

REAL CLIENT MANAGED PORTFOLIOS MEMORANDUM

... Financial Analysis and Valuation Gentex has been sustaining a stable set of Return on Assets and Return on Equity, with approximately 15% and 13% from 2007 to 2011. Its profit margin declined quickly due to the economic crisis in 2008 and 2009, and immediately picked up again in 2010, which is 16.87 ...

... Financial Analysis and Valuation Gentex has been sustaining a stable set of Return on Assets and Return on Equity, with approximately 15% and 13% from 2007 to 2011. Its profit margin declined quickly due to the economic crisis in 2008 and 2009, and immediately picked up again in 2010, which is 16.87 ...

Housing Key Issues, Problems and Solutions

... • What about the policy of cutting stamp duty to first time buyers (FTBs)? • The key point to recognise is that this can only help FTBs if the supply of FTB type houses is higher than it otherwise would be. • Initially the demand for FTB type houses rises and with constant supply, their price rises ...

... • What about the policy of cutting stamp duty to first time buyers (FTBs)? • The key point to recognise is that this can only help FTBs if the supply of FTB type houses is higher than it otherwise would be. • Initially the demand for FTB type houses rises and with constant supply, their price rises ...

The UK Housing Market: Measured Decline or Total Collapse?"

... • What about the policy of cutting stamp duty to first time buyers (FTBs)? • The key point to recognise is that this can only help FTBs if the supply of FTB type houses is higher than it otherwise would be. • Initially the demand for FTB type houses rises and with constant supply, their price rises ...

... • What about the policy of cutting stamp duty to first time buyers (FTBs)? • The key point to recognise is that this can only help FTBs if the supply of FTB type houses is higher than it otherwise would be. • Initially the demand for FTB type houses rises and with constant supply, their price rises ...

- Partners in Financial Planning

... However, investors have been waiting for this shoe to drop for the better part of three years, and meanwhile, interest rates have drifted decidedly lower in the first quarter. The Bloomberg U.S. Corporate Bond Index now has an effective yield of 2.93%. 30-year Treasuries are yielding 2.48%, roughly ...

... However, investors have been waiting for this shoe to drop for the better part of three years, and meanwhile, interest rates have drifted decidedly lower in the first quarter. The Bloomberg U.S. Corporate Bond Index now has an effective yield of 2.93%. 30-year Treasuries are yielding 2.48%, roughly ...

Risk and Return and the Financing Decision: Bonds vs

... Loan from bank Issue bonds in bond market ...

... Loan from bank Issue bonds in bond market ...

Three Years Down

... that if everybody pretended to be happy, their phoney smiles would blow the trouble away. ... The next day, Tuesday, the 29th of October, was the worst of all. In the first half hour 3,259,800 shares were traded, almost a full day's work for the laboring machinery of the Exchange. The selling pressu ...

... that if everybody pretended to be happy, their phoney smiles would blow the trouble away. ... The next day, Tuesday, the 29th of October, was the worst of all. In the first half hour 3,259,800 shares were traded, almost a full day's work for the laboring machinery of the Exchange. The selling pressu ...

Fourth Quarter 2016

... post-election. With these growth bursts and the anticipation of imminent rising rates, the bond market took a hit of 2.3% 2. We will discuss this further later in this report. Growth expectations based on Trump’s promises have led to a dramatic 12.5% jump in consumer sentiment in just two months to ...

... post-election. With these growth bursts and the anticipation of imminent rising rates, the bond market took a hit of 2.3% 2. We will discuss this further later in this report. Growth expectations based on Trump’s promises have led to a dramatic 12.5% jump in consumer sentiment in just two months to ...

Third Quarter – “The Stock Market: A Zero

... of funds from low-yielding bonds and money market funds to the stock market, where higher after-tax yields are currently available. Possible Overvaluation: With inflation at 2%, a market multiple of 18 on the Dow Jones and S&P 500 Index 2004 operating earnings provides room for 6-10% price appreciat ...

... of funds from low-yielding bonds and money market funds to the stock market, where higher after-tax yields are currently available. Possible Overvaluation: With inflation at 2%, a market multiple of 18 on the Dow Jones and S&P 500 Index 2004 operating earnings provides room for 6-10% price appreciat ...

![item[`#file`]->filename - Open Michigan](http://s1.studyres.com/store/data/020885087_1-d710d7cc1db60d2aaa7f3f828c06596e-300x300.png)