State of the Economy March 2017

... many issues overseas still lingering. Greece faces another deadline in July to secure a deal to pay private investors or face a default. The global economy is struggling to stimulate growth and many countries are still offering negative interest rates to their investors. We live in a global economy ...

... many issues overseas still lingering. Greece faces another deadline in July to secure a deal to pay private investors or face a default. The global economy is struggling to stimulate growth and many countries are still offering negative interest rates to their investors. We live in a global economy ...

Finance and Growth: a Micro

... financial variables need to be modified in order to ensure a sustainable financial-economic equilibrium and growth? does an optimum and correct balance between freedom and control in financial flows movements exist and, if so, is it really best suited to provide economic growth? how can a financ ...

... financial variables need to be modified in order to ensure a sustainable financial-economic equilibrium and growth? does an optimum and correct balance between freedom and control in financial flows movements exist and, if so, is it really best suited to provide economic growth? how can a financ ...

Weekly Commentary 10-13-14 PAA

... “Most viewed the risks to the outlook for economic activity and the labor market as broadly balanced. However, a number of participants noted that economic growth over the medium term might be slower than they expected if foreign economic growth came in weaker than anticipated, structural productivi ...

... “Most viewed the risks to the outlook for economic activity and the labor market as broadly balanced. However, a number of participants noted that economic growth over the medium term might be slower than they expected if foreign economic growth came in weaker than anticipated, structural productivi ...

Issuance of Common Stock example

... stock) utilizing the cost method. This is the most common approach. Under this method, an account called treasury stock is debited for the cost of the shares repurchased. This treasury stock account is a contra-equity account. That means, it is included in stockholder's equity, but is reflected as a ...

... stock) utilizing the cost method. This is the most common approach. Under this method, an account called treasury stock is debited for the cost of the shares repurchased. This treasury stock account is a contra-equity account. That means, it is included in stockholder's equity, but is reflected as a ...

Read more - Scott Investment Advisors

... countervailing deflationary pressures including the continuing effects of much lower energy prices. We note the Fed's latest prediction for inflation in 2015 is just 1.0%, which is a far cry from their 2.0% target which they say inflation should be closing in on before they move to increase rates. H ...

... countervailing deflationary pressures including the continuing effects of much lower energy prices. We note the Fed's latest prediction for inflation in 2015 is just 1.0%, which is a far cry from their 2.0% target which they say inflation should be closing in on before they move to increase rates. H ...

CF072M

... Net debts are defined to include all borrowings net of cash and cash equivalents. The Sponsor(s) should consider including any operating data and /or financial ratios which are commonly adopted in the industry of the listing applicants and its comparable companies (e.g. insurance companies – solvenc ...

... Net debts are defined to include all borrowings net of cash and cash equivalents. The Sponsor(s) should consider including any operating data and /or financial ratios which are commonly adopted in the industry of the listing applicants and its comparable companies (e.g. insurance companies – solvenc ...

How to Value Solar Energy Assets

... An estimate of Fair Market Value arrived at on the premise of continued use does not represent the amount that might be realized from piecemeal disposition in the open market or from an alternative use of the property. ...

... An estimate of Fair Market Value arrived at on the premise of continued use does not represent the amount that might be realized from piecemeal disposition in the open market or from an alternative use of the property. ...

Disclaimer - Betala.in

... others. The information contained herein is from the public domain or sources believed to be fair and correct and opinions based thereupon are reasonable. Due to the very nature of research it cannot be warranted or represented that it is accurate or complete and it should not be relied upon as such ...

... others. The information contained herein is from the public domain or sources believed to be fair and correct and opinions based thereupon are reasonable. Due to the very nature of research it cannot be warranted or represented that it is accurate or complete and it should not be relied upon as such ...

Saving

... Sector Stocks – corporations who operate in a specific part of the economy Cyclical and Non-Cyclical Stocks – success linked to the success of the economy International Stocks – corporations based in other ...

... Sector Stocks – corporations who operate in a specific part of the economy Cyclical and Non-Cyclical Stocks – success linked to the success of the economy International Stocks – corporations based in other ...

European Equity THE EUROPEAN EARNINGS

... The resilience in market earnings forecasts is in sharp contrast to the pattern seen in recent years. In each of the past five years (2012–2016) consensus estimates have declined materially in the first quarter. In each case, estimates continued to be reduced through the rest of the year. There ...

... The resilience in market earnings forecasts is in sharp contrast to the pattern seen in recent years. In each of the past five years (2012–2016) consensus estimates have declined materially in the first quarter. In each case, estimates continued to be reduced through the rest of the year. There ...

ACTA DE DIRECTORIO Nº 2547 (18

... convenient for the Company to extend the term of the plan on repurchase of treasury stock, due to expire on February 27, 2009, for an additional term of 180 calendar days, i.e., until August 26, 2009. Next, the President mentioned the basic terms and conditions for acquisition of treasury stock. Max ...

... convenient for the Company to extend the term of the plan on repurchase of treasury stock, due to expire on February 27, 2009, for an additional term of 180 calendar days, i.e., until August 26, 2009. Next, the President mentioned the basic terms and conditions for acquisition of treasury stock. Max ...

Percent Applications

... An account had $28000 in it in January. In December it had $18000. What was the percent of change in the value of the account? ...

... An account had $28000 in it in January. In December it had $18000. What was the percent of change in the value of the account? ...

01-0440 SmallCapGrSAR0301.lyt

... cash flow from an already significant base (with the exception of Cole National, which is undergoing a turnaround). Our investment philosophy focuses on buying companies with “real” earnings and free cash flows at prices we believe are significantly below our estimate of their worth. It is this pati ...

... cash flow from an already significant base (with the exception of Cole National, which is undergoing a turnaround). Our investment philosophy focuses on buying companies with “real” earnings and free cash flows at prices we believe are significantly below our estimate of their worth. It is this pati ...

Review for Midterm

... specific number of shares – option of the owner of the bond Redemption – Company can redeem the bonds at their discretion Retractable – bondholder has the option to redeem the bond before maturity Extendable – bondholder has the option to extend the maturity of the bond Callable – firm recalls the b ...

... specific number of shares – option of the owner of the bond Redemption – Company can redeem the bonds at their discretion Retractable – bondholder has the option to redeem the bond before maturity Extendable – bondholder has the option to extend the maturity of the bond Callable – firm recalls the b ...

? WHY ARE STOCKS SO RISKY Introduction

... tends to diminish over investment horizons as long as 40 years or more, because the value of stocks broadly follows the trend in GDP and corporate profits. Although stocks are better investments for the very long run, these periods can seem too long to suit savers who lack the capacity or the willin ...

... tends to diminish over investment horizons as long as 40 years or more, because the value of stocks broadly follows the trend in GDP and corporate profits. Although stocks are better investments for the very long run, these periods can seem too long to suit savers who lack the capacity or the willin ...

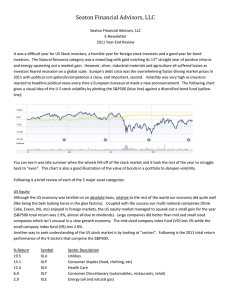

2011 - Seaton Financial Advisors, LLC

... suppliers and the constraints of domestic environmental regulations. Agriculture is still a good long term play but is affected by so many variables that conservative investors may wish to tread lightly. Bonds present perhaps the biggest investment challenge. With no way to know where interest rates ...

... suppliers and the constraints of domestic environmental regulations. Agriculture is still a good long term play but is affected by so many variables that conservative investors may wish to tread lightly. Bonds present perhaps the biggest investment challenge. With no way to know where interest rates ...

objective of the firm

... stockholders would think favorably of a project that promised its first return in 100 years. We must take into account the time pattern of returns in our analysis. Another shortcoming of the objective of maximizing earnings per share is that it does not consider the risk or uncertainty of the prospe ...

... stockholders would think favorably of a project that promised its first return in 100 years. We must take into account the time pattern of returns in our analysis. Another shortcoming of the objective of maximizing earnings per share is that it does not consider the risk or uncertainty of the prospe ...

LIA Mullingar Overview of the Irish Mortgage Market

... • The Central Statistics Office recorded yoy growth of 7.6% in Dec 2006 (growth rates have averaged at 5.3% since the beginning of the year) • Location remains strong and demand is driven by population growth and strong levels of net migration ...

... • The Central Statistics Office recorded yoy growth of 7.6% in Dec 2006 (growth rates have averaged at 5.3% since the beginning of the year) • Location remains strong and demand is driven by population growth and strong levels of net migration ...

Q1: What is your reading of the state of Indian economy

... Valuations for these sectors are not demanding. However, each of these sectors has its own sector specific drivers. For eg. Many investors are waiting to see the impact of a possible slowdown in the US on Indian software companies. There are concerns on billing rates as well as on volume growth for ...

... Valuations for these sectors are not demanding. However, each of these sectors has its own sector specific drivers. For eg. Many investors are waiting to see the impact of a possible slowdown in the US on Indian software companies. There are concerns on billing rates as well as on volume growth for ...