Plunder Blunder Cover Mech.indd

... One other group—the media—figures prominently in this story. Key news outlets presented the bubble promoters as experts on the economy. Even the most extreme bubble celebrants could count on a respectful hearing in these circles. James Glassman, coauthor of Dow 36,000: The New Strategy for Profiting ...

... One other group—the media—figures prominently in this story. Key news outlets presented the bubble promoters as experts on the economy. Even the most extreme bubble celebrants could count on a respectful hearing in these circles. James Glassman, coauthor of Dow 36,000: The New Strategy for Profiting ...

From Cattle to Cotton to Corn

... Many portfolios typically comprise of just two asset classes, stocks and bonds. However, investors tend to further diversify their portfolios, allocating a portion of their holdings to non-traditional securities such as commodities. These securities are not correlated to the broad markets, and may a ...

... Many portfolios typically comprise of just two asset classes, stocks and bonds. However, investors tend to further diversify their portfolios, allocating a portion of their holdings to non-traditional securities such as commodities. These securities are not correlated to the broad markets, and may a ...

GCC Markets Monthly Report

... in a YTD-15 return of 11.8%, the strongest in the GCC. After breaching the 9,000 mark on the very first day of February-15, the index was up by almost 27% from its lows recorded during December-14. Markets sentiments continue to remain elevated on the back of improving oil prices coupled with a stab ...

... in a YTD-15 return of 11.8%, the strongest in the GCC. After breaching the 9,000 mark on the very first day of February-15, the index was up by almost 27% from its lows recorded during December-14. Markets sentiments continue to remain elevated on the back of improving oil prices coupled with a stab ...

Controladora Vuela Compania de Aviacion, SAB de

... Total long-term liabilities Financial debt Stock market loans Other liabilities with cost Deferred tax liabilities Other non-current liabilities Financial instruments Deferred revenue Employee benefits Provisions Long-term liabilities related to available for sale assets Other Total equity Equity at ...

... Total long-term liabilities Financial debt Stock market loans Other liabilities with cost Deferred tax liabilities Other non-current liabilities Financial instruments Deferred revenue Employee benefits Provisions Long-term liabilities related to available for sale assets Other Total equity Equity at ...

BSL 4: Corporate finance

... • Example: Suppose that Garden Arena is not publicly traded, but Acme (which also owns a hockey franchise & sports arena) is publicly traded – Suppose Acme’s market value is $100M – Pick a relevant criteria to compare Acme to Garden Arena (earnings, assets, number of season ticket holders, etc.) – S ...

... • Example: Suppose that Garden Arena is not publicly traded, but Acme (which also owns a hockey franchise & sports arena) is publicly traded – Suppose Acme’s market value is $100M – Pick a relevant criteria to compare Acme to Garden Arena (earnings, assets, number of season ticket holders, etc.) – S ...

IBS1126 - The Hong Kong Institute of Education

... Demonstrate an understanding of personal financial planning and the economic, political and regulatory environment (including the required ethics) within which personal financial planners operate; CILO 2 Identify the key elements in personal financial planning; CILO 3 Overview various types of inves ...

... Demonstrate an understanding of personal financial planning and the economic, political and regulatory environment (including the required ethics) within which personal financial planners operate; CILO 2 Identify the key elements in personal financial planning; CILO 3 Overview various types of inves ...

CIT Investment Discl..

... fluctuate or fall in response to economic events or trends. The prices of bonds in which a Fund may invest may fall because of a rise in interest rates. Investments in foreign securities are subject to certain special risks and considerations, including potentially less liquidity and greater price v ...

... fluctuate or fall in response to economic events or trends. The prices of bonds in which a Fund may invest may fall because of a rise in interest rates. Investments in foreign securities are subject to certain special risks and considerations, including potentially less liquidity and greater price v ...

Interaction Between Value Line`s Timeliness and

... diminished. Exhibit 6 shows the average betas of securities across timeliness and safety ranks. For the sample as a whole, securities ranked as having higher levels of total risk are also those with higher betas. The average betas of the timeliness groups are all significantly different except T3 an ...

... diminished. Exhibit 6 shows the average betas of securities across timeliness and safety ranks. For the sample as a whole, securities ranked as having higher levels of total risk are also those with higher betas. The average betas of the timeliness groups are all significantly different except T3 an ...

East African Community Common Market Protocol

... were not allowed to participate in Government securities. After the amendments, East Africans can now participate in Government securities issuances up to a level of 40% of the issued sum. However, no group of investors from one East African country can exceed two-thirds of the cumulative 40% alloca ...

... were not allowed to participate in Government securities. After the amendments, East Africans can now participate in Government securities issuances up to a level of 40% of the issued sum. However, no group of investors from one East African country can exceed two-thirds of the cumulative 40% alloca ...

Transaction in the share market

... ‘ex’ means without. At the start of trading on the ex-dividend date, the share price will normally open for trading at the previous days close, less the value of the dividend per share. This reflects the fact that purchasers of the stock on the ex-dividend date and beyond WILL NOT receive the declar ...

... ‘ex’ means without. At the start of trading on the ex-dividend date, the share price will normally open for trading at the previous days close, less the value of the dividend per share. This reflects the fact that purchasers of the stock on the ex-dividend date and beyond WILL NOT receive the declar ...

Commonality In The Determinants Of Expected Stock Returns

... Given the price reactions to unexpected changes in market risk reported in longitudinal studies (French, Schwert and Stambaugh (1987) and Haugen, Talmor and Torous (1991)), differences in the risk of stocks are likely to have predictive power in the cross-section. Accepted paradigms point to specifi ...

... Given the price reactions to unexpected changes in market risk reported in longitudinal studies (French, Schwert and Stambaugh (1987) and Haugen, Talmor and Torous (1991)), differences in the risk of stocks are likely to have predictive power in the cross-section. Accepted paradigms point to specifi ...

Maximizing shareholder value: a new ideology for corporate

... funds and insurance companies to invest substantial proportions of their portfolios in corporate equities and other risky securities such as ‘junk bonds’ and venture funds rather than just in high-grade corporate and government securities. During the 1970s the US banking sector also experienced sign ...

... funds and insurance companies to invest substantial proportions of their portfolios in corporate equities and other risky securities such as ‘junk bonds’ and venture funds rather than just in high-grade corporate and government securities. During the 1970s the US banking sector also experienced sign ...

Financing Real Estate through Capital Markets Real Estate

... financial reporting purposes; and (vi) Growth: Over long holding periods, equity REIT returns have tended to outpace the rate of inflation in particular economies, helping investors hedge the purchasing power of their portfolios In 2011, the Capital Market and Securities Authority put up the regula ...

... financial reporting purposes; and (vi) Growth: Over long holding periods, equity REIT returns have tended to outpace the rate of inflation in particular economies, helping investors hedge the purchasing power of their portfolios In 2011, the Capital Market and Securities Authority put up the regula ...

The Relationship between Stock Returns and Macroeconomic

... shares. In addition, industrial production is indicated as neither the result variable nor the cause variable of stock price movement. The study shows the unidirectional causal relationship, finding stock returns do Granger couse exchange rate. This is consistent with Ozturk (2008). However, Aydemir ...

... shares. In addition, industrial production is indicated as neither the result variable nor the cause variable of stock price movement. The study shows the unidirectional causal relationship, finding stock returns do Granger couse exchange rate. This is consistent with Ozturk (2008). However, Aydemir ...

EUROPEAN COMMISSION Brussels, 14.7.2016 C(2016) 4390 final

... other similar financial instruments takes place in largely the same fashion, and fulfils a nearly identical economic purpose, as trading in shares admitted to trading on a regulated market, MiFIR extends its provisions to the former. In addition, MiFIR introduces an on-venue trading obligation for s ...

... other similar financial instruments takes place in largely the same fashion, and fulfils a nearly identical economic purpose, as trading in shares admitted to trading on a regulated market, MiFIR extends its provisions to the former. In addition, MiFIR introduces an on-venue trading obligation for s ...

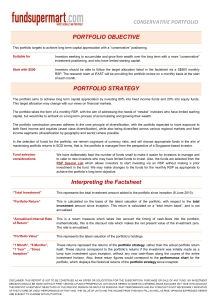

portfolio objective

... This portfolio targets to achieve long term capital appreciation with a “conservative” positioning. Suitable for ...

... This portfolio targets to achieve long term capital appreciation with a “conservative” positioning. Suitable for ...

міністерство освіти і науки україни державний економіко

... counted in the marketplace until it becomes a demand – the willingness and ability to purchase a desired object. Since an individual has limited resources, only some wants will end up as measurable demands. The terms goods and services are used to describe many things people desire. Consumer goods a ...

... counted in the marketplace until it becomes a demand – the willingness and ability to purchase a desired object. Since an individual has limited resources, only some wants will end up as measurable demands. The terms goods and services are used to describe many things people desire. Consumer goods a ...

Sustainable Investment Research International Group Local

... campaigns. At the same time, there has been a growing understanding of the potential benefits for investment returns of companies adopting higher corporate social responsibility standards as a way of both managing risk and identifying ways of enhancing future performance. With increasing pressure on ...

... campaigns. At the same time, there has been a growing understanding of the potential benefits for investment returns of companies adopting higher corporate social responsibility standards as a way of both managing risk and identifying ways of enhancing future performance. With increasing pressure on ...

PeteKyle_TaoLin_2002..

... An econometrician who observes a very long history of prices and dividends (and inferred the average signal from a linear combination of price and dividend) can estimate accurately the parameters of the actual returns process. Note that the true returns process is not relevant for calculating the eq ...

... An econometrician who observes a very long history of prices and dividends (and inferred the average signal from a linear combination of price and dividend) can estimate accurately the parameters of the actual returns process. Note that the true returns process is not relevant for calculating the eq ...

Mutual Funds - Cornerstone Retirement

... difference between the price a buyer is willing to pay for a security and the price at which the seller is willing to sell. Each time a mutual fund manager buys and sells securities, the fund incurs small trading costs. The greater the trading activity, the higher the trading costs for the fund and ...

... difference between the price a buyer is willing to pay for a security and the price at which the seller is willing to sell. Each time a mutual fund manager buys and sells securities, the fund incurs small trading costs. The greater the trading activity, the higher the trading costs for the fund and ...

The case for investing in smaller companies

... With three funds investing across different markets, the Standard Life smaller companies funds offer greater flexibility and meaningful diversification to our clients. ...

... With three funds investing across different markets, the Standard Life smaller companies funds offer greater flexibility and meaningful diversification to our clients. ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.