Do Market Efficiency Measures Yield Correct Inferences?

... market as inefficient, Burton Malkiel states that “there is considerable serial correlation. The markets are nowhere near a random walk.”2 This article investigates this common perception across both developed and emerging markets through a comprehensive analysis of profits from trading strategies, ...

... market as inefficient, Burton Malkiel states that “there is considerable serial correlation. The markets are nowhere near a random walk.”2 This article investigates this common perception across both developed and emerging markets through a comprehensive analysis of profits from trading strategies, ...

Stock Market Liquidity, Financial Crisis and Quantitative Easing

... Examining the effectiveness of QE stimulus in Japan, Shirakawa (2001) finds that when nominal short-term interest rates are essentially zero, QE non-conventional monetary policy fails to contribute to economic recovery but instead delays natural structural reforms. Also, Kawai (2015) comparing non-c ...

... Examining the effectiveness of QE stimulus in Japan, Shirakawa (2001) finds that when nominal short-term interest rates are essentially zero, QE non-conventional monetary policy fails to contribute to economic recovery but instead delays natural structural reforms. Also, Kawai (2015) comparing non-c ...

chapter 5 - BYU Marriott School

... The disadvantage of the shift is apparent from the fact that, if my client is willing to accept an expected return on his total portfolio of 11.2%, he can achieve that return with a lower standard deviation using my fund portfolio rather than the passive portfolio. To achieve a target mean of 11.2%, ...

... The disadvantage of the shift is apparent from the fact that, if my client is willing to accept an expected return on his total portfolio of 11.2%, he can achieve that return with a lower standard deviation using my fund portfolio rather than the passive portfolio. To achieve a target mean of 11.2%, ...

Investment - Stanford University

... 1. Introduction “Invest” is a word that is used frequently in economics, as the quotations above suggest. One can invest in developing new ideas, as suggested by Benjamin Franklin. One can invest in human capital, as suggested by Winston Churchill. Or one can invest in financial assets, perhaps the ...

... 1. Introduction “Invest” is a word that is used frequently in economics, as the quotations above suggest. One can invest in developing new ideas, as suggested by Benjamin Franklin. One can invest in human capital, as suggested by Winston Churchill. Or one can invest in financial assets, perhaps the ...

Let`s Make a Deal - Society of Actuaries

... company, particularly a life insurance company, you'll find all of those methodologies applied. But there's one other analysis that's particularly important to publicly traded companies: what an acquisition will do to the company's stock price. Many of the active acquirers are publicly traded compan ...

... company, particularly a life insurance company, you'll find all of those methodologies applied. But there's one other analysis that's particularly important to publicly traded companies: what an acquisition will do to the company's stock price. Many of the active acquirers are publicly traded compan ...

A Comparative Study of Venture Capital Performance in the US and

... investment horizon, and higher information asymmetry than the public equity investments. Venture capital funds specialize in long-term private equity investments in startup and super-growth companies that offer high potential returns and substantial risk. Since venture capital investments are made i ...

... investment horizon, and higher information asymmetry than the public equity investments. Venture capital funds specialize in long-term private equity investments in startup and super-growth companies that offer high potential returns and substantial risk. Since venture capital investments are made i ...

Reitway Global`s Investment Process

... philosophy is the cornerstone of our investment process, with the same philosophy and culture applied to all the portfolios managed by Reitway Global. Being convinced that a consistent adherence to our investment process produces better relative returns, we avoid modifying our philosophy to suit pre ...

... philosophy is the cornerstone of our investment process, with the same philosophy and culture applied to all the portfolios managed by Reitway Global. Being convinced that a consistent adherence to our investment process produces better relative returns, we avoid modifying our philosophy to suit pre ...

Regime-Switching Measure of Systemic Financial Stress

... the weekly frequency, in contrast to the daily data of a different set of financial variables used in González-Hermosillo and Hesse (2009). This allows my model to reduce the effects of the “noise” in high-frequency data on the identification of regimes. Second, I model the TED and CDS spreads in l ...

... the weekly frequency, in contrast to the daily data of a different set of financial variables used in González-Hermosillo and Hesse (2009). This allows my model to reduce the effects of the “noise” in high-frequency data on the identification of regimes. Second, I model the TED and CDS spreads in l ...

Presentation

... Under current guidance, if the fair value of the shares withheld to pay income taxes exceeds the employer’s minimum statutory withholding obligation, the entire award must be classified as a liability. The proposal allows for an employer to avoid triggering liability accounting if the value of t ...

... Under current guidance, if the fair value of the shares withheld to pay income taxes exceeds the employer’s minimum statutory withholding obligation, the entire award must be classified as a liability. The proposal allows for an employer to avoid triggering liability accounting if the value of t ...

Empirical Investigation of an Equity Pairs Trading Strategy

... Pairs trading strategy is a market neutral strategy that involves the following two steps. The first step is to identify pairs, which are trading instruments (stocks, options, currencies, bonds, etc.) that show high correlations, i.e., the price of one moves in the same direction as the other. In th ...

... Pairs trading strategy is a market neutral strategy that involves the following two steps. The first step is to identify pairs, which are trading instruments (stocks, options, currencies, bonds, etc.) that show high correlations, i.e., the price of one moves in the same direction as the other. In th ...

Special Comment US Executive Pay Structure and Metrics

... that some boards are reluctant to see their executives punished when options fail to deliver value. This negative effect on retention would not be so worrisome if the outcomes were simply a matter of poor performance for shareholders, since presumably a change of management is appropriate in those s ...

... that some boards are reluctant to see their executives punished when options fail to deliver value. This negative effect on retention would not be so worrisome if the outcomes were simply a matter of poor performance for shareholders, since presumably a change of management is appropriate in those s ...

Capital Market Report - World bank documents

... creation of a long term savings schemes, via a 401K and/or incentives for life insurance. In addition, the development of credit enhancements and other type of risk sharing mechanisms to foster investors’ participation in strategic sectors is also needed. All this will require coordination among the ...

... creation of a long term savings schemes, via a 401K and/or incentives for life insurance. In addition, the development of credit enhancements and other type of risk sharing mechanisms to foster investors’ participation in strategic sectors is also needed. All this will require coordination among the ...

The Evolution of Quantitative Investment Strategies

... to a safe investment that offers investors a return commensurate with the time value of money, a risky investment must offer them an extra reward to compensate for the likely losses they may incur. Markowitz’s successful characterization of risk using the standard deviation of returns led to the nex ...

... to a safe investment that offers investors a return commensurate with the time value of money, a risky investment must offer them an extra reward to compensate for the likely losses they may incur. Markowitz’s successful characterization of risk using the standard deviation of returns led to the nex ...

FREE Sample Here

... 22. Which of the following statements is correct? a. Because bonds can generally be called only at a premium, meaning that the bondholder will enjoy a capital gain, including a call provision (other than a sinking fund call) in the indenture increases the value of the bond and lowers the bond's requ ...

... 22. Which of the following statements is correct? a. Because bonds can generally be called only at a premium, meaning that the bondholder will enjoy a capital gain, including a call provision (other than a sinking fund call) in the indenture increases the value of the bond and lowers the bond's requ ...

European Capital Markets - The Family Wealth Community

... Paris was the destination for almost all (95%) the CrossRegional investment into the country and offices (71%) also attracted by far the highest proportion. The pattern of Cross-Regional investment in Germany is very different. Investment was very much more diverse geographically. Between them the t ...

... Paris was the destination for almost all (95%) the CrossRegional investment into the country and offices (71%) also attracted by far the highest proportion. The pattern of Cross-Regional investment in Germany is very different. Investment was very much more diverse geographically. Between them the t ...

Two Additional Market Vectors ETFs Offered to Qualified

... largest and most liquid stocks in the Chinese A-share market. Constituent stocks for the Index must have been listed for more than three months (unless the stock’s average daily A-share market capitalization since its initial listing ranks among the top 30 of all A-shares) and must not be experienci ...

... largest and most liquid stocks in the Chinese A-share market. Constituent stocks for the Index must have been listed for more than three months (unless the stock’s average daily A-share market capitalization since its initial listing ranks among the top 30 of all A-shares) and must not be experienci ...

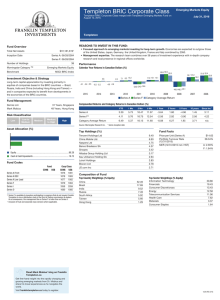

Templeton BRIC Corporate Class Series A

... Templeton BRIC Corporate Class merged with Templeton Emerging Markets Fund on August 12, 2016. ...

... Templeton BRIC Corporate Class merged with Templeton Emerging Markets Fund on August 12, 2016. ...

Market-Wide Impact of the Disposition Effect: Evidence from IPO

... after four weeks. This gives 1,712 firms. The last two sections in Table 2 present the descriptive statistics for these subsamples. Firms in the winner subsample are similar to winners overall, with a median market capitalization of $57.7 million. The size of the median firm in the loser subsample c ...

... after four weeks. This gives 1,712 firms. The last two sections in Table 2 present the descriptive statistics for these subsamples. Firms in the winner subsample are similar to winners overall, with a median market capitalization of $57.7 million. The size of the median firm in the loser subsample c ...

Document

... For illustrative purposes; the stock example above is intended only to illustrate the application of our investment philosophy, and this particular security may or may not be held in the current Japan Growth portfolio. The reader should not assume that this was, or will be, a profitable investment. ...

... For illustrative purposes; the stock example above is intended only to illustrate the application of our investment philosophy, and this particular security may or may not be held in the current Japan Growth portfolio. The reader should not assume that this was, or will be, a profitable investment. ...

FREE Sample Here - Find the cheapest test bank for your

... raise cash for capital investment would most likely A. conduct an IPO with the assistance of an investment banker B. engage in a secondary market sale of equity C. conduct a private placement to a large number of potential buyers D. place an ad in the Wall Street Journal soliciting retail suppliers ...

... raise cash for capital investment would most likely A. conduct an IPO with the assistance of an investment banker B. engage in a secondary market sale of equity C. conduct a private placement to a large number of potential buyers D. place an ad in the Wall Street Journal soliciting retail suppliers ...

popular earnings management techniques

... Companies often buy stock in other companies either to invest excess funds or to achieve some type of strategic alliance. GAAP presumes that investments of less than 20 percent of the stock of another company are passive investments and therefore the investing company need not include a share of the ...

... Companies often buy stock in other companies either to invest excess funds or to achieve some type of strategic alliance. GAAP presumes that investments of less than 20 percent of the stock of another company are passive investments and therefore the investing company need not include a share of the ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.