Indrani De - Quaffers.org

... • For stock returns, the predictive ability of ESG factors is stronger in midcap and small caps. Summarize • The ESG profile of a company is a predictor of its financial performance and long term stock returns. Good companies, defined as those having more strengths than weaknesses in various ESG fie ...

... • For stock returns, the predictive ability of ESG factors is stronger in midcap and small caps. Summarize • The ESG profile of a company is a predictor of its financial performance and long term stock returns. Good companies, defined as those having more strengths than weaknesses in various ESG fie ...

How to Invest in REITs

... NAREIT® does not intend this presentation to be a solicitation related to any particular company, nor does it intend to provide investment, legal or tax advice. Investors should consult with their own investment, legal or tax advisers regarding the appropriateness of investing in any of the securiti ...

... NAREIT® does not intend this presentation to be a solicitation related to any particular company, nor does it intend to provide investment, legal or tax advice. Investors should consult with their own investment, legal or tax advisers regarding the appropriateness of investing in any of the securiti ...

IFSL Brunsdon Investment Funds brochure

... With a mandate to target a return in excess of long-term equities, there will be a higher level of market participation than is usually seen in institutional mandates. The Adventurous mandate's asset allocation will therefore have a reduced core of diversified assets with an added allocation of a ba ...

... With a mandate to target a return in excess of long-term equities, there will be a higher level of market participation than is usually seen in institutional mandates. The Adventurous mandate's asset allocation will therefore have a reduced core of diversified assets with an added allocation of a ba ...

Poplar Forest Cornerstone Fund Summary Prospectus

... Equity securities in which the Fund may invest include, but are not limited to, common stocks, foreign equity securities, convertible securities, and options on stocks, warrants, rights, and/or other investment companies, including mutual funds and exchange-traded funds (“ETFs”). Equity securities w ...

... Equity securities in which the Fund may invest include, but are not limited to, common stocks, foreign equity securities, convertible securities, and options on stocks, warrants, rights, and/or other investment companies, including mutual funds and exchange-traded funds (“ETFs”). Equity securities w ...

The Effect of Poison Pills on Firm Risk: An Application of Options Pricing Theory

... options is a variation of the Black and Scholes option pricing model (Black & Scholes, 1973). The Black and Scholes model values options as a function. of their exercise price, the price of the underlying stock, time to expiration, the rate of return on risk free securities, and the volatility of th ...

... options is a variation of the Black and Scholes option pricing model (Black & Scholes, 1973). The Black and Scholes model values options as a function. of their exercise price, the price of the underlying stock, time to expiration, the rate of return on risk free securities, and the volatility of th ...

Communiqué de presse

... of its clients with UBP’s substantial expertise in managing liquid high income public debt strategies. Partners Group currently manages over EUR 54 billion in investment programs under management across its global private markets platform, with EUR 9 billion in private debt assets under management, ...

... of its clients with UBP’s substantial expertise in managing liquid high income public debt strategies. Partners Group currently manages over EUR 54 billion in investment programs under management across its global private markets platform, with EUR 9 billion in private debt assets under management, ...

Analyzing Investment Data Using Conditional Probabilities: The

... μ and σ that were presented in equations (7) and (8) above. To illustrate how these concepts are applied in practice, historical returns from the Ibbotson Associates Stocks, Bonds, Bills and Inflation 2002 Yearbook will be used. As noted above, it is common to adjust probabilistic forecasts for curr ...

... μ and σ that were presented in equations (7) and (8) above. To illustrate how these concepts are applied in practice, historical returns from the Ibbotson Associates Stocks, Bonds, Bills and Inflation 2002 Yearbook will be used. As noted above, it is common to adjust probabilistic forecasts for curr ...

~. Choose an initial investment allocation 4. Indicate any existing

... someone other than your spouse. These contracts do not provide for loans and cannot be assigned. Under federal la,\,; distributions before age 59'/2 or termination of cmployment may be prohibited, limited, a11d/or subject to substantial tax penalties. Your ability to make withdrawals and transfcrs i ...

... someone other than your spouse. These contracts do not provide for loans and cannot be assigned. Under federal la,\,; distributions before age 59'/2 or termination of cmployment may be prohibited, limited, a11d/or subject to substantial tax penalties. Your ability to make withdrawals and transfcrs i ...

Introduction_to_Volatility

... To get the basic idea of what volatility is please read the article Putting volatility to work written by Ravi Kant Jain and published in the Active Trader Magazine (April 2001). Here we will provide a description of what volatility is, why it is important in option trading and how one can estimate ...

... To get the basic idea of what volatility is please read the article Putting volatility to work written by Ravi Kant Jain and published in the Active Trader Magazine (April 2001). Here we will provide a description of what volatility is, why it is important in option trading and how one can estimate ...

WP SES

... significantly. The sample contains 11,464 different call and 11,377 put options corresponding to a total of 1,828,800 daily observations. Since a number of options are available every trading day, we have to select a single put and call option daily to implement different trading strategies. We use ...

... significantly. The sample contains 11,464 different call and 11,377 put options corresponding to a total of 1,828,800 daily observations. Since a number of options are available every trading day, we have to select a single put and call option daily to implement different trading strategies. We use ...

Evaluating Managers: Are We Sending the Right

... (right-hand side of the figure), the The information ratio depends not only on the time best ratio of those same 100 funds was just 0.91, the period but also on the benchmark used to calculate worst, –1.39, and the median, –0.47. As a measure of the ratio. For example, in Figure 2, the S&P 500 a man ...

... (right-hand side of the figure), the The information ratio depends not only on the time best ratio of those same 100 funds was just 0.91, the period but also on the benchmark used to calculate worst, –1.39, and the median, –0.47. As a measure of the ratio. For example, in Figure 2, the S&P 500 a man ...

Estimating an Equilibrium Model of Limit Order Markets

... taking it have a timing component however. A market order executes with an order that came before it. The active trader making the market order may have information newer to the market than information liquidity suppliers had when offering shares. If this information asymmetry fully characterized tr ...

... taking it have a timing component however. A market order executes with an order that came before it. The active trader making the market order may have information newer to the market than information liquidity suppliers had when offering shares. If this information asymmetry fully characterized tr ...

REAL ESTATE MARKETS IN URBAN RUSSIA Journal of

... In the short run, the housing market will be influenced primarily by factors that change the demand for rental space (such as changes in income, immigration, or emigration) or that change the demand for the housing stock (such as changes in the user cost of capital). Specifically, if the demand for ...

... In the short run, the housing market will be influenced primarily by factors that change the demand for rental space (such as changes in income, immigration, or emigration) or that change the demand for the housing stock (such as changes in the user cost of capital). Specifically, if the demand for ...

Download attachment

... to meet Shariah guidelines, including financial ratio filters4. After screening, a pool of approximately 640 stocks qualify and the individual stocks are selected for the portfolio. There are two approaches to portfolio management: active or passive (indexing). In the past few years, investors have ...

... to meet Shariah guidelines, including financial ratio filters4. After screening, a pool of approximately 640 stocks qualify and the individual stocks are selected for the portfolio. There are two approaches to portfolio management: active or passive (indexing). In the past few years, investors have ...

Table of Contents - Maryland Public Service Commission

... I will recommend a rate of return on rate base for Baltimore Gas and Electric Company (BGE), and comment ...

... I will recommend a rate of return on rate base for Baltimore Gas and Electric Company (BGE), and comment ...

The Influence of Macroeconomic Factors on Stock Markets

... industry and particular listed firm’s return and sometime comparison between these certain return of two firms and/or industry with assistance of common independent variables exist in any economy. Emin et al. examined the market based ratio(s) of four independent variables namely quarterly earnings ...

... industry and particular listed firm’s return and sometime comparison between these certain return of two firms and/or industry with assistance of common independent variables exist in any economy. Emin et al. examined the market based ratio(s) of four independent variables namely quarterly earnings ...

financial deepening in indonesia

... Finally, we examined the question of how to execute these 22 initiatives effectively. Financial deepening has been a hot topic in Indonesia, with multiple publications, reports and recommendations published over the last 15 years. However, practical progress in carrying out this financial deepening ...

... Finally, we examined the question of how to execute these 22 initiatives effectively. Financial deepening has been a hot topic in Indonesia, with multiple publications, reports and recommendations published over the last 15 years. However, practical progress in carrying out this financial deepening ...

LU0028118809

... recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustr ...

... recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustr ...

Managerial Economics - e

... business are financed by debt and how much by equity(ownership). Leverage is not necessarily a bad thing. Leverage is useful to fund company growth and development through the purchase of assets. But if the company has too much borrowing, it may not be able to pay back all of its debts. ...

... business are financed by debt and how much by equity(ownership). Leverage is not necessarily a bad thing. Leverage is useful to fund company growth and development through the purchase of assets. But if the company has too much borrowing, it may not be able to pay back all of its debts. ...

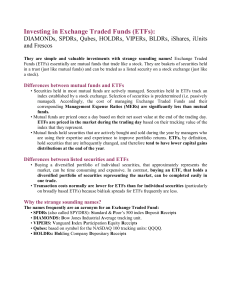

Investing in Exchange Traded Funds (ETFs):

... By definition, an investor holding an Exchange Traded Fund will never outperform the market. The investor will track the market (less a small MER). Some ETFs have a high percent of their portfolio invested either in a sector or an individual security. Concentrations can influence the volatility and ...

... By definition, an investor holding an Exchange Traded Fund will never outperform the market. The investor will track the market (less a small MER). Some ETFs have a high percent of their portfolio invested either in a sector or an individual security. Concentrations can influence the volatility and ...

Saving the Lives of the Most Vulnerable - With Financial Returns

... As BMGF explored possible approaches, initial thoughts were to take a few specific projects that were under development such as an anti-diarrheal drug, a cholera vaccine, and a tuberculosis test, and package them into one fund. But it became clear that it would be too difficult to do three deals sim ...

... As BMGF explored possible approaches, initial thoughts were to take a few specific projects that were under development such as an anti-diarrheal drug, a cholera vaccine, and a tuberculosis test, and package them into one fund. But it became clear that it would be too difficult to do three deals sim ...

Q1 FY2015 Form 10Q - Linear Technology

... Manufacturing and test equipment Office furniture and equipment Accumulated depreciation and amortization Net property, plant and equipment Identified intangible assets, net and goodwill ...

... Manufacturing and test equipment Office furniture and equipment Accumulated depreciation and amortization Net property, plant and equipment Identified intangible assets, net and goodwill ...

IOSR Journal of Business and Management (IOSR-JBM)

... The Bond Market – deals with tradeable long term debts, which have a specific repayment schedule, a specific repayment date and which pay an agreed income (interest) to the investor. c. Equity Market – deals with risk capital which has no redemption date and there are no dividend payment guarantees. ...

... The Bond Market – deals with tradeable long term debts, which have a specific repayment schedule, a specific repayment date and which pay an agreed income (interest) to the investor. c. Equity Market – deals with risk capital which has no redemption date and there are no dividend payment guarantees. ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.