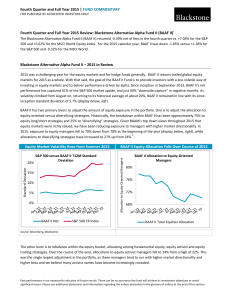

Fourth Quarter and Full Year 2015

... carefully before investing. The prospectus contains this and other information about the Fund. Investors can obtain a prospectus from your financial professional or on the Fund’s website at www.blackstone.com/blackstone‐alternative‐alpha‐funds. All investors are urged to carefully read the prospect ...

... carefully before investing. The prospectus contains this and other information about the Fund. Investors can obtain a prospectus from your financial professional or on the Fund’s website at www.blackstone.com/blackstone‐alternative‐alpha‐funds. All investors are urged to carefully read the prospect ...

PRECISION CASTPARTS CORP (Form: S-3

... proprietary technological advantage in the high quality, high volume manufacturing of complex metal components and products. In particular, the Company believes it is currently the only manufacturer in the world that can precision cast large, complex parts from a variety of metals and alloys in the ...

... proprietary technological advantage in the high quality, high volume manufacturing of complex metal components and products. In particular, the Company believes it is currently the only manufacturer in the world that can precision cast large, complex parts from a variety of metals and alloys in the ...

Stock dividends - McGraw Hill Higher Education

... Copyright © 2014 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. ...

... Copyright © 2014 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. ...

Invest globally - Putnam Investments

... Consider these risks before investing: International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Additional risks may be associated with emerging-market securities, including illiquidity and volatility. Diversification does not g ...

... Consider these risks before investing: International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Additional risks may be associated with emerging-market securities, including illiquidity and volatility. Diversification does not g ...

Impact of Dividend Policy on Market Capitalization of Firms Listed in

... regarding the selected topic was conducted on automobile sector of KSE Therefore the study aims to fill the gap by taking both stock price and quantity as a measure of market capitalization and exploring that how a dividend policy impact over it in automobile sector. ...

... regarding the selected topic was conducted on automobile sector of KSE Therefore the study aims to fill the gap by taking both stock price and quantity as a measure of market capitalization and exploring that how a dividend policy impact over it in automobile sector. ...

Pacer ETFs Crosses $1 Billion Threshold

... www.paceretfs.com or calling 1-877-337-0500. Please read the prospectus carefully before investing. An investment in the Funds is subject to investment risk, including the possible loss of principal. Pacer ETF shares may be bought and sold on an exchange through a brokerage account. Brokerage commis ...

... www.paceretfs.com or calling 1-877-337-0500. Please read the prospectus carefully before investing. An investment in the Funds is subject to investment risk, including the possible loss of principal. Pacer ETF shares may be bought and sold on an exchange through a brokerage account. Brokerage commis ...

Market Makers and Vampire Squid

... provides to investors come in two flavors. Sometimes clients come to them for advisory services (e.g. relating to takeovers, raising money for the company, or portfolio investing). At other times, investors look to them as market makers, intermediaries with an inventory of securities that can be bou ...

... provides to investors come in two flavors. Sometimes clients come to them for advisory services (e.g. relating to takeovers, raising money for the company, or portfolio investing). At other times, investors look to them as market makers, intermediaries with an inventory of securities that can be bou ...

HouseStyle

... Canada, Australia or Japan or any jurisdiction into which the same would be unlawful. This announcement does not constitute or form part of an offer or solicitation to purchase or subscribe for shares in the capital of the Company in the United States, Canada, Australia or Japan or any jurisdiction ...

... Canada, Australia or Japan or any jurisdiction into which the same would be unlawful. This announcement does not constitute or form part of an offer or solicitation to purchase or subscribe for shares in the capital of the Company in the United States, Canada, Australia or Japan or any jurisdiction ...

The Effect of Futures Trading on the Underlying Volatility: Evidence

... innovation of 1980’s. The first contract was the Chicago mercantile exchange S&P 500 futures, which begin trading in the US in April 1982. The futures contracts design spread to almost every financial futures market world wide- the Sydney Futures Exchange’s, Australian All Ordinary Share Price Index ...

... innovation of 1980’s. The first contract was the Chicago mercantile exchange S&P 500 futures, which begin trading in the US in April 1982. The futures contracts design spread to almost every financial futures market world wide- the Sydney Futures Exchange’s, Australian All Ordinary Share Price Index ...

Investment Methodology and the Batting Average

... fiduciary and investment principles. For your convenience, we’ve provided a summary below of the Fiduciary Series investment methodology. ...

... fiduciary and investment principles. For your convenience, we’ve provided a summary below of the Fiduciary Series investment methodology. ...

Download attachment

... their investors, much different investment opportunities compared to common stocks. Second, unlike deposit mobilization by the Islamic banks, the resource mobilization requirements of the MCos., compel them to participate in the capital markets. Third, while contributing to economic development by r ...

... their investors, much different investment opportunities compared to common stocks. Second, unlike deposit mobilization by the Islamic banks, the resource mobilization requirements of the MCos., compel them to participate in the capital markets. Third, while contributing to economic development by r ...

Inflation: The Influence of Inflation on Equity Returns

... these expenses on to its customers, thereby increasing revenues and maintaining net cash flows. The result is that cash flows are protected from the affects of inflation and continue to accrue to the equity investor. Unfortunately, this depiction of stocks is incomplete. It is common to measure infl ...

... these expenses on to its customers, thereby increasing revenues and maintaining net cash flows. The result is that cash flows are protected from the affects of inflation and continue to accrue to the equity investor. Unfortunately, this depiction of stocks is incomplete. It is common to measure infl ...

not fdic insured | may lose value | no bank

... The Salient Trend Fund offers an approach to trend following that is both dynamic, in that it constantly adjusts as market conditions evolve, and passive, meaning portfolio allocation decisions are made using a rules-based system rather than manager discretion. The investment process begins with the ...

... The Salient Trend Fund offers an approach to trend following that is both dynamic, in that it constantly adjusts as market conditions evolve, and passive, meaning portfolio allocation decisions are made using a rules-based system rather than manager discretion. The investment process begins with the ...

International Developed Markets Fund

... David Hodges, has a firm grasp of current market dynamics and how those impact his portfolio and maintains strong oversight of the collective international investment process. The firm’s strategy tends to favor mid/smaller capitalization companies, which will often do well in periods of economic exp ...

... David Hodges, has a firm grasp of current market dynamics and how those impact his portfolio and maintains strong oversight of the collective international investment process. The firm’s strategy tends to favor mid/smaller capitalization companies, which will often do well in periods of economic exp ...

investor sentiment indicator

... that you are part of this HNW market. The latest data from the Quarter 2 2012 survey reveals that HNW investor sentiment has moved back into negative territory, with the overall sentiment score dropping to -10.9 from +3.6 in Quarter 1, a result which is not surprising given the recent turmoil in glo ...

... that you are part of this HNW market. The latest data from the Quarter 2 2012 survey reveals that HNW investor sentiment has moved back into negative territory, with the overall sentiment score dropping to -10.9 from +3.6 in Quarter 1, a result which is not surprising given the recent turmoil in glo ...

FREE Sample Here

... 3. Carefully explain why the volume of financial assets outstanding must always equal the volume of liabilities outstanding. Answer: Because another definition of financial asset is any asset held by a business firm, government, or household that is also recorded as a liability or claim on some othe ...

... 3. Carefully explain why the volume of financial assets outstanding must always equal the volume of liabilities outstanding. Answer: Because another definition of financial asset is any asset held by a business firm, government, or household that is also recorded as a liability or claim on some othe ...

FREE Sample Here

... 3. Carefully explain why the volume of financial assets outstanding must always equal the volume of liabilities outstanding. Answer: Because another definition of financial asset is any asset held by a business firm, government, or household that is also recorded as a liability or claim on some othe ...

... 3. Carefully explain why the volume of financial assets outstanding must always equal the volume of liabilities outstanding. Answer: Because another definition of financial asset is any asset held by a business firm, government, or household that is also recorded as a liability or claim on some othe ...

Short-Selling Bans and Bank Stability

... enacted during the credit crisis of 2008-09 and the European sovereign debt crisis of 201112. This empirical framework is well suited for identification, in that different financial institutions experienced different exposures to the two crises and were affected in different ways by the bans. In 200 ...

... enacted during the credit crisis of 2008-09 and the European sovereign debt crisis of 201112. This empirical framework is well suited for identification, in that different financial institutions experienced different exposures to the two crises and were affected in different ways by the bans. In 200 ...

Download attachment

... often fit this profile and performed well from 2002 – 05. When risk aversion returns, as no doubt it will, then investors will flee from such indebted companies. Hedge funds may apply similar techniques to transform a reasonable return into a spectacular one. In the following example, loan rates have b ...

... often fit this profile and performed well from 2002 – 05. When risk aversion returns, as no doubt it will, then investors will flee from such indebted companies. Hedge funds may apply similar techniques to transform a reasonable return into a spectacular one. In the following example, loan rates have b ...

INTRODUCTION HIGHLIGHTS Regulatory Issues Market

... panicky sell-offs began in New York before spreading to other major global financial centers such as Tokyo, Istanbul, Oslo and Jakarta. In London, the FTSE 100 Index declined by 2.98%, its steepest fall since September 2011. Elsewhere in Europe, shares suffered their biggest one-day fall in 19 month ...

... panicky sell-offs began in New York before spreading to other major global financial centers such as Tokyo, Istanbul, Oslo and Jakarta. In London, the FTSE 100 Index declined by 2.98%, its steepest fall since September 2011. Elsewhere in Europe, shares suffered their biggest one-day fall in 19 month ...

taxing private equity carried interest using an incentive stock option

... has done both.2 The issue to which it relates is the taxation of the so-called “carried interest” that private equity professionals earn from their funds’ investments. Private equity funds are in the business of buying and selling companies. They make money when they sell their holdings at a profit ...

... has done both.2 The issue to which it relates is the taxation of the so-called “carried interest” that private equity professionals earn from their funds’ investments. Private equity funds are in the business of buying and selling companies. They make money when they sell their holdings at a profit ...

Mercer Low Volatility Equity Fund M3 GBP

... by law between the sub-funds of the umbrella. This means that the Fund's assets are held separately from other sub-funds. Your investment in the Fund will not be affected by any claims made against any other sub-fund in the umbrella. ...

... by law between the sub-funds of the umbrella. This means that the Fund's assets are held separately from other sub-funds. Your investment in the Fund will not be affected by any claims made against any other sub-fund in the umbrella. ...

summary prospectus

... ›› Growth Style Investing Risk: Different types of stocks tend to shift into and out of favor with stock market investors depending on market and economic conditions. The Fund invests in growth style stocks. The Fund’s performance may at times be better or worse than the performance of funds that fo ...

... ›› Growth Style Investing Risk: Different types of stocks tend to shift into and out of favor with stock market investors depending on market and economic conditions. The Fund invests in growth style stocks. The Fund’s performance may at times be better or worse than the performance of funds that fo ...

The case for multi asset investment

... We believe that actively managed strategies can add real value over time for investors, but true ‘investment skill’ is scarce and requires dedicated resources to seek it out. As shown in Chart 4, the difference this ability can make is significant, with skilled managers able to consistently outperfo ...

... We believe that actively managed strategies can add real value over time for investors, but true ‘investment skill’ is scarce and requires dedicated resources to seek it out. As shown in Chart 4, the difference this ability can make is significant, with skilled managers able to consistently outperfo ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.