ZKB Warrant Put on Troy Ounce of Silver

... The investor benefits from falling Underlyings as well as from rising volatility of the Underlyings. The Investor has the right (not the obligation), during the the Exercise Period (american) to sell (Put) the Underlying for the Exercise Price. Warrants are appropriate for investors with a high tole ...

... The investor benefits from falling Underlyings as well as from rising volatility of the Underlyings. The Investor has the right (not the obligation), during the the Exercise Period (american) to sell (Put) the Underlying for the Exercise Price. Warrants are appropriate for investors with a high tole ...

May 15, 2017 Basel Committee on Banking Supervision Bank for

... The Second Consultation likewise lacks clarity as to the appropriate treatment of regulated stock and bond funds in a framework designed to identify entities whose weakness or failure could prompt a bank sponsor to step in. On the one hand, the Committee correctly recognizes variable NAV funds as “c ...

... The Second Consultation likewise lacks clarity as to the appropriate treatment of regulated stock and bond funds in a framework designed to identify entities whose weakness or failure could prompt a bank sponsor to step in. On the one hand, the Committee correctly recognizes variable NAV funds as “c ...

Discount for Lack of Marketability in Preferred Financings

... 5. Was this round priced as an ”up round” or a “down round” (that is, at a premium or discount to the last per share price or implied enterprise value paid)? ...

... 5. Was this round priced as an ”up round” or a “down round” (that is, at a premium or discount to the last per share price or implied enterprise value paid)? ...

Back to basics on Risk Management – Futures

... A simple instrument available to deal with price risk is a Forward contract, where farmers and buyers of agricultural produce agree in advance on the terms of delivery regarding quantity and price. Prices are frequently in line with Futures prices but can also be fixed. With this type of contract, t ...

... A simple instrument available to deal with price risk is a Forward contract, where farmers and buyers of agricultural produce agree in advance on the terms of delivery regarding quantity and price. Prices are frequently in line with Futures prices but can also be fixed. With this type of contract, t ...

Capital Market Risk Return

... III. Systematic and unsystematic risks Systematic risks are unanticipated events that affect almost all assets to some degree because the effects are economywide. Unsystematic risks are unanticipated events that affect single assets or small groups of assets. Also called unique or asset-specific ris ...

... III. Systematic and unsystematic risks Systematic risks are unanticipated events that affect almost all assets to some degree because the effects are economywide. Unsystematic risks are unanticipated events that affect single assets or small groups of assets. Also called unique or asset-specific ris ...

Lecture 5

... Exchange Traded Funds (ETF) ETFs allow investors to buy or sell exposure to an index through a single financial instrument. They trade on a stock market just as shares of any individual company. ETFs have many advantages: Can assist in diversification. With a specific type of ETF (say an equity-orie ...

... Exchange Traded Funds (ETF) ETFs allow investors to buy or sell exposure to an index through a single financial instrument. They trade on a stock market just as shares of any individual company. ETFs have many advantages: Can assist in diversification. With a specific type of ETF (say an equity-orie ...

Provisions on Issues concerning the Implementation of the

... by Qualified Foreign Institutional Investors For the purpose of further improving the pilot program on qualified foreign institutional investors (hereinafter referred to as the “QFII”), the issues concerning the implementation of the Administrative Measures for Securities Investment made in China by ...

... by Qualified Foreign Institutional Investors For the purpose of further improving the pilot program on qualified foreign institutional investors (hereinafter referred to as the “QFII”), the issues concerning the implementation of the Administrative Measures for Securities Investment made in China by ...

Provisions on Issues concerning the Implementation of the

... by Qualified Foreign Institutional Investors For the purpose of further improving the pilot program on qualified foreign institutional investors (hereinafter referred to as the “QFII”), the issues concerning the implementation of the Administrative Measures for Securities Investment made in China by ...

... by Qualified Foreign Institutional Investors For the purpose of further improving the pilot program on qualified foreign institutional investors (hereinafter referred to as the “QFII”), the issues concerning the implementation of the Administrative Measures for Securities Investment made in China by ...

Measuring CRI`s Impact on Performance

... rebalancing — result in a slightly different portfolio than the managers’ unscreened portfolio, there will be some variation in comparative performance on a short-term basis. However, our analysis of long-term performance clearly demonstrates that CBIS’ CRI screens do not constrain our ability to de ...

... rebalancing — result in a slightly different portfolio than the managers’ unscreened portfolio, there will be some variation in comparative performance on a short-term basis. However, our analysis of long-term performance clearly demonstrates that CBIS’ CRI screens do not constrain our ability to de ...

Reading list - Dartmouth College

... (30%) At least one in class presentation of one of the assigned papers. Most of you will do two presentations. I will provide a standard format and guidelines. Students should meet with me several days prior to the presentation. (30%) Each day that a paper is being presented you must hand in three a ...

... (30%) At least one in class presentation of one of the assigned papers. Most of you will do two presentations. I will provide a standard format and guidelines. Students should meet with me several days prior to the presentation. (30%) Each day that a paper is being presented you must hand in three a ...

CEE macro outlook: is Emerging Europe on the way to a

... relates is only available to Relevant Persons or will be engaged in only with Relevant Persons. Solicitations resulting from this publication will only be responded to if the person concerned is a Relevant Person. Other persons should not rely or act upon this publication or any of its contents. The ...

... relates is only available to Relevant Persons or will be engaged in only with Relevant Persons. Solicitations resulting from this publication will only be responded to if the person concerned is a Relevant Person. Other persons should not rely or act upon this publication or any of its contents. The ...

Using Morningstar to Select Funds (TT07)

... BYU Library. To get into Morningstar, go to www.byu.edu. Click on [Students], the [Library]. Then from the [Search] bar at the top of the page, type in “Morningstar.” It will bring up options, including [Morningstar Investment Research], and click on this. It will bring you to the Morningstar.com Li ...

... BYU Library. To get into Morningstar, go to www.byu.edu. Click on [Students], the [Library]. Then from the [Search] bar at the top of the page, type in “Morningstar.” It will bring up options, including [Morningstar Investment Research], and click on this. It will bring you to the Morningstar.com Li ...

Information Disclosure in Speculative Markets

... disclose information. Are managers less likely to disclose what they know about their firms when their stock is overpriced? This paper attempts to shed light on this issue in the context of a model of discretionary disclosure in the presence of speculative premia induced by heterogeneity of beliefs, ...

... disclose information. Are managers less likely to disclose what they know about their firms when their stock is overpriced? This paper attempts to shed light on this issue in the context of a model of discretionary disclosure in the presence of speculative premia induced by heterogeneity of beliefs, ...

Text - Ulster Institutional Repository

... Investors make investment decisions based on the information available to market participants. News articles bring new information to the market. They contain news about a company, the activities in which it is involved, its fundamentals and what is expected by market participants about its future p ...

... Investors make investment decisions based on the information available to market participants. News articles bring new information to the market. They contain news about a company, the activities in which it is involved, its fundamentals and what is expected by market participants about its future p ...

THIS RELEASE (AND THE INFORMATION CONTAINED

... independent advice as to the legal, regulatory, tax, accounting, financial, credit and other related advice prior to making an investment. Any investment in Jackpotjoy's securities should be made solely on the basis of the information contained in the Prospectus issued by Jackpotjoy in connection wi ...

... independent advice as to the legal, regulatory, tax, accounting, financial, credit and other related advice prior to making an investment. Any investment in Jackpotjoy's securities should be made solely on the basis of the information contained in the Prospectus issued by Jackpotjoy in connection wi ...

Investments

... available for sale with a previous fair vale of $9,700, and transfers them into the held-to-maturity category when the current market value of the debt securities is $9,500. Investment in Held-to-Maturity Debt ...

... available for sale with a previous fair vale of $9,700, and transfers them into the held-to-maturity category when the current market value of the debt securities is $9,500. Investment in Held-to-Maturity Debt ...

Should Tender Offer Arbitrage Be Regulated

... HARV. J.LEGIS. 431, 432-33 (1968). This increase in tender offers gave rise to passage of the Williams Act, but that Act in no way dampened the incidence of tender offers. On the contrary, such offers have occurred with increasing frequency in the 1970s. See, e.g., Ehrbar, supra note 14, at 83 (refe ...

... HARV. J.LEGIS. 431, 432-33 (1968). This increase in tender offers gave rise to passage of the Williams Act, but that Act in no way dampened the incidence of tender offers. On the contrary, such offers have occurred with increasing frequency in the 1970s. See, e.g., Ehrbar, supra note 14, at 83 (refe ...

Growing Appetite for Dim Sum Bonds – The Global Rise of the

... RMB) had risen to become the second most-used trade financing currency in the world. In November 2014, the RMB entered the top five of world payment currencies, and now takes position behind the Japanese Yen, British pound, Euro and US dollar. These developments are results of the long-awaited steps ...

... RMB) had risen to become the second most-used trade financing currency in the world. In November 2014, the RMB entered the top five of world payment currencies, and now takes position behind the Japanese Yen, British pound, Euro and US dollar. These developments are results of the long-awaited steps ...

The Introduction of Economic Value Added (EVA ) in the Greek

... fiscal year end to three months after the current fiscal year end EPS is the earnings per share of firm at time t EPS is the change in earnings per share over period t-1 to t Pt-1 is the market value per share at the first trading day of the ninth month prior to fiscal year end EVA is the economic v ...

... fiscal year end to three months after the current fiscal year end EPS is the earnings per share of firm at time t EPS is the change in earnings per share over period t-1 to t Pt-1 is the market value per share at the first trading day of the ninth month prior to fiscal year end EVA is the economic v ...

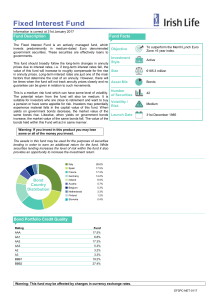

Fixed Interest Fund - Irish Life Corporate Business

... in annuity prices. Long-term interest rates are just one of the main factors that determine the cost of an annuity. However, there will be times when the fund will not track annuity prices closely and no Asset Mix guarantee can be given in relation to such movements. This is a medium risk fund which ...

... in annuity prices. Long-term interest rates are just one of the main factors that determine the cost of an annuity. However, there will be times when the fund will not track annuity prices closely and no Asset Mix guarantee can be given in relation to such movements. This is a medium risk fund which ...

Enhanced practice management

... of a mutual fund’s underperformance versus common market indexes. ...

... of a mutual fund’s underperformance versus common market indexes. ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.