Time-varying diversification benefits

... obtained from investing within the region when short selling constraints are present. For global diversification benefits: For most countries, the benefits of global diversification significantly outweigh the benefits of regional diversification, and the benefits are also more significant in a sta ...

... obtained from investing within the region when short selling constraints are present. For global diversification benefits: For most countries, the benefits of global diversification significantly outweigh the benefits of regional diversification, and the benefits are also more significant in a sta ...

Investment Fund Sample Portfolios

... Plan Sponsors today face daunting challenges: How do you offer a retirement plan that genuinely appeals to both current and prospective employees? How do you select and continuously monitor a full selection of diversified investment options that meet the needs of your diverse workforce? How do you i ...

... Plan Sponsors today face daunting challenges: How do you offer a retirement plan that genuinely appeals to both current and prospective employees? How do you select and continuously monitor a full selection of diversified investment options that meet the needs of your diverse workforce? How do you i ...

European Option Pricing and Hedging with both Fixed

... this problem applying the theory of viscosity solutions to Hamilton-JacobiBellman (HJB) equations (see, for example, Flemming and Soner (1993) for that theory). In the presence of proportional transaction costs the solution indicates that the portfolio space is divided into three disjoint regions, ...

... this problem applying the theory of viscosity solutions to Hamilton-JacobiBellman (HJB) equations (see, for example, Flemming and Soner (1993) for that theory). In the presence of proportional transaction costs the solution indicates that the portfolio space is divided into three disjoint regions, ...

What is an Exchange Traded Fund? How are ETFs bought and sold

... systems which are embedded into capital market workflows, exchanges and financial products across the globe. As part of London Stock Exchange Group, FTSE sits at the heart of Europe’s most liquid and diverse ETF marketplace. ...

... systems which are embedded into capital market workflows, exchanges and financial products across the globe. As part of London Stock Exchange Group, FTSE sits at the heart of Europe’s most liquid and diverse ETF marketplace. ...

Reflections on Recent Target Date Glide-Path

... the contribution rate of all investors or for using a real (inflation-indexed) payout annuity as the hurdle in which to measure the resulting trade-off between risk and reward despite the fact that (A) inflation-indexed annuities are uncommon in the marketplace, and (B) individuals tend to behaviora ...

... the contribution rate of all investors or for using a real (inflation-indexed) payout annuity as the hurdle in which to measure the resulting trade-off between risk and reward despite the fact that (A) inflation-indexed annuities are uncommon in the marketplace, and (B) individuals tend to behaviora ...

An international trend in market design: Endogenous effects of limit

... than a hybrid of dealer- and order-driven markets. The studied change in market design is common for limit order book markets, while hybrid markets tend to provide some transparency of dealer identity. Although we recognize that the market design change investigated in this paper is complex, it is t ...

... than a hybrid of dealer- and order-driven markets. The studied change in market design is common for limit order book markets, while hybrid markets tend to provide some transparency of dealer identity. Although we recognize that the market design change investigated in this paper is complex, it is t ...

Ch. 7 - UConn Math

... The covariance of Alcan with the market portfolio (σAlcan, Market) is the mean of the seven respective covariances between Alcan and each of the seven stocks in the portfolio. (The covariance of Alcan with itself is the variance of Alcan.) Therefore, σAlcan, Market is equal to the average of the sev ...

... The covariance of Alcan with the market portfolio (σAlcan, Market) is the mean of the seven respective covariances between Alcan and each of the seven stocks in the portfolio. (The covariance of Alcan with itself is the variance of Alcan.) Therefore, σAlcan, Market is equal to the average of the sev ...

CONSIGNMENT STOCK AGREEMENT

... Methode shall manage the consigned stock according to first-in first-out principles, and shall record all movements in accordance with good business practice. ...

... Methode shall manage the consigned stock according to first-in first-out principles, and shall record all movements in accordance with good business practice. ...

1 Getting new regulatory policy done: Crowdfunding

... that firms could reach out to wealthy investors via the internet). Title III and IV rules were passed at the same time but had still not finalized in mid 2014, however (at the date of writing ...

... that firms could reach out to wealthy investors via the internet). Title III and IV rules were passed at the same time but had still not finalized in mid 2014, however (at the date of writing ...

international stock exchanges

... In 1761 a group of 150 stock brokers and jobbers form a club at Jonathan's to buy and sell shares. And in 1773 the brokers erect their own building in Sweeting’s Alley, with a dealing room on the ground floor and a coffee room above. Briefly known as “New Jonathan’s”, members soon change the name to ...

... In 1761 a group of 150 stock brokers and jobbers form a club at Jonathan's to buy and sell shares. And in 1773 the brokers erect their own building in Sweeting’s Alley, with a dealing room on the ground floor and a coffee room above. Briefly known as “New Jonathan’s”, members soon change the name to ...

Institutional Ownership and the Extent to which Stock

... information about such actions (e.g., information about customer orders, long-term sales contracts, and investment activities) are available to investors. Such economic actions, though not reflected in current earnings, will eventually be reflected in future period earnings. We posit that sophistica ...

... information about such actions (e.g., information about customer orders, long-term sales contracts, and investment activities) are available to investors. Such economic actions, though not reflected in current earnings, will eventually be reflected in future period earnings. We posit that sophistica ...

Important Information about Hedge Funds

... Investors should be aware of the risks associated with hedge funds. Certain of the potential benefits of hedge fund investing also present special risks. While the risks will vary from fund to fund, and a hedge fund’s PPM will generally describe the primary risks, some of the more common risks inclu ...

... Investors should be aware of the risks associated with hedge funds. Certain of the potential benefits of hedge fund investing also present special risks. While the risks will vary from fund to fund, and a hedge fund’s PPM will generally describe the primary risks, some of the more common risks inclu ...

NBER WORKING PAPER SERIES ON THE INCEPTION OF RATIONAL Behzad Diba

... must, with probability one, eventually burst. This inference would rule out the possibility of a rational bubble that, with nonzero probability, lasts forever but not the possibility of one that almost surely bursts. The argument developed in the present paper applies to all forms of rational bubble ...

... must, with probability one, eventually burst. This inference would rule out the possibility of a rational bubble that, with nonzero probability, lasts forever but not the possibility of one that almost surely bursts. The argument developed in the present paper applies to all forms of rational bubble ...

Task force on Climate-Related Disclosures

... Asset owner and investment manager guidance: we recommend that the Task Force indicate clearly that responsibility for climate assessment, particularly footprinting and scenario analysis, needs to be taken across the investment chain by all key actors, not only asset owners. The guidance should cl ...

... Asset owner and investment manager guidance: we recommend that the Task Force indicate clearly that responsibility for climate assessment, particularly footprinting and scenario analysis, needs to be taken across the investment chain by all key actors, not only asset owners. The guidance should cl ...

FREE Sample Here

... problem when outsiders (i.e., non-managers) own shares in a corporation. b. Managers may operate in stockholders' best interests, or managers may operate in their own personal best interests. As long as managers stay within the law, there are no effective controls that stockholders can implement to ...

... problem when outsiders (i.e., non-managers) own shares in a corporation. b. Managers may operate in stockholders' best interests, or managers may operate in their own personal best interests. As long as managers stay within the law, there are no effective controls that stockholders can implement to ...

Life Technologies Corporation

... This supplement to the Prospectus was prepared pursuant to Article 34 of the Belgian Law of June 16, 2006 on the public offerings of securities and the admission to trading of securities on a regulated market and approved by the Belgian Financial Services and Markets Authority on July 26, 2011. This ...

... This supplement to the Prospectus was prepared pursuant to Article 34 of the Belgian Law of June 16, 2006 on the public offerings of securities and the admission to trading of securities on a regulated market and approved by the Belgian Financial Services and Markets Authority on July 26, 2011. This ...

Global Market Outlook 2016: Trends in real estate private equity

... A full seven years after the financial crisis that rocked the world’s economies, we find ourselves today in an environment where every aftershock — whether set off by a slowing Chinese economy, sovereign debt concerns or geopolitical concerns — is greeted with disturbing headlines that foster more f ...

... A full seven years after the financial crisis that rocked the world’s economies, we find ourselves today in an environment where every aftershock — whether set off by a slowing Chinese economy, sovereign debt concerns or geopolitical concerns — is greeted with disturbing headlines that foster more f ...

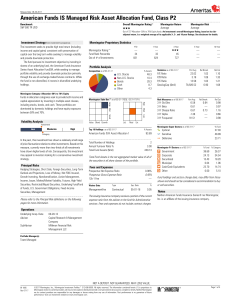

American Funds IS Managed Risk Asset Allocation Fund

... The Morningstar Return rates a fund's performance relative to other managed products in its Morningstar Category. It is an assessment of a product's excess return over a risk-free rate (the return of the 90-day Treasury Bill) in comparison with the products in its Morningstar category. In each Morni ...

... The Morningstar Return rates a fund's performance relative to other managed products in its Morningstar Category. It is an assessment of a product's excess return over a risk-free rate (the return of the 90-day Treasury Bill) in comparison with the products in its Morningstar category. In each Morni ...

Wespath`s Hedge Fund Strategy— The Path Not Followed

... Wespath’s Multiple Asset Fund, a common index of hedge fund ...

... Wespath’s Multiple Asset Fund, a common index of hedge fund ...

MACD BASED DOLLAR COST AVERAGING STRATEGY

... 2.2. Studies Related to Technical Analysis Investment Strategies While numerous technical analysis methods have been created, Moving Average Convergence Divergence (MACD) is one of the oscillators which has always been used for testing because the strategy behind MACD is easy to understand and has b ...

... 2.2. Studies Related to Technical Analysis Investment Strategies While numerous technical analysis methods have been created, Moving Average Convergence Divergence (MACD) is one of the oscillators which has always been used for testing because the strategy behind MACD is easy to understand and has b ...

Cross-sectional volatility and return dispersion

... market. When the difference between the best and worst mutual funds in the market expands twoor threefold, the behavior of the average investor is not difficult to predict. But plenty of research warns against such behavior. The best response for individual investors in this environment is to stick ...

... market. When the difference between the best and worst mutual funds in the market expands twoor threefold, the behavior of the average investor is not difficult to predict. But plenty of research warns against such behavior. The best response for individual investors in this environment is to stick ...

Economics of Money, Banking, and Financial Markets, 8e

... corporations pay attention to what is happening to their stock in the secondary market? Answer: The existence of the secondary market makes their stock more liquid and the price in the secondary market sets the price that the corporation would receive if they choose to sell more stock in the primar ...

... corporations pay attention to what is happening to their stock in the secondary market? Answer: The existence of the secondary market makes their stock more liquid and the price in the secondary market sets the price that the corporation would receive if they choose to sell more stock in the primar ...

Long-Term Investment Policy - American Speech

... Treasury Inflation Protected Securities and Corporate Inflation Protected Securities. ...

... Treasury Inflation Protected Securities and Corporate Inflation Protected Securities. ...

Glossary of Mutual Fund and Other Related Financial Terms

... intraday on stock exchanges at market-determined prices. Investors may buy or sell ETF shares on the secondary market through a broker, just as they would the shares of any publicly traded company. Authorized participants are the only entities allowed to purchase and redeem ETF shares directly from ...

... intraday on stock exchanges at market-determined prices. Investors may buy or sell ETF shares on the secondary market through a broker, just as they would the shares of any publicly traded company. Authorized participants are the only entities allowed to purchase and redeem ETF shares directly from ...

Spotlight on catastrophe bonds

... financial climates when investors may wish to protect themselves from market forces. For example in 2008, a year of intense economic upheaval, catastrophe bonds were one of the few asset classes which provided positive returns over the course of the year. As shown in Figure 1 below, catastrophe bond ...

... financial climates when investors may wish to protect themselves from market forces. For example in 2008, a year of intense economic upheaval, catastrophe bonds were one of the few asset classes which provided positive returns over the course of the year. As shown in Figure 1 below, catastrophe bond ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.