part three answers to market and economic questions

... delayed market, currency and commodity charts. Fee based site allows setup of an assortment of technical analysis tools. The least expensive is $14.95/month. The governing word is “Free.” These sites are for traders ...

... delayed market, currency and commodity charts. Fee based site allows setup of an assortment of technical analysis tools. The least expensive is $14.95/month. The governing word is “Free.” These sites are for traders ...

USING VARIABLE LIFE INSURANCE AS AN INVESTMENT

... the estate owner’s demise. • The same three alternative investment strategies used for family protection/investing were used for this wealth-transfer comparison (index, balanced, and actively traded funds on a buy-and-hold basis). • The same three alternative average investment returns used for fami ...

... the estate owner’s demise. • The same three alternative investment strategies used for family protection/investing were used for this wealth-transfer comparison (index, balanced, and actively traded funds on a buy-and-hold basis). • The same three alternative average investment returns used for fami ...

Reading All the News at the Same Time: Predicting Mid

... deciding whether a long or short strategy should be pursued during the investment horizon. We demonstrate that profitable stock index trading can be established based on news momentum for two different news sources. We calculate several performance metrics and pay special attention to the stability ...

... deciding whether a long or short strategy should be pursued during the investment horizon. We demonstrate that profitable stock index trading can be established based on news momentum for two different news sources. We calculate several performance metrics and pay special attention to the stability ...

The Public Market Equivalent and Private Equity Performance

... where a and b are determined by the risk-free rate and the market risk premium. In each periods, we solve for a and b,7 and we find a = 1.944 and b = 0.926 in the first period. In the second period, a = 1.871 and b = 0.840, and in the third period, a = 1.801 and b = 0.762. The resulting SDF is in Ta ...

... where a and b are determined by the risk-free rate and the market risk premium. In each periods, we solve for a and b,7 and we find a = 1.944 and b = 0.926 in the first period. In the second period, a = 1.871 and b = 0.840, and in the third period, a = 1.801 and b = 0.762. The resulting SDF is in Ta ...

Investing In Rare Stamps

... are Tangible Assets (RTA), offer the asset protection benefits you seek for your portfolio in any market environment. When most people think of luxury assets, they think of classic cars, wine and jewelry. Rare coins and rare stamps are part of that world, but are easier to buy, easier to own and eas ...

... are Tangible Assets (RTA), offer the asset protection benefits you seek for your portfolio in any market environment. When most people think of luxury assets, they think of classic cars, wine and jewelry. Rare coins and rare stamps are part of that world, but are easier to buy, easier to own and eas ...

The Canadian Fixed Income Market Report

... provides an overview of the main market participants, primary market issuance, secondary market trading and posttrade transparency, as well as a brief comparison of fixed income markets in other regions. The fixed income market in Canada was approximately $2 trillion in size (as of December 2014, pa ...

... provides an overview of the main market participants, primary market issuance, secondary market trading and posttrade transparency, as well as a brief comparison of fixed income markets in other regions. The fixed income market in Canada was approximately $2 trillion in size (as of December 2014, pa ...

INVESTORLIT Research Private Equity vs. Public Equity

... funds which had none (i.e., they were completely wound up). They calculated the returns of 148 matured venture capital funds on the Thomson database between 1960 and 1999, and compared them to public market returns over that period. By using only matured funds, the authors could calculate IRRs which ...

... funds which had none (i.e., they were completely wound up). They calculated the returns of 148 matured venture capital funds on the Thomson database between 1960 and 1999, and compared them to public market returns over that period. By using only matured funds, the authors could calculate IRRs which ...

Collective investment schemes regulations

... diversification. The publication focuses on regulatory issues facing participants in the western investment management industry. This experience can be used in the collective investments practice in Russia. Keywords: collective investment funds, mutual funds, closed-ended funds, open-ended investmen ...

... diversification. The publication focuses on regulatory issues facing participants in the western investment management industry. This experience can be used in the collective investments practice in Russia. Keywords: collective investment funds, mutual funds, closed-ended funds, open-ended investmen ...

Analyst Recommendations, Mutual Fund Herding, and

... past-return stocks. Further, mutual funds have become increasingly important in setting stock prices; for example, mutual fund equity holdings have almost doubled relative to the total capitalization of equity markets—from 12.7 percent (at the end of 1994) to 22.2 percent (at the end of 2005) of al ...

... past-return stocks. Further, mutual funds have become increasingly important in setting stock prices; for example, mutual fund equity holdings have almost doubled relative to the total capitalization of equity markets—from 12.7 percent (at the end of 1994) to 22.2 percent (at the end of 2005) of al ...

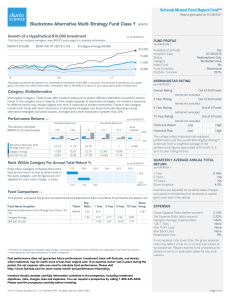

Blackstone Alternative Multi-Strategy Fund Class Y BXMYX

... This Mutual Fund Report Card is informational in nature and is not a recommendation or solicitation for any person to buy, sell or hold any particular security; nor is it intended to address any individual's investment objectives, financial situation or personal circumstances. We recommend that inve ...

... This Mutual Fund Report Card is informational in nature and is not a recommendation or solicitation for any person to buy, sell or hold any particular security; nor is it intended to address any individual's investment objectives, financial situation or personal circumstances. We recommend that inve ...

Fulltext

... successful in capturing the bond returns variation except only for low graded firms which have higher default risk. The final conclusion is that five factors, among those two are in addition to Fama and French three factor model or four are in addition to traditional capital asset pricing model, are ...

... successful in capturing the bond returns variation except only for low graded firms which have higher default risk. The final conclusion is that five factors, among those two are in addition to Fama and French three factor model or four are in addition to traditional capital asset pricing model, are ...

Implied Excess Return

... 5. Using EIR EIR is not a sure signal of mispricing, but a screen to select firms for further examination. It is based on limited but key public information about each firm – its IR component incorporates price, earnings, short-term and long-term earnings growth, and the dividend payout, while the R ...

... 5. Using EIR EIR is not a sure signal of mispricing, but a screen to select firms for further examination. It is based on limited but key public information about each firm – its IR component incorporates price, earnings, short-term and long-term earnings growth, and the dividend payout, while the R ...

At regional Level

... Capacity Development for CDM Actions and issues related to the Djerba Forum Additionality, Project Cycle, Sustainable Development Contractual issues for CDM Tunis, 27-29 August 2004 Samir Amous, APEX, Tunisia Regional Centre for North Africa and Middle-East RW4, Tunis 27-29 August 2004 ...

... Capacity Development for CDM Actions and issues related to the Djerba Forum Additionality, Project Cycle, Sustainable Development Contractual issues for CDM Tunis, 27-29 August 2004 Samir Amous, APEX, Tunisia Regional Centre for North Africa and Middle-East RW4, Tunis 27-29 August 2004 ...

Fintech and Disruptive Business Models in Financial Products

... or markets and the regulatory implications of such. This Article will not examine particular areas of fintech in detail, but will instead draw from a range of examples and their key features. The disruptive potential of fintech will be discussed to highlight market themes and changes in legal techno ...

... or markets and the regulatory implications of such. This Article will not examine particular areas of fintech in detail, but will instead draw from a range of examples and their key features. The disruptive potential of fintech will be discussed to highlight market themes and changes in legal techno ...

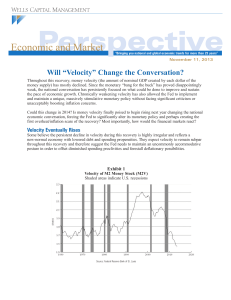

Will “Velocity” Change the Conversation?

... Wells Capital Management (WellsCap) is a registered investment adviser and a wholly owned subsidiary of Wells Fargo Bank, N.A. WellsCap provides investment management services for a variety of institutions. The views expressed are those of the author at the time of writing and are subject to change. ...

... Wells Capital Management (WellsCap) is a registered investment adviser and a wholly owned subsidiary of Wells Fargo Bank, N.A. WellsCap provides investment management services for a variety of institutions. The views expressed are those of the author at the time of writing and are subject to change. ...

Stock Market Volatility: Examining North America, Europe and

... shocks and events taking place in other stock markets. Volatility in the world’s major stock markets has reverberated to the Singapore stock market. The biggest fall in the STI on 14 April 2000 was due to the technology stock bubble burst in the US market. The STI fell by about 8.44%. The second lar ...

... shocks and events taking place in other stock markets. Volatility in the world’s major stock markets has reverberated to the Singapore stock market. The biggest fall in the STI on 14 April 2000 was due to the technology stock bubble burst in the US market. The STI fell by about 8.44%. The second lar ...

Margin Requirements, Volatility, and Market Integrity

... hold the view that margin requirements can be e®ective as a selective credit control and useful as a tool for stabilizing stock prices. Notwithstanding the opinions of those that share the 1934 Congressional viewpoint, the majority in the ¯nance profession appear to have abandoned the beliefs that u ...

... hold the view that margin requirements can be e®ective as a selective credit control and useful as a tool for stabilizing stock prices. Notwithstanding the opinions of those that share the 1934 Congressional viewpoint, the majority in the ¯nance profession appear to have abandoned the beliefs that u ...

Download attachment

... One of the merits of the KAOPEN index is that it attempts to measure the intensity of capital controls, insofar as the intensity is correlated with the existence of other restrictions on international transactions. One may argue that the KAOPEN index measures the extensity of capital controls becaus ...

... One of the merits of the KAOPEN index is that it attempts to measure the intensity of capital controls, insofar as the intensity is correlated with the existence of other restrictions on international transactions. One may argue that the KAOPEN index measures the extensity of capital controls becaus ...

Transparency, Financial Accounting Information, and Corporate

... A corporation can be viewed as a nexus of contracts designed to minimize contracting costs (Coase 1937). Parties contracting with the firm desire information both about the firm’s ability to satisfy the terms of contracts and the firm’s ultimate compliance with its contractual obligations. Financial ...

... A corporation can be viewed as a nexus of contracts designed to minimize contracting costs (Coase 1937). Parties contracting with the firm desire information both about the firm’s ability to satisfy the terms of contracts and the firm’s ultimate compliance with its contractual obligations. Financial ...

The Link between IPO Underpricing and Trading Volume: Evidence

... and individual investors. Booth and Chua (1996), Mello and Parsons (1998), and Stoughton and Zechner (1998) all emphasize that underpricing leads to oversubscription to the issue and thus gives issuers and underwriters discretion with regard to whom to allocate shares. Giving priority to either inve ...

... and individual investors. Booth and Chua (1996), Mello and Parsons (1998), and Stoughton and Zechner (1998) all emphasize that underpricing leads to oversubscription to the issue and thus gives issuers and underwriters discretion with regard to whom to allocate shares. Giving priority to either inve ...

For Whom the Bell Tolls: The Demise of Exchange

... A. Development of Stock Exchange Trading in the United States............................ 867 B. Development of Futures Trading on Exchange Floors ....................................... 871 ...

... A. Development of Stock Exchange Trading in the United States............................ 867 B. Development of Futures Trading on Exchange Floors ....................................... 871 ...

Time-varying diversification benefits

... obtained from investing within the region when short selling constraints are present. For global diversification benefits: For most countries, the benefits of global diversification significantly outweigh the benefits of regional diversification, and the benefits are also more significant in a sta ...

... obtained from investing within the region when short selling constraints are present. For global diversification benefits: For most countries, the benefits of global diversification significantly outweigh the benefits of regional diversification, and the benefits are also more significant in a sta ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.