Compounding Rate Of Return

... He has established himself so well in the market that everyone mirrors any of his movements. Due to the high volume of following, Warren’s actions have the ability to change the price of a stock in one day. Because of his high prestige, Warren has been called upon to act on behalf of companies to he ...

... He has established himself so well in the market that everyone mirrors any of his movements. Due to the high volume of following, Warren’s actions have the ability to change the price of a stock in one day. Because of his high prestige, Warren has been called upon to act on behalf of companies to he ...

2016 Preqin Global Real Estate Report

... fund context, and management fees and performance compensation vary considerably. Over the past few years, larger institutional investors have been seeking alternatives to the traditional commingled fund model. Large investors are placing larger amounts of capital with a smaller number of real estat ...

... fund context, and management fees and performance compensation vary considerably. Over the past few years, larger institutional investors have been seeking alternatives to the traditional commingled fund model. Large investors are placing larger amounts of capital with a smaller number of real estat ...

Correlation Between Company`s Returns, Market and Book Value

... attract investors and motivate them to keep and buy the company's shares. Ultimately, all these will reflect positively on the market value of the shares. So, in the case of absence these correlations it means there are different reasons and justifications must catch. In addition to studying these c ...

... attract investors and motivate them to keep and buy the company's shares. Ultimately, all these will reflect positively on the market value of the shares. So, in the case of absence these correlations it means there are different reasons and justifications must catch. In addition to studying these c ...

The Importance of Emerging Capital Markets

... When segmentation is present, we expect that investors from the capital abundant country where returns are low will make investments in the capital scarce country where the marginal product of capital (and returns) are high. Investments of this sort should eventually equalize the returns across mark ...

... When segmentation is present, we expect that investors from the capital abundant country where returns are low will make investments in the capital scarce country where the marginal product of capital (and returns) are high. Investments of this sort should eventually equalize the returns across mark ...

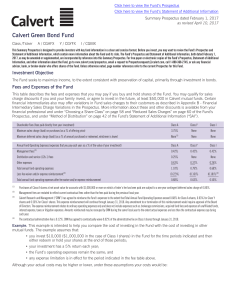

Calvert Green Bond Fund

... exist for certain investments, which may impair the ability of the Fund to sell or to realize the full value of such investments in the event of the need to liquidate such assets. Adverse market conditions may impair the liquidity of some actively traded investments. Fixed income markets have recent ...

... exist for certain investments, which may impair the ability of the Fund to sell or to realize the full value of such investments in the event of the need to liquidate such assets. Adverse market conditions may impair the liquidity of some actively traded investments. Fixed income markets have recent ...

Financial Accounting and Accounting Standards

... LO 2 Journal entries for Parent using complete equity method. ...

... LO 2 Journal entries for Parent using complete equity method. ...

Financial Development and Economic Growth: Views and

... markets and institutions that augment liquidity. Liquid capital markets, therefore, are markets where it is relatively inexpensive to trade financial instruments and where there is little uncertainty about the timing and settlement of those trades. Before delving into formal models of liquidity and ...

... markets and institutions that augment liquidity. Liquid capital markets, therefore, are markets where it is relatively inexpensive to trade financial instruments and where there is little uncertainty about the timing and settlement of those trades. Before delving into formal models of liquidity and ...

The fundamental drivers of recent volatility in

... spot price of the underlying physical commodities themselves. Underlying this argument is the assumption that money flows into futures markets can simply be equated with increasing real demand for the underlying physical commodities. However, futures markets are ‘zero-sum’ markets where all money fl ...

... spot price of the underlying physical commodities themselves. Underlying this argument is the assumption that money flows into futures markets can simply be equated with increasing real demand for the underlying physical commodities. However, futures markets are ‘zero-sum’ markets where all money fl ...

Does a Structural Macroeconomic Model Help Long

... Given the population’s increasing life span, institutional investors (such as insurance companies and pension funds) have an increasing social responsibility to allocate their funds in an optimal manner. The allocation must be made on a long-term basis and the institutional investor must account for ...

... Given the population’s increasing life span, institutional investors (such as insurance companies and pension funds) have an increasing social responsibility to allocate their funds in an optimal manner. The allocation must be made on a long-term basis and the institutional investor must account for ...

A Guide to Irish Regulated Real Estate Funds

... For retail funds and for PIFs the fund documentation (prospectus, constitutive documentation, asset management / administration / custody agreements and certain ancillary documentation) must to be submitted for prior consideration by the Financial Regulator and must go through a process of addressin ...

... For retail funds and for PIFs the fund documentation (prospectus, constitutive documentation, asset management / administration / custody agreements and certain ancillary documentation) must to be submitted for prior consideration by the Financial Regulator and must go through a process of addressin ...

Stock Exchange Ordinance

... The securities dealer must have a minimum capital of CHF 1.5 million, which must be fully paid. In the event of non-cash capital contributions, the value of the assets brought in and the amount of the liabilities shall be examined by the auditors recognised by FINMA; this shall also apply when an ex ...

... The securities dealer must have a minimum capital of CHF 1.5 million, which must be fully paid. In the event of non-cash capital contributions, the value of the assets brought in and the amount of the liabilities shall be examined by the auditors recognised by FINMA; this shall also apply when an ex ...

Stock Exchange Ordinance SESTO unofficial translation

... The securities dealer must have a minimum capital of CHF 1.5 million, which must be fully paid. In the event of non-cash capital contributions, the value of the assets brought in and the amount of the liabilities shall be examined by the auditors recognised by FINMA; this shall also apply when an ex ...

... The securities dealer must have a minimum capital of CHF 1.5 million, which must be fully paid. In the event of non-cash capital contributions, the value of the assets brought in and the amount of the liabilities shall be examined by the auditors recognised by FINMA; this shall also apply when an ex ...

The cyclical relations between traded property stock prices and

... capita show trends in the real economy. The cyclical movements of these aggregates are expected to correlate positively with the turnover of the property sector and the variation in property backed asset prices. A higher turnover is the result of a buoyant economy that would lead to rising property ...

... capita show trends in the real economy. The cyclical movements of these aggregates are expected to correlate positively with the turnover of the property sector and the variation in property backed asset prices. A higher turnover is the result of a buoyant economy that would lead to rising property ...

REIT Stocks: An Underutilized Portfolio Diversifier

... the $49 billion Massachusetts Pension Reserves Investment Trust Fund, which held $1.2 billion in publicly traded REITs, or 2.4% of total fund assets.7 Reasons for investors’ lack of REIT exposure It is difficult to determine exactly why diversified U.S. equity mutual funds on average have been peren ...

... the $49 billion Massachusetts Pension Reserves Investment Trust Fund, which held $1.2 billion in publicly traded REITs, or 2.4% of total fund assets.7 Reasons for investors’ lack of REIT exposure It is difficult to determine exactly why diversified U.S. equity mutual funds on average have been peren ...

Professional Letter

... cap stocks. The other Non-U.S. equity fund, The American Funds EuroPacific Growth Fund, focuses primarily on large international stocks. Adds a socially responsible fund to Lincoln’s core fund lineup. This fund is similar to the Calvert Large Cap Growth fund in that it employs social screens to cons ...

... cap stocks. The other Non-U.S. equity fund, The American Funds EuroPacific Growth Fund, focuses primarily on large international stocks. Adds a socially responsible fund to Lincoln’s core fund lineup. This fund is similar to the Calvert Large Cap Growth fund in that it employs social screens to cons ...

essen-ch18-presentat..

... The supply of loanable funds comes from saving. The demand for funds comes from investment. The interest rate adjusts to balance supply and demand in the loanable funds market. ...

... The supply of loanable funds comes from saving. The demand for funds comes from investment. The interest rate adjusts to balance supply and demand in the loanable funds market. ...

NBER WORKING PAPER SERIES THE LIMITS OF FINANCIAL GLOBALIZATION René M. Stulz

... constituencies of the current rulers of the state and include redistributive taxes. The discretion of rulers to use the state for their own benefit creates an agency problem that I call “the agency problem of state ruler discretion.” When this agency problem is significant, corporations with profes ...

... constituencies of the current rulers of the state and include redistributive taxes. The discretion of rulers to use the state for their own benefit creates an agency problem that I call “the agency problem of state ruler discretion.” When this agency problem is significant, corporations with profes ...

Item 1 – Cover Page - NorthCoast Asset Management

... and $66,000,000 on a non-discretionary basis for a total of $1.7 billion. NorthCoast specializes in providing clients with portfolio management services to separately managed accounts and a mutual fund through the use of quantitative analysis and systematic investing. We believe a thoroughly researc ...

... and $66,000,000 on a non-discretionary basis for a total of $1.7 billion. NorthCoast specializes in providing clients with portfolio management services to separately managed accounts and a mutual fund through the use of quantitative analysis and systematic investing. We believe a thoroughly researc ...

JOIM - CSInvesting

... For example the overall …rm average of leverage is 44% while …rms that are about to fail have an average leverage of 73.7%. This higher level is 1.05 standard deviations higher than the overall mean. When interpreting the statistics, it is important to remember a few things about the sample and the ...

... For example the overall …rm average of leverage is 44% while …rms that are about to fail have an average leverage of 73.7%. This higher level is 1.05 standard deviations higher than the overall mean. When interpreting the statistics, it is important to remember a few things about the sample and the ...

Exchange Gann Financial Astrology Ebooks

... 34,Raphael 1905 : Raphael's Mundane Astrology 35,Rodden Louise : Money−− how to find it with astrology 36,sedgwick phillip:sun in the centre−heliocentric astrology 37,tyler j ross : financial astrology 38,tyl noel : astrology's special measurements 39,winski Norman: energy point trend technique If s ...

... 34,Raphael 1905 : Raphael's Mundane Astrology 35,Rodden Louise : Money−− how to find it with astrology 36,sedgwick phillip:sun in the centre−heliocentric astrology 37,tyler j ross : financial astrology 38,tyl noel : astrology's special measurements 39,winski Norman: energy point trend technique If s ...

the fragile capital structure of hedge funds and the

... shocks. This helps to understand why banks rather than hedge funds are at the center of the recent …nancial crisis. Many observers seem to have been surprised that hedge funds, typically regarded as the riskiest segment of institutional investors, are in much better shape than banks. Since banks wer ...

... shocks. This helps to understand why banks rather than hedge funds are at the center of the recent …nancial crisis. Many observers seem to have been surprised that hedge funds, typically regarded as the riskiest segment of institutional investors, are in much better shape than banks. Since banks wer ...

Long Term Capital Gains Tax Strategies

... Sufficient Gains on Investment to Cover Cost of Put Assume an investor owns a security, which created paper profit over part of a year holding period, but he/she believes the security value will fall during the remainder of the year, reducing or eliminating the paper profit. The investor wants to ta ...

... Sufficient Gains on Investment to Cover Cost of Put Assume an investor owns a security, which created paper profit over part of a year holding period, but he/she believes the security value will fall during the remainder of the year, reducing or eliminating the paper profit. The investor wants to ta ...

Active Managers are Doing the Unexpected

... representations with respect to its accuracy or completeness. Further, the information presented herein is for informational purposes only and should not be construed in any way as an offer to sell or a solicitation of an offer to buy any securities, investment product or investment advisory service ...

... representations with respect to its accuracy or completeness. Further, the information presented herein is for informational purposes only and should not be construed in any way as an offer to sell or a solicitation of an offer to buy any securities, investment product or investment advisory service ...

Mutual funds

... • A variant of index funds that are traded on an exchange. • The advantage of an ETF is that it can be traded throughout the day at continuously updated prices. • ETFs can be purchased on margin and sold short, unlike index funds. • There are no capital gains distributions to add to tax liabilitiy i ...

... • A variant of index funds that are traded on an exchange. • The advantage of an ETF is that it can be traded throughout the day at continuously updated prices. • ETFs can be purchased on margin and sold short, unlike index funds. • There are no capital gains distributions to add to tax liabilitiy i ...

part three answers to market and economic questions

... delayed market, currency and commodity charts. Fee based site allows setup of an assortment of technical analysis tools. The least expensive is $14.95/month. The governing word is “Free.” These sites are for traders ...

... delayed market, currency and commodity charts. Fee based site allows setup of an assortment of technical analysis tools. The least expensive is $14.95/month. The governing word is “Free.” These sites are for traders ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.